Spread Betting vs. CFD Trading: Understanding the Key Differences

When navigating the world of financial trading, two popular methods frequently arise: spread betting and Contracts for Difference (CFDs). Both offer opportunities to speculate on the price movements of various assets without owning the underlying asset. However, significant differences exist between spread betting vs CFD, impacting taxation, risk management, and overall trading strategy. This article provides a comprehensive comparison to help you determine which approach aligns best with your financial goals and risk tolerance.

What is Spread Betting?

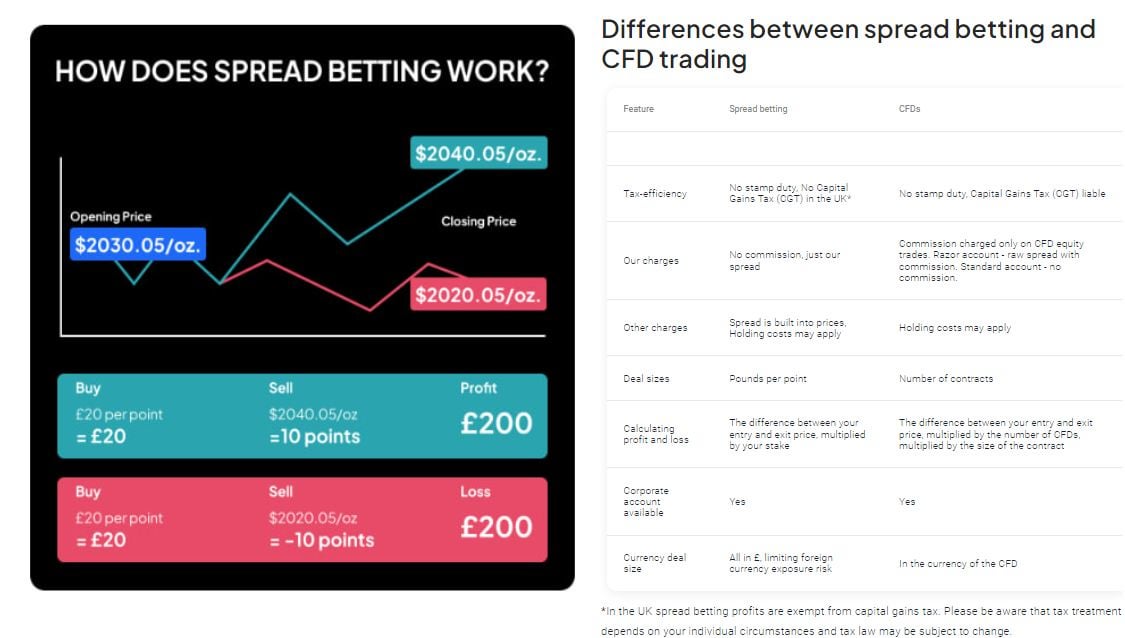

Spread betting is a form of speculation that involves betting on the direction of price movements in financial markets. Instead of buying or selling an asset, you predict whether its price will rise (go long) or fall (go short). The ‘spread’ refers to the difference between the buying and selling price quoted by the broker. Your profit or loss is determined by the accuracy of your prediction and the size of your stake per point movement.

Key Features of Spread Betting

- Tax Advantages: In the UK and Ireland, profits from spread betting are generally exempt from Capital Gains Tax (CGT) and Stamp Duty. This is a significant advantage for many traders.

- Fixed Odds: Spread betting firms offer fixed odds, meaning you know your potential profit or loss per point movement in advance.

- Leverage: Spread betting allows you to control a large position with a relatively small deposit, amplifying both potential profits and losses.

- Wide Range of Markets: You can spread bet on various markets, including stocks, indices, commodities, and currencies.

What are CFDs?

Contracts for Difference (CFDs) are derivative products that allow you to speculate on the price movements of an asset. Similar to spread betting, you don’t own the underlying asset. Instead, you enter into a contract with a broker to exchange the difference in the asset’s price between the opening and closing of the contract.

