Navigating Uncertainty: Stock Market Predictions and Investment Strategies

The stock market, a dynamic and often unpredictable arena, is constantly scrutinized by investors, analysts, and economists alike. Understanding potential future trends is crucial for making informed investment decisions. This article will delve into the complexities of stock market predictions, exploring the methodologies used, the factors influencing market behavior, and strategies for navigating the inherent uncertainties. It aims to provide a balanced perspective, acknowledging the limitations of forecasting while offering insights into managing risk and maximizing opportunities in the ever-evolving financial landscape. This is important for those looking to understand predictions for the stock market.

Understanding Stock Market Prediction Methodologies

Various methodologies are employed to forecast stock market movements. These range from fundamental analysis, which focuses on intrinsic value, to technical analysis, which examines historical price patterns, and quantitative analysis, which utilizes statistical models. Each approach has its strengths and weaknesses, and often, a combination of methods is used to arrive at a more comprehensive stock market prediction.

Fundamental Analysis: Assessing Intrinsic Value

Fundamental analysis involves evaluating a company’s financial health, management, and competitive positioning to determine its intrinsic value. This includes analyzing financial statements (balance sheets, income statements, and cash flow statements), assessing industry trends, and considering macroeconomic factors. Investors using this approach believe that the market price will eventually converge with the intrinsic value. This can help with predictions for the stock market because it helps you understand the value of the companies in the market.

Technical Analysis: Charting the Past to Predict the Future

Technical analysis focuses on identifying patterns and trends in historical price and volume data. Technical analysts use charts and indicators to identify potential entry and exit points for trades. Common technical indicators include moving averages, relative strength index (RSI), and Moving Average Convergence Divergence (MACD). The underlying assumption is that history tends to repeat itself, and past price patterns can provide clues about future price movements. While technical analysis can be useful for short-term trading, its effectiveness for long-term stock market predictions is often debated.

Quantitative Analysis: The Power of Numbers

Quantitative analysis utilizes statistical models and algorithms to analyze large datasets and identify patterns that may not be apparent through traditional methods. This approach often involves using sophisticated software and programming skills to process data and generate trading signals. Quantitative analysts may use machine learning techniques to identify predictive variables and improve the accuracy of their models. However, the complexity of these models can also make them vulnerable to overfitting and false signals. These models can also help with predictions for the stock market.

Factors Influencing Stock Market Behavior

The stock market is influenced by a complex interplay of factors, including macroeconomic conditions, interest rates, inflation, geopolitical events, and investor sentiment. Understanding these factors is crucial for making informed investment decisions and assessing the validity of stock market predictions.

Macroeconomic Conditions: The Big Picture

Economic indicators such as GDP growth, unemployment rates, and inflation can significantly impact stock market performance. Strong economic growth typically leads to higher corporate earnings and increased investor confidence, driving stock prices higher. Conversely, economic recessions can lead to lower earnings and decreased investor confidence, causing stock prices to decline. Central bank policies, such as interest rate changes and quantitative easing, also play a significant role in influencing market behavior. Keeping track of these factors can help with predictions for the stock market.

Interest Rates and Inflation: The Cost of Money

Interest rates and inflation are closely watched by investors as they directly impact the cost of capital and corporate profitability. Higher interest rates can make it more expensive for companies to borrow money, potentially slowing down growth and reducing earnings. Inflation can erode purchasing power and increase costs for businesses, also impacting profitability. Central banks often adjust interest rates to control inflation and stimulate economic growth. Understanding the relationship between interest rates, inflation, and stock market performance is crucial for making informed investment decisions. These factors can help with predictions for the stock market.

Geopolitical Events: The Global Stage

Geopolitical events, such as wars, political instability, and trade disputes, can have a significant impact on stock markets. These events can create uncertainty and volatility, leading to sharp price swings. Investors often react to geopolitical events by shifting their investments to safer assets, such as government bonds or gold. Understanding the potential impact of geopolitical events on specific industries and companies is crucial for managing risk and making informed investment decisions.

