Decoding the Evening Star Forex Pattern: A Comprehensive Guide

The evening star forex pattern is a crucial reversal signal in the world of forex trading. Identifying this pattern can provide traders with valuable insights into potential trend reversals, allowing them to make informed decisions and optimize their trading strategies. This comprehensive guide will delve into the intricacies of the evening star pattern, exploring its formation, interpretation, and practical application in the forex market.

Understanding Forex Candlestick Patterns

Before diving into the specifics of the evening star forex pattern, it’s essential to understand the basics of candlestick patterns. Candlesticks are graphical representations of price movements over a specific period, typically a day. Each candlestick consists of a body, which represents the opening and closing prices, and wicks (or shadows), which represent the high and low prices.

Different candlestick patterns can provide clues about market sentiment and potential future price movements. Bullish patterns suggest upward price movement, while bearish patterns suggest downward movement. The evening star forex pattern falls into the latter category.

What is the Evening Star Forex Pattern?

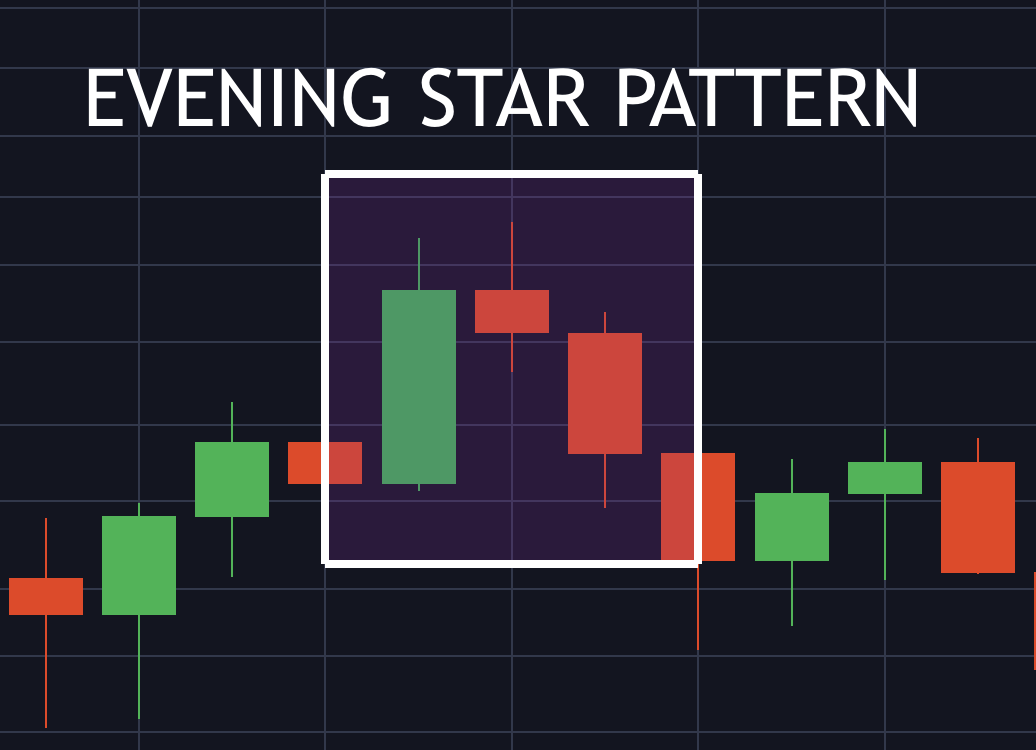

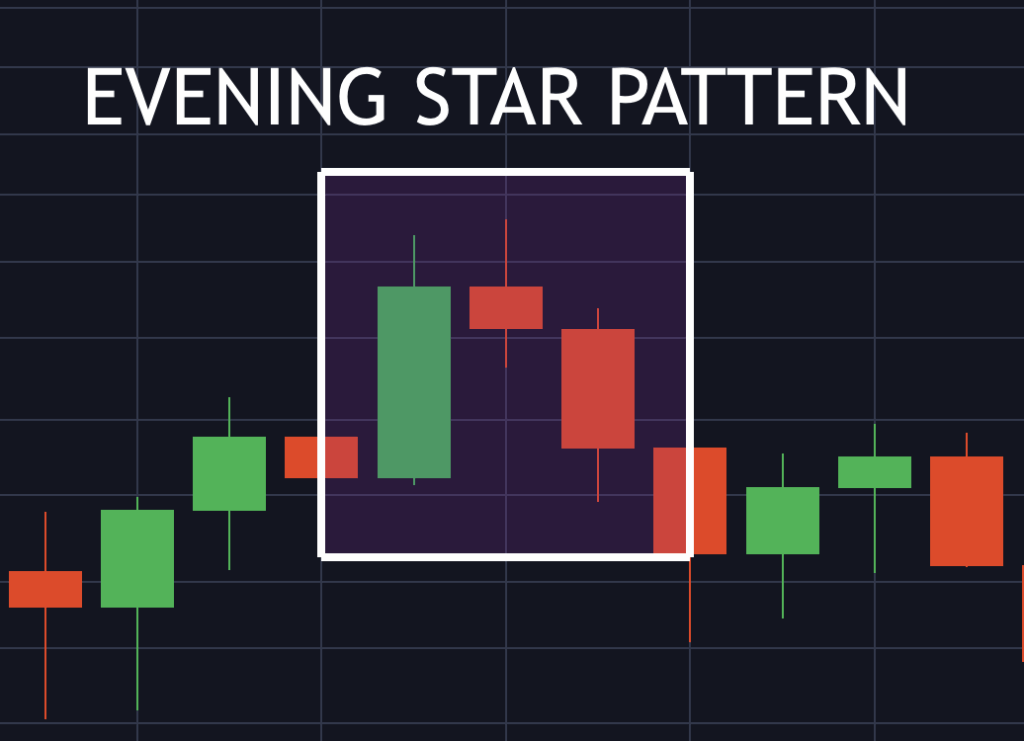

The evening star forex pattern is a bearish reversal pattern that typically appears at the top of an uptrend. It signals a potential shift in market sentiment from bullish to bearish. The pattern consists of three candlesticks:

- The First Candle: A large bullish (white or green) candlestick, indicating strong buying pressure and continuation of the existing uptrend.

- The Second Candle: A small-bodied candlestick (either bullish or bearish) that gaps up from the close of the first candle. This candle represents indecision in the market. It’s often a Doji or a spinning top.

- The Third Candle: A large bearish (black or red) candlestick that closes well into the body of the first candle. This confirms the bearish reversal.

The key characteristics of the evening star forex pattern are the gap up between the first and second candles, and the significant downward movement indicated by the third candle. This pattern suggests that the bullish momentum is waning, and the bears are taking control.

Identifying the Evening Star Pattern on a Forex Chart

Identifying the evening star forex pattern requires careful observation of candlestick formations. Look for the three-candle sequence described above at the end of an uptrend. Here are some tips for identifying the pattern:

- Confirm the Uptrend: Ensure that the pattern appears after a sustained uptrend.

- Look for the Gap: The gap up between the first and second candles is a crucial element of the pattern.

- Assess the Third Candle: The third candle should be a strong bearish candle that closes significantly below the midpoint of the first candle’s body.

- Volume Confirmation: Ideally, the third candle should be accompanied by increased trading volume, further confirming the bearish reversal.

It’s important to note that not all evening star forex patterns are created equal. Some patterns may be more reliable than others. Factors such as the size of the candles, the strength of the gap, and the volume can all influence the pattern’s effectiveness.

Trading Strategies Using the Evening Star Forex Pattern