Key Features of CFDs

- Tax Implications: CFD profits are generally subject to Capital Gains Tax (CGT). Tax rules vary by jurisdiction.

- Direct Market Access: CFDs often provide more direct access to market prices, potentially resulting in tighter spreads compared to spread betting.

- Leverage: Like spread betting, CFDs offer leveraged trading, increasing both potential profits and losses.

- Global Market Access: CFDs provide access to a wide range of global markets, including stocks, indices, commodities, and currencies.

- Dividend Adjustments: If you hold a CFD on a stock and the company pays a dividend, you may receive a dividend adjustment (if long) or be charged a dividend adjustment (if short).

Spread Betting vs. CFD Trading: A Detailed Comparison

Understanding the nuances between spread betting vs CFD is crucial for making informed trading decisions. Here’s a breakdown of the key differences:

Taxation

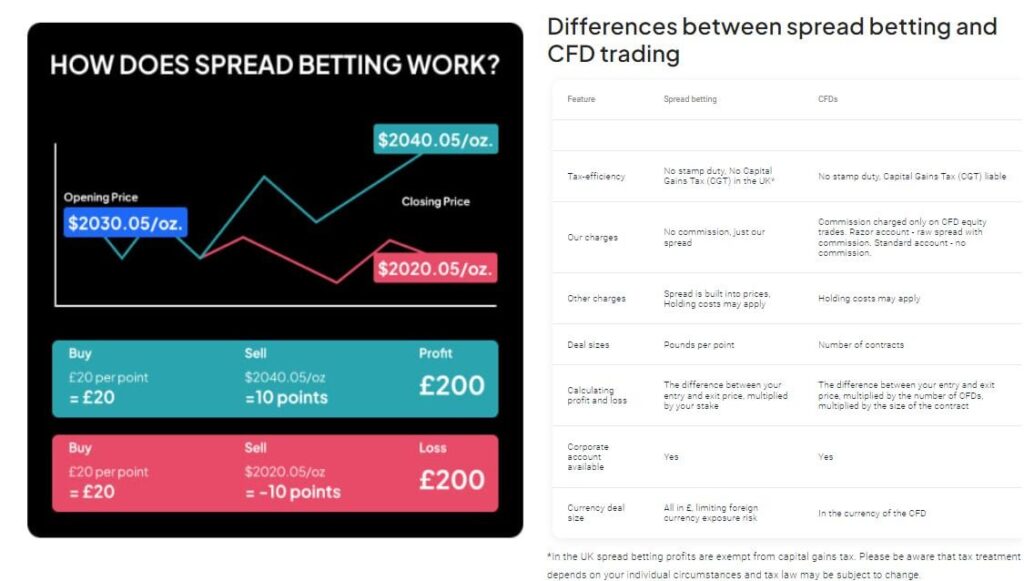

This is arguably the most significant difference. In the UK and Ireland, spread betting profits are typically tax-free, while CFD profits are subject to Capital Gains Tax. This can significantly impact your overall profitability, especially if you’re a high-volume trader. Always consult with a tax professional for personalized advice.

Spreads and Commissions

Both spread betting and CFDs involve spreads, which represent the broker’s profit margin. Generally, CFDs may offer slightly tighter spreads than spread betting, particularly on highly liquid assets. However, some CFD brokers also charge commissions on trades, which can offset the benefit of tighter spreads. You need to consider the overall cost, including both the spread and any commissions, when comparing the two.

Market Access

Both spread betting and CFDs provide access to a wide range of markets, including stocks, indices, commodities, and currencies. The specific markets available may vary depending on the broker. Generally, both offer similar market coverage.

Leverage

Both spread betting and CFDs offer leveraged trading. Leverage allows you to control a larger position with a smaller deposit. While leverage can amplify profits, it also significantly increases the risk of losses. It’s crucial to use leverage cautiously and implement robust risk management strategies. Regulatory bodies often impose limits on leverage to protect retail traders.

Regulation

Both spread betting and CFD brokers are typically regulated by financial authorities in their respective jurisdictions. This regulation provides a level of protection for traders. In the UK, both are regulated by the Financial Conduct Authority (FCA). Ensure you choose a broker that is regulated by a reputable authority.

