Deflation Explained: Understanding the Economic Phenomenon

Deflation, the opposite of inflation, is a sustained decrease in the general price level of goods and services in an economy. While it might seem beneficial at first glance – who wouldn’t want lower prices? – deflation can actually be a sign of deeper economic problems and can have significant negative consequences. This article aims to provide a comprehensive explanation of deflation, its causes, effects, and the measures governments and central banks take to combat it.

What is Deflation?

Deflation occurs when the inflation rate falls below 0%, meaning that the average price of goods and services is decreasing. This is different from disinflation, which is a slowdown in the rate of inflation. With deflation, money becomes more valuable over time because you can buy more goods and services with the same amount of money than you could before. This might sound appealing, but it can lead to a vicious cycle.

Causes of Deflation

Several factors can contribute to deflation. Understanding these causes is crucial to grasping the complexities of this economic phenomenon.

Decrease in Aggregate Demand

One of the most common causes of deflation is a decrease in aggregate demand. This can happen due to several reasons:

- Recession: During an economic downturn, people lose their jobs or fear losing them, leading to reduced spending. Businesses, in turn, lower prices to attract customers, contributing to deflation.

- Increased Savings: If people become more cautious and start saving more, spending decreases, leading to a fall in demand and potentially deflation.

- Government Austerity: Government policies aimed at reducing debt, such as cutting spending or raising taxes, can also decrease aggregate demand.

Increase in Aggregate Supply

Conversely, an increase in aggregate supply without a corresponding increase in demand can also lead to deflation. This can occur due to:

- Technological Advancements: Technological innovations can increase productivity and output, leading to a surplus of goods and services. If demand doesn’t keep pace, prices may fall.

- Increased Competition: Globalization and increased competition can lead to lower prices as businesses try to gain market share.

- Lower Input Costs: A decrease in the cost of raw materials or other inputs can allow businesses to lower their prices while maintaining profitability.

Debt Deflation

Economist Irving Fisher identified “debt deflation” as a major contributor to economic depressions. This theory suggests that deflation increases the real value of debt, making it more difficult for debtors to repay their loans. This can lead to:

- Defaults: As debt becomes harder to repay, defaults increase, leading to financial instability.

- Reduced Investment: Businesses and individuals become hesitant to borrow and invest, further reducing demand and exacerbating the deflation.

- Bankruptcies: Businesses struggling with debt may be forced into bankruptcy, further disrupting the economy.

Effects of Deflation

While lower prices might seem appealing, deflation can have several negative consequences for the economy.

Delayed Consumption

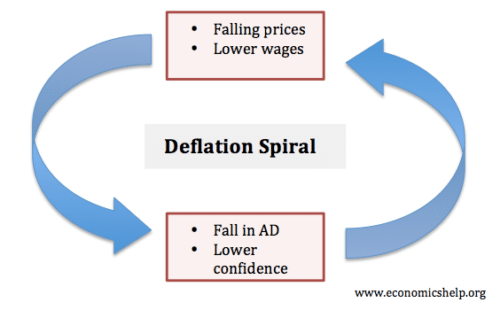

One of the most significant problems with deflation is that it encourages consumers to delay purchases. If people expect prices to be lower tomorrow, they will postpone buying goods and services today. This decrease in current demand further exacerbates the deflationary spiral.

Increased Real Debt Burden

As mentioned earlier, deflation increases the real value of debt. This means that borrowers have to pay back more in terms of real purchasing power than they initially borrowed. This can lead to financial distress and defaults.

Reduced Corporate Profits

When prices fall, businesses often struggle to maintain their profit margins. This can lead to reduced investment, job cuts, and even bankruptcies. Reduced corporate profits can also lead to lower stock prices, further damaging investor confidence.

Increased Unemployment

As businesses struggle with falling prices and reduced demand, they may be forced to lay off workers. This leads to increased unemployment, which further reduces aggregate demand and contributes to the deflationary spiral.

Disincentive to Invest

Deflation can discourage investment because the real return on investment is lower. Businesses may be hesitant to invest in new projects if they expect prices to fall, as the future value of their output will be lower. [See also: Understanding Investment Strategies]

Combating Deflation

Governments and central banks have several tools at their disposal to combat deflation.

Monetary Policy

Central banks can use monetary policy to stimulate demand and combat deflation. Some common tools include:

- Lowering Interest Rates: Reducing interest rates makes it cheaper for businesses and individuals to borrow money, encouraging spending and investment. However, when interest rates are already near zero, this tool becomes less effective.

- Quantitative Easing (QE): QE involves a central bank injecting liquidity into the economy by purchasing assets, such as government bonds, from commercial banks. This increases the money supply and lowers long-term interest rates.

- Negative Interest Rates: Some central banks have experimented with negative interest rates, charging commercial banks for holding reserves at the central bank. This is intended to encourage banks to lend more money.

Fiscal Policy

Governments can also use fiscal policy to combat deflation. This involves:

- Increased Government Spending: Government spending on infrastructure projects, education, or other public goods can directly increase aggregate demand.

- Tax Cuts: Reducing taxes can increase disposable income, encouraging consumers to spend more.

Managing Expectations

Central banks can also try to manage expectations by communicating their commitment to fighting deflation. If people believe that prices will eventually rise, they are more likely to spend money today.

Examples of Deflation

Deflation has occurred in various countries throughout history. Some notable examples include:

The Great Depression (1930s)

The Great Depression was characterized by severe deflation. Prices fell dramatically, leading to widespread unemployment and economic hardship. The deflation was caused by a combination of factors, including a decrease in aggregate demand and a contraction of the money supply.

Japan in the 1990s and 2000s

Japan experienced a prolonged period of deflation in the 1990s and 2000s, often referred to as the “Lost Decade.” This deflation was caused by a combination of factors, including a bursting of the asset bubble, an aging population, and a lack of structural reforms. Japan struggled to escape this deflationary environment despite aggressive monetary and fiscal policies. [See also: Economic Challenges in Japan]

Conclusion

Deflation, while seemingly beneficial due to lower prices, can be a serious economic problem. It can lead to delayed consumption, increased debt burdens, reduced corporate profits, and increased unemployment. Governments and central banks have various tools to combat deflation, including monetary policy, fiscal policy, and managing expectations. Understanding the causes and effects of deflation is crucial for policymakers and individuals alike to navigate the complexities of the modern economy. Recognizing the potential dangers of deflation is the first step towards implementing effective strategies to maintain economic stability and growth. Deflation’s impact underscores the importance of proactive economic management and understanding the interconnectedness of economic variables.