Maximize Your Forex Profits: The Ultimate Guide to Using a Forex Calculator

In the fast-paced world of Forex trading, precision and efficiency are paramount. One tool that can significantly enhance your trading strategy is a forex calculator profit tool. Whether you’re a seasoned trader or just starting out, understanding how to use a forex calculator profit effectively can make the difference between a successful trade and a costly mistake. This guide will delve into the intricacies of forex calculator profit tools, explaining their purpose, benefits, and how to leverage them for optimal results. We’ll cover various types of calculators, provide practical examples, and offer tips to help you make informed trading decisions.

Understanding the Basics of Forex Trading and Profit Calculation

Before diving into the specifics of forex calculator profit, it’s essential to understand the fundamentals of Forex trading. Forex, or foreign exchange, involves buying and selling currencies in the global market. The goal is to profit from the fluctuations in exchange rates between different currencies.

Profit in Forex trading is determined by several factors, including the size of your position (lot size), the entry and exit prices, and the currency pair being traded. A forex calculator profit simplifies this calculation by automating the process and providing quick and accurate results. Without such a tool, traders would need to manually calculate potential profits and losses, which can be time-consuming and prone to errors.

Key Components of Forex Profit Calculation

- Currency Pair: The two currencies being traded (e.g., EUR/USD).

- Lot Size: The quantity of currency you are trading (e.g., a standard lot is 100,000 units of the base currency).

- Entry Price: The price at which you enter the trade.

- Exit Price: The price at which you exit the trade.

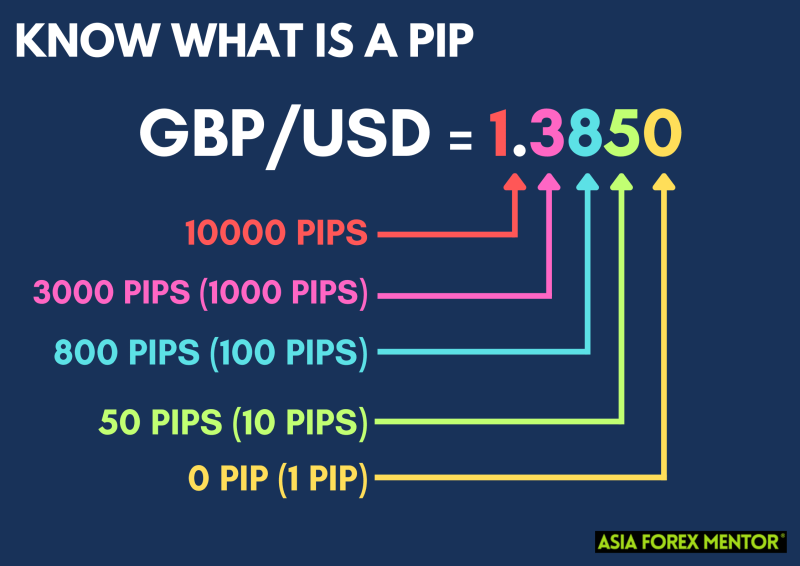

- Pip Value: The value of a pip (percentage in point), which is the smallest price increment a currency pair can make.

Types of Forex Calculators and Their Uses

Several types of forex calculator profit tools are available, each designed to assist with different aspects of trading. Understanding these tools and their specific functions is crucial for effective Forex trading.

Profit Calculator

The most straightforward type, a profit calculator, helps traders determine the potential profit or loss of a trade. By inputting the currency pair, lot size, entry price, and exit price, the calculator provides an estimate of the profit or loss in the account’s base currency. This type of forex calculator profit is essential for risk management and setting realistic profit targets.

Pip Value Calculator

A pip value calculator determines the monetary value of a single pip for a specific currency pair and lot size. This is crucial because the pip value directly impacts the potential profit or loss of a trade. Understanding the pip value allows traders to accurately assess the risk associated with each trade. Using a forex calculator profit to determine pip value is a fundamental step in Forex trading.

Margin Calculator

Margin is the amount of money required to open a trade. A margin calculator helps traders determine the margin needed for a specific trade based on the currency pair, lot size, and leverage. Proper margin calculation is vital for avoiding margin calls and managing risk effectively. This forex calculator profit is essential for understanding the financial commitment required for a trade.

Position Size Calculator

A position size calculator helps traders determine the appropriate lot size for a trade based on their account balance, risk tolerance, and stop-loss level. This tool is essential for managing risk and ensuring that no single trade exposes an excessive portion of the trading account. A well-used forex calculator profit of this type can significantly improve risk management.

Fibonacci Calculator

Based on the Fibonacci sequence, this calculator helps traders identify potential support and resistance levels. By inputting high and low prices, the calculator generates Fibonacci retracement and extension levels, which can be used to identify potential entry and exit points. This type of forex calculator profit is more advanced and used in technical analysis.

How to Use a Forex Calculator Profit Effectively

While using a forex calculator profit is relatively simple, maximizing its effectiveness requires a strategic approach. Here are some tips to help you use these tools effectively:

- Choose a Reliable Calculator: Not all forex calculator profit tools are created equal. Opt for reputable calculators from trusted sources to ensure accuracy. Many brokers offer these tools for free on their websites.

