Navigating the World of Cryptocurrency Exchanges: A Comprehensive List

The cryptocurrency market has exploded in popularity over the last decade, transforming from a niche interest into a mainstream investment opportunity. As the digital asset landscape continues to evolve, understanding the role and function of cryptocurrency exchanges becomes increasingly crucial. These platforms serve as the gateway to buying, selling, and trading various cryptocurrencies, connecting buyers and sellers in a decentralized financial ecosystem. This article provides a comprehensive cryptocurrency exchanges list, exploring different types of exchanges, key features, and factors to consider when choosing the right platform for your needs.

Understanding Cryptocurrency Exchanges

Before diving into a cryptocurrency exchanges list, it’s essential to understand what these platforms are and how they operate. A cryptocurrency exchange is a digital marketplace where individuals can buy, sell, or trade cryptocurrencies for other digital currencies or traditional fiat currencies like USD or EUR. They function as intermediaries, matching buy and sell orders to facilitate transactions. These exchanges play a vital role in providing liquidity and price discovery for the cryptocurrency market.

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges come in various forms, each with its own set of features, fees, and security protocols. Understanding these differences is critical when selecting an exchange that aligns with your investment goals and risk tolerance.

- Centralized Exchanges (CEXs): These are the most common type of cryptocurrency exchange. CEXs are operated by a central authority or company that oversees the trading process. Examples include Binance, Coinbase, and Kraken. They typically offer a wide range of cryptocurrencies, high liquidity, and user-friendly interfaces. However, they require users to trust the exchange with their funds and personal information, making them potential targets for hacking and regulatory scrutiny.

- Decentralized Exchanges (DEXs): DEXs operate without a central authority, allowing users to trade cryptocurrencies directly with each other using smart contracts. Examples include Uniswap, SushiSwap, and PancakeSwap. DEXs offer greater privacy and security, as users retain control of their funds. However, they can be more complex to use, have lower liquidity, and may be subject to higher transaction fees.

- Hybrid Exchanges: These exchanges attempt to combine the best features of both CEXs and DEXs. They offer a centralized platform with decentralized features, such as non-custodial wallets or on-chain order books. This approach aims to provide a balance between user-friendliness, security, and control.

