Today’s Market Prediction: Navigating Uncertainty with Data-Driven Insights

The global financial markets are in constant flux, influenced by a myriad of factors ranging from geopolitical events to macroeconomic indicators. Understanding today’s market prediction requires a deep dive into these elements, coupled with a keen awareness of prevailing investor sentiment. This article aims to provide a comprehensive overview of the current market landscape, offering data-driven insights to help investors navigate the inherent uncertainties and make informed decisions. We’ll explore the key drivers shaping market behavior and offer potential scenarios for the near future.

Analyzing Key Market Drivers

Several factors are currently exerting significant influence on the global markets. These include:

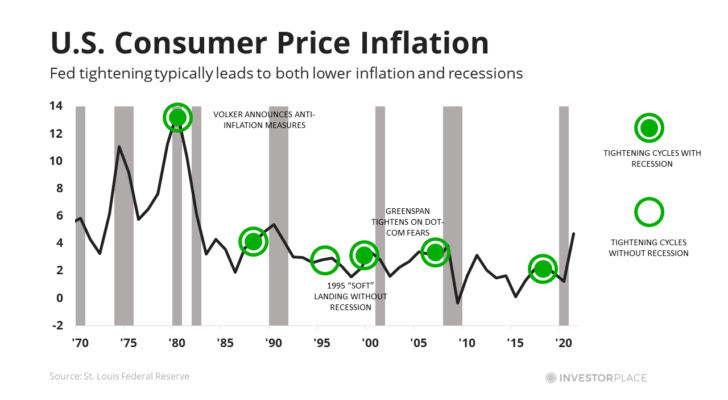

- Inflation and Interest Rates: Persistent inflation remains a primary concern for central banks worldwide. The Federal Reserve, the European Central Bank, and other major monetary authorities are closely monitoring inflation data and adjusting interest rates accordingly. Higher interest rates can curb inflation but also dampen economic growth, creating a delicate balancing act.

- Geopolitical Risks: Ongoing conflicts and political instability in various regions can disrupt supply chains, increase commodity prices, and heighten investor risk aversion. These events often trigger volatility in equity and bond markets.

- Economic Growth: The pace of economic growth in major economies, such as the United States, China, and the Eurozone, is a critical determinant of market performance. Slower growth can lead to lower corporate earnings and reduced investor confidence.

- Corporate Earnings: The financial performance of publicly traded companies directly impacts stock prices. Strong earnings reports can boost investor sentiment, while weak results can trigger sell-offs.

- Technological Advancements: Disruptive technologies and innovations continue to reshape industries and create new investment opportunities. Companies that successfully adapt to these changes are often rewarded with higher valuations.

Examining Current Market Trends

Currently, several notable trends are shaping the market landscape:

- The Rise of Artificial Intelligence (AI): AI is rapidly transforming various sectors, from healthcare and finance to manufacturing and transportation. Companies that are leveraging AI to improve efficiency, develop new products, and enhance customer experiences are attracting significant investor interest.

- The Energy Transition: The global shift towards renewable energy sources is creating both challenges and opportunities for energy companies. Investments in solar, wind, and other clean energy technologies are on the rise.

- Supply Chain Disruptions: While supply chain bottlenecks have eased somewhat, they continue to pose challenges for many businesses. Companies are seeking to diversify their supply chains and build greater resilience.

- The Growth of E-commerce: E-commerce continues to expand rapidly, driven by changing consumer preferences and technological advancements. Online retailers are gaining market share at the expense of traditional brick-and-mortar stores.

Potential Market Scenarios

Given the complex interplay of factors influencing the markets, it is essential to consider several potential scenarios:

Scenario 1: Soft Landing

In this scenario, central banks successfully manage to curb inflation without triggering a significant recession. Economic growth slows moderately, but corporate earnings remain relatively stable. Investor sentiment improves, leading to a rebound in equity markets. This is often the hoped-for outcome by many analysts when providing a today’s market prediction.

