Unlock Your Trading Potential: Mastering Leverage with a Forex Calculator

In the fast-paced world of forex trading, understanding and effectively utilizing leverage is crucial for both seasoned traders and newcomers alike. A forex calculator equipped with leverage calculation capabilities is an indispensable tool in this endeavor. This article delves into the intricacies of leverage, explains how a forex calculator can help manage risk, and provides insights into maximizing your trading potential while mitigating potential pitfalls.

What is Leverage in Forex Trading?

Leverage is essentially borrowed capital that allows traders to control a larger position than their initial investment would typically allow. It’s expressed as a ratio, such as 50:1, 100:1, or even 500:1. For example, with a 100:1 leverage, a trader can control $100,000 worth of currency with just $1,000 of their own capital. While this amplifies potential profits, it also magnifies potential losses, making risk management paramount.

The allure of leverage lies in its ability to generate substantial returns from relatively small price movements. However, it’s a double-edged sword. Without proper understanding and risk management strategies, it can quickly lead to significant losses.

The Role of a Forex Calculator in Managing Leverage

A forex calculator is a versatile tool that assists traders in various aspects of their trading activities. When it comes to leverage, a forex calculator helps traders:

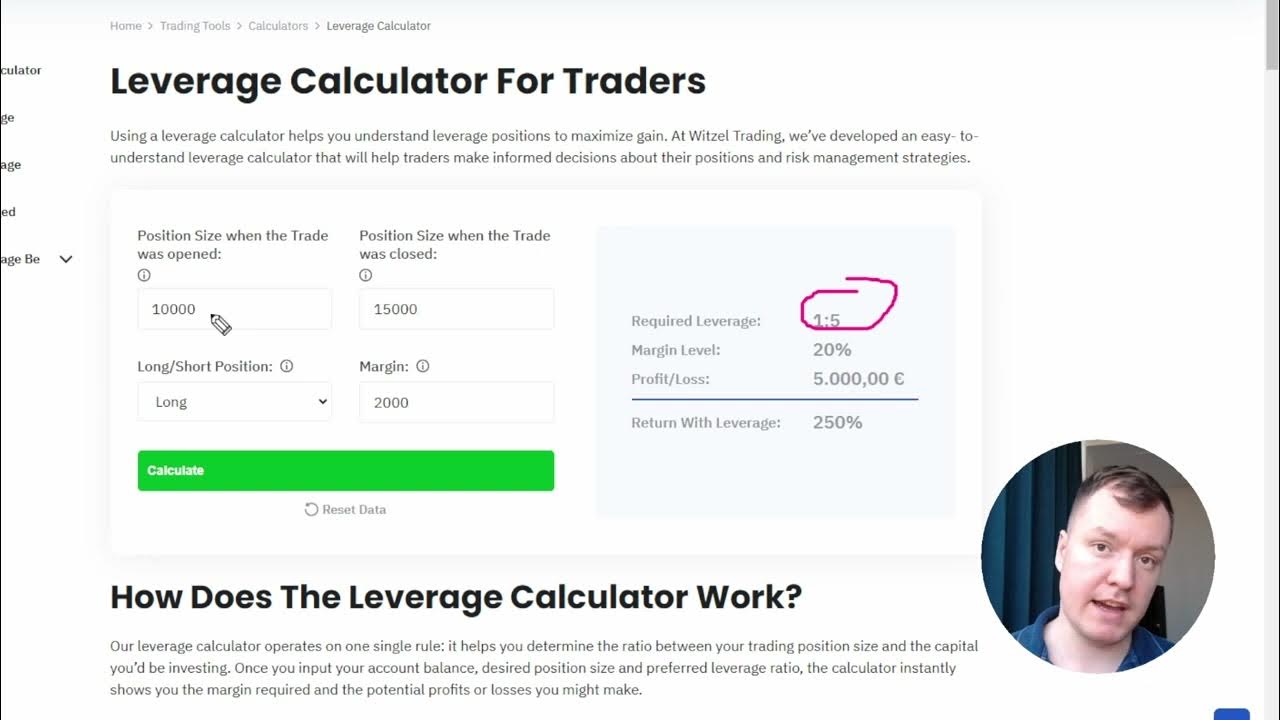

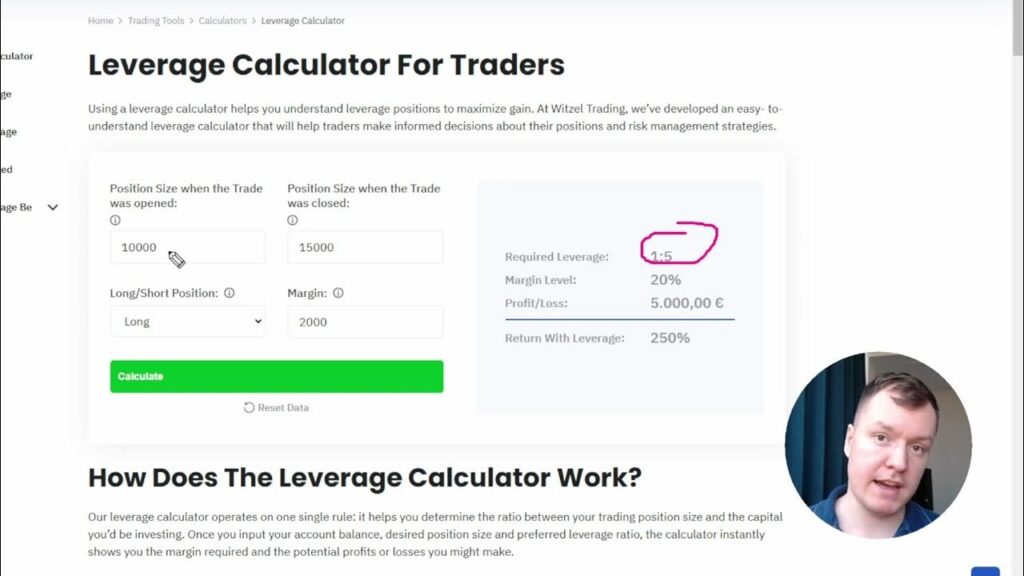

- Calculate Margin Requirements: Margin is the amount of capital required to open and maintain a leveraged position. A forex calculator accurately determines the margin needed based on the leverage ratio and the size of the trade.