Investor Sentiment: The Psychology of the Market

Investor sentiment, also known as market psychology, refers to the overall attitude of investors towards the stock market. Optimistic sentiment can drive prices higher, while pessimistic sentiment can lead to sell-offs. Investor sentiment is often influenced by news events, economic data, and social media trends. Understanding investor sentiment can be challenging, but it is an important factor to consider when making investment decisions. [See also: Understanding Market Sentiment]

Strategies for Navigating Market Uncertainty

Given the inherent uncertainty of the stock market, it is crucial to have a well-defined investment strategy that incorporates risk management techniques. Diversification, long-term investing, and dollar-cost averaging are common strategies used to mitigate risk and navigate market volatility. Understanding these strategies can help with predictions for the stock market as it allows you to anticipate how other investors may react.

Diversification: Don’t Put All Your Eggs in One Basket

Diversification involves spreading your investments across different asset classes, industries, and geographic regions. This helps to reduce the impact of any single investment on your overall portfolio. A well-diversified portfolio can help to mitigate risk and improve long-term returns. Diversification can be achieved by investing in mutual funds, exchange-traded funds (ETFs), or individual stocks and bonds.

Long-Term Investing: Riding Out the Storm

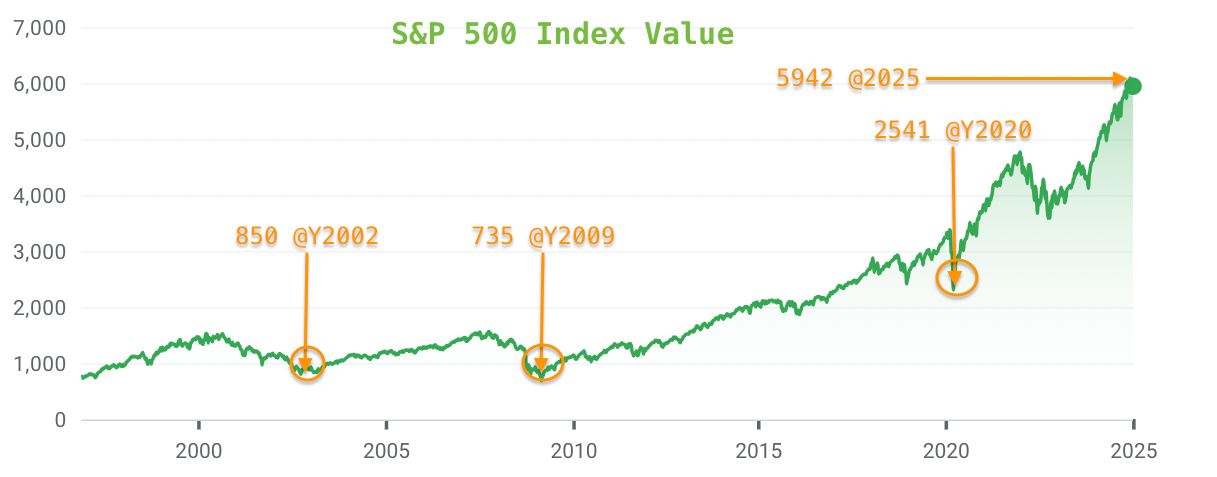

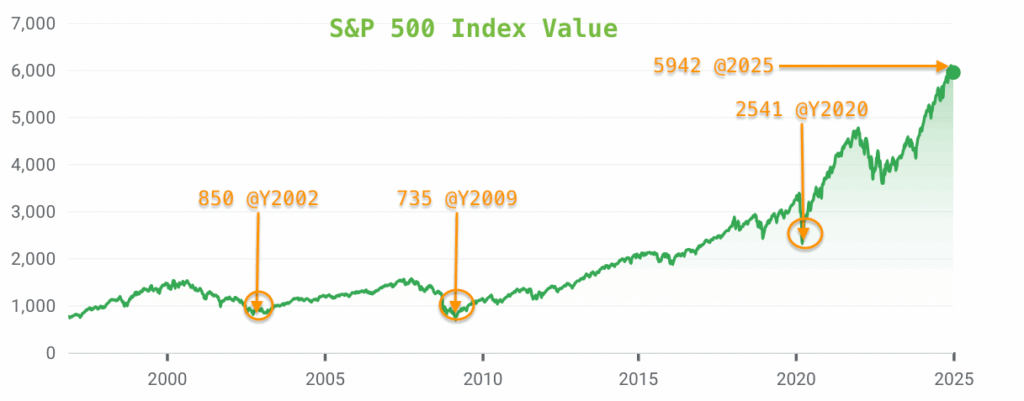

Long-term investing involves holding investments for an extended period, typically several years or even decades. This allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential of the stock market. Long-term investors are less concerned with short-term stock market predictions and focus on the underlying fundamentals of their investments.

