Navigating the Labyrinth: Understanding Stock Price Predictions and Their Pitfalls

The allure of accurately forecasting the future value of stocks is undeniable. Investors, both seasoned professionals and newcomers alike, are constantly seeking an edge, a glimpse into the crystal ball that reveals whether a particular stock will soar or plummet. This quest has fueled the proliferation of stock price predictions, ranging from sophisticated algorithmic models to gut-feeling pronouncements from market gurus. However, the reality of stock price predictions is far more nuanced and fraught with uncertainty than many realize. This article aims to dissect the world of stock price predictions, examining their methodologies, limitations, and the inherent risks involved in relying on them.

The Appeal and the Promise of Stock Price Predictions

The driving force behind the demand for stock price predictions is simple: the desire to maximize returns and minimize risk. Imagine the potential benefits of knowing with certainty that a specific stock will double in value within a year. Investors could allocate their capital accordingly, reaping substantial profits. Conversely, an accurate prediction of a stock’s decline would allow investors to avoid losses by selling their holdings before the downturn.

This promise of financial gain has led to the development of various methods for generating stock price predictions, each with its own underlying assumptions and techniques. These methods can be broadly categorized into two main approaches: fundamental analysis and technical analysis.

Fundamental Analysis: Digging into the Core

Fundamental analysis focuses on evaluating a company’s intrinsic value by examining its financial statements, industry trends, and overall economic outlook. Analysts using this approach scrutinize factors such as revenue growth, profitability, debt levels, and management quality to determine whether a stock is undervalued or overvalued. Based on this assessment, they may issue stock price predictions, suggesting that the stock price will eventually converge with its perceived intrinsic value.

For example, a fundamental analyst might predict that a technology company with strong revenue growth, a high profit margin, and a solid balance sheet will see its stock price increase over time. This prediction is based on the assumption that the market will eventually recognize the company’s underlying strength and adjust the stock price accordingly.

Technical Analysis: Reading the Charts

Technical analysis, on the other hand, relies on historical price and volume data to identify patterns and trends that may indicate future price movements. Technical analysts use charts and various technical indicators to detect these patterns, believing that market psychology and investor behavior are reflected in price action. They often employ terms like “support levels,” “resistance levels,” and “moving averages” to describe these patterns and make stock price predictions.

A technical analyst might predict that a stock that has consistently bounced off a particular price level (support level) will continue to do so in the future. This prediction is based on the assumption that the market will continue to react to this price level in a predictable manner.

The Inherent Limitations of Stock Price Predictions

Despite the sophistication of these analytical methods, the reality is that stock price predictions are inherently unreliable. The stock market is a complex and dynamic system influenced by a multitude of factors, many of which are unpredictable. These factors include:

- Economic events: Unexpected economic downturns, interest rate hikes, or changes in government policy can significantly impact stock prices.

- Geopolitical events: Wars, political instability, and trade disputes can create market volatility and disrupt stock price predictions.

- Company-specific news: Surprise earnings announcements, product recalls, or changes in management can drastically alter a company’s stock price.

- Investor sentiment: Market psychology and investor emotions can drive stock prices up or down, often independently of fundamental factors.

- Black Swan events: Unforeseeable and highly impactful events, such as the COVID-19 pandemic, can completely upend market expectations and render stock price predictions useless.

These unpredictable factors make it virtually impossible to accurately predict stock prices with any degree of certainty. Even the most sophisticated models and experienced analysts can be caught off guard by unforeseen events.

The Dangers of Relying on Stock Price Predictions

Relying solely on stock price predictions can lead to poor investment decisions and significant financial losses. Investors who blindly follow predictions without conducting their own research and due diligence are particularly vulnerable.

