CFD vs. Spread Betting: Unveiling the Key Differences for Informed Trading

Choosing the right trading instrument is crucial for success in the financial markets. Two popular options are Contracts for Difference (CFDs) and spread betting. Both allow you to speculate on the price movements of various assets without actually owning them. However, understanding the nuances of CFD vs. spread betting is essential to determine which suits your trading style, risk tolerance, and financial goals. This article provides a comprehensive comparison to help you make an informed decision.

What are CFDs?

A Contract for Difference (CFD) is an agreement between two parties to exchange the difference in the value of an asset between the time the contract opens and closes. You’re essentially speculating on whether the price of an asset will rise or fall. CFDs cover a wide range of markets, including stocks, indices, commodities, and currencies. With CFDs, you trade on margin, meaning you only need to deposit a percentage of the total trade value (the margin) to open a position. This leverage can amplify both profits and losses. [See also: How to Manage Risk with Leverage in CFD Trading]

Key Features of CFDs

- Leverage: CFDs offer high leverage, allowing you to control a large position with a relatively small amount of capital.

- Wide Range of Markets: Access to a diverse range of global markets, including stocks, indices, commodities, and forex.

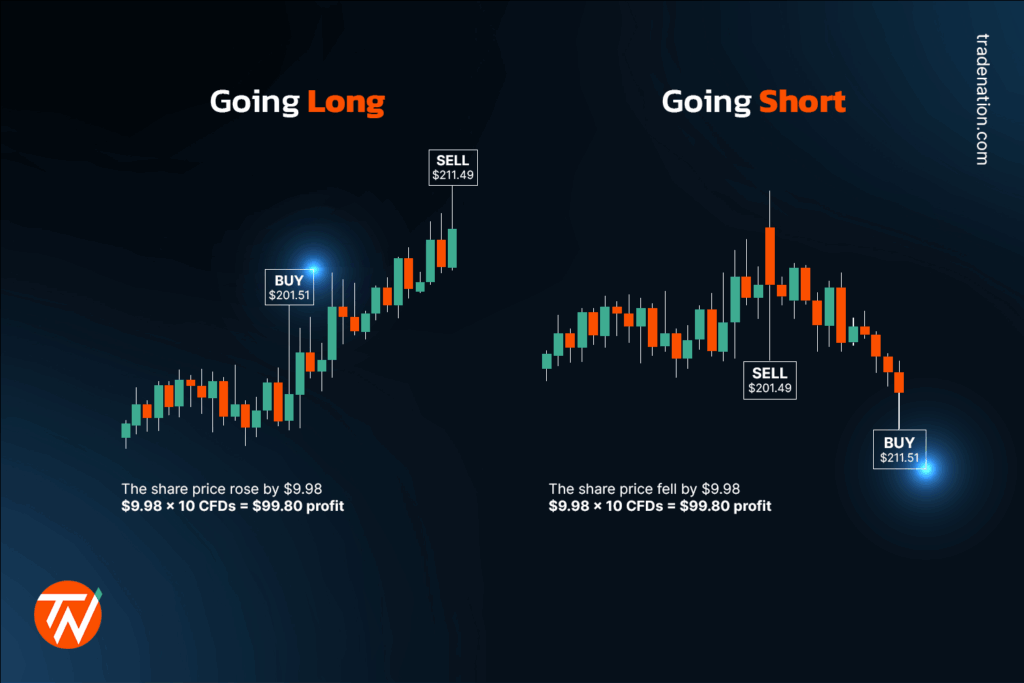

- Flexibility: Trade both rising and falling markets by going long (buying) or short (selling).

- No Stamp Duty: In most jurisdictions, CFDs are exempt from stamp duty.

- Direct Market Access (DMA): Some brokers offer DMA, providing direct access to the order books of exchanges.

What is Spread Betting?

Spread betting involves speculating on the direction of price movements in various financial markets. Instead of buying or selling an asset, you bet on whether the price will go above or below a specified “spread” (the difference between the buying and selling price). The profit or loss depends on the accuracy of your prediction and the amount you stake per point of movement. Like CFDs, spread betting utilizes leverage, requiring only a margin deposit. Spread betting is particularly popular in the UK due to its tax advantages. Understanding the difference between CFD vs. spread betting is crucial for choosing the right instrument.

Key Features of Spread Betting

- Tax-Free Profits (UK): In the UK, profits from spread betting are generally exempt from capital gains tax.

