Liquidity Sweep: Understanding Market Dynamics and Implications

In the dynamic world of financial markets, understanding the nuances of trading strategies and market manipulations is crucial for both seasoned investors and newcomers alike. One such concept gaining increasing attention is the liquidity sweep. A liquidity sweep refers to a trading strategy where a large order is placed to quickly execute across multiple price levels, aiming to fill the entire order by ‘sweeping’ through available liquidity. This article delves into the intricacies of liquidity sweeps, exploring their mechanics, implications, and potential impact on market participants.

What is a Liquidity Sweep?

A liquidity sweep occurs when a trader or institution places a large order designed to be filled immediately, regardless of the price impact. This order aggressively consumes all available buy or sell orders at various price points until the entire order is filled. The primary goal isn’t necessarily to obtain the best possible price, but rather to execute the entire order swiftly. This contrasts with more passive trading strategies where orders are placed and allowed to fill gradually over time.

For example, imagine a scenario where a large institutional investor wants to sell a significant number of shares of a particular stock. Instead of placing a limit order at a specific price and waiting for buyers to come along, they initiate a liquidity sweep by placing a market order that immediately starts selling shares at the current best bid, then moves down the order book, selling at progressively lower prices until the entire block of shares is sold. This action ‘sweeps’ through the available liquidity on the buy side.

How Liquidity Sweeps Work

The mechanics of a liquidity sweep are relatively straightforward, but their execution requires sophisticated trading platforms and a deep understanding of market microstructure. Here’s a breakdown of the typical process:

- Order Placement: A trader identifies a desired quantity of an asset to buy or sell and determines that a liquidity sweep is the most efficient way to execute the trade.

- Order Type: Typically, market orders or aggressive limit orders are used to ensure immediate execution. Market orders will execute at the best available price, while aggressive limit orders are set to execute at or better than the current market price.

- Execution: The order is sent to the exchange or trading venue, and the trading platform automatically fills the order by matching it against available orders in the order book at various price levels.

- Price Impact: As the liquidity sweep consumes available liquidity, it can cause significant price movement, especially in thinly traded markets.

Reasons for Using Liquidity Sweeps

Traders employ liquidity sweeps for various reasons, often related to specific market conditions or investment strategies. Some common motivations include:

- Urgency: When time is of the essence, a liquidity sweep ensures rapid execution, regardless of price impact. This might be necessary when reacting to breaking news or executing time-sensitive arbitrage strategies.

- Large Order Size: For large orders that would take a long time to fill passively, a liquidity sweep provides a way to execute the entire trade quickly, minimizing the risk of adverse price movements before the order is complete.

- Market Impact Minimization (Paradoxically): While it might seem counterintuitive, in some cases, a liquidity sweep can be used to minimize overall market impact. By executing the entire order quickly, the trader avoids signaling their intentions to the market, which could lead to other traders front-running their order and driving the price against them.

- Exploiting Temporary Imbalances: A liquidity sweep can be used to capitalize on temporary imbalances between supply and demand. For example, if there is a sudden surge in buy orders, a trader might use a liquidity sweep to quickly sell a large quantity of shares at elevated prices.

Potential Implications and Risks

While liquidity sweeps can be an effective trading strategy, they also carry potential implications and risks that market participants should be aware of:

- Price Volatility: The aggressive nature of liquidity sweeps can lead to significant price volatility, especially in thinly traded markets. This volatility can create opportunities for some traders but also poses risks for others.

- Slippage: Slippage occurs when the execution price of an order differs from the expected price. Liquidity sweeps are particularly susceptible to slippage, as the order is designed to execute regardless of price.

- Market Manipulation Concerns: In some cases, liquidity sweeps can be used for manipulative purposes, such as creating artificial price movements or triggering stop-loss orders. Regulatory bodies closely monitor market activity to detect and prevent such abuses.

- Impact on Other Traders: A liquidity sweep can negatively impact other traders by quickly depleting available liquidity and causing unexpected price movements. This is particularly true for traders who have placed limit orders or stop-loss orders that are triggered by the sweep.

Liquidity Sweep vs. Other Order Types

Understanding how a liquidity sweep differs from other order types is essential for comprehending its unique characteristics and potential impact. Here’s a comparison with some common order types:

- Market Order: A market order is an order to buy or sell an asset at the best available price. Similar to a liquidity sweep, a market order prioritizes immediate execution over price. However, a liquidity sweep typically involves a much larger order size and a more aggressive approach to consuming available liquidity.

- Limit Order: A limit order is an order to buy or sell an asset at a specific price or better. Unlike a liquidity sweep, a limit order only executes if the market price reaches the specified limit price. This provides price certainty but does not guarantee execution.

- Stop-Loss Order: A stop-loss order is an order to sell an asset when the price falls below a specified stop price. A liquidity sweep can trigger stop-loss orders, potentially exacerbating price declines.

- Iceberg Order: An iceberg order is a large order that is broken up into smaller, more manageable orders to avoid signaling intentions to the market. This is the opposite of a liquidity sweep, which aims for immediate and complete execution.

Examples of Liquidity Sweeps in Action

While specific instances of liquidity sweeps are often difficult to identify definitively, here are some hypothetical scenarios that illustrate how they might occur in real-world markets:

- Earnings Announcement Reaction: After a major company releases surprisingly negative earnings, a large institutional investor might initiate a liquidity sweep to quickly sell off their shares before the price declines further.

- News-Driven Panic Selling: In response to a major geopolitical event or economic crisis, a wave of panic selling might trigger a liquidity sweep as investors rush to exit their positions.

