Game of Trades: Navigating the Complex World of Financial Markets

The financial markets are often described as a complex and ever-evolving landscape, a “game” in which participants constantly seek to gain an edge. This intricate arena, often referred to as the Game of Trades, involves a multitude of players, strategies, and instruments. Understanding the dynamics of the Game of Trades is crucial for anyone looking to participate, whether as an individual investor, a seasoned trader, or a financial professional. This article delves into the key aspects of the Game of Trades, exploring its intricacies, challenges, and potential rewards.

Understanding the Fundamentals of Trading

Before diving into advanced strategies, it’s essential to grasp the foundational concepts of trading. This includes understanding different asset classes such as stocks, bonds, commodities, and currencies. Each asset class has its own unique characteristics, risk profiles, and potential returns. Understanding these differences is the first step in mastering the Game of Trades.

- Stocks: Represent ownership in a company. Their value is influenced by company performance, market sentiment, and economic factors.

- Bonds: Represent debt instruments issued by governments or corporations. They offer a fixed income stream and are generally considered less risky than stocks.

- Commodities: Raw materials such as oil, gold, and agricultural products. Their prices are affected by supply and demand dynamics, geopolitical events, and weather patterns.

- Currencies: Traded in the foreign exchange (Forex) market. Their values fluctuate based on economic indicators, interest rates, and geopolitical stability.

Furthermore, understanding market mechanics, such as order types (market orders, limit orders, stop-loss orders), margin trading, and short selling, is critical. These tools allow traders to execute strategies efficiently and manage risk effectively in the Game of Trades.

Key Players in the Game of Trades

The Game of Trades involves a diverse range of participants, each with their own objectives and strategies. These players can be broadly categorized as follows:

- Individual Investors: Retail investors who trade for their own accounts. They may have varying levels of experience and risk tolerance.

- Institutional Investors: Large organizations such as mutual funds, hedge funds, pension funds, and insurance companies. They manage significant amounts of capital and often employ sophisticated trading strategies.

- Market Makers: Entities that provide liquidity to the market by quoting bid and ask prices for securities. They profit from the spread between these prices.

- Brokers: Intermediaries that facilitate trades between buyers and sellers. They earn commissions for their services.

- Regulators: Government agencies that oversee the financial markets to ensure fair and transparent trading practices.

Understanding the roles and motivations of these different players is essential for navigating the complexities of the Game of Trades. Each participant’s actions can influence market prices and trends, requiring traders to adapt their strategies accordingly.

Strategies and Techniques in the Game of Trades

Successful participation in the Game of Trades requires a well-defined strategy and the ability to adapt to changing market conditions. There are various trading strategies that participants can employ, depending on their risk tolerance, investment horizon, and market outlook. Some common strategies include:

- Day Trading: Involves buying and selling securities within the same day, aiming to profit from small price fluctuations.

- Swing Trading: Holding securities for a few days or weeks to capture short-term price swings.

- Position Trading: Holding securities for several months or years, based on long-term fundamental analysis.

- Value Investing: Identifying undervalued securities and holding them until their market price reflects their intrinsic value.

- Growth Investing: Investing in companies with high growth potential, even if their current valuation is high.

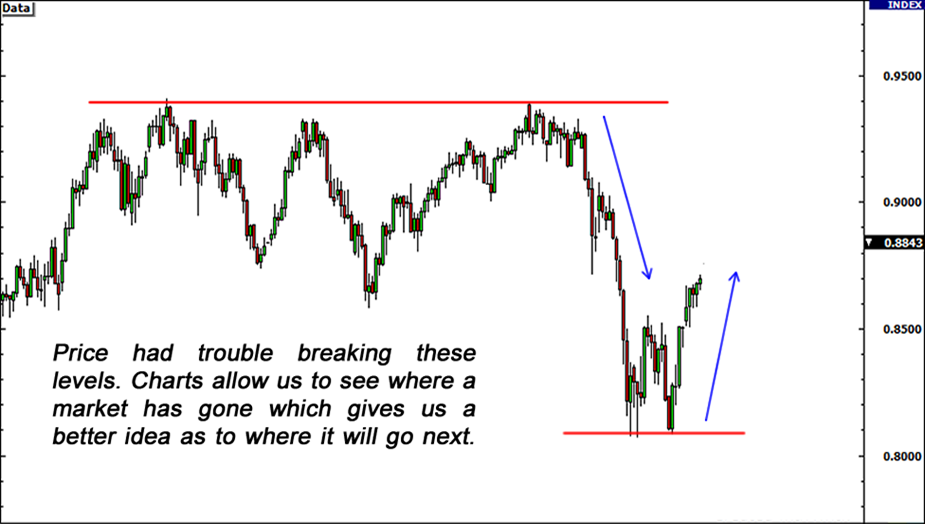

- Technical Analysis: Using charts and other technical indicators to identify patterns and predict future price movements.

