Unveiling the Meaning of Duty-Free Shops: A Traveler’s Guide

For seasoned travelers and occasional globetrotters alike, the allure of a duty-free shop is often irresistible. These havens, typically found in international airports and border crossings, promise savings on a variety of goods. But what exactly does ‘duty-free‘ mean, and how can you make the most of these shopping opportunities? This article delves into the meaning of duty-free shops, exploring their history, operation, and the potential benefits they offer to consumers.

The Core Concept: What Does Duty-Free Mean?

The term ‘duty-free‘ refers to the exemption from certain taxes and duties on goods sold to travelers who will be taking them out of the country or customs territory. These taxes and duties typically include import duties, excise taxes, and value-added tax (VAT) or sales tax. Essentially, duty-free shops allow you to purchase items without paying the taxes that would normally be applied within the country of purchase. This reduction in price is the primary draw for many shoppers.

The meaning of duty-free shops is rooted in international trade agreements and regulations designed to facilitate travel and commerce. By eliminating taxes on goods destined for export, countries aim to encourage tourism and international business. The savings are then passed on to the consumer, making certain products more affordable than they would be in regular retail outlets.

A Brief History of Duty-Free Shopping

The concept of duty-free shopping dates back to the mid-20th century. The first duty-free shop was established at Shannon Airport in Ireland in 1947. Brendan O’Regan is credited with pioneering the idea, recognizing the opportunity to provide a service to transatlantic passengers who were often stopping over in Shannon. This innovative approach proved to be incredibly successful, and the model was quickly adopted by airports and border crossings around the world.

Initially, duty-free shops primarily offered items like tobacco, alcohol, and perfumes, which were heavily taxed. Over time, the range of products expanded to include cosmetics, electronics, fashion accessories, and even local souvenirs. The evolution of duty-free shopping reflects the changing needs and preferences of international travelers.

How Duty-Free Shops Operate

Duty-free shops operate under strict regulations imposed by customs authorities. They are required to verify that the goods they sell are indeed being exported, typically by checking boarding passes or travel documents. This ensures that the tax exemption is only applied to items that are leaving the country. The shops are also subject to audits and inspections to prevent abuse of the system.

The pricing structure in duty-free shops is often complex. While the absence of taxes can lead to significant savings, it’s important to compare prices with those in regular retail stores, both at your destination and point of origin. Sometimes, special promotions or currency exchange rates can influence the overall cost. Additionally, the perceived savings can be a powerful psychological driver, leading some shoppers to make impulse purchases.

What Products Are Typically Available in Duty-Free Shops?

The selection of products available in duty-free shops varies depending on the location and the target audience. However, some common categories include:

- Alcohol: Spirits, wines, and beers are often heavily discounted due to the high taxes typically applied to alcoholic beverages.

- Tobacco: Cigarettes, cigars, and other tobacco products are also frequently offered at lower prices.

- Perfumes and Cosmetics: Many popular brands of perfumes, makeup, and skincare products can be found in duty-free shops.

- Fashion Accessories: Sunglasses, handbags, wallets, and other accessories are often available.

- Electronics: Some duty-free shops offer electronics such as headphones, cameras, and travel adapters.

- Confectionery: Chocolates, candies, and other sweets are a popular choice for travelers.

- Local Souvenirs: Many duty-free shops also sell local crafts, gifts, and souvenirs.

Maximizing Your Duty-Free Shopping Experience

To make the most of your duty-free shopping experience, consider the following tips:

- Do your research: Before you travel, research the prices of items you’re interested in buying. This will help you determine whether the duty-free price is actually a good deal.

- Compare prices: Don’t assume that duty-free is always the cheapest option. Compare prices with those in regular retail stores, both at your destination and point of origin.

- Be aware of your allowances: Check the customs regulations of your destination country to ensure that you don’t exceed your duty-free allowance. Exceeding the allowance can result in taxes and penalties.

- Consider currency exchange rates: Be mindful of the exchange rate when making purchases in a foreign currency. The exchange rate can significantly impact the final cost.

