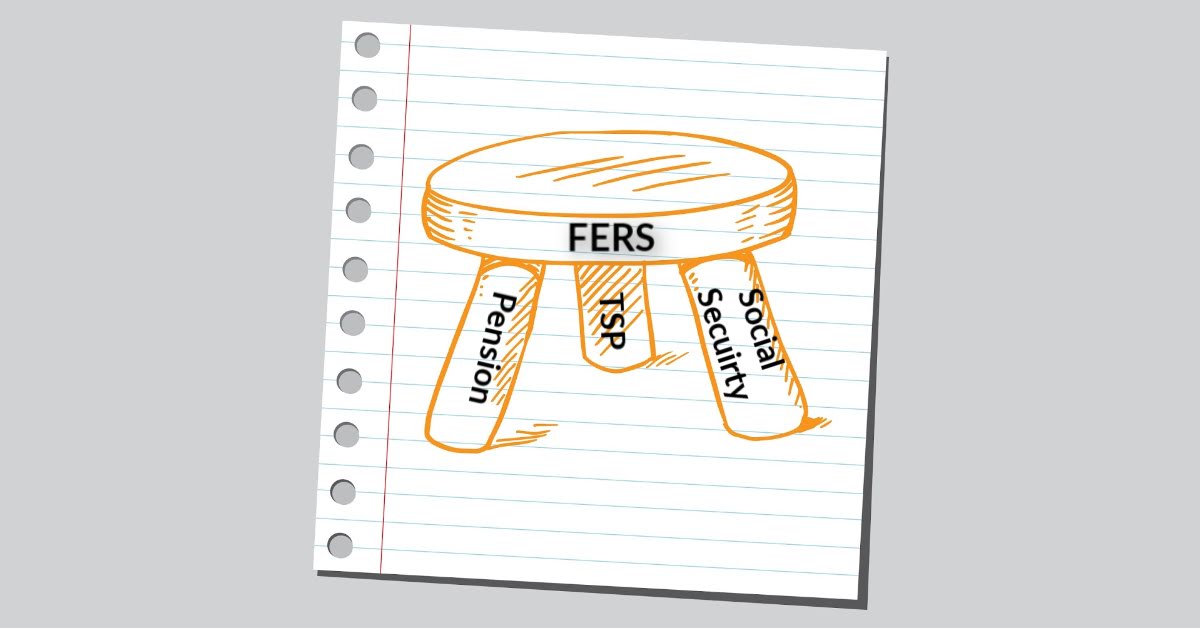

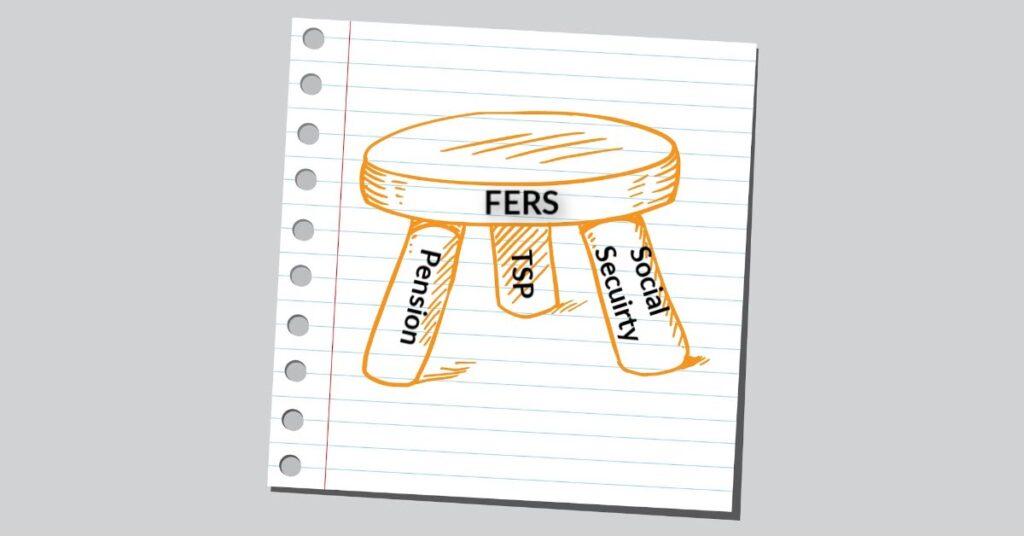

Understanding the Three-Legged Stool of Retirement: A Comprehensive Guide

The concept of the three-legged stool of retirement is a widely recognized framework for understanding the key sources of income that people typically rely on during their retirement years. This model, while somewhat simplified, provides a valuable structure for planning and securing a comfortable retirement. The three-legged stool of retirement traditionally consists of Social Security, employer-sponsored retirement plans (like 401(k)s or pensions), and personal savings. However, the landscape of retirement is evolving, and many argue that this model needs to be adapted to reflect current realities. This guide will delve into each leg of the stool, exploring their strengths, weaknesses, and how they fit together to form a solid retirement foundation.

The First Leg: Social Security

Social Security is a government-run program that provides retirement, disability, and survivor benefits to millions of Americans. It’s funded through payroll taxes, and the amount of your benefit is based on your earnings history. For many retirees, Social Security represents a crucial foundation of their retirement income. It offers a predictable and guaranteed income stream, adjusted annually for inflation. This inflation protection is particularly valuable in retirement, as it helps maintain purchasing power over time.

However, relying solely on Social Security is generally insufficient for a comfortable retirement. Benefit amounts are often modest, and the future of Social Security is a topic of ongoing debate. Factors such as increasing life expectancies and demographic shifts are putting pressure on the system. It’s wise to view Social Security as one component of a broader retirement strategy, rather than the entire plan.

Maximizing Your Social Security Benefits

There are several strategies you can use to maximize your Social Security benefits. One key decision is when to begin receiving benefits. You can start as early as age 62, but your benefit will be reduced. Waiting until your full retirement age (FRA), which varies depending on your birth year, will give you your standard benefit amount. Delaying benefits even further, until age 70, will result in the highest possible benefit. Understanding the implications of these choices is crucial for optimizing your retirement income.

