What is a Liquidity Sweep? Understanding Cash Management Strategies

In the fast-paced world of finance, efficient cash management is crucial for businesses of all sizes. One strategy employed to optimize cash flow and maximize returns is a liquidity sweep. But what is a liquidity sweep, and how does it work? This article dives deep into the mechanics, benefits, and considerations of this powerful cash management tool.

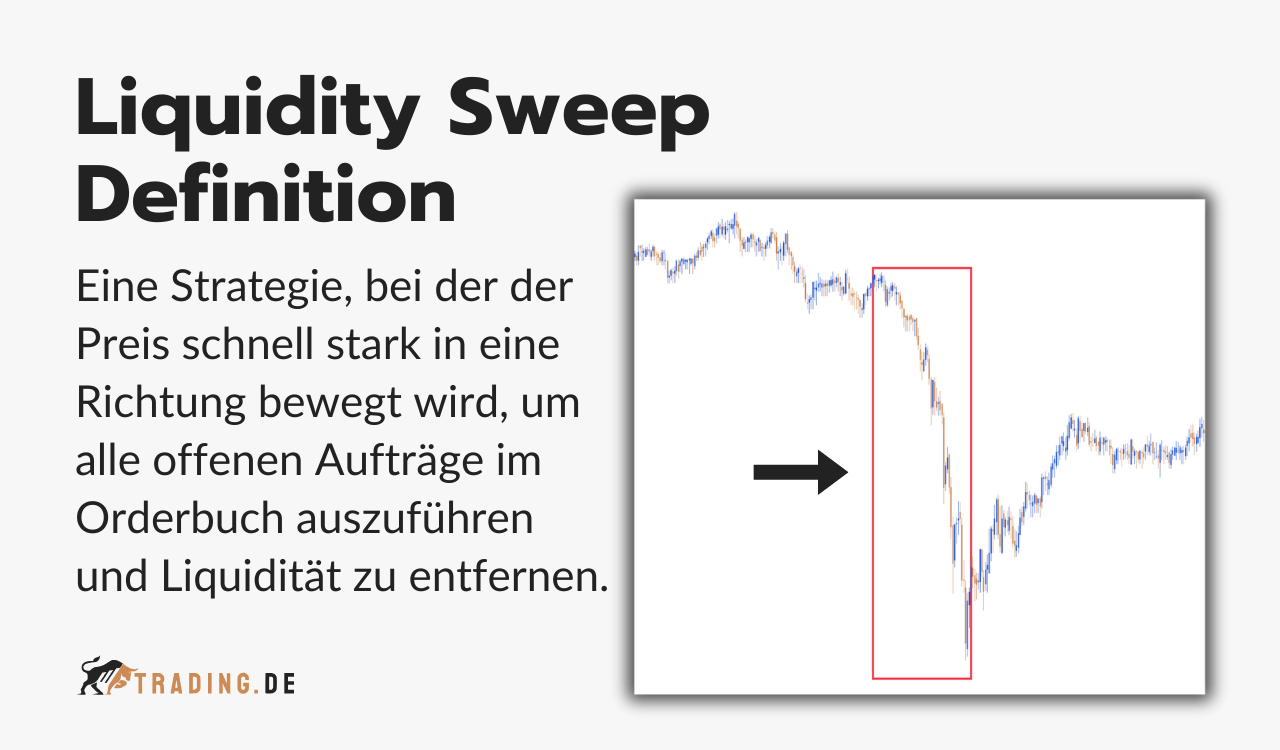

Defining Liquidity Sweep

A liquidity sweep, often referred to as a cash concentration or zero balancing, is an automated process that transfers excess cash from various subsidiary accounts or sub-accounts into a central, interest-bearing master account. The primary goal is to consolidate funds, enabling businesses to efficiently manage their cash reserves and potentially earn higher returns on idle balances. Understanding what is a liquidity sweep involves recognizing its role in streamlining financial operations.

How a Liquidity Sweep Works

The mechanics of a liquidity sweep are relatively straightforward. At the end of each business day, or at predetermined intervals, the system automatically assesses the balances in designated subsidiary accounts. If a balance exceeds a pre-defined target level (often zero), the excess funds are swept into the master account. Conversely, if an account falls below the target, funds can be transferred from the master account to replenish the balance. This automated process ensures that cash is optimally allocated and utilized across the organization. The key to understanding what is a liquidity sweep is understanding this automated transfer process.

The Process in Detail

- Target Balance Setting: Each subsidiary account is assigned a target balance, which can be zero or a specified minimum amount.

- Automated Monitoring: The system continuously monitors the balances of all participating accounts.

- Sweep Trigger: When an account balance deviates from the target balance, a sweep is triggered.

- Fund Transfer: Excess funds are transferred to the master account, or funds are drawn from the master account to cover shortfalls.

- Reporting: Comprehensive reports are generated, providing a clear overview of cash positions and sweep activity.

Benefits of a Liquidity Sweep

Implementing a liquidity sweep offers several significant advantages for businesses:

- Improved Cash Flow Management: By consolidating funds into a central account, businesses gain a clearer view of their overall cash position, allowing for more informed financial decision-making.

- Enhanced Investment Opportunities: Concentrated funds can be used to invest in higher-yielding instruments, maximizing returns on idle cash.

- Reduced Borrowing Costs: By optimizing cash utilization, businesses may reduce their reliance on short-term borrowing, leading to lower interest expenses.

- Streamlined Accounting: Automated sweeps simplify accounting processes and reduce the administrative burden associated with manual cash transfers.

