Understanding Trading Liquidity Sweeps: A Comprehensive Guide

In the fast-paced world of financial markets, understanding the nuances of order execution and market dynamics is crucial for both novice and experienced traders. One such dynamic is the concept of trading liquidity sweeps. A liquidity sweep is a market event where a large order, or a series of orders, rapidly consumes available liquidity at multiple price levels. This can result in significant price movements and can impact trading strategies significantly. This guide aims to provide a comprehensive understanding of liquidity sweeps, their causes, effects, and how traders can navigate them effectively.

What is a Trading Liquidity Sweep?

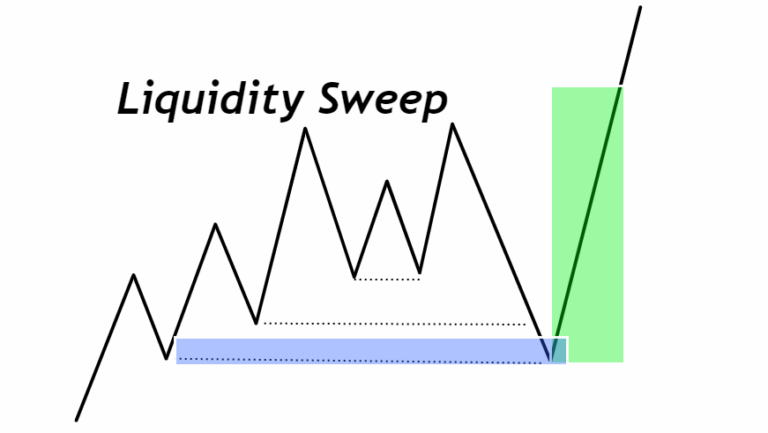

A trading liquidity sweep, also known as a liquidity grab or sweep of liquidity, occurs when a sizable market order or a series of smaller orders quickly executes against all available buy or sell orders at various price points. This rapid consumption of liquidity leads to a swift and often substantial price movement in the direction of the sweep. The primary purpose behind a liquidity sweep is typically to fill a large order quickly, even if it means accepting less favorable prices.

Imagine a scenario where a large institutional investor needs to purchase a significant number of shares of a particular stock. Rather than placing a single large order that might move the market price adversely, they might initiate a liquidity sweep. This involves breaking the larger order into smaller chunks and executing them aggressively against available limit orders, effectively ‘sweeping’ through the order book until the desired quantity is filled.

Causes of Liquidity Sweeps

Several factors can contribute to the occurrence of liquidity sweeps. Understanding these causes can help traders anticipate and potentially profit from these events.

Large Institutional Orders

As mentioned earlier, large institutional investors, such as hedge funds, mutual funds, and pension funds, are often the primary drivers of liquidity sweeps. These entities frequently need to execute substantial orders, and a liquidity sweep is an efficient way to achieve this without causing excessive price slippage. The urgency to fill these orders can stem from various reasons, including portfolio rebalancing, index tracking, or responding to market news.

Algorithmic Trading

The rise of algorithmic trading has significantly impacted market dynamics. Sophisticated algorithms are designed to identify and exploit inefficiencies in the market, including areas of high liquidity. These algorithms can be programmed to execute liquidity sweeps automatically, seeking to capitalize on short-term price movements. These automated sweeps can happen very quickly and be difficult to predict.

News Events and Market Sentiment

Major news announcements, economic data releases, and geopolitical events can trigger rapid shifts in market sentiment. This can lead to a sudden surge in buying or selling pressure, resulting in a liquidity sweep. For example, a positive earnings report from a major company could prompt a wave of buying, leading to a liquidity sweep as investors rush to acquire shares.

Stop-Loss Hunting

While controversial, some market participants may engage in stop-loss hunting, which involves deliberately triggering stop-loss orders to profit from the resulting price movement. This can be achieved by initiating a liquidity sweep that drives the price down to a level where a significant number of stop-loss orders are clustered. Once these orders are triggered, the increased selling pressure can further exacerbate the price decline, allowing the hunters to profit.

Effects of Liquidity Sweeps

Liquidity sweeps can have a significant impact on market participants, both positive and negative. Understanding these effects is essential for developing effective trading strategies.

Price Volatility

One of the most immediate effects of a liquidity sweep is increased price volatility. The rapid consumption of liquidity leads to sharp price movements, which can create opportunities for short-term traders but also pose risks for those with less experience. The volatility often subsides after the sweep is completed, but the immediate impact can be substantial.

Slippage

Slippage occurs when the execution price of an order differs from the expected price. Liquidity sweeps can exacerbate slippage, especially for market orders. As the sweep consumes available liquidity at various price levels, orders may be filled at progressively worse prices, leading to significant slippage. Limit orders are less susceptible to slippage but may not be filled if the price moves too quickly.

