The Three-Legged Retirement Stool: Is Your Retirement Plan Balanced?

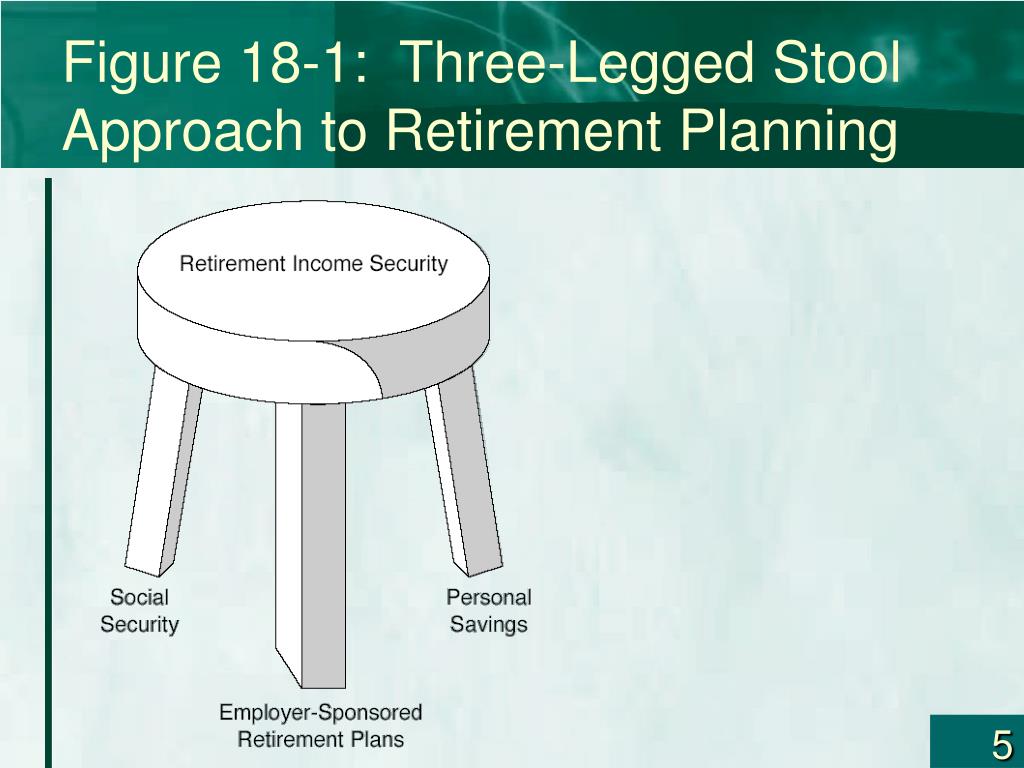

Retirement planning can feel like a high-wire act, a delicate balancing act between present needs and future security. One of the most enduring metaphors for understanding retirement income sources is the “three-legged retirement stool.” This concept illustrates the three primary pillars that traditionally supported retirement income: Social Security, pensions, and personal savings. However, in today’s rapidly evolving economic landscape, the stability of this stool is being questioned. Are all three legs equally sturdy? Are some legs wobbling, requiring reinforcement, or even replacement?

The term “three-legged retirement stool” has been around for decades, serving as a simple yet effective way to explain the diverse sources of income that retirees rely on. Each leg represents a crucial component of a comprehensive retirement strategy, and ideally, all three legs should work together to provide a stable and comfortable retirement. This article will delve into each leg of the three-legged retirement stool, examine the challenges they face, and explore strategies for ensuring a well-balanced and secure retirement.

Understanding the Traditional Three-Legged Stool

Let’s break down each leg of the three-legged retirement stool:

Social Security

Social Security is a government-administered program that provides retirement, disability, and survivor benefits. It is funded through payroll taxes and is designed to provide a safety net for retirees. While Social Security is a vital source of income for many Americans, it’s important to understand its limitations. The amount you receive from Social Security depends on your earnings history and the age at which you begin claiming benefits. Claiming early (as early as age 62) will result in a reduced monthly benefit, while delaying until age 70 will maximize your payments. However, the future of Social Security is a topic of ongoing debate, with concerns about its long-term solvency due to demographic shifts and increasing life expectancies. Many experts suggest that future retirees may see reduced benefits or increased taxes to ensure the program’s sustainability. Therefore, relying solely on Social Security for retirement income is generally not advisable. [See also: Social Security Strategies for Maximizing Benefits]