Dollar-Cost Averaging: Investing at Regular Intervals

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy helps to reduce the risk of investing a large sum of money at the wrong time. When prices are low, you buy more shares, and when prices are high, you buy fewer shares. Over time, this can lead to a lower average cost per share. This strategy can be particularly useful in volatile markets. [See also: Dollar Cost Averaging Explained]

The Role of Technology in Stock Market Predictions

Technology plays an increasingly significant role in stock market predictions. The availability of vast amounts of data and the development of sophisticated algorithms have enabled analysts to identify patterns and trends that were previously impossible to detect. Artificial intelligence (AI) and machine learning are being used to develop predictive models that can forecast market movements with increasing accuracy. However, it is important to remember that these models are not foolproof and should be used in conjunction with other analytical techniques. This is important for those looking to understand predictions for the stock market.

Artificial Intelligence and Machine Learning: The Future of Forecasting

AI and machine learning algorithms can analyze massive datasets and identify complex relationships that humans may miss. These algorithms can be trained to predict stock prices, identify trading opportunities, and manage risk. However, it is important to remember that these models are only as good as the data they are trained on, and they can be vulnerable to biases and errors. Continuous monitoring and refinement are essential to ensure the accuracy and reliability of AI-powered stock market predictions.

Big Data Analytics: Uncovering Hidden Insights

Big data analytics involves processing and analyzing large volumes of data to identify patterns and trends. This can be used to gain insights into market behavior and improve the accuracy of stock market predictions. Big data sources include financial news articles, social media posts, and economic data releases. By analyzing this data, analysts can identify potential market-moving events and adjust their investment strategies accordingly.

The Limitations of Stock Market Predictions

It is crucial to acknowledge the limitations of stock market predictions. The market is inherently unpredictable, and no forecasting method is foolproof. Unexpected events, such as natural disasters, political crises, and technological breakthroughs, can significantly impact market behavior and render even the most sophisticated models inaccurate. Investors should be wary of anyone who claims to have a crystal ball and should always conduct their own research and due diligence before making investment decisions. This is important for those looking to understand predictions for the stock market.

The Efficient Market Hypothesis: Can the Market Be Beaten?

The efficient market hypothesis (EMH) states that stock prices reflect all available information, making it impossible to consistently outperform the market. According to the EMH, any attempt to predict future price movements is futile, as any new information will be immediately incorporated into prices. While the EMH is a controversial theory, it highlights the difficulty of consistently beating the market through stock market predictions.

The Black Swan Effect: Unforeseen Events

The black swan effect refers to the impact of rare and unpredictable events that have a significant impact on the market. These events are often impossible to foresee and can invalidate even the most sophisticated stock market predictions. Examples of black swan events include the 2008 financial crisis and the COVID-19 pandemic. These events highlight the importance of having a robust risk management strategy and being prepared for the unexpected.

Conclusion: Investing Wisely in an Uncertain World

Stock market predictions can be a valuable tool for investors, but they should be used with caution. While understanding the methodologies, factors, and technologies involved in forecasting can provide insights into potential market trends, it is crucial to acknowledge the inherent limitations of prediction. A well-defined investment strategy, incorporating diversification, long-term investing, and risk management techniques, is essential for navigating market uncertainty and achieving long-term financial goals. Remember that past performance is not indicative of future results, and it is always best to consult with a qualified financial advisor before making any investment decisions. Always be wary of sensational headlines promising sure-fire predictions for the stock market and focus instead on building a solid, diversified portfolio that aligns with your risk tolerance and financial goals.