Dividend Adjustments

This is relevant when trading stocks. With CFDs, you may receive a dividend adjustment if you hold a long position on a stock when the company pays a dividend. Conversely, you may be charged a dividend adjustment if you hold a short position. With spread betting, dividend adjustments are usually factored into the spread, so you don’t receive separate dividend payments or charges.

Transparency

CFDs are generally considered more transparent than spread betting. With CFDs, you often have more direct access to market prices and order books. This can provide a clearer understanding of market dynamics. However, both spread betting and CFD brokers are required to provide fair and transparent pricing.

Risk Management Strategies for Spread Betting and CFD Trading

Regardless of whether you choose spread betting or CFD trading, effective risk management is paramount. Here are some essential strategies:

- Set Stop-Loss Orders: Stop-loss orders automatically close your position when the price reaches a predetermined level, limiting your potential losses.

- Use Appropriate Leverage: Avoid using excessive leverage, as it can magnify losses. Start with lower leverage and gradually increase it as you gain experience.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your trading portfolio across different assets and markets.

- Manage Your Emotions: Avoid making impulsive decisions based on fear or greed. Stick to your trading plan and avoid chasing losses.

- Stay Informed: Keep up-to-date with market news and economic events that could impact your trades.

- Understand Margin Requirements: Both spread betting and CFDs require you to maintain a certain margin in your account. Understand the margin requirements and ensure you have sufficient funds to cover potential losses.

Choosing the Right Platform: Spread Betting or CFD?

The choice between spread betting vs CFD depends on your individual circumstances, trading style, and risk tolerance. Consider the following factors:

- Tax Situation: If you’re based in the UK or Ireland and want to take advantage of tax-free profits, spread betting may be more appealing.

- Trading Style: If you prefer a more direct market access and potentially tighter spreads, CFDs may be a better option.

- Risk Tolerance: Both spread betting and CFDs involve risk. Assess your risk tolerance and choose the option that aligns with your comfort level.

- Capital Available: Consider the minimum deposit requirements and margin requirements of each platform.

- Broker Reputation: Choose a reputable and regulated broker with a proven track record.

Example Scenario: Comparing Spread Betting and CFD Trade

Let’s imagine you want to speculate on the price of gold. The current price is $2,000 per ounce.

Spread Betting Example

You decide to place a spread betting trade, predicting that the price of gold will rise. The broker offers a spread of $1,999 – $2,001. You ‘buy’ (go long) at $2,001, betting £10 per point. If the price rises to $2,011, you make a profit of £100 (10 points x £10 per point). If the price falls to $1,991, you incur a loss of £100 (10 points x £10 per point).

CFD Example

You decide to buy one CFD contract on gold at $2,000. The broker charges a commission of $5 per trade. If the price rises to $2,010, you make a profit of $10 (before commission). After deducting the commission ($5 to open and $5 to close), your net profit is $0. If the price falls to $1,990, you incur a loss of $10 (before commission). After adding the commission, your net loss is $20.

This example illustrates the importance of considering both spreads and commissions when comparing spread betting vs CFD. In this scenario, the tax implications would also need to be considered to determine the most profitable option.

Conclusion: Which is Right for You?

Spread betting vs CFD both offer opportunities to profit from financial market movements. The best choice depends on your individual circumstances, trading style, and risk tolerance. Consider the tax implications, spreads, commissions, market access, leverage, and regulation when making your decision. Always practice proper risk management and choose a reputable and regulated broker. Ultimately, understanding the key differences between spread betting vs CFD is essential for making informed trading decisions and achieving your financial goals. Remember that both involve significant risk and are not suitable for everyone. Conduct thorough research and seek professional advice before engaging in either form of trading. Both spread betting and CFD trading can be effective tools for speculating on market movements, but only when used responsibly and with a solid understanding of the risks involved.

[See also: Understanding Leverage in Trading]

[See also: Risk Management Strategies for Forex Trading]