What’s Cross Trading: Understanding the Risks and Rewards

In the dynamic world of finance and digital assets, understanding various trading strategies is crucial for making informed decisions. One such strategy, often shrouded in complexity and controversy, is cross trading. This article delves into the nuances of cross trading, exploring its definition, mechanisms, potential benefits, inherent risks, and ethical considerations. Whether you are a seasoned investor or a curious newcomer, grasping the intricacies of cross trading is essential for navigating the modern financial landscape.

Defining Cross Trading

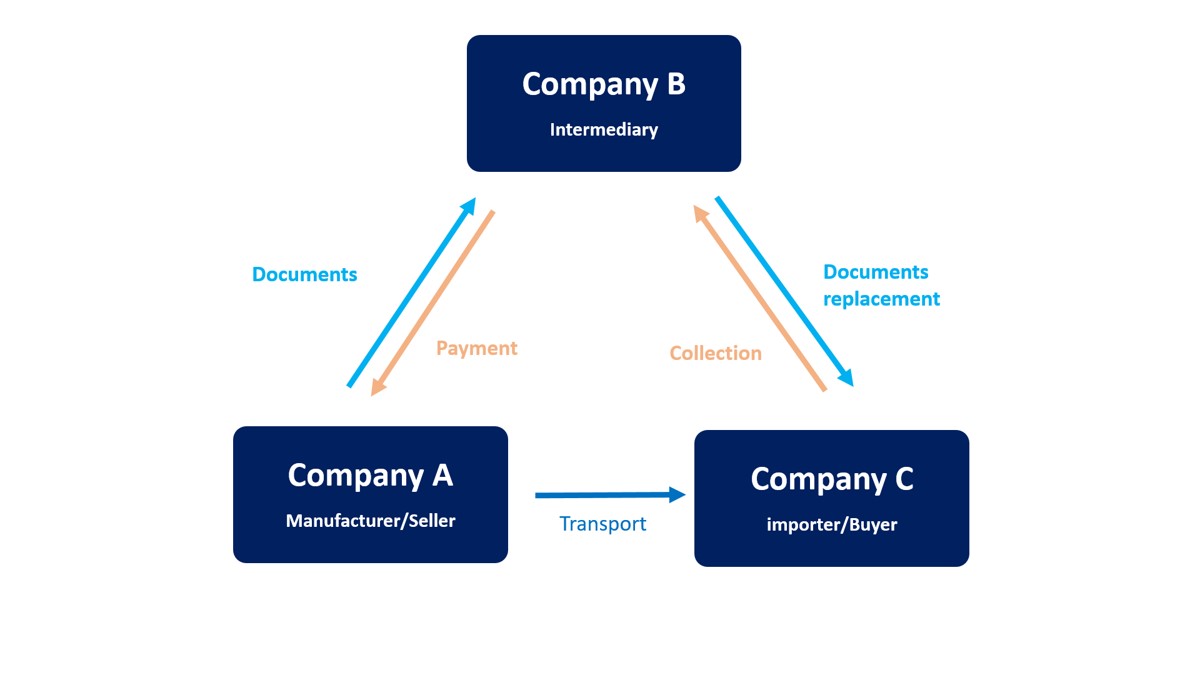

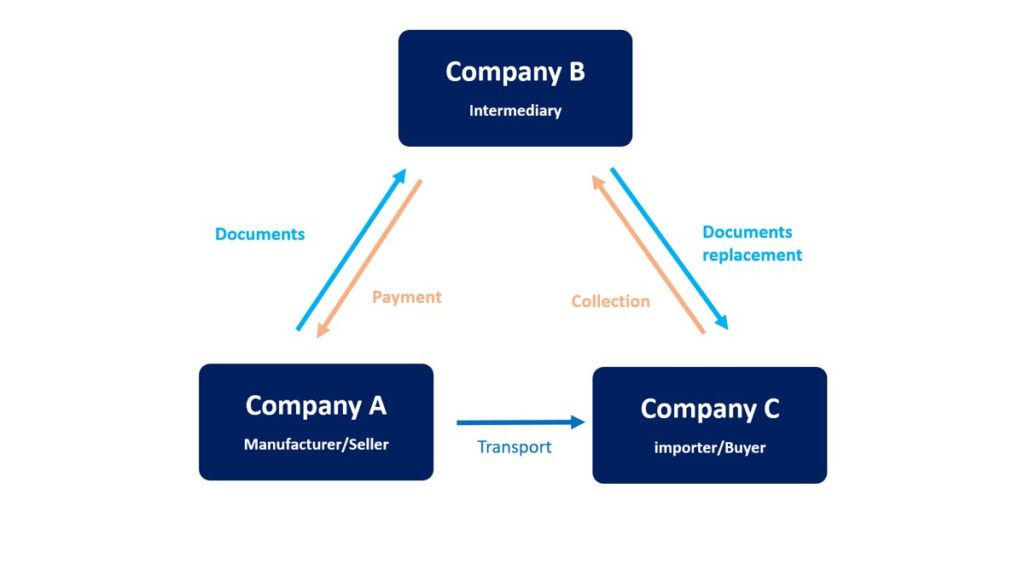

Cross trading, in its simplest form, refers to the practice of buying and selling the same security or asset between different accounts controlled by the same individual or entity. This can occur within a single brokerage firm or across multiple platforms. The key characteristic is the involvement of the same beneficial owner on both sides of the transaction. The motivations behind cross trading can vary, ranging from legitimate portfolio rebalancing to potentially manipulative practices.

To further clarify, consider a scenario where an investment firm manages two separate funds. If the firm decides to sell shares of Company A from Fund X and simultaneously purchase those same shares for Fund Y, this constitutes cross trading. The firm acts as both the seller and the buyer, making it a transaction that requires careful scrutiny.

