Trading Forex with Micro Lots: A Comprehensive Guide

The world of Forex (Foreign Exchange) trading can seem daunting, especially for newcomers. The sheer volume of information, the complex strategies, and the potential risks can be overwhelming. However, one of the most effective ways to ease into Forex trading and manage risk effectively is by trading with micro lots. This comprehensive guide will delve into what micro lot forex trading is, its advantages, how to get started, and essential strategies to consider.

Understanding Forex Lots: From Standard to Micro

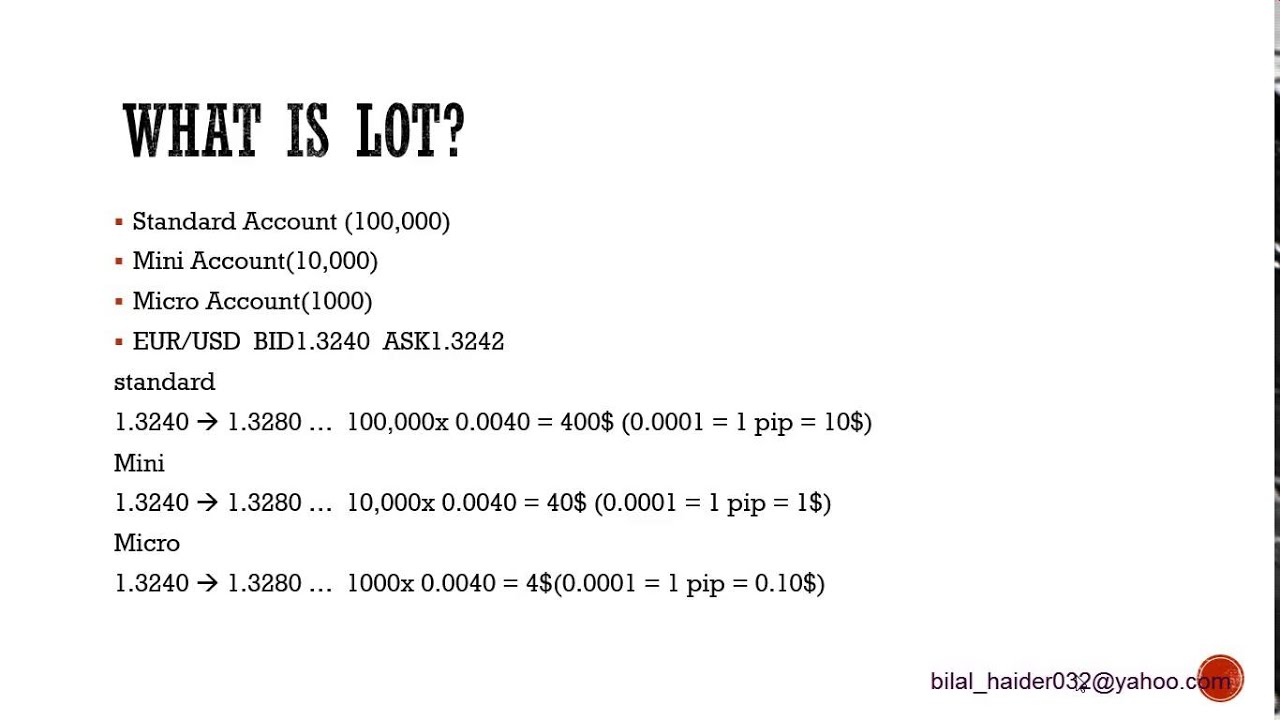

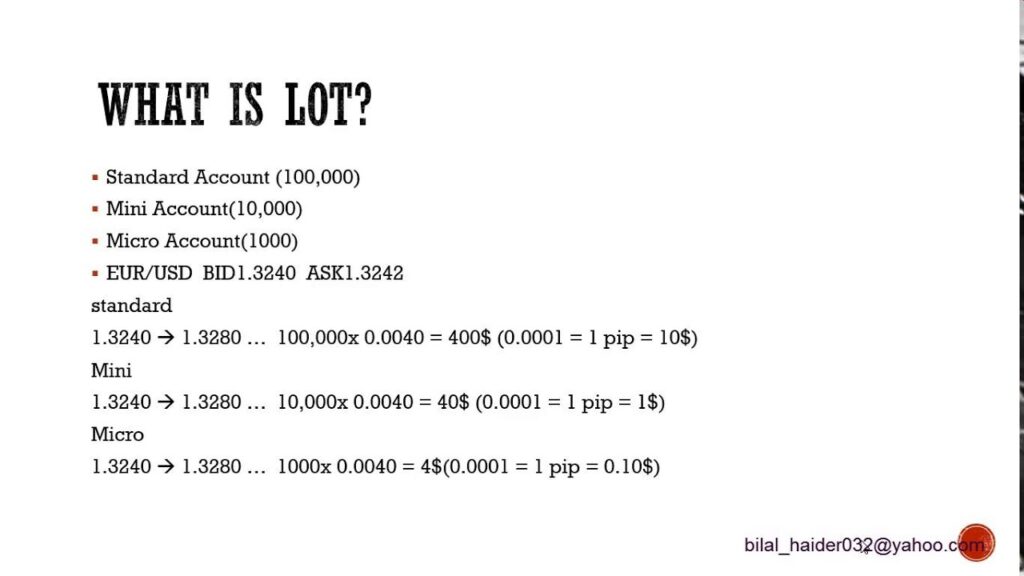

Before diving into the specifics of micro lots, it’s crucial to understand the concept of a ‘lot’ in Forex trading. A lot is a standardized unit of measurement used to quantify the amount of currency you are trading. There are primarily three types of lots:

- Standard Lot: This is the largest lot size, consisting of 100,000 units of the base currency.

- Mini Lot: A mini lot is 10,000 units of the base currency.

- Micro Lot: A micro lot, the smallest of the three, represents 1,000 units of the base currency.

For example, if you’re trading EUR/USD with a micro lot, you’re essentially controlling 1,000 Euros worth of the transaction. This significantly reduces the capital required compared to trading standard or mini lots.

What is Micro Lot Forex Trading?

Micro lot Forex trading is a method where traders execute trades using micro lots. This approach is particularly beneficial for beginners because it allows them to participate in the Forex market with minimal capital and reduced risk. Instead of trading a standard lot, which demands a substantial margin, traders can trade micro lots, requiring only a small fraction of the capital.

Benefits of Trading with Micro Lots

Trading with micro lots offers several advantages, particularly for novice traders:

- Reduced Risk: The primary benefit of trading micro lots is the significantly reduced risk. Since you’re trading smaller amounts, the potential losses are also smaller. This allows you to learn and experiment without risking a substantial portion of your capital.

- Lower Capital Requirements: Trading standard lots can require thousands of dollars in capital. Micro lots, on the other hand, allow you to start trading with as little as $100, depending on the broker’s leverage and margin requirements.

