Navigating Uncertainty: What are the Predictions for the Stock Market?

The stock market, a complex ecosystem driven by a myriad of factors, is always subject to speculation and forecasting. Investors, analysts, and economists constantly attempt to predict its future movements. So, what are the predictions for the stock market in the coming months and years? Predicting the stock market with certainty is impossible, but examining current trends, economic indicators, and expert opinions can provide valuable insights. This article will delve into various perspectives on the future of the stock market, providing a comprehensive overview for investors seeking to make informed decisions.

Current Market Landscape

Before diving into specific stock market predictions, it’s essential to understand the current market landscape. Several key factors are influencing market behavior:

- Inflation: Persistently high inflation rates continue to be a major concern, impacting consumer spending and corporate earnings.

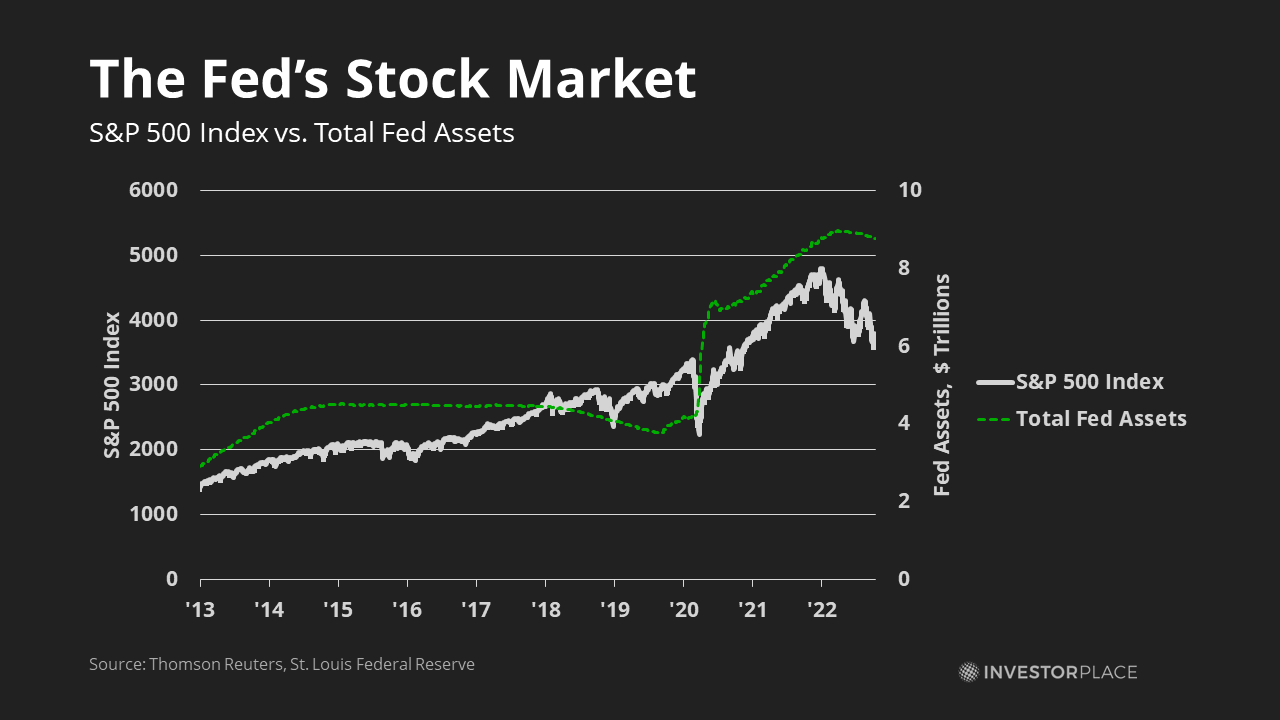

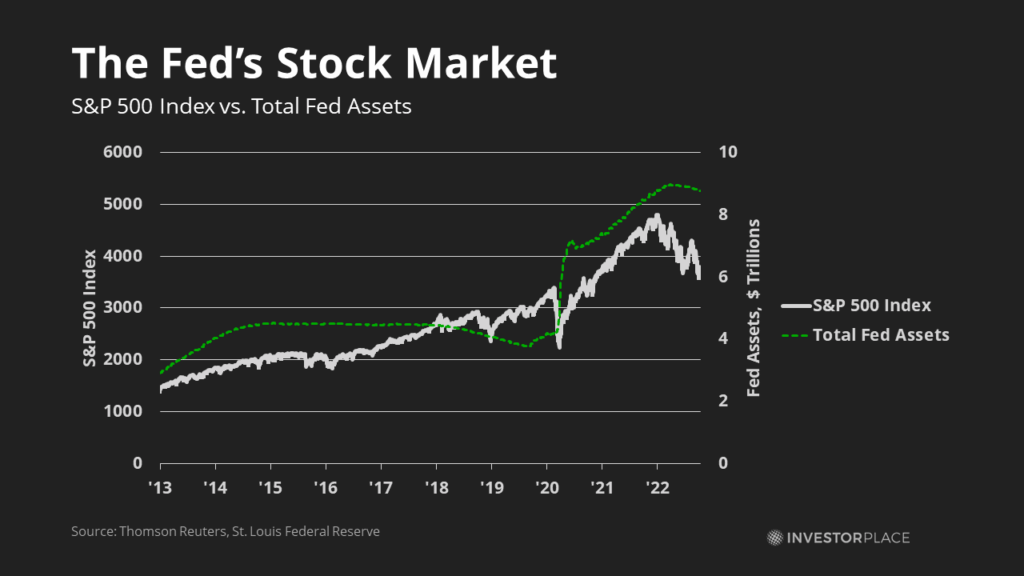

- Interest Rates: Central banks are aggressively raising interest rates to combat inflation, which can slow economic growth and negatively affect stock valuations.

- Geopolitical Risks: Ongoing geopolitical tensions, such as the war in Ukraine and rising tensions in other regions, create uncertainty and volatility in the market.

- Supply Chain Disruptions: Lingering supply chain issues continue to impact production and distribution, contributing to inflationary pressures.

- Economic Growth: Concerns about a potential recession are growing as economic growth slows in many major economies.

Expert Opinions on Stock Market Predictions

Financial experts and institutions offer varying perspectives on the future of the stock market. It’s crucial to consider these diverse opinions when formulating your own investment strategy. Here’s a summary of some common viewpoints:

Bearish Outlook