A Detailed Cryptocurrency Exchanges List

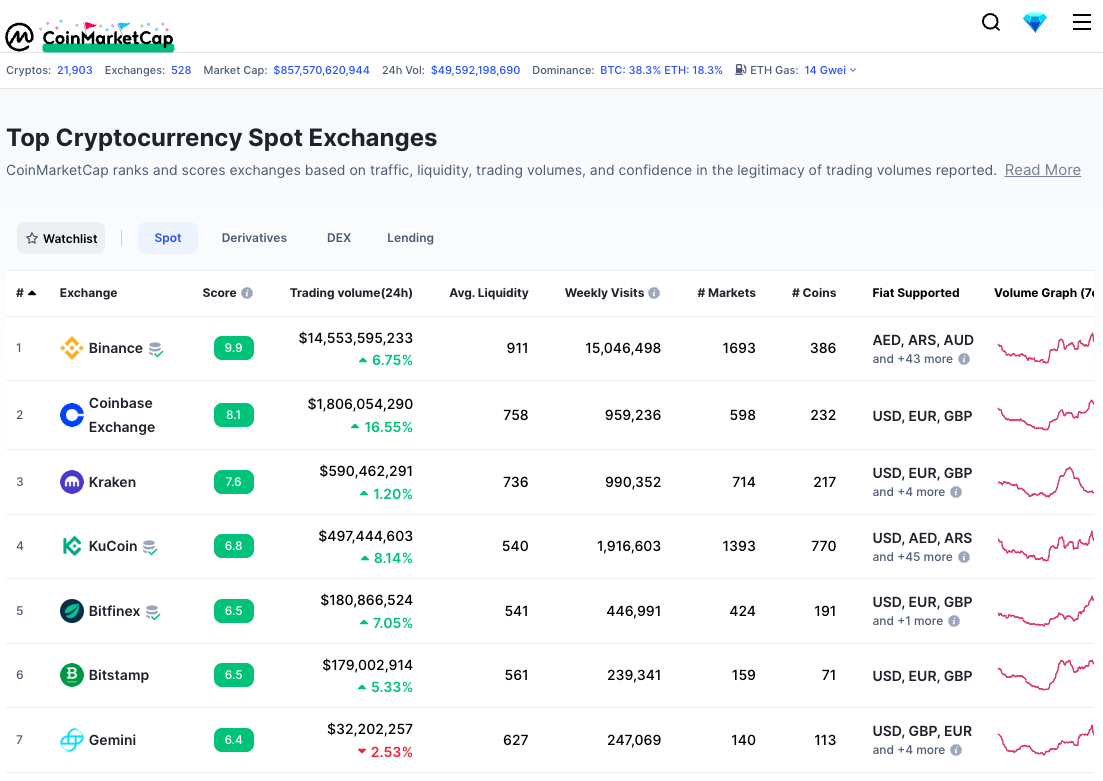

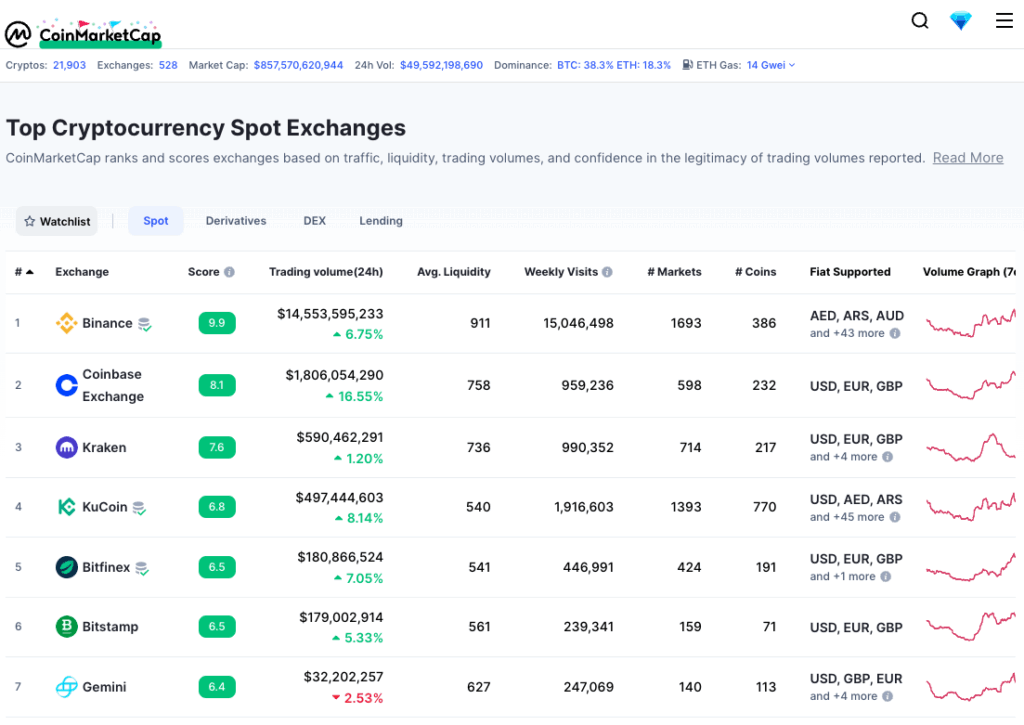

Here’s a cryptocurrency exchanges list featuring some of the most popular and reputable platforms in the market:

- Binance: One of the largest cryptocurrency exchanges globally, Binance offers a wide variety of cryptocurrencies, low fees, and advanced trading features. It also provides various services like staking, lending, and futures trading. [See also: Binance Coin (BNB): The Utility Token Powering the Binance Ecosystem]

- Coinbase: Known for its user-friendly interface and focus on security, Coinbase is a popular choice for beginners. It offers a limited selection of cryptocurrencies but provides a simple and secure platform for buying and selling digital assets.