- Learning and Experimentation: Micro lot forex trading provides a safe environment to learn the intricacies of Forex trading. You can test different strategies, understand market dynamics, and get comfortable with the trading platform without the pressure of large financial risks.

- Emotional Control: When trading with larger amounts, emotions can often cloud judgment, leading to impulsive decisions. Micro lots help maintain emotional control by reducing the financial stress associated with each trade.

- Precision in Position Sizing: Micro lots allow for more precise position sizing. You can fine-tune your trade size to align perfectly with your risk management strategy, ensuring that each trade contributes optimally to your overall trading plan.

How to Get Started with Micro Lot Forex Trading

Getting started with micro lot forex trading is relatively straightforward. Here’s a step-by-step guide:

- Choose a Reputable Broker: Select a Forex broker that offers micro lot trading. Ensure the broker is regulated by a reputable financial authority (e.g., FCA, CySEC, ASIC) to ensure the safety of your funds. Also, consider factors like trading platform, spreads, commissions, and customer support.

- Open a Trading Account: Once you’ve chosen a broker, open a trading account. Many brokers offer demo accounts, which allow you to practice trading with virtual money. This is an excellent way to familiarize yourself with the platform and test your strategies before risking real capital.

- Fund Your Account: After you’re comfortable with the platform, fund your account. Start with a small amount that you’re comfortable losing. Remember, the goal is to learn and gain experience without risking significant capital.

- Understand the Basics of Forex Trading: Before you start trading, familiarize yourself with the fundamentals of Forex trading. Learn about currency pairs, pips, leverage, margin, and different order types (e.g., market orders, limit orders, stop-loss orders).

- Develop a Trading Strategy: A well-defined trading strategy is crucial for success in Forex trading. Your strategy should outline your entry and exit criteria, risk management rules, and the currency pairs you intend to trade.

- Start Trading with Micro Lots: Once you have a strategy in place, start trading with micro lots. Monitor your trades closely and keep a trading journal to track your progress and identify areas for improvement.