Another consideration is how your work history affects your benefits. Social Security calculates your benefit based on your highest 35 years of earnings. Working longer, even at a lower salary, can sometimes increase your overall benefit. Also, consider spousal benefits. Even if you haven’t worked much yourself, you may be eligible for benefits based on your spouse’s earnings record. [See also: Social Security Retirement Age Calculator]

The Second Leg: Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans, such as 401(k)s, 403(b)s, and pensions, represent the second leg of the three-legged stool of retirement. These plans offer a way to save for retirement with potential tax advantages. 401(k)s and 403(b)s are typically defined contribution plans, where employees contribute a portion of their salary, often with an employer match. Pensions, on the other hand, are defined benefit plans, where employers guarantee a specific monthly payment in retirement. Pensions are becoming less common, with defined contribution plans taking their place.

Participating in your employer’s retirement plan is generally a smart move. The employer match is essentially free money, and the tax advantages can significantly boost your savings over time. Contributions to traditional 401(k)s and 403(b)s are tax-deferred, meaning you don’t pay taxes on the money until you withdraw it in retirement. Roth 401(k)s and 403(b)s offer a different tax advantage: contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

Managing Your Employer-Sponsored Retirement Plan

Effectively managing your employer-sponsored retirement plan is essential for building a substantial retirement nest egg. This includes understanding your investment options, choosing an appropriate asset allocation, and rebalancing your portfolio periodically. Diversification is key to managing risk. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help cushion your portfolio against market volatility. [See also: Asset Allocation Strategies for Retirement]

Regularly review your investment performance and make adjustments as needed. As you get closer to retirement, you may want to gradually shift your portfolio to a more conservative allocation, reducing your exposure to riskier assets like stocks. Also, be aware of the fees associated with your retirement plan. High fees can erode your returns over time.