Scenario 2: Recession

A recessionary scenario involves a sharper slowdown in economic growth, accompanied by declining corporate earnings and rising unemployment. Investor confidence plummets, leading to a significant correction in equity markets. This scenario could be triggered by a more aggressive tightening of monetary policy or an escalation of geopolitical tensions.

Scenario 3: Stagflation

Stagflation is characterized by high inflation and slow economic growth. This scenario poses a significant challenge for policymakers, as traditional monetary policy tools may be ineffective. Investor sentiment is likely to remain weak in a stagflationary environment.

Strategies for Navigating Market Uncertainty

Given the inherent uncertainties in the market, investors should adopt a disciplined and diversified approach. Here are some key strategies:

- Diversification: Spreading investments across different asset classes, sectors, and geographic regions can help mitigate risk.

- Long-Term Perspective: Focusing on long-term investment goals rather than short-term market fluctuations can help investors weather periods of volatility.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals can help reduce the impact of market timing on investment returns.

- Risk Management: Understanding and managing risk is crucial for protecting capital. Investors should carefully assess their risk tolerance and adjust their portfolios accordingly.

- Staying Informed: Keeping abreast of market developments and economic trends is essential for making informed investment decisions.

The Role of Technology in Market Prediction

Technology is playing an increasingly important role in market prediction. Sophisticated algorithms and machine learning models are being used to analyze vast amounts of data and identify patterns that can help forecast market movements. While these tools can provide valuable insights, it is important to remember that they are not foolproof. Market predictions are inherently uncertain, and no model can perfectly predict the future.

The accuracy of today’s market prediction also hinges on the quality of data used. Models are only as good as the data they are trained on. Biases and inaccuracies in the data can lead to flawed predictions. Furthermore, market conditions are constantly evolving, and models need to be continuously updated to reflect these changes.

Expert Opinions on Today’s Market

Financial analysts and economists offer diverse perspectives on today’s market prediction. Some believe that the economy is resilient and can withstand the current challenges, while others are more pessimistic and foresee a recession. It is important to consider a range of opinions and form your own informed judgment.

Many experts emphasize the importance of focusing on fundamentals, such as corporate earnings and economic growth, rather than getting caught up in short-term market noise. They also advise investors to remain disciplined and avoid making impulsive decisions based on fear or greed.

Impact of Global Events on Market Prediction

Global events, such as geopolitical tensions, trade wars, and pandemics, can have a significant impact on market prediction. These events can disrupt supply chains, increase volatility, and alter investor sentiment. It is essential to monitor these events closely and assess their potential impact on your investment portfolio.

For example, a sudden escalation of geopolitical tensions could lead to a flight to safety, with investors selling risky assets and buying safe-haven assets such as gold and government bonds. A trade war could disrupt global trade flows and negatively impact corporate earnings. A pandemic could lead to a sharp decline in economic activity and a significant correction in equity markets. Therefore, any today’s market prediction should consider these factors.

The Future of Market Prediction

The future of market prediction is likely to be shaped by technological advancements and the increasing availability of data. Machine learning and artificial intelligence are expected to play an even greater role in analyzing market trends and forecasting future movements. However, it is important to remember that market prediction will always be subject to uncertainty. Human judgment and expertise will continue to be essential for making informed investment decisions.

As data becomes more readily available and analytical tools become more sophisticated, investors will have access to better insights and more accurate predictions. However, it is important to use these tools responsibly and avoid relying solely on them. A balanced approach that combines data-driven analysis with human judgment is likely to be the most effective strategy for navigating the complexities of the financial markets.

Conclusion: Making Informed Decisions in a Dynamic Market

Today’s market prediction requires a comprehensive understanding of the key drivers, trends, and potential scenarios shaping the global financial landscape. By analyzing these factors and adopting a disciplined and diversified investment approach, investors can navigate the inherent uncertainties and make informed decisions. While market predictions are inherently uncertain, staying informed and focusing on long-term goals can help investors achieve their financial objectives. Remember to consult with a qualified financial advisor before making any investment decisions. Consider the long term when thinking about today’s market prediction. [See also: Investing for Beginners] [See also: Understanding Risk Tolerance] [See also: Diversification Strategies]