Some analysts predict a continued downturn in the stock market, citing concerns about a potential recession and the impact of rising interest rates. They believe that corporate earnings will decline as economic growth slows, leading to further stock price declines. They suggest investors should adopt a defensive strategy, focusing on value stocks and high-quality bonds. This bearish stock market prediction emphasizes the potential for further downside risk.

Bullish Outlook

Other experts remain optimistic, arguing that the current market correction is temporary and that the stock market will eventually rebound. They point to strong corporate balance sheets, continued consumer spending, and the potential for innovation to drive future growth. They recommend investors to buy the dip and focus on growth stocks with long-term potential. These bullish stock market predictions highlight the resilience of the economy and the potential for future gains.

Neutral Outlook

A more neutral perspective suggests that the stock market will likely experience continued volatility in the near term, with no clear direction. These analysts believe that the market will remain range-bound as investors grapple with conflicting economic signals. They advise investors to remain patient and focus on diversification and risk management. This neutral stock market prediction acknowledges the uncertainty and suggests a balanced approach.

Key Economic Indicators to Watch

Monitoring key economic indicators can provide valuable insights into the future direction of the stock market. Here are some of the most important indicators to watch:

- Gross Domestic Product (GDP): GDP growth is a key indicator of overall economic health. A slowdown in GDP growth can signal a potential recession and negatively impact the stock market.

- Inflation Rate: The inflation rate measures the pace of price increases. High inflation can erode consumer spending and corporate earnings, leading to stock market declines.