False Breakouts

Liquidity sweeps can sometimes create the illusion of a breakout, where the price appears to be breaking through a key resistance or support level. However, these breakouts may be temporary, as the price quickly reverses after the sweep is completed. This can trap inexperienced traders who enter positions based on the false breakout signal.

Increased Trading Volume

The occurrence of a liquidity sweep typically leads to a spike in trading volume. This is because the sweep involves the execution of a large number of orders in a short period. The increased volume can provide additional liquidity for other traders, but it can also make it more difficult to predict future price movements.

How to Navigate Trading Liquidity Sweeps

While liquidity sweeps can be unpredictable, there are several strategies that traders can employ to mitigate their impact and potentially profit from them.

Use Limit Orders

Limit orders allow traders to specify the maximum price they are willing to pay (for buy orders) or the minimum price they are willing to accept (for sell orders). By using limit orders, traders can avoid slippage and ensure that their orders are only filled at the desired price. However, there is a risk that the order may not be filled if the price moves too quickly during a liquidity sweep.

Monitor Order Book Depth

The order book provides a real-time view of the available buy and sell orders at various price levels. By monitoring the order book depth, traders can identify potential areas of high liquidity and anticipate potential liquidity sweeps. A sudden thinning of the order book can indicate that a sweep is imminent.

Implement Stop-Loss Orders Strategically

Stop-loss orders are designed to limit potential losses by automatically selling a position if the price falls below a specified level. However, stop-loss orders can also be vulnerable to stop-loss hunting during liquidity sweeps. To mitigate this risk, traders should place their stop-loss orders strategically, avoiding obvious levels where they are likely to be triggered. Consider using wider stop-loss orders or trailing stop-loss orders to provide more flexibility.

Diversify Trading Strategies

Relying on a single trading strategy can be risky, especially in volatile market conditions. By diversifying trading strategies, traders can reduce their exposure to the negative effects of liquidity sweeps. For example, a trader might combine a trend-following strategy with a mean-reversion strategy to capitalize on different market conditions.

Stay Informed and Adaptable

The financial markets are constantly evolving, and it is essential for traders to stay informed about market news, economic data, and geopolitical events. By understanding the factors that can influence market sentiment and trigger liquidity sweeps, traders can adapt their strategies accordingly. Flexibility and a willingness to adjust to changing market conditions are crucial for long-term success.

Examples of Liquidity Sweeps

To further illustrate the concept of liquidity sweeps, let’s consider a few hypothetical examples.

Example 1: Earnings Announcement

A major technology company is scheduled to release its quarterly earnings report after the market close. Analysts are expecting strong results, but there is also some uncertainty about the company’s future guidance. As the earnings report is released, it exceeds expectations, and the company provides optimistic guidance for the next quarter. This triggers a surge in buying pressure, leading to a liquidity sweep as investors rush to acquire shares. The stock price jumps significantly in after-hours trading, and many limit orders are filled at higher prices.

Example 2: Geopolitical Event

Tensions escalate between two major countries, raising concerns about potential trade disruptions. This news sends shockwaves through the market, causing investors to sell off risky assets and seek refuge in safe-haven investments. The sudden increase in selling pressure leads to a liquidity sweep in the stock market, as large institutional investors liquidate their positions. The market experiences a sharp decline, and many stop-loss orders are triggered, further exacerbating the sell-off.

Example 3: Algorithmic Trading

A sophisticated algorithmic trading program identifies a temporary imbalance in the order book for a particular stock. The algorithm is programmed to exploit this imbalance by initiating a liquidity sweep. The algorithm rapidly executes a series of buy orders, consuming available liquidity at various price levels. This causes a brief but significant price spike, allowing the algorithm to profit from the temporary inefficiency. Other traders who were not aware of the algorithm’s activity may be caught off guard by the sudden price movement.

Conclusion

Trading liquidity sweeps are a common occurrence in financial markets, driven by factors such as large institutional orders, algorithmic trading, news events, and stop-loss hunting. Understanding the causes and effects of liquidity sweeps is crucial for traders who want to navigate the market effectively. By using limit orders, monitoring order book depth, implementing stop-loss orders strategically, diversifying trading strategies, and staying informed, traders can mitigate the risks associated with liquidity sweeps and potentially profit from these events. While they can cause volatility and slippage, informed and adaptable traders can navigate these sweeps to their advantage. Ultimately, success in the market requires a combination of knowledge, skill, and discipline. Recognizing the potential for a liquidity sweep is just one aspect of a broader understanding of market dynamics.

[See also: Understanding Order Book Dynamics] [See also: Algorithmic Trading Strategies] [See also: Risk Management in Trading]