The Third Leg: Personal Savings

Personal savings represent the third leg of the three-legged stool of retirement. This includes savings accounts, brokerage accounts, IRAs, and other investments that you accumulate on your own. Personal savings provide flexibility and control over your retirement funds. You can use them to supplement your Social Security and employer-sponsored retirement plan income, or to cover unexpected expenses.

Building a strong foundation of personal savings requires discipline and planning. Start by setting a savings goal. How much will you need to retire comfortably? Then, create a budget and identify ways to cut expenses and increase your savings rate. Automate your savings by setting up regular transfers from your checking account to your savings or investment accounts. The earlier you start saving, the more time your money has to grow through the power of compounding.

Different Types of Personal Savings Accounts

There are various types of personal savings accounts to choose from, each with its own advantages and disadvantages. Traditional IRAs offer tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement. Brokerage accounts provide access to a wide range of investments, including stocks, bonds, mutual funds, and ETFs. High-yield savings accounts offer competitive interest rates, allowing your savings to grow faster. Consider consulting with a financial advisor to determine which types of accounts are best suited to your individual needs and circumstances. [See also: Roth IRA vs. Traditional IRA: Which is Right for You?]

Strengthening the Three-Legged Stool

The three-legged stool of retirement works best when all three legs are strong and stable. However, many people find that one or more legs are weaker than they should be. For example, someone who has not worked for many years may have a low Social Security benefit. Someone who has not participated in their employer’s retirement plan may have little or no savings in that account. And someone who has not saved diligently on their own may have a limited amount of personal savings.

If you find that one or more legs of your retirement stool are weak, take steps to strengthen them. This might involve working longer to increase your Social Security benefit, contributing more to your employer’s retirement plan, or increasing your personal savings rate. It’s also important to consider the impact of inflation, taxes, and healthcare costs on your retirement income. Planning for these expenses can help ensure that your retirement savings last throughout your retirement years.

The Evolving Retirement Landscape

The traditional three-legged stool of retirement may need to be adapted to reflect the evolving retirement landscape. Factors such as increasing life expectancies, rising healthcare costs, and the decline of traditional pensions are changing the way people approach retirement planning. Some experts suggest adding a fourth leg to the stool: continued employment. Working part-time in retirement can provide supplemental income, keep you engaged, and help you stay active.

Another factor to consider is the gig economy. Many people are now working as independent contractors or freelancers, which can make it more challenging to save for retirement. These individuals may need to rely more heavily on personal savings and may need to seek out alternative retirement savings options. The gig economy workers need to be proactive in planning for their retirement.

Conclusion: Planning for a Secure Retirement

The three-legged stool of retirement provides a useful framework for understanding the key sources of retirement income. By strengthening each leg of the stool – Social Security, employer-sponsored retirement plans, and personal savings – you can build a more secure and comfortable retirement. Remember to start planning early, save diligently, and seek professional advice when needed. A well-thought-out retirement plan can help you achieve your financial goals and enjoy a fulfilling retirement. The three-legged stool concept is a valuable tool for anyone approaching or already in retirement. Understanding its components and how they interact is crucial for long-term financial security. Neglecting any of the three legs can lead to financial instability later in life. Therefore, proactive planning and consistent effort are essential. Don’t underestimate the importance of diversifying your retirement income sources and regularly reviewing your financial plan. The three-legged stool represents a solid foundation for a worry-free retirement. The three-legged stool, when properly constructed, provides a stable and reliable source of income. Each of the three legs plays a crucial role in ensuring a comfortable retirement. Planning with the three-legged stool in mind can help individuals achieve their financial goals. Successfully navigating the three-legged stool requires knowledge, planning, and discipline. The three-legged stool model is a cornerstone of retirement planning. Therefore, take control of your future and build a strong three-legged stool today. Remember to consider the three-legged stool as a starting point and adjust it to your unique circumstances. Ultimately, the goal is to create a personalized retirement plan that meets your individual needs and aspirations.