Hedge Funds vs. Mutual Funds: Understanding the Key Differences

Navigating the world of investments can feel like traversing a complex maze. Among the myriad options available, hedge funds and mutual funds often stand out, each promising potential returns but catering to vastly different investor profiles. Understanding the differences between hedge funds and mutual funds is crucial for making informed decisions that align with your financial goals and risk tolerance. This article delves into the core distinctions between these two investment vehicles, providing a clear and concise comparison to help you navigate the investment landscape.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the fund’s shareholders. The primary objective of a mutual fund is to provide investors with access to a diversified portfolio at a relatively low cost.

Key Characteristics of Mutual Funds

- Accessibility: Mutual funds are readily accessible to the general public. Anyone with a brokerage account can typically invest in a mutual fund.

- Regulation: Mutual funds are heavily regulated by government agencies like the Securities and Exchange Commission (SEC) to protect investors. This regulation ensures transparency and accountability in fund management.

- Diversification: Mutual funds offer instant diversification, reducing the risk associated with investing in individual securities.

- Liquidity: Mutual fund shares can typically be bought or sold on any business day at the fund’s net asset value (NAV).

- Transparency: Mutual funds are required to disclose their holdings and performance regularly, providing investors with transparency into their investments.

What are Hedge Funds?

Hedge funds are investment partnerships that use more aggressive strategies to generate higher returns for their investors. Unlike mutual funds, hedge funds are not heavily regulated and are typically available only to accredited investors – individuals with a high net worth or income. They are known for their flexibility in investment strategies, often employing tactics such as short selling, leverage, and derivatives.

Key Characteristics of Hedge Funds

- Exclusivity: Hedge funds are typically only accessible to accredited investors due to their higher risk profile and regulatory constraints.

- Less Regulation: Hedge funds face less stringent regulatory oversight compared to mutual funds, allowing them greater flexibility in their investment strategies.

- Aggressive Strategies: Hedge funds employ a wide range of aggressive investment strategies, including short selling, leverage, and arbitrage, to generate higher returns.

- Higher Fees: Hedge funds typically charge higher fees than mutual funds, often following a “2 and 20” model (2% management fee and 20% of profits).

- Lower Liquidity: Hedge fund investments may have lock-up periods, restricting investors from withdrawing their funds for a certain period.

Hedge Funds vs. Mutual Funds: A Detailed Comparison

To further clarify the differences between hedge funds and mutual funds, let’s examine the key aspects in more detail:

Investor Accessibility

One of the most significant differences between hedge funds and mutual funds lies in their accessibility. Mutual funds are designed for the general public, allowing anyone with a brokerage account to invest. In contrast, hedge funds are exclusively available to accredited investors, who meet specific income or net worth requirements. This exclusivity is due to the higher risk and complexity associated with hedge fund investments.

Regulatory Oversight

Mutual funds are subject to rigorous regulatory oversight by the SEC, ensuring transparency and protecting investors. Hedge funds, on the other hand, face less stringent regulations, giving them greater flexibility in their investment strategies but also increasing the potential for risk. This difference in regulation is a key factor to consider when evaluating the differences between hedge funds and mutual funds.

Investment Strategies

Mutual funds typically follow more conservative investment strategies, focusing on long-term growth and diversification. Hedge funds, however, are known for their aggressive strategies, employing tactics such as short selling, leverage, and derivatives to generate higher returns. These differing strategies reflect the different risk tolerances and investment objectives of the investors they serve. Understanding these strategies is crucial when assessing the differences between hedge funds and mutual funds.

Fee Structure

Mutual funds generally have lower fees compared to hedge funds. Mutual funds typically charge an expense ratio, which is a percentage of the assets under management. Hedge funds, on the other hand, often follow a “2 and 20” model, charging a 2% management fee and 20% of the profits generated. This higher fee structure reflects the more active management and specialized expertise required to manage hedge fund investments. The fee structure is a significant aspect of the differences between hedge funds and mutual funds.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares on any business day at the fund’s NAV. Hedge funds, however, may have lock-up periods, restricting investors from withdrawing their funds for a certain period. This lower liquidity is a trade-off for the potential of higher returns. Liquidity is an important consideration when analyzing the differences between hedge funds and mutual funds.

