Maximize Your Forex Profits: The Power of a Forex Profit Calculator with Leverage

In the fast-paced world of forex trading, precision and informed decision-making are paramount. A key tool for any trader, regardless of experience level, is a forex profit calculator with leverage. This indispensable instrument allows traders to estimate potential profits and losses, factoring in the complexities introduced by leverage. Understanding how to effectively use a forex profit calculator with leverage is crucial for risk management and strategic trading. This article delves into the intricacies of these calculators, explaining their functions, benefits, and how they can enhance your trading strategy.

Understanding Forex Trading and Leverage

Before diving into the specifics of a forex profit calculator with leverage, it’s essential to grasp the fundamentals of forex trading and the role leverage plays. Forex trading involves buying and selling currencies with the goal of profiting from fluctuations in their exchange rates. Leverage, offered by brokers, amplifies both potential profits and potential losses by allowing traders to control larger positions with a smaller amount of capital. While leverage can significantly increase returns, it also magnifies risk, making it vital to understand its implications.

For example, a leverage of 1:100 means that for every $1 of capital you have, you can control $100 worth of currency. This allows you to participate in larger trades and potentially earn greater profits. However, it also means that even small adverse movements in the market can lead to substantial losses.

What is a Forex Profit Calculator with Leverage?

A forex profit calculator with leverage is a tool designed to estimate the potential profit or loss of a forex trade, taking into account the leverage used. It requires several inputs, including:

- Currency Pair: The specific currencies being traded (e.g., EUR/USD, GBP/JPY).

- Trade Size (Lot Size): The volume of currency being traded, typically measured in lots (standard, mini, or micro).

- Entry Price: The price at which the trade was initiated.

- Exit Price: The anticipated or actual price at which the trade will be closed.

- Leverage: The leverage ratio applied to the trade (e.g., 1:50, 1:100, 1:200).

- Account Currency: The currency in which your trading account is denominated.

By inputting these values, the calculator determines the profit or loss in your account currency, providing a clear picture of the potential outcome of the trade. It also helps you understand the impact of leverage on your potential gains and losses.

Benefits of Using a Forex Profit Calculator with Leverage

Risk Management

One of the primary benefits of using a forex profit calculator with leverage is improved risk management. By estimating potential losses before entering a trade, traders can make informed decisions about position sizing and stop-loss levels. This helps prevent excessive losses and protects trading capital. Understanding the potential downside allows you to trade more responsibly and avoid emotionally driven decisions.

Strategic Planning

A forex profit calculator with leverage is an invaluable tool for strategic planning. It allows traders to simulate different scenarios and assess the potential outcomes of various trading strategies. By experimenting with different entry and exit prices, leverage ratios, and trade sizes, traders can optimize their strategies and improve their chances of success. This proactive approach helps in developing well-thought-out trading plans.

Understanding Leverage Impact

Leverage can be a double-edged sword. A forex profit calculator with leverage helps traders understand the true impact of leverage on their trades. It demonstrates how leverage can amplify both profits and losses, enabling traders to make more informed decisions about the appropriate level of leverage to use. This understanding is crucial for managing risk effectively and avoiding over-leveraging positions.

Quick and Accurate Calculations

Manually calculating potential profits and losses, especially when leverage is involved, can be time-consuming and prone to errors. A forex profit calculator with leverage automates this process, providing quick and accurate calculations. This saves time and reduces the risk of errors, allowing traders to focus on other aspects of their trading strategy. The speed and accuracy of these calculators are particularly useful in fast-moving markets.

Educational Tool

For novice traders, a forex profit calculator with leverage serves as an excellent educational tool. It helps them understand the mechanics of forex trading, the impact of leverage, and the importance of risk management. By using the calculator to simulate trades and analyze the results, beginners can gain valuable insights and build a solid foundation for their trading careers. It allows them to learn through experimentation without risking real capital.

How to Use a Forex Profit Calculator with Leverage

Using a forex profit calculator with leverage is typically straightforward. Most online calculators follow a similar format:

- Select the Currency Pair: Choose the currency pair you intend to trade from the available options.

- Enter the Trade Size: Specify the volume of currency you plan to trade, usually in lots (standard, mini, or micro).

- Input the Entry Price: Enter the price at which you plan to enter the trade.

- Enter the Exit Price: Input the anticipated or actual price at which you will exit the trade.

- Specify the Leverage: Choose the leverage ratio you will be using for the trade.

- Select Account Currency: Choose the currency your trading account is denominated in.

- Calculate: Click the calculate button to generate the potential profit or loss.

The calculator will then display the estimated profit or loss in your account currency, providing a clear indication of the potential outcome of the trade. Remember to always double-check your inputs to ensure accuracy.