- Centralized Control: A liquidity sweep provides centralized control over cash resources, enhancing security and reducing the risk of fraud.

- Optimized Interest Earnings: Consolidating funds into a single account often allows businesses to negotiate better interest rates with their financial institutions.

Understanding what is a liquidity sweep also means understanding these benefits and how they can improve a company’s financial health. [See also: Treasury Management Best Practices]

Considerations Before Implementing a Liquidity Sweep

While liquidity sweeps offer numerous benefits, businesses should carefully consider several factors before implementation:

- Banking Relationships: A strong banking relationship is essential, as the bank will be responsible for managing the sweep process.

- Account Structure: The existing account structure may need to be modified to accommodate the sweep mechanism.

- System Integration: The sweep system must be seamlessly integrated with the company’s accounting and treasury management systems.

- Tax Implications: Businesses should consult with tax advisors to understand the tax implications of liquidity sweeps.

- Fees and Charges: Banks may charge fees for liquidity sweep services, which should be carefully evaluated.

- Regulatory Compliance: Ensure compliance with all relevant regulations, including those related to fund transfers and anti-money laundering.

Types of Liquidity Sweeps

There are different types of liquidity sweeps, each tailored to specific needs:

- Zero Balance Account (ZBA) Sweep: This is the most common type, where subsidiary accounts are swept to a zero balance at the end of each day.

- Target Balance Sweep: Accounts are swept to a pre-determined target balance, rather than zero.

- Threshold Sweep: Funds are swept only when the balance exceeds a specific threshold.

- Concentration Sweep: Funds from multiple accounts are concentrated into a single master account.

Liquidity Sweeps vs. Other Cash Management Techniques

While liquidity sweeps are a valuable tool, they are not the only cash management technique available. Other options include:

- Cash Forecasting: Predicting future cash inflows and outflows to optimize cash planning.

- Working Capital Management: Optimizing the management of current assets and liabilities.

- Short-Term Investments: Investing excess cash in short-term, liquid instruments.

Businesses should carefully evaluate their needs and choose the cash management techniques that best suit their specific circumstances. A thorough understanding of what is a liquidity sweep will help in this decision-making process.

Industries That Benefit Most from Liquidity Sweeps

Certain industries find liquidity sweeps particularly beneficial due to their operational structures and cash flow patterns. These include:

- Retail Chains: With numerous store locations generating daily cash, a liquidity sweep centralizes funds efficiently.

- Franchise Businesses: Similar to retail chains, franchises benefit from consolidating cash from various franchise locations.

- Healthcare Organizations: Hospitals and clinics with multiple departments can streamline cash management using liquidity sweeps.

- Manufacturing Companies: Companies with complex supply chains and multiple production facilities can optimize cash flow through centralized sweeping.

- Real Estate Firms: Managing cash flow across multiple properties and projects becomes more efficient with a liquidity sweep system.

The Future of Liquidity Sweeps

As technology continues to evolve, liquidity sweeps are becoming increasingly sophisticated. Automation, artificial intelligence, and real-time data analytics are transforming the way businesses manage their cash. Expect to see more advanced features such as predictive sweeping, personalized investment recommendations, and enhanced security measures. The core principle of what is a liquidity sweep will remain the same—optimizing cash management—but the tools and techniques used to achieve this goal will continue to advance. [See also: Future of Treasury Management]

Implementing a Liquidity Sweep: A Step-by-Step Guide

Successfully implementing a liquidity sweep requires careful planning and execution. Here’s a step-by-step guide:

- Assess Your Needs: Determine your cash management goals and identify areas where a liquidity sweep could be beneficial.

- Choose a Banking Partner: Select a bank with experience in providing liquidity sweep services and a strong track record.

- Design Your Account Structure: Determine the number of subsidiary accounts and the target balances for each account.

- Integrate Your Systems: Ensure seamless integration between the sweep system and your accounting and treasury management systems.

- Test the System: Conduct thorough testing to ensure that the system is functioning correctly and that all data is accurate.

- Train Your Staff: Provide comprehensive training to your staff on how the sweep system works and how to interpret the reports.

- Monitor and Optimize: Continuously monitor the performance of the sweep system and make adjustments as needed to optimize its effectiveness.

Potential Risks and Challenges

While liquidity sweeps offer numerous advantages, it’s important to be aware of potential risks and challenges:

- Operational Errors: Incorrectly configured systems or human error can lead to unintended consequences.

- System Downtime: System outages can disrupt the sweep process and impact cash flow.

- Cybersecurity Threats: Sweep systems are vulnerable to cybersecurity threats, such as hacking and fraud.

- Compliance Risks: Failure to comply with regulations can result in penalties and legal action.

Mitigating these risks requires robust security measures, thorough system testing, and ongoing monitoring. Understanding what is a liquidity sweep also means understanding its potential vulnerabilities and how to address them.

Conclusion: Mastering Cash Management with Liquidity Sweeps

In conclusion, a liquidity sweep is a powerful cash management tool that can help businesses optimize their cash flow, maximize returns, and streamline their financial operations. By consolidating funds into a central account, businesses can gain a clearer view of their overall cash position, reduce borrowing costs, and enhance investment opportunities. While implementation requires careful planning and consideration, the benefits of a well-executed liquidity sweep can be substantial. Understanding what is a liquidity sweep is essential for any business looking to improve its financial performance and achieve its strategic goals. [See also: Cash Management Strategies for Small Businesses]