- Fundamental Analysis: Analyzing financial statements and economic data to assess the intrinsic value of a security.

Furthermore, risk management techniques, such as setting stop-loss orders, diversifying portfolios, and managing position sizes, are crucial for protecting capital and minimizing losses in the Game of Trades. [See also: Risk Management Strategies for Traders]

The Role of Technology in Modern Trading

Technology has revolutionized the Game of Trades, providing traders with unprecedented access to information, tools, and markets. High-speed computers, algorithmic trading systems, and sophisticated analytical software have become essential components of modern trading. These technologies allow traders to:

- Access real-time market data: Stay informed about price movements, trading volumes, and other market indicators.

- Automate trading strategies: Execute trades automatically based on predefined rules and algorithms.

- Analyze vast amounts of data: Identify patterns and trends that would be impossible to detect manually.

- Trade in multiple markets simultaneously: Diversify portfolios and capitalize on global opportunities.

However, technology also presents new challenges. The speed and complexity of modern trading can create opportunities for errors and manipulation. Traders must be aware of these risks and take steps to mitigate them.

Psychological Aspects of Trading

The Game of Trades is not just about numbers and algorithms; it also involves a significant psychological component. Emotions such as fear, greed, and overconfidence can cloud judgment and lead to poor trading decisions. Successful traders must develop emotional discipline and learn to control their impulses. [See also: The Psychology of Successful Traders]

Some key psychological factors that influence trading performance include:

- Fear of missing out (FOMO): The anxiety of potentially missing out on a profitable trade.

- Loss aversion: The tendency to feel the pain of a loss more strongly than the pleasure of a gain.

- Confirmation bias: The tendency to seek out information that confirms existing beliefs, while ignoring contradictory evidence.

- Overconfidence: An exaggerated belief in one’s own abilities and knowledge.

By understanding these psychological biases, traders can make more rational and objective decisions in the Game of Trades.

The Importance of Continuous Learning

The Game of Trades is a constantly evolving field. New technologies, strategies, and regulations emerge regularly. To stay ahead of the curve, traders must commit to continuous learning and professional development. This includes:

- Reading books and articles: Staying up-to-date on the latest trends and research in the financial markets.

- Attending conferences and seminars: Networking with other traders and learning from industry experts.

- Taking online courses: Acquiring new skills and knowledge in areas such as technical analysis, fundamental analysis, and risk management.

- Mentorship: Learning from experienced traders who can provide guidance and support.

By embracing a mindset of continuous learning, traders can adapt to changing market conditions and improve their performance in the Game of Trades.

Ethical Considerations in Trading

Ethical behavior is paramount in the Game of Trades. Traders have a responsibility to act with integrity and fairness, and to avoid engaging in unethical or illegal practices. This includes:

- Avoiding insider trading: Using non-public information to gain an unfair advantage.

- Manipulating markets: Engaging in activities that artificially inflate or deflate the price of a security.

- Misleading clients: Providing false or misleading information to clients.

Maintaining high ethical standards is essential for building trust and preserving the integrity of the financial markets. [See also: Ethical Trading Practices]

The Future of the Game of Trades

The Game of Trades is likely to continue to evolve in the years to come. Emerging technologies such as artificial intelligence (AI) and blockchain are poised to transform the industry, creating new opportunities and challenges for traders. AI-powered trading systems can analyze vast amounts of data and execute trades with unparalleled speed and efficiency. Blockchain technology can improve transparency and security in trading processes.

As the Game of Trades becomes more complex and competitive, traders will need to adapt and innovate to succeed. This includes developing new strategies, mastering new technologies, and cultivating a strong ethical foundation.

Conclusion

The Game of Trades is a challenging but potentially rewarding endeavor. By understanding the fundamentals, developing effective strategies, managing risk, embracing technology, and maintaining ethical standards, participants can increase their chances of success. Continuous learning and adaptation are essential for navigating the ever-changing landscape of the financial markets. Whether you are an individual investor or a seasoned trader, the Game of Trades offers opportunities for those who are willing to learn and adapt. The key to success in the Game of Trades lies in a combination of knowledge, skill, discipline, and a commitment to continuous improvement. So, understand the Game of Trades and play wisely!