Choosing the Right Forex Profit Calculator with Leverage

With numerous forex profit calculator with leverage tools available online, it’s important to choose one that meets your needs. Consider the following factors:

- Accuracy: Ensure the calculator provides accurate calculations and uses up-to-date exchange rates.

- User-Friendliness: Opt for a calculator with a clear and intuitive interface that is easy to use.

- Customization: Look for a calculator that allows you to customize inputs, such as leverage ratios and currency pairs.

- Mobile Compatibility: If you trade on the go, choose a calculator that is mobile-friendly.

- Reputation: Select a calculator from a reputable source to ensure reliability and accuracy.

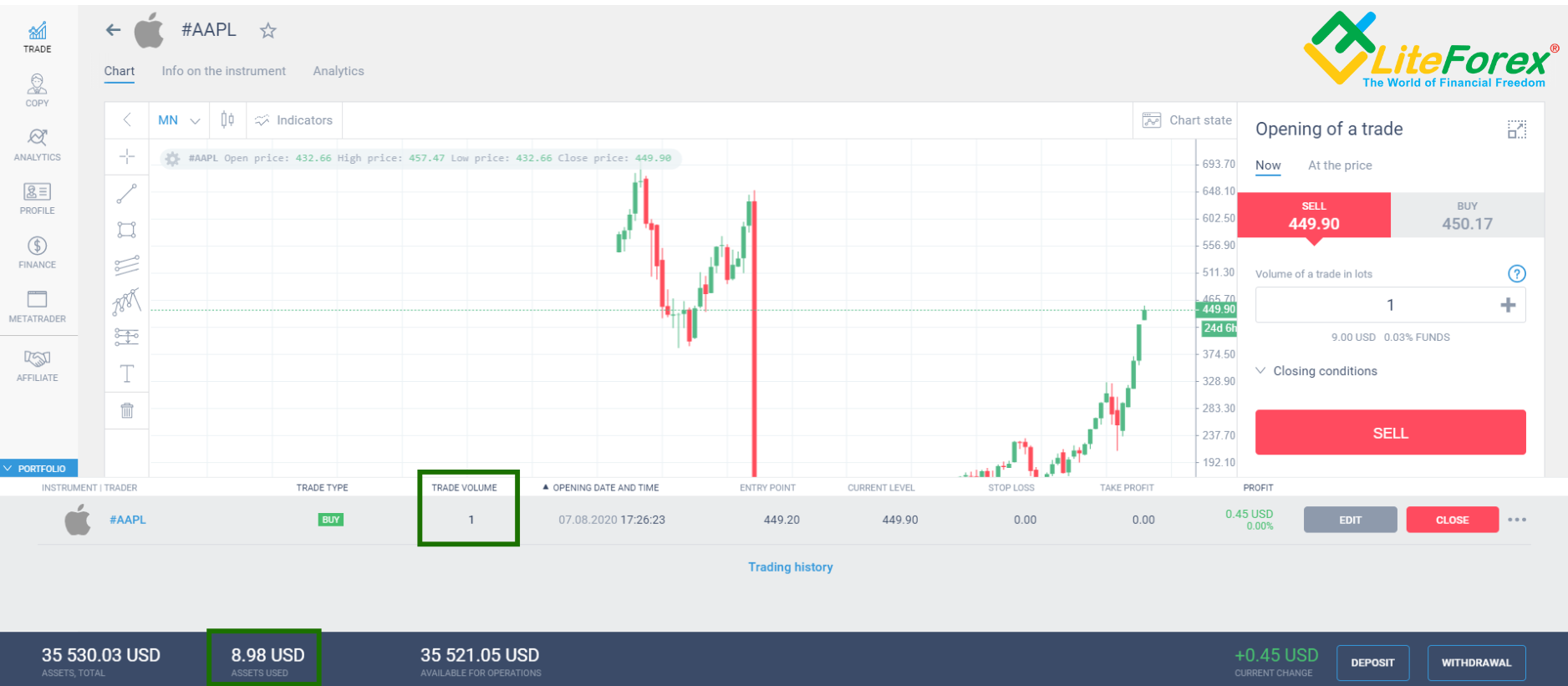

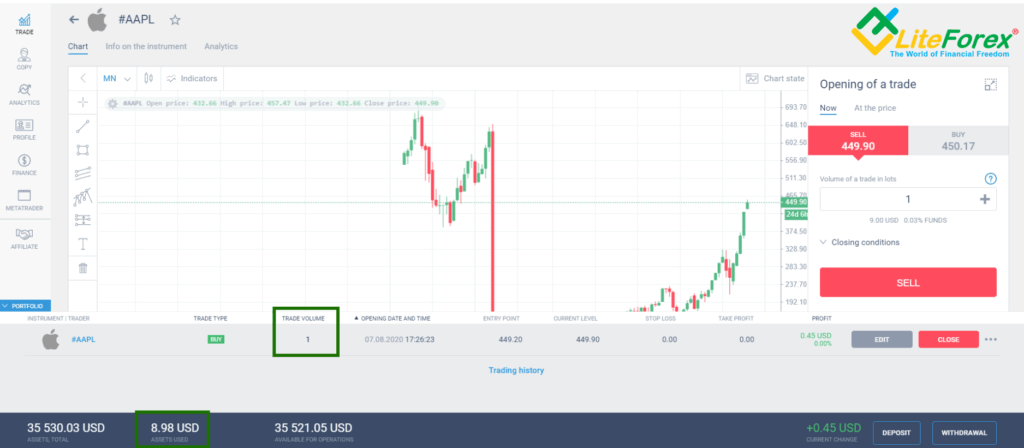

Real-World Examples

Let’s illustrate how a forex profit calculator with leverage works with a couple of examples:

Example 1: EUR/USD Trade

- Currency Pair: EUR/USD

- Trade Size: 1 standard lot (100,000 units)

- Entry Price: 1.1000

- Exit Price: 1.1050

- Leverage: 1:100

- Account Currency: USD

Using the forex profit calculator with leverage, the potential profit would be approximately $500. This is calculated as follows: (1.1050 – 1.1000) * 100,000 = $500. The leverage of 1:100 amplifies the profit based on the initial margin requirement.

Example 2: GBP/JPY Trade

- Currency Pair: GBP/JPY

- Trade Size: 0.5 standard lot (50,000 units)

- Entry Price: 150.00

- Exit Price: 149.50

- Leverage: 1:50

- Account Currency: USD

In this scenario, the potential loss would be approximately $250. This is calculated as follows: (149.50 – 150.00) * 50,000 = -$250. The leverage of 1:50 magnifies the loss based on the initial margin requirement.

Integrating a Forex Profit Calculator with Leverage into Your Trading Strategy

A forex profit calculator with leverage should be an integral part of your trading strategy. Here are some ways to incorporate it effectively:

- Pre-Trade Analysis: Always use the calculator before entering a trade to assess potential profits and losses.

- Scenario Planning: Simulate different scenarios by varying entry and exit prices to understand the potential outcomes.

- Risk Assessment: Determine the appropriate position size and stop-loss levels based on the calculator’s results.

- Leverage Management: Use the calculator to understand the impact of different leverage ratios on your trades.

