Hedge Funds vs. Mutual Funds: Understanding the Key Differences

When navigating the complex world of investments, understanding the nuances between different investment vehicles is crucial. Two prominent players in this arena are hedge funds and mutual funds. While both aim to generate returns for investors, they operate under different structures, employ distinct strategies, and cater to different types of investors. This article delves into the key differences between hedge funds vs mutual funds, providing a comprehensive overview to help you make informed investment decisions.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. They are regulated investment companies subject to strict regulatory oversight. Mutual funds offer a relatively accessible way for individual investors to participate in the financial markets with smaller amounts of capital.

Key Characteristics of Mutual Funds:

- Accessibility: Typically available to a wide range of investors, including individuals with modest investment amounts.

- Regulation: Heavily regulated by government agencies like the Securities and Exchange Commission (SEC) in the United States.

- Transparency: Required to disclose their holdings and performance regularly.

- Liquidity: Investors can typically buy or sell shares daily at the fund’s net asset value (NAV).

- Diversification: Offer instant diversification across a range of assets.

- Investment Strategies: Employ various strategies, from passive index tracking to active management, with varying risk levels.

What are Hedge Funds?

Hedge funds are private investment partnerships that employ a wider range of investment strategies than mutual funds, often including leverage, short selling, and derivatives. They are typically less regulated and cater to accredited investors – individuals or institutions with high net worth or income.

Key Characteristics of Hedge Funds:

- Limited Accessibility: Generally restricted to accredited investors due to higher investment minimums and regulatory requirements.

- Regulation: Subject to less stringent regulation compared to mutual funds.

- Transparency: Offer less transparency regarding their holdings and strategies.

- Liquidity: May have lock-up periods, restricting investors from withdrawing their funds for a specified time.

- Investment Strategies: Employ more complex and often riskier strategies aiming for higher returns.

- Fees: Typically charge higher fees, including management fees and performance fees (e.g., the “2 and 20” model).