Mechanisms of Cross Trading

The mechanics of cross trading can differ depending on the platform and the specific regulatory environment. Generally, the process involves the following steps:

- Identification of Opportunity: The trader or investment manager identifies an opportunity to transfer assets between accounts. This might be driven by a need to rebalance portfolios, allocate assets based on different investment mandates, or manage tax implications.

- Execution of Trade: The trader initiates buy and sell orders for the same asset across the relevant accounts. This can be done manually or through automated trading systems.

- Price Determination: Determining the price at which the cross trade occurs is a critical aspect. Ideally, the price should reflect the prevailing market price to ensure fairness and avoid any undue advantage to either account.

- Reporting and Compliance: Proper documentation and reporting of the cross trade are essential to comply with regulatory requirements and maintain transparency.

Potential Benefits of Cross Trading

While cross trading can be viewed with suspicion, it can offer legitimate benefits when conducted ethically and transparently:

- Portfolio Rebalancing: Cross trading allows investment managers to efficiently rebalance portfolios to maintain desired asset allocations. This can be particularly useful when managing multiple funds with different investment strategies.

- Tax Optimization: In some jurisdictions, cross trading can be used to optimize tax liabilities by transferring assets with unrealized gains or losses between accounts.

- Efficient Asset Allocation: Cross trading can facilitate the efficient allocation of assets based on the specific needs and objectives of different accounts. For example, an asset might be more suitable for a tax-advantaged account than a taxable account.

- Reduced Transaction Costs: By executing trades internally, cross trading can potentially reduce transaction costs compared to executing trades on the open market.

Inherent Risks and Ethical Considerations

Despite the potential benefits, cross trading carries significant risks and raises ethical concerns:

- Conflict of Interest: The primary concern is the potential for conflict of interest. When the same entity controls both sides of the transaction, there is a risk that one account could be favored at the expense of the other.

- Price Manipulation: Cross trading can be used to manipulate asset prices, creating an artificial impression of demand or supply. This can mislead other investors and distort market dynamics.

- Lack of Transparency: If not properly disclosed and documented, cross trading can lack transparency, making it difficult for regulators and investors to assess the fairness of the transactions.

- Regulatory Scrutiny: Due to the potential for abuse, cross trading is subject to intense regulatory scrutiny. Violations of regulations can result in severe penalties, including fines and sanctions.

Regulatory Landscape

The regulatory landscape surrounding cross trading varies across different jurisdictions. Generally, regulators require firms to implement strict policies and procedures to prevent abuse and ensure fair treatment of all accounts. Key regulatory requirements often include:

- Disclosure: Firms must disclose their cross trading policies to clients and provide detailed information about specific transactions.

- Fair Pricing: Transactions must be executed at prices that are consistent with prevailing market prices.

- Best Execution: Firms must demonstrate that they have obtained the best possible execution for both the buying and selling accounts.

- Compliance Monitoring: Firms must implement robust compliance monitoring systems to detect and prevent any potential abuses.

Examples of Cross Trading Scenarios

To illustrate the concept of cross trading further, let’s consider a few examples:

- Mutual Fund Management: A mutual fund company manages two funds: a growth fund and an income fund. The company decides to sell shares of a high-growth stock from the income fund (where it is no longer suitable) and purchase those shares for the growth fund. This is an example of cross trading used for portfolio rebalancing.

- Hedge Fund Operations: A hedge fund manager uses cross trading to transfer assets between different trading strategies. For example, the manager might sell a position from a long-only strategy and buy it for a market-neutral strategy.

- Individual Investor: An individual investor manages two brokerage accounts: a taxable account and a retirement account. The investor decides to transfer shares of a stock with significant capital gains from the taxable account to the retirement account to defer taxes.

Best Practices for Cross Trading

If cross trading is deemed necessary, adhering to best practices is crucial to mitigate risks and maintain ethical standards. These practices include:

- Transparency: Fully disclose all cross trading activities to clients and regulators.

- Fair Pricing: Execute trades at prices that are consistent with prevailing market prices, using independent sources to validate pricing.

- Documentation: Maintain thorough records of all cross trading transactions, including the rationale for the trades and the pricing methodology used.

- Compliance Oversight: Implement robust compliance monitoring systems to detect and prevent any potential abuses.

- Independent Review: Consider having an independent third party review cross trading activities to ensure fairness and compliance.

The Future of Cross Trading

As financial markets continue to evolve and become more complex, the role of cross trading is likely to remain a subject of debate and scrutiny. Technological advancements, such as algorithmic trading and blockchain technology, could potentially enhance the efficiency and transparency of cross trading. However, they also introduce new challenges for regulators and compliance professionals.

The key to the future of cross trading lies in striking a balance between allowing legitimate portfolio management activities and preventing abusive practices. This requires a combination of robust regulatory frameworks, effective compliance monitoring, and a strong ethical culture within financial institutions.

Conclusion

Cross trading is a complex and multifaceted strategy that requires careful consideration. While it can offer legitimate benefits in terms of portfolio rebalancing, tax optimization, and efficient asset allocation, it also carries significant risks and raises ethical concerns. Understanding the nuances of cross trading, adhering to best practices, and maintaining a strong ethical compass are essential for navigating this challenging area of finance. The focus must always remain on ensuring fairness, transparency, and the best interests of all investors.

Ultimately, whether cross trading is a beneficial tool or a potential pitfall depends on how it is implemented and managed. By prioritizing ethical conduct and adhering to regulatory requirements, financial professionals can harness the potential benefits of cross trading while minimizing the risks.

[See also: Algorithmic Trading Strategies]

[See also: Risk Management in Finance]

[See also: Regulatory Compliance for Investment Firms]