- Continuous Monitoring: Regularly monitor your trades and use the calculator to reassess potential outcomes as market conditions change.

Common Mistakes to Avoid

While a forex profit calculator with leverage is a valuable tool, it’s essential to avoid common mistakes that can lead to inaccurate calculations and poor trading decisions:

- Incorrect Inputs: Double-check all inputs, such as currency pair, trade size, entry price, and exit price, to ensure accuracy.

- Ignoring Trading Costs: Remember to factor in trading costs, such as spreads and commissions, when calculating potential profits and losses.

- Over-Reliance: Don’t rely solely on the calculator; consider other factors, such as market analysis and economic indicators.

- Neglecting Risk Management: Use the calculator as part of a comprehensive risk management strategy, not as a substitute for it.

- Emotional Trading: Avoid making trading decisions based on emotions; stick to your pre-defined trading plan and use the calculator to assess potential outcomes objectively.

The Future of Forex Trading Tools

As technology advances, forex profit calculator with leverage tools are becoming more sophisticated. Future calculators may incorporate features such as:

- Real-Time Data: Integration with real-time market data for more accurate calculations.

- Automated Analysis: Automated analysis of potential trades based on market conditions and trading strategies.

- AI-Powered Predictions: AI-powered predictions of potential profits and losses based on historical data.

- Personalized Recommendations: Personalized recommendations for leverage ratios and position sizes based on individual risk tolerance.

- Integration with Trading Platforms: Seamless integration with trading platforms for automated trade execution.

[See also: Forex Trading Strategies for Beginners] and [See also: Understanding Forex Leverage and Margin]

Conclusion

A forex profit calculator with leverage is an essential tool for any forex trader looking to manage risk effectively and make informed trading decisions. By understanding how to use these calculators and integrating them into your trading strategy, you can improve your chances of success in the dynamic world of forex trading. Remember to always double-check your inputs, consider trading costs, and use the calculator as part of a comprehensive risk management strategy. With the right tools and knowledge, you can navigate the complexities of forex trading and maximize your potential profits.