Unveiling Trading Liquidity Sweeps: A Comprehensive Guide

In the fast-paced world of financial markets, understanding the nuances of order execution is crucial for traders aiming to maximize profits and minimize risks. One such concept that often flies under the radar but holds significant importance is the trading liquidity sweep. This article delves into the intricacies of trading liquidity sweeps, exploring their mechanisms, implications, and how traders can leverage them to their advantage. Understanding how trading liquidity sweeps work can provide a significant edge in navigating the complexities of modern markets.

What is a Trading Liquidity Sweep?

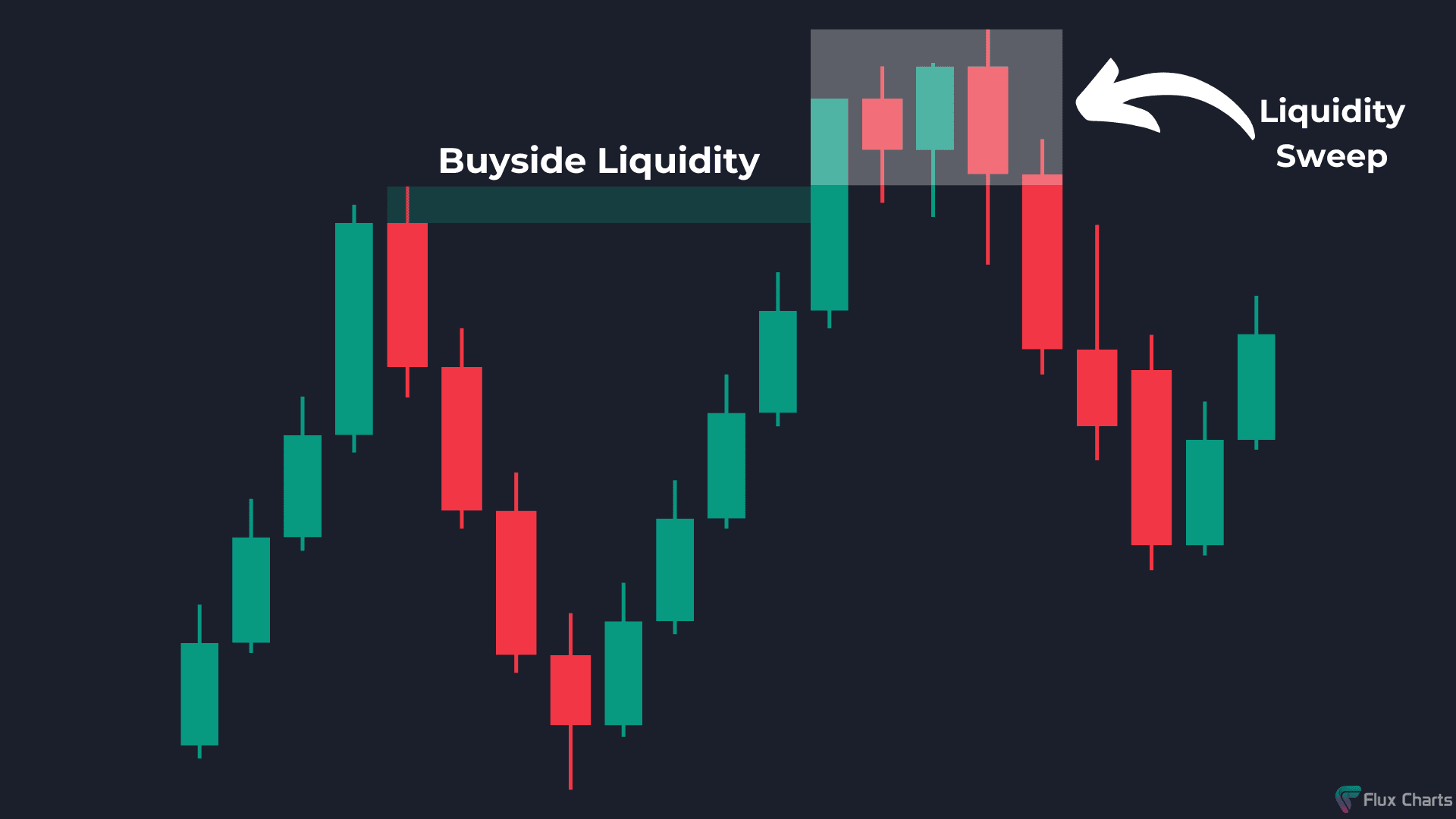

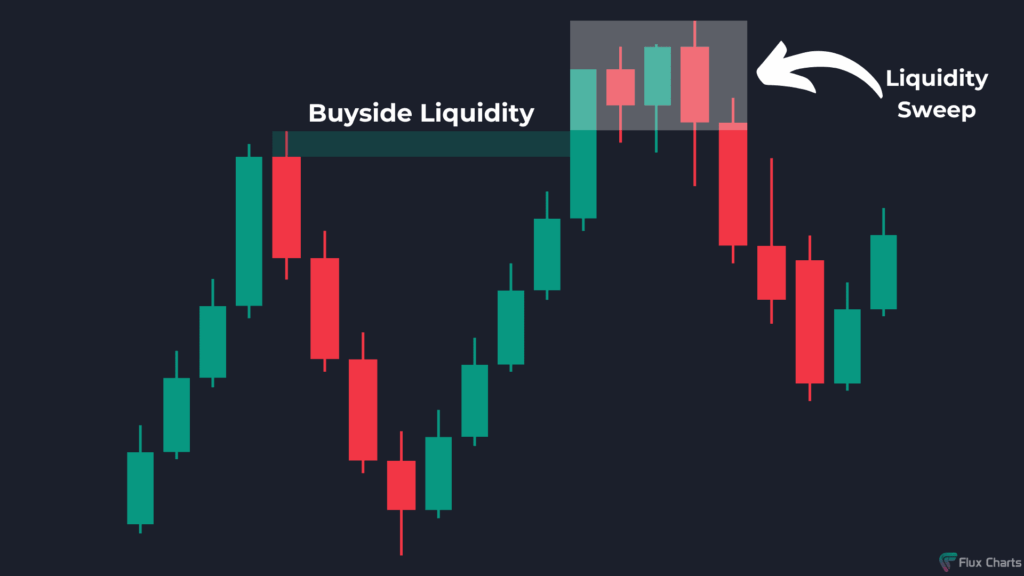

A trading liquidity sweep, also known as a market order sweep, occurs when a large order is executed by consuming all available liquidity at the best prices across multiple order books or exchanges. Instead of being filled at a single price point, the order ‘sweeps’ through the market, filling at successively worse prices until the entire order is filled. This phenomenon typically arises when a trader needs to execute a substantial order quickly and is willing to accept slightly less favorable prices to ensure complete execution.

The Mechanics of a Liquidity Sweep

To better grasp the concept, consider a scenario where a trader wants to buy 1,000 shares of a particular stock. If the best available offer is 100 shares at $50, and the trader places a market order for 1,000 shares, the order will first fill the 100 shares at $50. Then, it will move to the next best offer, perhaps 200 shares at $50.05, and so on, until all 1,000 shares are acquired. This process of ‘sweeping’ through the order book is a trading liquidity sweep. The final execution price will be an average of all the prices at which the shares were bought, and it will likely be higher than the initial best offer.

Why Do Liquidity Sweeps Happen?

Several factors contribute to the occurrence of trading liquidity sweeps. The most common reason is the urgency of the order. Traders might need to enter or exit a position quickly due to news events, technical analysis signals, or risk management considerations. In such cases, speed trumps price, and a market order is the preferred method of execution.

Another factor is the size of the order relative to the available liquidity. If a large order exceeds the depth of the order book at the best prices, a sweep is inevitable. This is particularly true for thinly traded assets or during periods of low trading volume. Algorithmic trading and high-frequency trading (HFT) can also trigger trading liquidity sweeps, as these systems often execute large orders based on pre-programmed strategies.

Implications of Liquidity Sweeps for Traders

Trading liquidity sweeps can have significant implications for traders, both positive and negative. On the one hand, they guarantee order execution, which is crucial when timing is critical. This is especially important for institutional investors and professional traders who manage large portfolios.

However, the downside is that the final execution price might be less favorable than anticipated. The price slippage caused by the sweep can erode profits or increase losses, particularly for large orders. Traders need to be aware of this potential cost and factor it into their trading strategies.

