Spread Betting vs CFD Trading: Unveiling the Key Differences

For individuals looking to participate in the financial markets, a critical decision lies in choosing the right trading instrument. Two popular options frequently considered are spread betting and CFD (Contract for Difference) trading. While both offer opportunities to speculate on price movements of various assets, they operate under different frameworks and possess distinct characteristics. Understanding the difference between spread betting and CFD trading is crucial for making informed decisions aligned with individual risk tolerance, financial goals, and regulatory considerations. This article will provide a comprehensive comparison of these two trading methods, highlighting their key distinctions and similarities.

What is Spread Betting?

Spread betting is a form of speculation where you bet on the direction of a price movement without actually owning the underlying asset. Instead of buying shares, commodities, or currencies, you’re essentially placing a bet on whether the price will rise or fall. Your profit or loss is determined by the accuracy of your prediction and the size of your stake per point movement.

The beauty of spread betting lies in its tax advantages in certain jurisdictions, most notably the UK and Ireland, where profits are generally exempt from capital gains tax and stamp duty. This is because spread betting is classified as gambling rather than investment. However, it’s essential to remember that tax laws can change, and it’s always advisable to seek professional tax advice.

Key Features of Spread Betting:

- Tax Advantages: Profits are often tax-free in certain jurisdictions.

- Leverage: Offers high leverage, allowing you to control a large position with a relatively small deposit.

- No Ownership: You don’t own the underlying asset.

- Fixed Spreads: Some brokers offer fixed spreads, providing more predictable costs.

What is CFD Trading?

CFD trading, or Contract for Difference trading, is another popular method of speculating on the price movements of assets without taking ownership. In a CFD trade, you enter into a contract with a broker to exchange the difference in the price of an asset between the time the contract is opened and when it is closed.

Unlike spread betting, CFD trading is generally considered a financial instrument rather than gambling. As such, profits are typically subject to capital gains tax. However, CFD trading offers access to a wider range of markets and instruments, making it attractive to more experienced traders. The difference between spread betting and CFD trading also extends to the regulatory environment, with CFDs often being subject to stricter regulations.

Key Features of CFD Trading:

- Wider Market Access: Access to a broader range of markets and instruments.

- Leverage: Similar to spread betting, CFDs offer high leverage.

- Subject to Capital Gains Tax: Profits are generally subject to capital gains tax.

- Ownership: You don’t own the underlying asset.

The Core Differences: A Detailed Comparison

Understanding the nuanced difference between spread betting and CFD trading requires a closer look at several key aspects:

Taxation

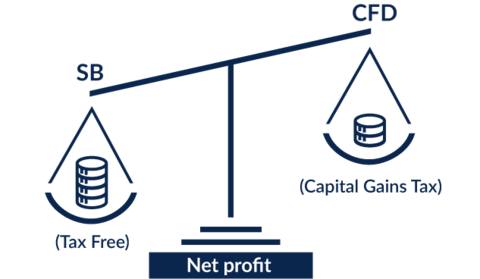

This is perhaps the most significant difference between spread betting and CFD trading, particularly for traders in the UK and Ireland. Spread betting profits are typically tax-free, while CFD profits are subject to capital gains tax. This can have a substantial impact on your overall profitability, especially if you’re a frequent trader or generate significant profits. Consider your tax bracket and consult with a tax advisor to determine which option is more advantageous for your specific circumstances.

Regulation

CFD trading is generally subject to stricter regulations than spread betting. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) oversee CFD brokers to ensure fair trading practices and protect investors. While spread betting is also regulated, the regulatory framework may differ depending on the jurisdiction. This difference between spread betting and CFD trading in regulation can impact the level of investor protection and the types of safeguards in place.

Market Access

While both spread betting and CFD trading offer access to a wide range of markets, CFD trading often provides a slightly broader selection. This can include more niche markets and less liquid assets. The specific markets available will vary depending on the broker you choose, so it’s essential to compare the offerings of different brokers before making a decision. The difference between spread betting and CFD trading in market access might be a deciding factor for traders interested in specific, less common assets.

Spreads and Commissions

Both spread betting and CFD trading generate revenue for brokers through spreads, which is the difference between spread betting and CFD trading. The spread is the difference between the buying and selling price of an asset. In spread betting, the spread is typically the only cost you incur. In CFD trading, brokers may also charge commissions on top of the spread. It’s crucial to compare the overall costs, including spreads and commissions, to determine which option is more cost-effective for your trading style.

Leverage

Both spread betting and CFD trading offer high leverage, allowing you to control a large position with a relatively small deposit. While leverage can amplify your profits, it can also magnify your losses. It’s crucial to understand the risks associated with leverage and to use it responsibly. The availability and maximum leverage offered may vary depending on the broker, the asset being traded, and the regulatory environment. Before engaging in leveraged trading, make sure you fully understand the potential risks and have a robust risk management strategy in place. The difference between spread betting and CFD trading in leverage isn’t usually a significant factor, as both offer similar levels.

Contract Size

The contract size, or the amount of the underlying asset represented by one unit of the trade, can differ between spread betting and CFD trading. In spread betting, the contract size is typically expressed as a monetary value per point movement of the asset. In CFD trading, the contract size is usually equivalent to one unit of the underlying asset. This difference between spread betting and CFD trading can affect the minimum stake size and the overall cost of trading.

Similarities Between Spread Betting and CFD Trading

Despite the key differences, spread betting and CFD trading also share some important similarities:

- Leverage: Both offer high leverage, allowing you to control a large position with a small deposit.

- No Ownership: You don’t own the underlying asset in either case.

- Speculation: Both are used to speculate on price movements.

- Accessibility: Both are easily accessible through online trading platforms.

Choosing the Right Option for You

The best choice between spread betting and CFD trading depends on your individual circumstances and trading preferences. Consider the following factors:

- Tax Situation: If you’re in a jurisdiction where spread betting profits are tax-free, this may be a significant advantage.

- Risk Tolerance: Both involve high leverage, so understand the risks involved.

- Trading Style: Consider your trading frequency and the size of your trades.

- Market Access: Ensure the broker offers access to the markets you want to trade.

- Regulatory Environment: Understand the regulations in your jurisdiction.

Risk Management is Key

Regardless of whether you choose spread betting or CFD trading, effective risk management is crucial. Use stop-loss orders to limit potential losses, manage your leverage responsibly, and never risk more than you can afford to lose. The difference between spread betting and CFD trading is less important than having a sound risk management strategy in place.

Conclusion: Weighing the Options

The difference between spread betting and CFD trading lies primarily in taxation and regulatory treatment. Spread betting often offers tax advantages in certain jurisdictions, while CFD trading may provide access to a slightly wider range of markets and is generally subject to stricter regulations. Both offer high leverage and the opportunity to profit from price movements without owning the underlying asset. Ultimately, the best choice depends on your individual circumstances, risk tolerance, and trading preferences. Thorough research and a clear understanding of the risks involved are essential before engaging in either form of trading. Consider consulting with a financial advisor to determine which option is most suitable for your needs. Remember that both spread betting and CFD trading are complex financial instruments, and it’s crucial to approach them with caution and a well-defined trading strategy. Understanding the difference between spread betting and CFD trading is the first step towards making informed decisions and navigating the financial markets successfully. [See also: Forex Trading Strategies for Beginners] [See also: Understanding Leverage in Trading] [See also: Risk Management Techniques for Traders]