- Don’t be afraid to negotiate: In some duty-free shops, particularly in certain countries, you may be able to negotiate the price.

- Check for promotions: Look out for special promotions, discounts, and bundle deals.

- Factor in convenience: Consider the convenience of buying items at the duty-free shop versus carrying them with you throughout your trip.

The Future of Duty-Free Shopping

The meaning of duty-free shops continues to evolve in the face of changing consumer behavior and global trade dynamics. Online shopping and e-commerce have presented new challenges and opportunities for the duty-free industry. Some airports are experimenting with online duty-free platforms that allow travelers to pre-order items and pick them up at the airport.

Furthermore, the rise of sustainable and ethical consumerism is influencing the types of products that are offered in duty-free shops. There is a growing demand for locally sourced, eco-friendly, and ethically produced goods. Duty-free shops that adapt to these trends are likely to thrive in the future.

Duty-Free vs. Tax-Free: Understanding the Difference

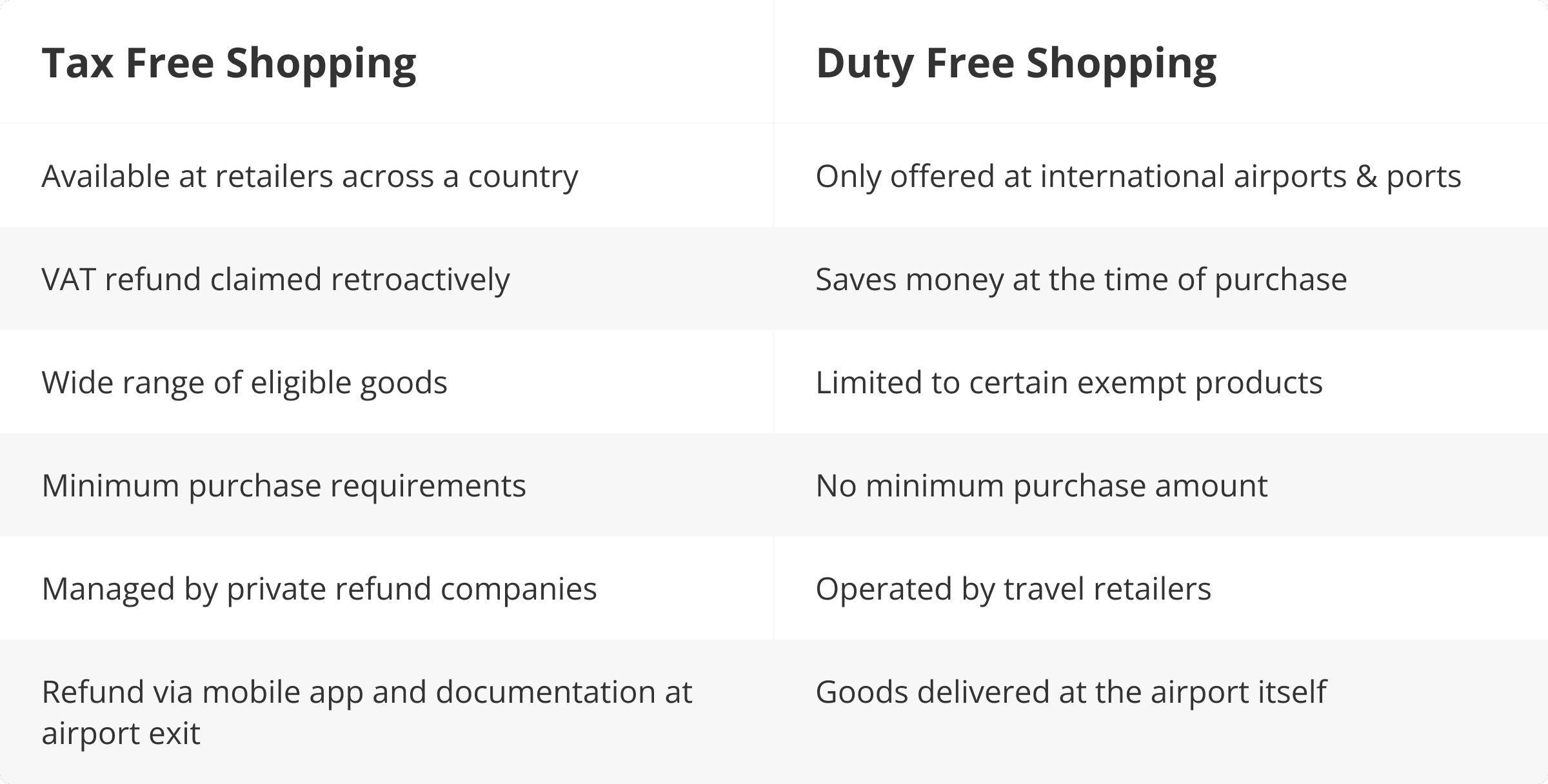

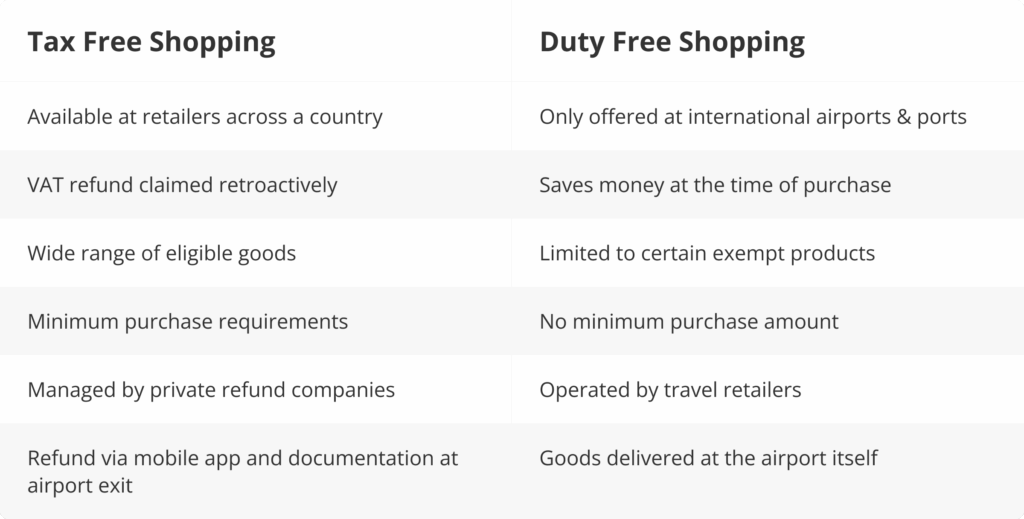

It’s important to distinguish between duty-free and tax-free shopping. While both offer potential savings, they operate differently. As discussed, duty-free refers to exemption from duties and taxes on goods being exported. Tax-free shopping, on the other hand, typically involves claiming a refund on the value-added tax (VAT) or sales tax that you paid on goods purchased within a country. This refund is usually processed at the airport or border crossing upon departure. [See also: VAT Refund Guide for Tourists]

The Economic Impact of Duty-Free Shops

Duty-free shops play a significant role in the global economy. They generate revenue for airports, airlines, and other businesses involved in the travel industry. They also create jobs and contribute to tourism. The presence of duty-free shops can enhance the overall travel experience, making airports more attractive and convenient for passengers.

Conclusion: The Enduring Appeal of Duty-Free Shopping

The meaning of duty-free shops extends beyond simply saving money on taxes. They represent a unique shopping opportunity for travelers, offering a wide range of products from around the world. While it’s crucial to be a savvy shopper and compare prices, the allure of finding a great deal in a duty-free shop remains a powerful draw for many. As the travel industry continues to evolve, duty-free shops will likely adapt and innovate to meet the changing needs and preferences of their customers. Understanding the intricacies of duty-free shopping empowers travelers to make informed decisions and maximize their savings while exploring the world.

Whether you’re looking for a special gift, a treat for yourself, or simply a way to pass the time during a layover, the duty-free shop offers a unique and often rewarding shopping experience. Remember to do your research, compare prices, and be aware of your allowances to make the most of your next duty-free shopping spree.