Impact on Market Volatility

Trading liquidity sweeps can also contribute to short-term market volatility. The sudden influx of a large order can cause rapid price movements, which can trigger stop-loss orders and further exacerbate the volatility. This is especially true in markets with limited liquidity, where even relatively small orders can have a disproportionate impact on prices. Understanding this impact allows traders to better anticipate market reactions and adjust their strategies accordingly. [See also: Algorithmic Trading Strategies]

Strategies to Mitigate the Impact of Liquidity Sweeps

While trading liquidity sweeps are sometimes unavoidable, traders can employ several strategies to mitigate their negative impact. One approach is to use limit orders instead of market orders. A limit order specifies the maximum price a buyer is willing to pay or the minimum price a seller is willing to accept. While this doesn’t guarantee execution, it prevents the order from being filled at an unfavorable price. However, the risk is that the order might not be filled at all if the price never reaches the specified limit.

Another strategy is to break up large orders into smaller chunks and execute them over time. This can reduce the impact on the order book and minimize price slippage. However, it also increases the risk of missing out on favorable price movements. Algorithmic trading tools can be helpful in implementing this strategy, as they can automatically execute orders based on pre-defined parameters.

Using Order Book Analysis

Analyzing the order book can also help traders anticipate and navigate trading liquidity sweeps. By examining the depth of the order book at different price levels, traders can get a sense of the available liquidity and the potential for price slippage. If the order book is thin, it might be prudent to use limit orders or break up the order into smaller pieces. Conversely, if the order book is deep, a market order might be acceptable, as the price impact is likely to be minimal.

The Role of Technology in Liquidity Sweeps

Technology plays a crucial role in the execution of trading liquidity sweeps. Modern trading platforms provide traders with real-time access to order books across multiple exchanges, allowing them to identify the best available prices and execute orders efficiently. Algorithmic trading systems automate the process of order execution, enabling traders to implement complex strategies and respond quickly to market changes.

Smart Order Routing

Smart order routing (SOR) is a technology that automatically routes orders to the exchanges or market centers with the best available prices. This can help traders minimize price slippage and ensure that their orders are filled at the most favorable prices. SOR systems continuously monitor the order books and adjust the routing of orders based on real-time market conditions. This technology is particularly useful for executing large orders, as it can distribute the order across multiple venues and minimize the impact on any single order book.

Examples of Trading Liquidity Sweeps in Action

To illustrate the concept of trading liquidity sweeps, consider a few real-world examples. Suppose a major news event triggers a sudden surge in demand for a particular stock. Traders rush to buy the stock, and the order book quickly becomes depleted at the best prices. As buyers continue to place market orders, the price of the stock rises rapidly, and the orders are filled at successively higher prices. This is a classic example of a trading liquidity sweep driven by news events.

Another example is the execution of a large institutional order. A mutual fund or hedge fund might need to buy a substantial amount of a particular stock to rebalance its portfolio or implement a new investment strategy. If the order is large relative to the available liquidity, the fund might need to execute a trading liquidity sweep to ensure that the entire order is filled. This can have a significant impact on the price of the stock, particularly if the market is thinly traded. [See also: Market Manipulation Techniques]

The Future of Liquidity Sweeps

As financial markets continue to evolve, the dynamics of trading liquidity sweeps are likely to change as well. The increasing prevalence of algorithmic trading and HFT is expected to further automate the process of order execution and potentially reduce the impact of large orders on market prices. However, it could also lead to new forms of market manipulation and increased volatility.

The Impact of Decentralized Finance (DeFi)

The rise of decentralized finance (DeFi) could also have a significant impact on trading liquidity sweeps. DeFi platforms offer new ways to trade and provide liquidity, which could potentially reduce the reliance on traditional exchanges and order books. However, DeFi markets are still in their early stages of development, and they are subject to their own set of risks and challenges.

Conclusion

Trading liquidity sweeps are an integral part of modern financial markets. Understanding how they work and their potential implications is essential for traders aiming to succeed in today’s competitive environment. By employing appropriate strategies and leveraging technology, traders can mitigate the negative impact of trading liquidity sweeps and maximize their chances of achieving their investment goals. As markets continue to evolve, it is crucial to stay informed and adapt to the changing dynamics of order execution. Recognizing and understanding trading liquidity sweeps is a key component of successful trading.