Maximize Your Forex Profits: The Ultimate Forex Profit Calculator with Leverage Guide

In the fast-paced world of Forex trading, understanding how leverage impacts your potential profits (and losses) is crucial. A forex profit calculator with leverage is an indispensable tool for traders of all levels, offering a clear picture of potential outcomes before risking capital. This guide will delve into the intricacies of using a forex profit calculator with leverage, providing you with the knowledge to make informed trading decisions and optimize your profitability.

Understanding Forex Trading and Leverage

Forex, or foreign exchange, is the global decentralized marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, with trillions of dollars changing hands daily. Traders buy and sell currencies with the goal of profiting from fluctuations in their exchange rates.

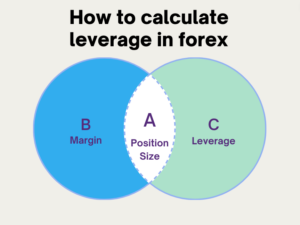

Leverage is a powerful tool offered by Forex brokers that allows traders to control a larger position size than their initial capital would otherwise permit. It’s essentially a loan from the broker, enabling you to amplify both potential profits and losses. For example, with a leverage of 1:100, you can control $100,000 worth of currency with just $1,000 of your own capital. While this can significantly increase potential gains, it also magnifies the risk of losses.

The Importance of a Forex Profit Calculator

Before entering any trade, it’s essential to assess the potential profit and loss scenarios. A forex profit calculator simplifies this process, allowing you to quickly determine the potential outcome of a trade based on various factors, including:

- Currency Pair: The specific currencies being traded (e.g., EUR/USD, GBP/JPY).

- Trade Size (Lot Size): The volume of currency being traded.

- Entry Price: The price at which you enter the trade.

- Exit Price: The price at which you plan to exit the trade.

- Leverage: The leverage ratio applied to the trade.

By inputting these parameters into a forex profit calculator with leverage, you can instantly calculate the potential profit or loss in your account currency. This allows you to:

- Assess Risk: Determine the maximum potential loss if the trade moves against you.

- Set Realistic Profit Targets: Calculate the potential profit if the trade moves in your favor.

- Manage Your Account: Ensure that the potential risk aligns with your risk tolerance and account size.

- Compare Trading Opportunities: Evaluate different trading scenarios and choose the most favorable ones.

How to Use a Forex Profit Calculator with Leverage

Using a forex profit calculator with leverage is typically straightforward. Most calculators are available online and require you to input the following information:

- Select the Currency Pair: Choose the currency pair you are trading (e.g., EUR/USD).

- Enter the Account Currency: Select the currency your trading account is denominated in (e.g., USD, EUR, GBP).

- Input the Trade Size: Specify the lot size of your trade (e.g., 0.1 lot, 1 lot). Understanding lot sizes is critical. A standard lot is 100,000 units of the base currency. Mini lots are 10,000 units, and micro lots are 1,000 units.

- Enter the Entry Price: Input the price at which you entered (or plan to enter) the trade.

- Enter the Exit Price: Input the price at which you plan to exit the trade. This could be based on your target profit or stop-loss level.

- Specify the Leverage: Enter the leverage ratio you are using (e.g., 1:50, 1:100, 1:200).

Once you have entered all the required information, the forex profit calculator will automatically calculate the potential profit or loss in your account currency. Some calculators also provide additional information, such as the pip value and the margin required for the trade.

Example Calculation

Let’s say you are trading EUR/USD with a leverage of 1:100. Your account currency is USD, and you are trading 1 standard lot (100,000 units). You enter the trade at 1.1000 and plan to exit at 1.1050.

Using a forex profit calculator with leverage, you would input the following:

- Currency Pair: EUR/USD

- Account Currency: USD

- Trade Size: 1 lot

- Entry Price: 1.1000

- Exit Price: 1.1050

- Leverage: 1:100

The calculator would then show you a potential profit of $500. This is calculated as follows: (1.1050 – 1.1000) * 100,000 = $5000. However, since you used leverage of 1:100, the actual capital at risk is much smaller. This highlights the amplified profit potential.

Choosing the Right Forex Profit Calculator

While many forex profit calculators are available online, it’s essential to choose one that is accurate, reliable, and user-friendly. Look for calculators that:

- Provide Accurate Calculations: Ensure the calculator uses the correct formulas and real-time exchange rates.

- Offer a User-Friendly Interface: The calculator should be easy to use and understand, even for beginners.

- Support a Wide Range of Currency Pairs: The calculator should support the currency pairs you trade.

- Offer Additional Features: Some calculators offer additional features, such as pip value calculations and margin requirements.

Consider using calculators from reputable Forex brokers or financial websites. These calculators are often more accurate and reliable than those from unknown sources.

The Risks of Leverage

While leverage can amplify potential profits, it’s crucial to remember that it also magnifies potential losses. Using high leverage without proper risk management can quickly deplete your trading account. Before using leverage, it’s essential to understand the risks involved and implement appropriate risk management strategies, such as:

- Setting Stop-Loss Orders: A stop-loss order automatically closes your trade when the price reaches a predetermined level, limiting your potential losses.

- Using Appropriate Lot Sizes: Avoid using excessively large lot sizes that could expose you to significant risk.

- Managing Your Margin: Monitor your margin levels closely and ensure you have sufficient margin to cover potential losses.

- Understanding Margin Call: Be aware of your broker’s margin call policy. A margin call occurs when your account equity falls below a certain level, and the broker may automatically close your positions to protect their capital.

Integrating the Calculator into Your Trading Strategy

A forex profit calculator with leverage should be an integral part of your Forex trading strategy. Use it to:

- Plan Your Trades: Before entering a trade, use the calculator to assess the potential profit and loss scenarios and determine if the trade aligns with your risk tolerance and profit goals.

- Adjust Your Position Size: Use the calculator to determine the appropriate lot size based on your account size, risk tolerance, and the leverage you are using.

- Set Realistic Profit Targets and Stop-Loss Levels: Use the calculator to determine appropriate profit targets and stop-loss levels based on your trading strategy and market conditions.

- Evaluate Your Trading Performance: Use the calculator to analyze your past trades and identify areas for improvement.

By consistently using a forex profit calculator with leverage as part of your trading process, you can make more informed decisions, manage your risk effectively, and increase your chances of success in the Forex market.

Beyond the Basic Calculator: Advanced Considerations

While basic forex profit calculators with leverage are useful, more advanced traders might consider tools that incorporate additional factors, such as:

- Commission and Spread Costs: These fees can significantly impact your profitability, especially for high-frequency traders. Look for calculators that allow you to factor in these costs.

- Swap Rates (Rollover Fees): If you hold positions overnight, you may be subject to swap rates, which can either add to or subtract from your profits.

- Different Account Types: Some brokers offer different account types with varying leverage levels and trading conditions. Choose a calculator that reflects the specific conditions of your account.

Furthermore, remember that no calculator can guarantee profits. Market conditions are constantly changing, and unforeseen events can impact currency prices. A forex profit calculator with leverage is a tool to help you make informed decisions, but it’s not a substitute for sound trading strategies, risk management, and continuous learning. [See also: Forex Risk Management Strategies] and [See also: Understanding Forex Leverage]

Conclusion

A forex profit calculator with leverage is an essential tool for any Forex trader who wants to make informed decisions and manage their risk effectively. By understanding how leverage works and using a calculator to assess potential profit and loss scenarios, you can increase your chances of success in the Forex market. Remember to choose a reliable calculator, understand the risks of leverage, and integrate the calculator into your overall trading strategy. With careful planning and disciplined execution, you can maximize your Forex profits and achieve your financial goals.