- Assess Potential Profit and Loss: By inputting trade parameters such as entry price, exit price, and leverage, a forex calculator estimates the potential profit or loss of a trade. This allows traders to evaluate the risk-reward ratio before entering a position.

- Determine Position Size: A forex calculator can help traders determine the appropriate position size based on their risk tolerance and account balance. This is crucial for preventing over-leveraging and protecting capital.

- Understand the Impact of Leverage: By experimenting with different leverage ratios in a forex calculator, traders can gain a better understanding of how leverage affects their potential profits and losses.

Benefits of Using a Forex Calculator with Leverage Functionality

Employing a forex calculator with leverage functionality offers several key benefits:

- Enhanced Risk Management: Accurately calculating margin requirements and potential profit/loss enables traders to make informed decisions and manage risk effectively.

- Improved Trading Strategies: By understanding the impact of leverage, traders can refine their trading strategies and optimize their risk-reward profiles.

- Increased Efficiency: A forex calculator automates complex calculations, saving traders time and reducing the risk of errors.

- Better Decision-Making: With clear insights into the potential outcomes of a trade, traders can make more rational and informed decisions.

How to Use a Forex Calculator for Leverage Effectively

To maximize the benefits of a forex calculator for leverage, follow these steps:

- Select a Reputable Forex Calculator: Choose a forex calculator from a reputable source that provides accurate and reliable calculations. Many online brokers offer free forex calculators on their websites.

- Input Accurate Data: Ensure that you enter accurate data, including the currency pair, trade size, entry price, exit price, and leverage ratio.

- Analyze the Results: Carefully analyze the results provided by the forex calculator, paying close attention to the margin requirements, potential profit/loss, and risk-reward ratio.

- Adjust Your Strategy: Based on the results, adjust your trading strategy as needed. This may involve reducing your position size, adjusting your stop-loss orders, or choosing a lower leverage ratio.

- Practice with a Demo Account: Before trading with real money, practice using the forex calculator with a demo account to familiarize yourself with its features and functionality.

Understanding Margin Call and Stop-Out Levels

When trading with leverage, it’s crucial to understand the concepts of margin call and stop-out levels. A margin call occurs when your account equity falls below a certain percentage of the required margin. The broker will then issue a warning, requesting you to deposit more funds to maintain your open positions. If you fail to do so, the broker may trigger a stop-out, which automatically closes your positions to prevent further losses.

A forex calculator can help you estimate the margin call and stop-out levels for your trades, allowing you to proactively manage your risk and avoid these situations. By understanding these levels, you can set appropriate stop-loss orders and ensure that your account is adequately funded to withstand potential market fluctuations.

Choosing the Right Leverage Ratio

Selecting the appropriate leverage ratio is a critical decision that depends on your risk tolerance, trading experience, and trading strategy. Higher leverage ratios offer the potential for greater profits but also carry a higher risk of losses. Lower leverage ratios reduce the potential for profit but also limit the risk of losses.

Beginner traders should typically start with lower leverage ratios, such as 10:1 or 20:1, to gain experience and develop their trading skills. As they become more experienced and confident, they may gradually increase their leverage ratio. However, it’s essential to always trade within your risk tolerance and never risk more capital than you can afford to lose.

Common Mistakes to Avoid When Using Leverage

While leverage can be a powerful tool, it’s important to avoid common mistakes that can lead to significant losses:

- Over-Leveraging: Using excessive leverage can quickly deplete your account if the market moves against you. Always trade within your risk tolerance and avoid risking too much capital on a single trade.

- Ignoring Risk Management: Failing to implement proper risk management strategies, such as stop-loss orders and position sizing, can expose you to significant losses.

- Trading Emotionally: Letting emotions influence your trading decisions can lead to impulsive and irrational actions, especially when trading with leverage.

- Lack of Knowledge: Trading with leverage without a thorough understanding of the forex market and the risks involved is a recipe for disaster.

Advanced Strategies for Leveraging a Forex Calculator

Beyond basic calculations, a forex calculator can be integrated into more advanced trading strategies. For instance, traders can use it to backtest different leverage scenarios on historical data to assess the potential profitability and risk of their strategies. Furthermore, some forex calculators offer features like correlation analysis, which can help traders diversify their portfolios and reduce their overall risk exposure. [See also: Forex Risk Management Strategies]

The Future of Forex Trading and Leverage

The forex market is constantly evolving, with new technologies and trading strategies emerging regularly. As algorithmic trading and artificial intelligence become more prevalent, forex calculators are likely to become even more sophisticated, offering traders more advanced tools for managing leverage and optimizing their trading performance. The key to success in this dynamic environment lies in continuous learning and adaptation.

Conclusion: Leverage Your Knowledge, Leverage Responsibly

Leverage, when used responsibly and in conjunction with a reliable forex calculator, can be a powerful tool for amplifying trading profits. However, it’s crucial to understand the risks involved and implement effective risk management strategies. By mastering the art of leverage and utilizing a forex calculator effectively, traders can unlock their full trading potential and achieve their financial goals. Remember to always prioritize risk management and trade within your comfort zone. A forex calculator is your ally in navigating the complexities of leverage, helping you make informed decisions and protect your capital.