Liquidity Sweep Meaning: Understanding Order Execution

In the fast-paced world of financial markets, understanding the nuances of order execution is crucial for both institutional and retail traders. One such concept is the liquidity sweep, a sophisticated trading strategy that ensures orders are filled quickly and efficiently. This article delves into the liquidity sweep meaning, its mechanics, benefits, and risks, providing a comprehensive overview for anyone looking to enhance their trading knowledge.

What is a Liquidity Sweep?

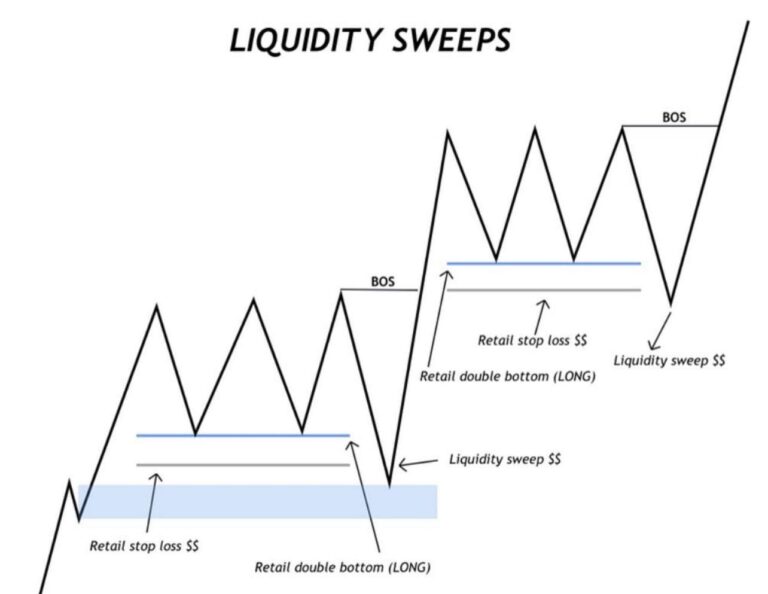

A liquidity sweep, also known as a ‘sweep order,’ is a type of market order designed to execute a large volume of shares as quickly as possible. The primary goal of a liquidity sweep is to fill the entire order by ‘sweeping’ across multiple price levels in the order book until the order is completely filled. This contrasts with a standard market order, which may only fill at the best available price and leave the remainder unfilled if sufficient liquidity isn’t immediately available.

To truly understand the liquidity sweep meaning, it’s essential to grasp the context in which it operates. Market makers and algorithmic traders often employ liquidity sweeps to capitalize on fleeting opportunities or to execute large block trades without significantly impacting the market price. [See also: Understanding Market Makers and Their Role]

How Liquidity Sweeps Work

The mechanics of a liquidity sweep are relatively straightforward but require a deep understanding of the order book. Here’s a step-by-step breakdown:

- Order Placement: A trader places a liquidity sweep order for a specific quantity of shares.

- Price Level Scanning: The order execution system scans the order book to identify the best available prices at various levels.

- Aggressive Execution: The system aggressively executes the order, starting with the best price and moving to successively higher (for buy orders) or lower (for sell orders) prices until the entire order is filled.

- Partial Fills: The order may be filled at multiple price points. For example, a buy order might fill some shares at $10.00, more at $10.01, and the remainder at $10.02.

The key characteristic of a liquidity sweep is its urgency. Unlike limit orders, which wait for a specific price, a liquidity sweep prioritizes speed and completeness of execution over price precision. This makes it particularly useful in volatile markets or when trading large volumes.

Benefits of Using Liquidity Sweeps

There are several advantages to using liquidity sweeps, particularly for institutional traders and those managing large portfolios:

- Guaranteed Fill: The primary benefit is the high likelihood of a complete order fill. This is crucial when traders need to execute a specific strategy that requires a certain position size.

- Speed of Execution: Liquidity sweeps are designed for rapid execution, allowing traders to capitalize on short-term market movements.

- Reduced Market Impact: By spreading the order across multiple price levels, liquidity sweeps can minimize the impact on the market price, especially when dealing with large orders.

- Efficiency: They automate the process of filling large orders, saving time and reducing the need for manual intervention.

For instance, a hedge fund manager needing to quickly establish a large position in a stock might use a liquidity sweep to avoid slippage and ensure the entire order is filled promptly. [See also: Hedge Fund Strategies and Order Execution]

Risks and Considerations

While liquidity sweeps offer several advantages, they also come with inherent risks and considerations:

- Price Slippage: The most significant risk is price slippage. Because the order is filled at multiple price levels, the average execution price may be less favorable than the initial quoted price.

