Understanding the Liquidity Preference Framework: A Comprehensive Guide

In the realm of macroeconomics, understanding the forces that drive interest rates is crucial for predicting economic trends and formulating effective monetary policies. One of the key frameworks for analyzing these forces is the liquidity preference framework. This framework, developed by John Maynard Keynes, provides a model for understanding how the supply and demand for money determine the nominal interest rate. This article will delve into the intricacies of the liquidity preference framework, exploring its underlying assumptions, key components, and practical implications. The liquidity preference framework is vital for investors and policymakers alike.

What is the Liquidity Preference Framework?

The liquidity preference framework posits that the interest rate is determined by the supply of and demand for money. In this context, ‘liquidity preference’ refers to the demand for holding wealth in the form of money, rather than less liquid assets like bonds or real estate. People prefer to hold money for various reasons, and the strength of this preference influences the prevailing interest rate. The liquidity preference framework explains short-run fluctuations in interest rates.

Assumptions of the Liquidity Preference Framework

Several key assumptions underpin the liquidity preference framework:

- Two Asset Economy: The model simplifies the economy by assuming only two assets: money and bonds. Money is perfectly liquid and earns no interest, while bonds are less liquid but offer a return (interest).

- Fixed Price Level: The framework typically assumes a fixed price level, making it more suitable for analyzing short-run fluctuations where prices are relatively stable.

- Given Real Income: Real income (or output) is assumed to be given. This assumption allows the model to focus solely on the monetary side of the economy.

Components of the Liquidity Preference Framework

The framework consists of two main components: the demand for money and the supply of money.

Demand for Money

The demand for money represents the total amount of money that individuals and firms want to hold at various interest rates. According to Keynes, there are three primary motives for holding money:

- Transactions Motive: This motive arises from the need to make everyday purchases. Individuals and firms hold money to facilitate transactions. The amount of money demanded for transactions is positively related to income; higher income levels lead to more transactions and thus a greater demand for money.

- Precautionary Motive: This motive stems from the desire to hold money as a buffer against unexpected expenses or opportunities. People hold money as a safety net in case of unforeseen events. Similar to the transactions motive, the precautionary motive is also positively related to income.

- Speculative Motive: This motive is based on expectations about future interest rates. Individuals hold money if they believe that interest rates will rise in the future, causing bond prices to fall. By holding money, they can avoid capital losses on bonds and potentially buy bonds at a lower price later. The speculative motive is inversely related to the interest rate; higher interest rates reduce the demand for money for speculative purposes.

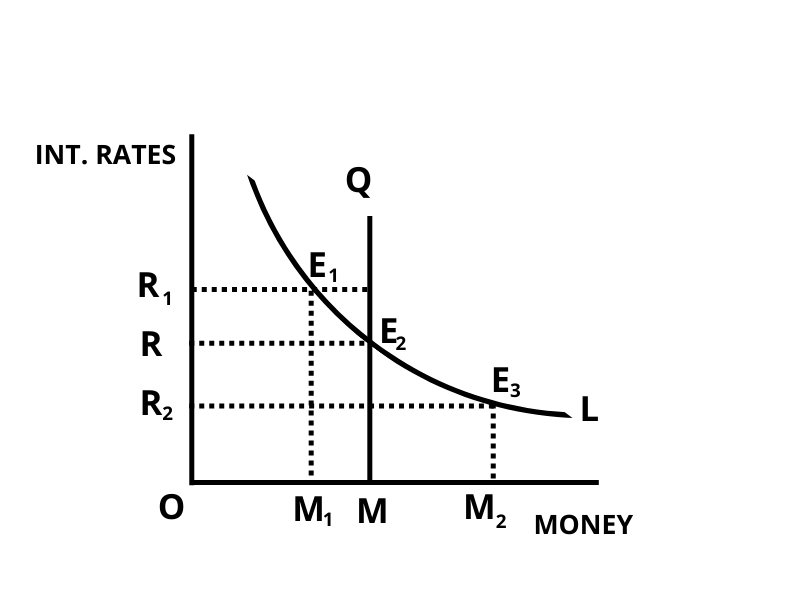

The total demand for money (Md) can be expressed as a function of the interest rate (i) and income (Y): Md = f(i, Y). The demand curve for money slopes downward, reflecting the inverse relationship between the interest rate and the quantity of money demanded. An increase in income shifts the demand curve to the right, indicating a higher demand for money at any given interest rate.

Supply of Money

The supply of money (Ms) is determined by the central bank (e.g., the Federal Reserve in the United States). The central bank controls the money supply through various tools, such as open market operations, reserve requirements, and the discount rate. In the liquidity preference framework, the money supply is typically assumed to be fixed by the central bank at a certain level.

Graphically, the supply of money is represented by a vertical line, indicating that the quantity of money supplied is independent of the interest rate. Changes in monetary policy, such as an increase in the money supply, shift the supply curve to the right.