- Arbitrage Opportunity: A sophisticated trading firm might identify a temporary price discrepancy between two different exchanges and use a liquidity sweep to quickly profit from the arbitrage opportunity.

How to Identify a Liquidity Sweep

Identifying a liquidity sweep in real-time can be challenging, but there are several indicators that traders can look for:

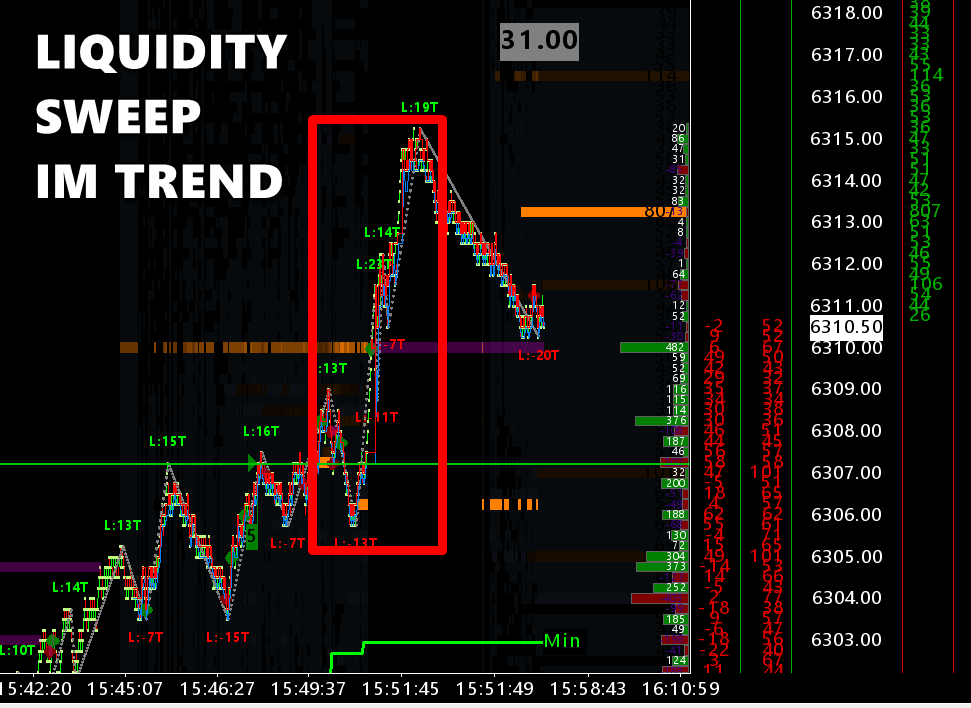

- Sudden Price Movements: A rapid and significant price movement, especially in the absence of any major news or events, can be a sign of a liquidity sweep.

- High Trading Volume: A surge in trading volume, particularly at specific price levels, can indicate that a large order is being executed.

- Order Book Imbalances: A sudden depletion of liquidity on one side of the order book can suggest that a liquidity sweep is underway.

- Level 2 Data Analysis: Analyzing Level 2 data, which provides real-time information about the order book, can help traders identify large orders being executed at multiple price levels.

The Role of High-Frequency Trading (HFT)

High-frequency trading (HFT) firms often play a significant role in liquidity sweeps. Their sophisticated algorithms and ultra-fast execution speeds allow them to quickly identify and capitalize on opportunities created by liquidity sweeps. HFT firms can also contribute to liquidity sweeps by providing liquidity to the market and filling orders at various price levels.

Regulation and Monitoring

Regulatory bodies like the Securities and Exchange Commission (SEC) in the United States closely monitor market activity to detect and prevent manipulative practices related to liquidity sweeps. They use various surveillance tools and techniques to identify suspicious trading patterns and investigate potential violations of securities laws. The goal is to ensure fair and orderly markets and protect investors from fraud and manipulation. [See also: Market Surveillance Techniques].

Strategies to Mitigate Risks from Liquidity Sweeps

While it’s impossible to completely eliminate the risks associated with liquidity sweeps, traders can implement several strategies to mitigate their potential impact:

- Use Limit Orders: Limit orders provide price certainty and can help traders avoid being caught in a liquidity sweep.

- Avoid Thinly Traded Markets: Thinly traded markets are more susceptible to price volatility caused by liquidity sweeps.

- Monitor Order Book: Closely monitoring the order book can help traders anticipate potential liquidity sweeps and adjust their trading strategies accordingly.

- Diversify Portfolio: Diversifying a portfolio across different asset classes and markets can reduce the overall impact of liquidity sweeps on investment returns.

- Use Stop-Limit Orders: A stop-limit order combines the features of a stop-loss order and a limit order, providing some protection against slippage while still ensuring execution if the stop price is triggered.

The Future of Liquidity Sweeps

As financial markets continue to evolve, the use of liquidity sweeps is likely to remain a relevant trading strategy. Advancements in technology and the increasing sophistication of trading algorithms will likely lead to even more complex and nuanced approaches to executing large orders. [See also: Algorithmic Trading Strategies]. Regulatory scrutiny will also continue to play a crucial role in ensuring that liquidity sweeps are not used for manipulative purposes.

Conclusion

Liquidity sweeps are a complex and often misunderstood aspect of financial markets. Understanding their mechanics, implications, and potential risks is crucial for both individual traders and institutional investors. While liquidity sweeps can be an effective tool for executing large orders quickly, they also have the potential to cause price volatility and negatively impact other market participants. By carefully monitoring market activity and implementing appropriate risk management strategies, traders can navigate the challenges posed by liquidity sweeps and potentially capitalize on the opportunities they create. The key is to stay informed, adapt to changing market conditions, and always prioritize risk management. [See also: Risk Management in Trading].