Essential Strategies for Micro Lot Forex Trading

While trading with micro lots reduces risk, it’s still essential to employ effective trading strategies. Here are some strategies to consider:

Risk Management

Risk management is paramount in Forex trading, regardless of the lot size. Implement the following risk management techniques:

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. Determine the maximum amount you’re willing to lose on a trade and set your stop-loss order accordingly.

- Position Sizing: Carefully calculate your position size to ensure that you’re not risking more than a small percentage of your capital on any single trade. A common rule of thumb is to risk no more than 1-2% of your capital per trade.

- Leverage Management: While leverage can amplify profits, it can also amplify losses. Use leverage cautiously and avoid over-leveraging your account. Understand the risks associated with leverage and only use it if you fully understand its implications.

Technical Analysis

Technical analysis involves analyzing price charts and using technical indicators to identify potential trading opportunities. Some popular technical indicators include:

- Moving Averages: Moving averages smooth out price data and can help identify trends.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Fibonacci Retracement: Fibonacci retracement levels are used to identify potential support and resistance levels.

Fundamental Analysis

Fundamental analysis involves analyzing economic indicators, news events, and geopolitical factors to assess the value of a currency. Keep an eye on key economic releases such as:

- GDP Growth: Gross Domestic Product (GDP) reflects the overall health of an economy.

- Inflation Rates: Inflation rates can influence central bank policies and currency values.

- Interest Rates: Interest rate decisions by central banks can have a significant impact on currency values.

- Employment Data: Employment figures provide insights into the strength of a country’s labor market.

By combining technical and fundamental analysis, you can gain a more comprehensive understanding of the market and make more informed trading decisions.

Trading Psychology

Trading psychology plays a crucial role in Forex trading success. Develop the following psychological traits:

- Patience: Avoid impulsive trades and wait for high-probability setups.

- Discipline: Stick to your trading plan and avoid deviating from your strategy.

- Emotional Control: Manage your emotions and avoid making decisions based on fear or greed.

- Continuous Learning: Stay updated with market news and trends, and continuously refine your trading skills.

Choosing the Right Broker for Micro Lot Trading

Selecting the right broker is a critical step in your micro lot forex trading journey. Here are some key factors to consider when choosing a broker:

- Regulation: Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and protection for your funds.

- Trading Platform: Choose a broker with a user-friendly and reliable trading platform. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Spreads and Commissions: Compare the spreads and commissions offered by different brokers. Lower spreads and commissions can significantly reduce your trading costs.

- Leverage: Understand the leverage offered by the broker and use it cautiously. High leverage can amplify both profits and losses.

- Customer Support: Choose a broker with responsive and helpful customer support. You should be able to reach customer support easily via phone, email, or live chat.

- Account Types: Some brokers offer specialized micro lot accounts. These accounts often come with lower minimum deposit requirements and smaller trading sizes.

Common Mistakes to Avoid in Micro Lot Forex Trading

Even when trading with micro lots, it’s easy to fall into common trading pitfalls. Here are some mistakes to avoid:

- Overtrading: Avoid trading too frequently. Overtrading can lead to impulsive decisions and increased trading costs.

- Ignoring Risk Management: Never ignore risk management principles, even when trading with small amounts. Always use stop-loss orders and manage your position size.

- Chasing Losses: Avoid trying to recover losses quickly by taking on more risk. Chasing losses can lead to even greater losses.

- Lack of a Trading Plan: Always have a well-defined trading plan and stick to it. A trading plan should outline your entry and exit criteria, risk management rules, and the currency pairs you intend to trade.

- Emotional Trading: Avoid making trading decisions based on emotions. Stay calm and rational, and stick to your trading plan.

The Future of Micro Lot Forex Trading

Micro lot forex trading is becoming increasingly popular, especially among new traders. As more people enter the Forex market, the demand for micro lot trading is likely to grow. Brokers are also adapting to this trend by offering more micro lot account options and educational resources. The accessibility and affordability of micro lot trading make it an attractive option for anyone looking to explore the Forex market without risking a significant amount of capital.

Conclusion

Micro lot Forex trading is an excellent way to enter the world of Forex trading, especially for beginners. It offers reduced risk, lower capital requirements, and a safe environment to learn and experiment. By understanding the basics of micro lot trading, employing effective strategies, and avoiding common mistakes, you can increase your chances of success in the Forex market. Remember to choose a reputable broker, develop a solid trading plan, and continuously refine your skills. Happy trading!

[See also: Forex Trading Strategies for Beginners]

[See also: Understanding Leverage in Forex Trading]

[See also: Risk Management in Forex Trading]