For example, an investor who buys a stock based on a prediction that it will double in value may be disappointed to see the stock price stagnate or even decline. This investor may then panic and sell the stock at a loss, missing out on potential future gains. [See also: Understanding Market Volatility]

Furthermore, the constant pursuit of accurate stock price predictions can lead to excessive trading, which can erode returns through transaction costs and taxes. Investors who are constantly buying and selling stocks based on predictions are more likely to make emotional decisions and chase short-term gains, rather than focusing on long-term investment strategies.

A More Prudent Approach to Investing

Instead of relying on stock price predictions, a more prudent approach to investing involves focusing on long-term value creation and diversification. This approach emphasizes:

- Conducting thorough research: Investors should carefully analyze companies’ financial statements, industry trends, and competitive landscape before making investment decisions.

- Diversifying portfolios: Spreading investments across different asset classes, industries, and geographic regions can reduce risk.

- Investing for the long term: Focusing on long-term growth potential rather than short-term price fluctuations can lead to more consistent returns.

- Understanding your risk tolerance: Investors should choose investments that align with their individual risk tolerance and financial goals.

- Seeking professional advice: Consulting with a qualified financial advisor can provide valuable insights and guidance.

The Role of Artificial Intelligence in Stock Price Predictions

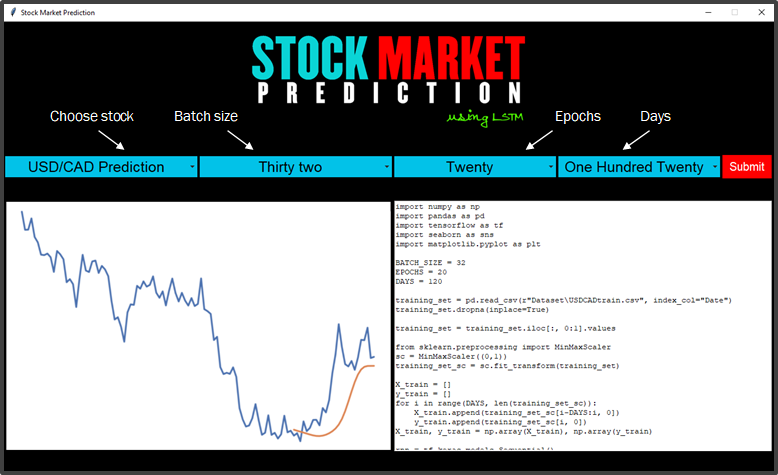

The rise of artificial intelligence (AI) has led to the development of increasingly sophisticated algorithms for stock price predictions. These AI-powered models can analyze vast amounts of data, including historical price data, news articles, social media sentiment, and economic indicators, to identify patterns and predict future price movements.

While AI has the potential to improve the accuracy of stock price predictions, it is not a magic bullet. Even the most advanced AI models are still subject to the limitations of the stock market’s inherent unpredictability. Furthermore, AI models can be biased by the data they are trained on, leading to inaccurate or misleading predictions. [See also: The Impact of AI on Financial Markets]

Therefore, investors should be cautious about relying solely on AI-powered stock price predictions. It is essential to understand the underlying assumptions and limitations of these models and to use them in conjunction with other analytical tools and techniques.

Conclusion: Embrace Uncertainty, Focus on Fundamentals

The quest for accurate stock price predictions is a never-ending pursuit, but one that is ultimately fraught with uncertainty. While various analytical methods and technologies can provide valuable insights, they cannot eliminate the inherent unpredictability of the stock market. Instead of chasing the elusive promise of perfect predictions, investors should focus on building a solid foundation of financial knowledge, conducting thorough research, diversifying their portfolios, and investing for the long term. By embracing uncertainty and focusing on fundamentals, investors can navigate the complexities of the stock market and achieve their financial goals. Remember that stock price predictions should be seen as just one piece of the puzzle, not the entire picture. Always do your own research and consult with financial professionals before making any investment decisions. The key is to be informed, be disciplined, and be prepared for the inevitable ups and downs of the market. The future of stock price predictions remains uncertain, but a sound investment strategy built on solid principles will always be the best approach.