Equilibrium in the Liquidity Preference Framework

Equilibrium in the liquidity preference framework occurs where the demand for money equals the supply of money (Md = Ms). At this point, the equilibrium interest rate is determined. If the interest rate is above the equilibrium level, there is an excess supply of money, leading individuals to buy bonds, which drives up bond prices and lowers interest rates. Conversely, if the interest rate is below the equilibrium level, there is an excess demand for money, leading individuals to sell bonds, which drives down bond prices and raises interest rates. This process continues until the interest rate reaches the equilibrium level.

Factors that Shift the Equilibrium

Several factors can shift the equilibrium interest rate in the liquidity preference framework:

- Changes in the Money Supply: An increase in the money supply shifts the supply curve to the right, leading to a lower equilibrium interest rate. Conversely, a decrease in the money supply shifts the supply curve to the left, resulting in a higher equilibrium interest rate.

- Changes in Income: An increase in income shifts the demand curve for money to the right, leading to a higher equilibrium interest rate. Conversely, a decrease in income shifts the demand curve to the left, resulting in a lower equilibrium interest rate.

- Changes in Expectations: Changes in expectations about future interest rates can also shift the demand curve for money. For example, if individuals expect interest rates to rise in the future, they will increase their demand for money today, shifting the demand curve to the right and raising the equilibrium interest rate.

Implications of the Liquidity Preference Framework

The liquidity preference framework has significant implications for understanding monetary policy and its effects on the economy.

Monetary Policy

The framework provides a theoretical basis for understanding how central banks can influence interest rates through monetary policy. By manipulating the money supply, central banks can affect the equilibrium interest rate and, consequently, influence investment, consumption, and overall economic activity. For example, during a recession, a central bank might increase the money supply to lower interest rates, encouraging borrowing and investment to stimulate economic growth. This is a core tenet of the liquidity preference framework.

Fiscal Policy

While the liquidity preference framework primarily focuses on monetary policy, it also has implications for fiscal policy. Expansionary fiscal policy, such as increased government spending or tax cuts, can lead to higher income levels, which in turn increases the demand for money and raises interest rates. This phenomenon is known as the crowding-out effect, where increased government borrowing leads to higher interest rates, potentially reducing private investment. [See also: The Crowding-Out Effect Explained]

Limitations of the Liquidity Preference Framework

Despite its usefulness, the liquidity preference framework has certain limitations:

- Short-Run Focus: The framework is primarily designed to analyze short-run fluctuations in interest rates. It does not adequately address long-run factors that influence interest rates, such as inflation expectations and productivity growth.

- Simplified Assumptions: The assumption of a two-asset economy and a fixed price level are simplifications that may not accurately reflect real-world conditions. In reality, there are many different types of assets, and prices are often flexible.

- Neglect of Credit Markets: The framework focuses primarily on the money market and does not explicitly incorporate the role of credit markets in determining interest rates. Credit markets, where loans are made and bonds are traded, can have a significant impact on interest rate levels.

Real-World Applications of the Liquidity Preference Framework

Despite its limitations, the liquidity preference framework remains a valuable tool for understanding and analyzing interest rate movements. It is used by economists, policymakers, and investors to make informed decisions about monetary policy, investment strategies, and economic forecasting.

Central Bank Decision-Making

Central banks regularly use the liquidity preference framework to assess the impact of their policy decisions on interest rates and the economy. By monitoring the demand for money and adjusting the money supply accordingly, central banks can influence interest rates to achieve their desired policy goals, such as price stability and full employment.

Investment Strategies

Investors can use the liquidity preference framework to understand how changes in monetary policy and economic conditions may affect interest rates and bond prices. By anticipating these changes, investors can adjust their portfolios to maximize returns and minimize risk. For example, if an investor believes that the central bank is likely to increase the money supply, they may choose to invest in bonds, anticipating that interest rates will fall and bond prices will rise. [See also: Bond Investing Strategies for Beginners]

Economic Forecasting

Economists use the liquidity preference framework as part of their broader economic forecasting models. By incorporating the framework into their models, economists can better predict future interest rate movements and their impact on economic growth, inflation, and employment. The liquidity preference framework helps to provide a more complete picture of the economy.

Conclusion

The liquidity preference framework provides a valuable tool for understanding how the supply and demand for money determine the nominal interest rate. While it has certain limitations, it remains a cornerstone of macroeconomic analysis and is widely used by economists, policymakers, and investors. By understanding the underlying assumptions, key components, and practical implications of the liquidity preference framework, individuals can gain a deeper insight into the workings of the economy and make more informed decisions. The liquidity preference framework is crucial for anyone seeking to understand monetary policy. The insights from the liquidity preference framework are still relevant today. The liquidity preference framework continues to be a vital tool. The liquidity preference framework offers valuable insights. The liquidity preference framework is still widely studied. Further study of the liquidity preference framework is recommended.