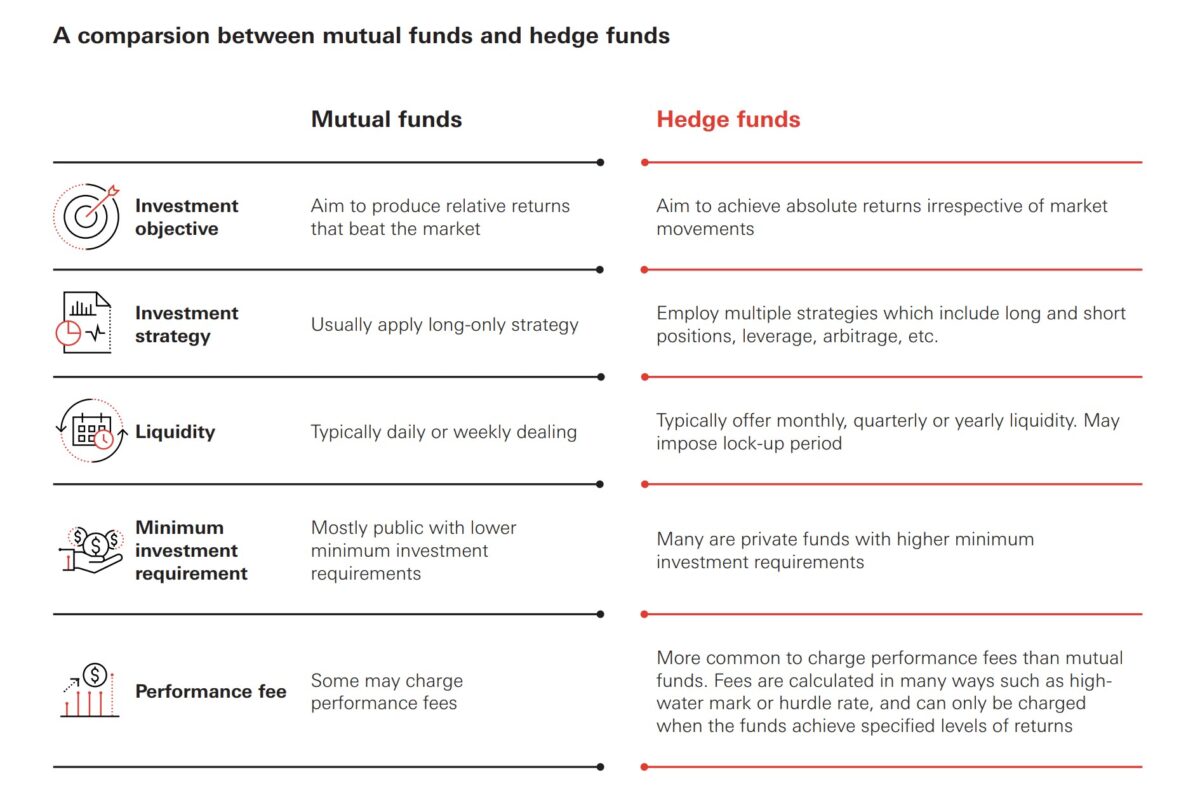

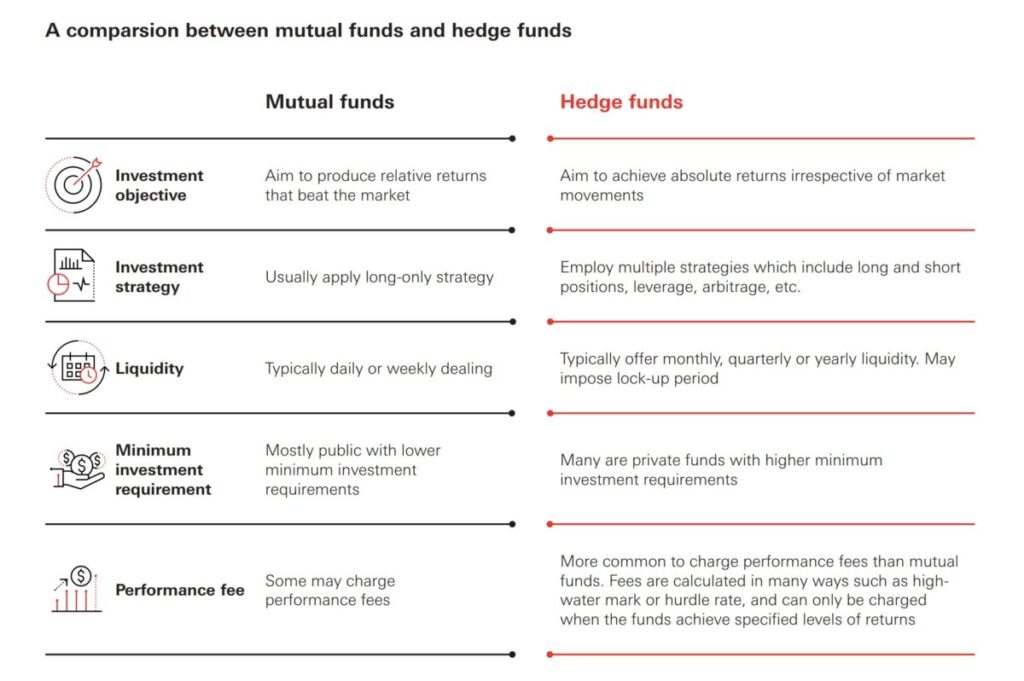

Hedge Funds vs Mutual Funds: A Detailed Comparison

The differences between hedge funds vs mutual funds extend beyond their accessibility and regulatory frameworks. Let’s delve deeper into the critical distinctions:

Investment Strategies

Mutual Funds: Primarily focus on traditional investment strategies such as buying and holding stocks or bonds. Some actively managed mutual funds may use more sophisticated techniques, but they are generally constrained by regulatory guidelines and investor expectations.