- Leverage: Similar to CFDs, spread betting offers high leverage.

- Fixed Spreads: Some brokers offer fixed spreads, providing more predictable trading costs.

- Simplicity: The concept is relatively simple to understand, making it attractive to beginners.

- Diverse Markets: Access to a wide range of markets, similar to CFDs.

CFD vs. Spread Betting: A Detailed Comparison

Now, let’s delve into the specific differences between CFD vs. spread betting:

Taxation

This is arguably the most significant difference. In the UK, profits from spread betting are generally tax-free under current legislation, as they are classified as gambling. However, profits from CFD trading are subject to capital gains tax. Outside the UK, the tax implications vary depending on the jurisdiction. Always consult with a tax advisor to understand the specific regulations in your country. When considering CFD vs. spread betting, taxation is a key factor.

Pricing

Both CFDs and spread betting make money through the spread, which is the difference between the buying and selling price. CFD brokers may also charge commissions, while spread betting brokers typically do not. It’s important to compare the overall costs, including spreads, commissions, and any other fees, to determine which option is more cost-effective for your trading style. The pricing structures of CFD vs. spread betting can impact profitability.

Market Access

Both CFDs and spread betting offer access to a wide range of markets, including stocks, indices, commodities, and currencies. However, the specific instruments available may vary depending on the broker. Check with your broker to ensure they offer the markets you’re interested in trading. Market access is generally similar in both CFD vs. spread betting.

Regulation

Both CFDs and spread betting are regulated by financial authorities in most jurisdictions. This provides a level of protection for traders, ensuring that brokers adhere to certain standards of conduct. In the UK, both are regulated by the Financial Conduct Authority (FCA). Regulation is an important consideration when choosing between CFD vs. spread betting, ensuring broker accountability.

Contract Size

CFDs are typically traded in contract sizes that reflect the underlying asset. For example, a CFD on a stock might represent one share of that stock. Spread betting, on the other hand, is traded in terms of a stake per point movement. The amount you stake per point determines the potential profit or loss for each point the price moves in your favor or against you. The contract size differs in CFD vs. spread betting, impacting risk management strategies.

Transparency

CFD pricing is often considered more transparent than spread betting, as CFD brokers may provide direct market access (DMA), allowing you to see the order books of exchanges. This can give you a better understanding of the underlying market dynamics. However, both CFD vs. spread betting should be approached with caution and thorough research.

Who Should Choose CFDs?

CFDs might be a better option for:

- Traders who want direct market access.

- Traders who are comfortable paying commissions in exchange for tighter spreads.

- Traders who are not based in the UK or who are not concerned about capital gains tax.

- Traders who prefer contract sizes that reflect the underlying asset.

Who Should Choose Spread Betting?

Spread betting might be a better option for:

- UK-based traders who want to take advantage of tax-free profits.

- Traders who prefer the simplicity of staking per point movement.

- Traders who are comfortable with wider spreads and no commissions.

- Beginner traders who are looking for a relatively simple way to speculate on financial markets.

Risk Management Considerations

Both CFDs and spread betting are leveraged products, which means they carry a high level of risk. It’s crucial to implement effective risk management strategies, such as using stop-loss orders and managing your leverage carefully. Never trade with money you can’t afford to lose. The inherent risks of CFD vs. spread betting require robust risk management techniques.

Stop-Loss Orders

A stop-loss order is an instruction to your broker to automatically close your position if the price reaches a certain level. This can help limit your potential losses. Using stop-loss orders is crucial when trading CFD vs. spread betting.

Leverage Management

While leverage can amplify profits, it can also amplify losses. Use leverage cautiously and avoid over-leveraging your account. Understanding and managing leverage is vital in both CFD vs. spread betting.

Position Sizing

Determine the appropriate position size for each trade based on your risk tolerance and account size. Avoid risking too much capital on any single trade. Proper position sizing is essential for managing risk in CFD vs. spread betting.

Conclusion: Making the Right Choice

The choice between CFD vs. spread betting depends on your individual circumstances and preferences. Consider your tax situation, trading style, risk tolerance, and the markets you want to trade. Both options offer opportunities to profit from price movements in financial markets, but it’s essential to understand the differences and risks involved before making a decision. Thorough research and a clear understanding of your own trading goals are paramount. Ultimately, the best approach is to educate yourself, practice with a demo account, and seek professional advice if needed. Understanding the nuances of CFD vs. spread betting will empower you to make informed trading decisions.