- Unemployment Rate: The unemployment rate reflects the health of the labor market. A rising unemployment rate can signal a weakening economy and negatively impact the stock market.

- Interest Rates: Interest rates set by central banks influence borrowing costs for businesses and consumers. Rising interest rates can slow economic growth and negatively affect stock valuations.

- Consumer Confidence: Consumer confidence reflects consumers’ attitudes towards the economy. Low consumer confidence can lead to reduced spending and negatively impact the stock market.

Factors Influencing Stock Market Predictions

Several factors contribute to the difficulty in accurately predicting the stock market. These include:

- Unforeseen Events: Unexpected events, such as geopolitical crises or natural disasters, can significantly impact the stock market.

- Investor Sentiment: Investor sentiment can be highly volatile and can drive market movements in the short term.

- Algorithmic Trading: Algorithmic trading, which uses computer programs to execute trades, can amplify market volatility.

- Global Interconnectedness: The increasing interconnectedness of global markets means that events in one country can quickly impact markets around the world.

Strategies for Navigating Market Uncertainty

Given the uncertainty surrounding the future of the stock market, it’s essential to adopt strategies to mitigate risk and protect your portfolio. Here are some key strategies:

Diversification

Diversifying your portfolio across different asset classes, industries, and geographic regions can help reduce risk. This strategy ensures that your portfolio is not overly exposed to any single investment.

Long-Term Investing

Focusing on long-term investing rather than short-term speculation can help you weather market volatility. A long-term perspective allows you to ride out market downturns and benefit from long-term growth.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help you buy more shares when prices are low and fewer shares when prices are high, potentially leading to better returns over time.

Risk Management

Understanding your risk tolerance and setting appropriate risk management strategies is crucial. This includes setting stop-loss orders and rebalancing your portfolio regularly to maintain your desired asset allocation. [See also: Understanding Risk Tolerance in Investing]

Staying Informed

Staying informed about market trends, economic indicators, and expert opinions is essential for making informed investment decisions. Regularly reviewing financial news and consulting with a financial advisor can help you stay ahead of the curve. Understanding what are the predictions for the stock market requires continuous learning.

The Impact of Technology on Stock Market Predictions

Technology plays an increasingly important role in stock market predictions. Advanced algorithms and machine learning models are being used to analyze vast amounts of data and identify patterns that humans may miss. However, it’s important to remember that even the most sophisticated algorithms are not foolproof and can be influenced by biases in the data. [See also: The Role of Artificial Intelligence in Finance]

The rise of Fintech companies has also democratized access to investment tools and information, empowering individual investors to make their own decisions. However, this also increases the risk of misinformation and the potential for irrational exuberance or panic in the market.

The Role of Government Policy

Government policies, such as fiscal stimulus and regulatory changes, can have a significant impact on the stock market. Changes in tax laws, trade policies, and environmental regulations can all affect corporate earnings and investor sentiment. Understanding the potential impact of government policies is crucial for making informed investment decisions. This is a critical aspect when considering what are the predictions for the stock market.

Conclusion: Navigating the Future of the Stock Market

What are the predictions for the stock market? While no one can predict the future with certainty, understanding current market conditions, expert opinions, and key economic indicators can help you make informed investment decisions. Remember to diversify your portfolio, focus on long-term investing, and manage your risk appropriately. By staying informed and adopting a disciplined approach, you can navigate the uncertainties of the stock market and achieve your financial goals. The stock market remains a dynamic and ever-changing landscape, requiring constant adaptation and learning. Staying abreast of the latest developments and seeking professional advice when needed are essential for long-term success. Therefore, continuous assessment of what are the predictions for the stock market is vital for any investor.

Ultimately, the key to successful investing is to remain patient, disciplined, and adaptable. By focusing on your long-term goals and staying true to your investment strategy, you can weather market volatility and achieve your financial objectives. The ability to analyze stock market predictions critically is a valuable skill in today’s complex financial world.