Hedge Funds: Utilize a broad range of strategies, including long-short equity, arbitrage, event-driven investing, and global macro strategies. They often employ leverage to amplify returns and may engage in short selling to profit from declining asset prices. The flexibility in strategy allows them to seek profits in various market conditions. This is a key differentiator when considering hedge funds vs mutual funds.

Risk Profile

Mutual Funds: Generally considered less risky than hedge funds due to their diversified portfolios and regulatory oversight. Risk levels can vary depending on the fund’s investment objective and strategy.

Hedge Funds: Typically involve higher risk due to their use of leverage, derivatives, and less regulated environment. While the potential for higher returns exists, so does the potential for significant losses. Understanding the risk tolerance is crucial when comparing hedge funds vs mutual funds.

Fees and Expenses

Mutual Funds: Charge lower fees compared to hedge funds. Common fees include management fees, expense ratios, and sales loads (for some funds).

Hedge Funds: Charge significantly higher fees, often following the “2 and 20” model – a 2% management fee on assets under management and a 20% performance fee on profits. These fees reflect the perceived expertise and potential for higher returns. The fee structure is an important point of comparison in the hedge funds vs mutual funds debate.

Regulation and Transparency

Mutual Funds: Subject to stringent regulation by government agencies, ensuring investor protection and transparency. They are required to disclose their holdings and performance regularly.

Hedge Funds: Face less stringent regulation, offering greater flexibility in their investment strategies but also reducing transparency. Investors typically have less insight into the fund’s specific holdings and trading activities. The level of regulation is a significant factor when evaluating hedge funds vs mutual funds.

Investor Suitability

Mutual Funds: Suitable for a broad range of investors, including those with limited capital and a preference for lower-risk investments.

Hedge Funds: Primarily suitable for accredited investors who understand the risks involved and have the financial resources to withstand potential losses. These investors are often looking for higher returns and are comfortable with less liquidity. Investor suitability is a critical consideration when choosing between hedge funds vs mutual funds.

Examples of Hedge Fund Strategies

To further illustrate the difference, here are some common hedge fund strategies:

- Long-Short Equity: Involves taking long positions in stocks expected to appreciate and short positions in stocks expected to decline.

- Event-Driven Investing: Focuses on profiting from corporate events such as mergers, acquisitions, bankruptcies, and restructurings.

- Global Macro: Makes investment decisions based on macroeconomic trends and events, such as interest rate changes, currency fluctuations, and political developments.

- Arbitrage: Exploits price discrepancies in different markets or related securities to generate risk-free profits.

The Role of Due Diligence

Regardless of whether you’re considering investing in hedge funds or mutual funds, thorough due diligence is essential. For mutual funds, this involves researching the fund’s investment objective, strategy, performance history, and fees. For hedge funds, due diligence is even more critical due to the lack of transparency and higher risk. Investors should carefully evaluate the fund manager’s experience, track record, investment process, and risk management practices.

Recent Trends in Hedge Funds and Mutual Funds

The landscape of both hedge funds and mutual funds is constantly evolving. Recent trends include the increasing popularity of passive investing in mutual funds, the rise of ESG (Environmental, Social, and Governance) investing, and the growing use of technology and data analytics in both industries. In the hedge fund world, there’s been a shift towards more specialized strategies and a greater focus on risk management following periods of market volatility.

Conclusion: Choosing the Right Investment Vehicle

The choice between hedge funds vs mutual funds depends on individual investment goals, risk tolerance, and financial circumstances. Mutual funds offer a more accessible and regulated option for a broad range of investors, while hedge funds cater to accredited investors seeking potentially higher returns through more complex and riskier strategies. Understanding the key differences outlined in this article is crucial for making informed investment decisions. Ultimately, consulting with a qualified financial advisor is recommended to determine the most suitable investment strategy for your specific needs. Remember to carefully consider all factors, including fees, risks, and investment objectives, when comparing hedge funds vs mutual funds. [See also: Understanding Investment Risk Tolerance] [See also: Diversifying Your Investment Portfolio] [See also: Choosing a Financial Advisor]