- Kraken: A well-established cryptocurrency exchange with a strong reputation for security and compliance. Kraken offers a wide range of cryptocurrencies, margin trading, and futures trading. It is also a popular choice for institutional investors.

- KuCoin: KuCoin offers a diverse selection of cryptocurrencies, including many smaller altcoins. It also provides features like staking, lending, and a trading bot.

- Huobi Global: A leading cryptocurrency exchange with a global presence. Huobi Global offers a wide range of cryptocurrencies, margin trading, and futures trading.

- Gemini: A US-based cryptocurrency exchange known for its strong regulatory compliance and security measures. Gemini offers a limited selection of cryptocurrencies but provides a secure and reliable platform for trading digital assets.

- Bitstamp: One of the oldest cryptocurrency exchanges, Bitstamp has a long history of security and reliability. It offers a limited selection of cryptocurrencies but provides a simple and secure platform for buying and selling digital assets.

- Bittrex: Bittrex offers a wide range of cryptocurrencies and advanced trading features. It is a popular choice for experienced traders.

- OKEx: A leading cryptocurrency exchange with a global presence. OKEx offers a wide range of cryptocurrencies, margin trading, and futures trading.

- Bybit: Bybit is a cryptocurrency derivatives exchange that focuses on providing a seamless trading experience for leveraged products.

Factors to Consider When Choosing a Cryptocurrency Exchange

With so many cryptocurrency exchanges available, choosing the right platform can be overwhelming. Here are some key factors to consider:

- Security: Security should be your top priority. Look for exchanges that implement robust security measures, such as two-factor authentication (2FA), cold storage of funds, and regular security audits.

- Fees: Cryptocurrency exchanges charge various fees, including trading fees, withdrawal fees, and deposit fees. Compare the fees of different exchanges to find the most cost-effective option.

- Liquidity: Liquidity refers to the ease with which you can buy or sell cryptocurrencies on an exchange. Higher liquidity means that you can execute trades quickly and at a fair price.

- Cryptocurrency Selection: Choose an exchange that offers the cryptocurrencies you want to trade. Some exchanges offer a wide variety of cryptocurrencies, while others focus on a smaller selection of more established assets.

- User Interface: The user interface should be intuitive and easy to use, especially if you are a beginner. Look for exchanges that offer a clean and user-friendly platform.

- Customer Support: Choose an exchange that offers reliable customer support. You should be able to easily contact customer support if you have any questions or issues.

- Regulation: Consider the regulatory compliance of the exchange. Exchanges that are regulated by reputable authorities are generally considered to be more secure and reliable.

The Future of Cryptocurrency Exchanges

The cryptocurrency exchange landscape is constantly evolving. As the market matures, we can expect to see further innovation and consolidation. Some key trends to watch include:

- Increased Regulatory Scrutiny: Governments around the world are increasingly focusing on regulating cryptocurrency exchanges. This could lead to greater transparency and security but could also increase compliance costs.

- Growth of Decentralized Exchanges: DEXs are gaining popularity as users seek greater privacy and control over their funds. We can expect to see further development and adoption of DEXs in the future.

- Integration with Traditional Financial Systems: Cryptocurrency exchanges are increasingly integrating with traditional financial systems, such as banks and payment processors. This could make it easier for mainstream investors to access the cryptocurrency market.

- Emergence of New Exchange Models: We can expect to see the emergence of new exchange models, such as hybrid exchanges and social trading platforms. These models aim to address the limitations of existing exchanges and provide a better user experience.

Conclusion

Cryptocurrency exchanges are essential for participating in the digital asset market. By understanding the different types of exchanges, key features, and factors to consider, you can choose the right platform for your needs and navigate the world of cryptocurrency trading with confidence. This cryptocurrency exchanges list should provide a good starting point for your research, but remember to always do your own due diligence before investing in any cryptocurrency or using any exchange. The world of cryptocurrency exchanges can be complex, but with careful research and planning, you can find a platform that meets your needs and helps you achieve your investment goals. Remember to prioritize security and only invest what you can afford to lose. The cryptocurrency exchanges are constantly evolving, so stay informed and adapt your strategies accordingly.