- Higher Transaction Costs: Due to the aggressive nature of the order, transaction costs, including commissions and fees, may be higher compared to other order types.

- Market Volatility: In highly volatile markets, the price can change rapidly, leading to unexpected execution prices and potentially significant slippage.

- Availability of Liquidity: While liquidity sweeps aim to find liquidity, there is no guarantee that sufficient liquidity will be available at reasonable prices, especially in thinly traded stocks.

Traders must carefully weigh these risks against the benefits before using a liquidity sweep. Proper risk management and a thorough understanding of market conditions are essential.

Liquidity Sweep vs. Other Order Types

To fully appreciate the liquidity sweep meaning, it’s helpful to compare it with other common order types:

- Market Order: A market order executes at the best available price. However, it may not fill completely if liquidity is insufficient at that price level.

- Limit Order: A limit order executes only at a specified price or better. While it offers price control, it may not fill if the market price never reaches the limit price.

- Stop Order: A stop order becomes a market order when the market price reaches a specified stop price. It’s used to limit losses or protect profits.

- Hidden Order: A hidden order, also known as an iceberg order, displays only a portion of the total order size to the market. It’s used to minimize market impact when trading large volumes.

Each order type serves a different purpose, and the choice depends on the trader’s objectives and risk tolerance. Liquidity sweeps are best suited for situations where guaranteed fill and speed of execution are paramount.

Examples of Liquidity Sweep in Action

Consider a scenario where a large institutional investor needs to buy 100,000 shares of a company. The current market price is $50.00 per share. Here are two possible outcomes:

- Using a Market Order: The investor places a market order for 100,000 shares. The order fills 50,000 shares at $50.00, but the remaining 50,000 shares are filled at progressively higher prices, resulting in an average execution price of $50.10 and a total cost of $5,010,000.

- Using a Liquidity Sweep: The investor places a liquidity sweep order for 100,000 shares. The order fills 30,000 shares at $50.00, 40,000 shares at $50.01, and 30,000 shares at $50.02, resulting in an average execution price of $50.015 and a total cost of $5,001,500.

In this example, the liquidity sweep results in a slightly better average execution price and ensures the entire order is filled. This highlights the benefits of using liquidity sweeps for large orders in volatile markets.

The Role of Technology in Liquidity Sweeps

Modern trading technology plays a critical role in the execution of liquidity sweeps. Algorithmic trading systems are used to automate the process of scanning the order book, identifying the best available prices, and executing orders rapidly. These systems can analyze vast amounts of data in real-time and make split-second decisions to optimize order execution.

Furthermore, sophisticated order routing systems can direct liquidity sweeps to multiple exchanges and trading venues to find the best available liquidity. This ensures that the order is filled as quickly and efficiently as possible. [See also: Algorithmic Trading Strategies and Order Routing]

Regulatory Considerations

The use of liquidity sweeps is subject to regulatory oversight to ensure fair and transparent market practices. Regulators, such as the Securities and Exchange Commission (SEC) in the United States, monitor order execution practices to prevent market manipulation and ensure that investors are treated fairly.

Traders and brokers must comply with regulations regarding best execution, which requires them to seek the most favorable terms reasonably available for their clients’ orders. Failure to comply with these regulations can result in penalties and reputational damage.

The Future of Liquidity Sweeps

As financial markets continue to evolve, the role of liquidity sweeps is likely to become even more important. The increasing prevalence of algorithmic trading and high-frequency trading has created a need for sophisticated order execution strategies that can adapt to rapidly changing market conditions.

Furthermore, the fragmentation of trading venues and the growing complexity of financial instruments are driving demand for more efficient and reliable order execution methods. Liquidity sweeps are well-positioned to meet these challenges and remain a valuable tool for traders and investors.

Conclusion: Mastering Liquidity Sweeps

Understanding the liquidity sweep meaning is essential for anyone involved in financial markets. While it involves a degree of complexity, the benefits of guaranteed fill, speed of execution, and reduced market impact make it a valuable strategy for institutional traders and those managing large portfolios.

However, it’s important to be aware of the risks, including price slippage and higher transaction costs. By carefully weighing the pros and cons and using appropriate risk management techniques, traders can effectively leverage liquidity sweeps to achieve their investment goals. As technology continues to advance and markets become more complex, mastering the art of liquidity sweeps will be a key differentiator for successful traders.