Transparency

Mutual funds are required to disclose their holdings and performance regularly, providing investors with transparency into their investments. Hedge funds, on the other hand, are not subject to the same level of disclosure, making it more difficult for investors to assess their performance and risk. This difference in transparency is another key aspect of the differences between hedge funds and mutual funds.

The Role of Risk

Risk is a crucial factor to consider when comparing hedge funds and mutual funds. Mutual funds, with their diversified portfolios and regulatory oversight, generally carry lower risk than hedge funds. Hedge funds, with their aggressive strategies and less stringent regulations, involve higher risk. Investors should carefully assess their risk tolerance and investment objectives before choosing between these two investment vehicles.

Which is Right for You?

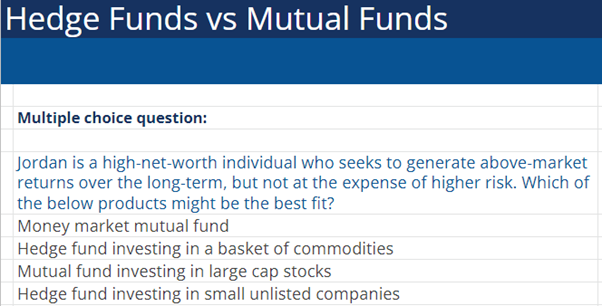

The choice between hedge funds and mutual funds depends on your individual circumstances, including your risk tolerance, investment objectives, and financial resources. If you are a conservative investor seeking diversification and transparency, a mutual fund may be the better option. If you are an accredited investor with a higher risk tolerance and the desire for potentially higher returns, a hedge fund may be more suitable. It’s essential to understand the differences between hedge funds and mutual funds before making any investment decisions.

Examples to Illustrate the Differences

Consider two hypothetical investors: Sarah and John. Sarah is a young professional with a moderate risk tolerance and a desire to save for retirement. She invests in a diversified mutual fund that tracks the S&P 500. John, on the other hand, is an accredited investor with a high net worth and a high risk tolerance. He invests in a hedge fund that employs a complex strategy involving short selling and leverage. While John has the potential to generate higher returns, he also faces a higher risk of loss. This illustrates the fundamental differences between hedge funds and mutual funds in practice.

The Future of Hedge Funds and Mutual Funds

Both hedge funds and mutual funds continue to evolve in response to changing market conditions and investor preferences. Mutual funds are increasingly offering more specialized investment options, while hedge funds are facing increased scrutiny and demands for greater transparency. The differences between hedge funds and mutual funds are likely to remain significant, but both investment vehicles will continue to play a vital role in the financial markets. [See also: Alternative Investment Strategies] [See also: Understanding Investment Risk]

Conclusion

Understanding the differences between hedge funds and mutual funds is essential for making informed investment decisions. Mutual funds offer accessibility, regulation, diversification, and liquidity, making them suitable for a wide range of investors. Hedge funds, on the other hand, offer exclusivity, less regulation, aggressive strategies, and potentially higher returns, but also involve higher risk and lower liquidity. By carefully considering these differences between hedge funds and mutual funds, investors can choose the investment vehicle that best aligns with their individual needs and goals. Ultimately, the decision hinges on a thorough assessment of your risk tolerance, investment objectives, and financial resources. Remember to consult with a qualified financial advisor before making any investment decisions. The key is to understand the nuances and differences between hedge funds and mutual funds to make a well-informed choice. The fundamental differences between hedge funds and mutual funds should be at the forefront of your decision-making process. A clear understanding of these differences between hedge funds and mutual funds will empower you to navigate the investment landscape with confidence. Recognizing the differences between hedge funds and mutual funds is paramount for any investor. The core differences between hedge funds and mutual funds dictate their suitability for different investor profiles. Grasping the differences between hedge funds and mutual funds allows for strategic portfolio allocation. Ignoring the differences between hedge funds and mutual funds can lead to misaligned investment strategies. Keep in mind the significant differences between hedge funds and mutual funds when considering your investment options. The stark differences between hedge funds and mutual funds highlight the importance of due diligence. Be sure to weigh the differences between hedge funds and mutual funds carefully before investing. Investors should always be aware of the critical differences between hedge funds and mutual funds.