Micro Lot Trading: A Comprehensive Guide for Beginners

In the dynamic world of forex trading, understanding the nuances of lot sizes is crucial for success, especially for newcomers. A micro lot represents the smallest standardized unit available for trading, offering a low-risk entry point into the market. This article delves into the concept of micro lot trading, its benefits, strategies, and how it fits into a comprehensive trading plan. Whether you’re a seasoned investor looking to refine your risk management or a complete novice eager to start trading, understanding micro lots is essential.

What is a Micro Lot?

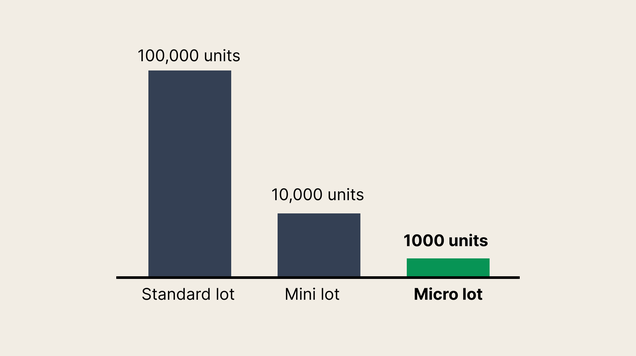

A standard lot in forex trading represents 100,000 units of the base currency. A micro lot, on the other hand, is equal to 1,000 units of the base currency. This smaller size significantly reduces the capital required to open a position, making it an attractive option for traders with limited funds or those who want to practice with real money without risking substantial amounts. For example, if you’re trading EUR/USD, a micro lot would represent €1,000. The profit or loss per pip (the smallest price increment) is also smaller, typically around $0.10 for most currency pairs when trading a micro lot.

Benefits of Trading with Micro Lots

Several advantages make micro lot trading a popular choice, particularly for beginners:

- Lower Capital Requirement: As mentioned earlier, micro lots allow you to trade with a significantly smaller account balance. This is ideal for those who want to learn the ropes without committing a large sum of money.

- Reduced Risk: The smaller position size translates to lower potential losses. This allows traders to experiment with different strategies and currency pairs without risking a substantial portion of their capital.

- Improved Risk Management: Micro lots provide greater flexibility in managing risk. Traders can fine-tune their position sizes to align with their risk tolerance and trading goals.

- Psychological Advantage: Trading with smaller amounts can reduce the emotional stress associated with trading, allowing traders to make more rational decisions. This is particularly beneficial for beginners who are still developing their trading psychology.

- Testing Strategies: Micro lots are an excellent tool for backtesting and forward testing trading strategies in a live market environment without significant financial risk.

How to Calculate Profit and Loss with Micro Lots

Understanding how to calculate profit and loss is essential for any trader. Here’s a simple example:

Let’s say you buy a micro lot of EUR/USD at 1.1000 and sell it at 1.1010. The difference is 10 pips. Since a pip is typically worth $0.10 when trading a micro lot, your profit would be $1 (10 pips x $0.10/pip). Conversely, if you sold at 1.0990, your loss would be $1.

The formula is straightforward: (Selling Price – Buying Price) x Lot Size x Pip Value. Keep in mind that broker commissions and spreads will also affect your overall profit or loss.

Strategies for Micro Lot Trading

While the principles of trading remain the same regardless of the lot size, some strategies are particularly well-suited for micro lot trading:

Scalping

Scalping involves making numerous small trades throughout the day, aiming to profit from minor price fluctuations. With micro lots, the risk per trade is minimized, making it a suitable strategy for beginners. However, scalping requires discipline and quick decision-making skills.

Trend Following

Trend following involves identifying and trading in the direction of the prevailing trend. Micro lots allow traders to build positions gradually as the trend strengthens, minimizing the risk of premature entry. This strategy requires patience and the ability to identify and confirm trends.

Breakout Trading

Breakout trading involves entering a trade when the price breaks through a significant support or resistance level. Micro lots can be used to test the validity of a breakout without risking a large sum of money. If the breakout is confirmed, traders can add to their position.

Range Trading

Range trading involves identifying a currency pair that is trading within a defined range and buying at the support level and selling at the resistance level. Micro lots allow for multiple entries and exits within the range, maximizing potential profits while minimizing risk. [See also: Support and Resistance Trading Strategies]

Risk Management with Micro Lots

Even with the reduced risk associated with micro lot trading, proper risk management is crucial. Here are some key considerations:

- Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses. Determine the maximum amount you’re willing to risk on each trade and set your stop-loss accordingly.

- Calculate Position Size: Even with micro lots, it’s important to calculate your position size based on your account balance and risk tolerance. Avoid risking more than 1-2% of your account balance on any single trade.

- Use Leverage Wisely: While leverage can amplify profits, it can also amplify losses. Be cautious when using leverage, especially when trading with micro lots. Understand the risks involved and use leverage responsibly.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your portfolio by trading different currency pairs and asset classes. This can help to reduce overall risk.

- Keep a Trading Journal: Document your trades, including entry and exit points, reasons for entering the trade, and the outcome. This will help you to identify patterns and improve your trading performance over time. [See also: The Importance of a Trading Journal]

Choosing a Broker for Micro Lot Trading

Not all brokers offer micro lot trading. When choosing a broker, consider the following factors:

- Minimum Deposit: Look for brokers with low minimum deposit requirements, as this will allow you to start trading with a smaller amount of capital.

- Leverage: Check the leverage offered by the broker and ensure it aligns with your trading strategy and risk tolerance.

- Spreads and Commissions: Compare the spreads and commissions charged by different brokers. Lower spreads and commissions will reduce your trading costs.

- Trading Platform: Choose a broker with a user-friendly and reliable trading platform. The platform should offer the tools and features you need to analyze the market and execute trades effectively.

- Regulation: Ensure the broker is regulated by a reputable regulatory body. This will provide you with some protection in case of disputes or financial difficulties.

- Customer Support: Choose a broker with responsive and helpful customer support. You should be able to contact them easily if you have any questions or issues.

Common Mistakes to Avoid When Trading Micro Lots

Even when trading with micro lots, it’s easy to fall into common traps. Here are some mistakes to avoid:

- Overtrading: The low risk of micro lots can tempt traders to overtrade, leading to increased transaction costs and impulsive decisions. Stick to your trading plan and avoid trading just for the sake of trading.

- Ignoring Risk Management: Don’t become complacent just because you’re trading with smaller amounts. Always use stop-loss orders and manage your risk effectively.

- Chasing Losses: Don’t try to recover losses by increasing your position size or taking on more risk. This can lead to even bigger losses.

- Lack of Education: Don’t trade without understanding the fundamentals of forex trading and the specific currency pairs you’re trading. Educate yourself about market analysis, trading strategies, and risk management.

- Emotional Trading: Avoid making trading decisions based on emotions such as fear, greed, or anger. Stick to your trading plan and make rational decisions based on market analysis.

The Future of Micro Lot Trading

Micro lot trading is likely to remain a popular option for beginners and risk-averse traders. As more brokers offer micro lot trading and as trading platforms become more accessible, the popularity of micro lots is expected to grow. The ability to trade with smaller amounts of capital makes forex trading more accessible to a wider range of individuals, fostering financial inclusion and promoting financial literacy. [See also: The Evolution of Forex Trading Platforms]

Conclusion

Micro lot trading offers a valuable entry point into the world of forex trading, particularly for beginners. By understanding the benefits, strategies, and risk management principles associated with micro lots, traders can gain valuable experience and develop their skills without risking substantial capital. Remember to choose a reputable broker, develop a sound trading plan, and always manage your risk effectively. Happy trading!