Pensions

Pensions, also known as defined benefit plans, are employer-sponsored retirement plans that guarantee a specific monthly payment to retirees based on their years of service and salary. Historically, pensions were a cornerstone of retirement security, providing a predictable and reliable income stream. However, the prevalence of traditional pensions has declined significantly in recent decades. Many companies have shifted away from defined benefit plans in favor of defined contribution plans, such as 401(k)s, which place the responsibility of saving and investing on the employee. This shift has left many workers without the guaranteed income that pensions once provided. If you are fortunate enough to have a pension, it’s crucial to understand the terms of your plan, including the benefit calculation formula, vesting requirements, and survivor benefits. [See also: Understanding Your Pension Plan Options]

Personal Savings

Personal savings encompass a wide range of retirement savings vehicles, including 401(k)s, IRAs, brokerage accounts, and other investments. The amount you accumulate in personal savings depends on your savings rate, investment performance, and time horizon. Unlike Social Security and pensions, personal savings offer more flexibility and control over your retirement funds. You can choose your investments, adjust your savings rate, and access your funds (with potential tax implications) as needed. However, personal savings also come with more responsibility. You need to actively manage your investments, make informed decisions about asset allocation, and avoid making costly mistakes. Furthermore, the market volatility can impact the value of your savings, creating uncertainty about your future income. Building a substantial nest egg requires discipline, patience, and a sound investment strategy. A robust personal savings strategy is crucial for a balanced three-legged retirement stool. [See also: Building a Successful Retirement Savings Plan]

The Shifting Landscape: Are the Legs Still Stable?

The traditional three-legged retirement stool is facing several challenges in the 21st century. The decline of pensions, the uncertainty surrounding Social Security, and the increasing responsibility placed on individuals to manage their own retirement savings have created a more complex and precarious retirement landscape.

- Longevity Risk: People are living longer than ever before, which means they need to save more to cover their expenses throughout retirement.

- Inflation: The rising cost of goods and services can erode the purchasing power of retirement savings, especially for those on fixed incomes.

- Healthcare Costs: Healthcare expenses are a major concern for retirees, as they tend to increase with age.

- Market Volatility: Fluctuations in the stock market can impact the value of retirement savings, creating uncertainty about future income.

- Low Interest Rates: Low interest rates make it more difficult to generate income from savings and investments.

These challenges highlight the need for a more comprehensive and proactive approach to retirement planning. Relying solely on the traditional three-legged retirement stool may not be sufficient to ensure a secure and comfortable retirement.

Adding a Fourth Leg: Diversifying Your Retirement Income

Given the challenges facing the traditional three-legged retirement stool, many experts advocate for adding a fourth leg: alternative income sources. This could include:

- Part-time work: Working part-time in retirement can provide supplemental income, keep you active and engaged, and delay the need to draw down on your savings.

- Real estate: Investing in real estate can provide rental income or serve as a source of capital appreciation.

- Annuities: Annuities are insurance contracts that provide a guaranteed stream of income for life.

- Royalties: If you have intellectual property, such as a book or patent, you may be able to generate royalty income.

- Gig economy: Participating in the gig economy, such as freelancing or driving for a ride-sharing service, can provide flexible income opportunities.

By diversifying your income sources, you can reduce your reliance on any single leg of the stool and create a more resilient retirement plan. This strategy enhances the stability of your three-legged retirement stool or even transforms it into a more robust four-legged structure.

Strategies for Strengthening Your Retirement Stool

Regardless of whether you rely on the traditional three-legged retirement stool or incorporate additional income sources, it’s essential to take proactive steps to strengthen your retirement plan. Here are some strategies to consider:

- Start saving early: The earlier you start saving, the more time your money has to grow through the power of compounding.

- Maximize your contributions: Take advantage of employer matching contributions and contribute as much as you can to your retirement accounts.

- Diversify your investments: Spread your investments across different asset classes to reduce risk and enhance returns.

- Manage your debt: High-interest debt can erode your savings and make it more difficult to achieve your retirement goals.

- Plan for healthcare costs: Estimate your future healthcare expenses and consider options such as health savings accounts (HSAs) or long-term care insurance.

- Seek professional advice: Consider consulting with a financial advisor to develop a personalized retirement plan.

Conclusion: Building a Balanced and Secure Retirement

The three-legged retirement stool remains a useful framework for understanding retirement income sources, but it’s essential to recognize its limitations and adapt to the changing economic landscape. By diversifying your income sources, strengthening your savings habits, and seeking professional advice, you can build a balanced and secure retirement plan that meets your individual needs and goals. The key is to proactively manage your retirement planning and not rely solely on traditional income streams. Securing a comfortable retirement requires careful planning and a realistic assessment of the strengths and weaknesses of each leg of your personal three-legged retirement stool. Remember, a well-balanced stool is a stable stool, ensuring a secure and fulfilling retirement.