- Input Accurate Data: The accuracy of the results depends on the accuracy of the data you input. Double-check all entries, including the currency pair, lot size, entry price, and exit price.

- Understand the Calculator’s Limitations: While calculators provide valuable estimates, they are not foolproof. Market conditions can change rapidly, affecting the actual profit or loss of a trade.

- Use Calculators in Conjunction with Other Tools: Don’t rely solely on calculators. Combine them with other analysis tools, such as technical and fundamental analysis, to make well-informed trading decisions.

- Consider Transaction Costs: Remember that forex calculator profit tools typically do not account for transaction costs, such as spreads and commissions. Factor these costs into your calculations to get a more accurate estimate of your net profit or loss.

Practical Examples of Using a Forex Calculator Profit

To illustrate the practical application of a forex calculator profit, let’s consider a few examples:

Example 1: Calculating Potential Profit

Suppose you want to trade EUR/USD with a lot size of 1 standard lot (100,000 units). You enter the trade at 1.1000 and plan to exit at 1.1050. Using a profit calculator, you input these values:

- Currency Pair: EUR/USD

- Lot Size: 1

- Entry Price: 1.1000

- Exit Price: 1.1050

The calculator shows a potential profit of $500 (assuming a pip value of $10 per pip for a standard lot). This information helps you assess the potential reward of the trade.

Example 2: Determining Pip Value

You want to trade GBP/JPY and need to know the pip value for a mini lot (10,000 units). Using a pip value calculator, you input the currency pair and lot size:

- Currency Pair: GBP/JPY

- Lot Size: 0.1 (mini lot)

The calculator shows a pip value of approximately $1.00. This information is crucial for understanding the potential risk and reward of the trade.

Example 3: Calculating Margin Requirements

You want to trade USD/CAD with a lot size of 2 standard lots and your broker offers a leverage of 1:100. Using a margin calculator, you input these values:

- Currency Pair: USD/CAD

- Lot Size: 2

- Leverage: 1:100

The calculator shows a margin requirement of $2,000. This information helps you ensure that you have sufficient funds in your account to open the trade without risking a margin call.

Advanced Strategies with Forex Calculators

Beyond basic calculations, forex calculator profit tools can be used in more advanced trading strategies. For example, traders can use position size calculators to optimize their risk-reward ratio. By setting a specific risk percentage (e.g., 1% of the account balance) and a stop-loss level, the calculator determines the appropriate lot size for the trade. This ensures that the potential loss is limited to the predetermined risk percentage.

Another advanced strategy involves using Fibonacci calculators to identify potential entry and exit points. By combining Fibonacci levels with other technical indicators, such as moving averages and trendlines, traders can improve the accuracy of their trading signals.

Choosing the Right Forex Calculator Profit Tool

Selecting the right forex calculator profit tool is crucial for effective Forex trading. Consider the following factors when choosing a calculator:

- Accuracy: Ensure that the calculator provides accurate results by comparing it with other reputable sources.

- Ease of Use: Opt for a calculator with a user-friendly interface that is easy to navigate and understand.

- Features: Choose a calculator that offers the specific features you need, such as profit calculation, pip value calculation, margin calculation, and position size calculation.

- Accessibility: Select a calculator that is easily accessible, whether it’s a web-based tool or a mobile app.

- Reputation: Choose a calculator from a reputable source, such as a well-known broker or financial website.

Common Mistakes to Avoid When Using Forex Calculators

While forex calculator profit tools are valuable, they are not immune to misuse. Here are some common mistakes to avoid:

- Relying Solely on Calculators: Don’t rely solely on calculators without considering other factors, such as market conditions and economic news.

- Ignoring Transaction Costs: Remember to factor in transaction costs, such as spreads and commissions, when calculating potential profits and losses.

- Using Inaccurate Data: Double-check all data inputs to ensure accuracy. Even a small error can significantly impact the results.

- Overlooking Risk Management: Use calculators as part of a comprehensive risk management strategy, rather than as a substitute for it.

- Failing to Update Calculators: Ensure that the calculators you use are up-to-date with the latest market conditions and currency values.

The Future of Forex Calculators

As technology continues to evolve, forex calculator profit tools are becoming more sophisticated and user-friendly. We can expect to see more advanced calculators that incorporate artificial intelligence (AI) and machine learning (ML) to provide more accurate and personalized trading recommendations. These AI-powered calculators will analyze vast amounts of data, including historical prices, economic indicators, and news events, to generate more precise profit forecasts and risk assessments.

Moreover, we can expect to see more integration of calculators into trading platforms and mobile apps, making them even more accessible and convenient for traders. This integration will allow traders to seamlessly calculate potential profits and losses directly within their trading environment, streamlining the trading process and improving efficiency. [See also: Forex Trading Strategies for Beginners]

Conclusion

A forex calculator profit is an indispensable tool for any Forex trader, regardless of their experience level. By understanding how to use these calculators effectively, traders can make more informed decisions, manage risk more effectively, and ultimately increase their chances of success in the Forex market. Whether you’re calculating potential profits, determining pip values, or assessing margin requirements, a forex calculator profit can provide valuable insights and help you navigate the complexities of Forex trading. Embrace these tools, use them wisely, and watch your trading performance improve.