Once you’ve identified an evening star forex pattern, you can use it to inform your trading decisions. Here are some common trading strategies:

Entry Points

The most common entry point is to enter a short position after the close of the third candle. This confirms the bearish reversal and allows you to capitalize on the expected downward price movement. Some traders prefer to wait for a retest of the resistance level formed by the pattern before entering short.

Stop-Loss Placement

Proper stop-loss placement is crucial for managing risk. A common strategy is to place the stop-loss order just above the high of the second candle (the ‘star’). This protects your position if the price unexpectedly moves upward. Another option is to place the stop-loss above the high of the first candle in the evening star forex pattern.

Take-Profit Targets

Determining take-profit targets depends on your risk tolerance and trading style. One approach is to use Fibonacci retracement levels to identify potential support levels where you can take profit. Another strategy is to set a fixed risk-reward ratio, such as 1:2 or 1:3. You can also use previous swing lows as potential target for your take profit.

Example of an Evening Star Forex Trade

Let’s consider a hypothetical example. Suppose you’re analyzing the EUR/USD currency pair and you spot an evening star forex pattern forming at the end of an uptrend. The first candle is a large bullish candle, the second is a small Doji that gaps up, and the third is a strong bearish candle that closes well into the body of the first candle.

Based on this pattern, you decide to enter a short position at the close of the third candle. You place your stop-loss order just above the high of the Doji and set a take-profit target based on a 1:2 risk-reward ratio. If the price moves downward as expected, you’ll achieve your target and secure a profit.

Factors Affecting the Reliability of the Evening Star Pattern

While the evening star forex pattern can be a valuable tool, it’s important to recognize that it’s not foolproof. Several factors can affect the pattern’s reliability:

- Market Conditions: The pattern may be more reliable in trending markets than in ranging markets.

- Timeframe: The pattern’s effectiveness can vary depending on the timeframe. It may be more reliable on higher timeframes, such as daily or weekly charts.

- Confirmation: Always look for confirmation from other indicators or price action signals before acting on the pattern.

- News Events: Major economic news events can disrupt technical patterns and lead to unexpected price movements.

Remember that no trading strategy is guaranteed to be successful. It’s essential to manage risk carefully and to continuously adapt your strategies based on market conditions.

Combining the Evening Star with Other Technical Indicators

To increase the reliability of the evening star forex pattern, consider combining it with other technical indicators. Here are some popular combinations:

- Moving Averages: Use moving averages to confirm the overall trend and identify potential support and resistance levels.

- Relative Strength Index (RSI): The RSI can help identify overbought or oversold conditions, providing additional confirmation of a potential reversal.

- MACD: The MACD can confirm the momentum shift indicated by the evening star forex pattern.

- Fibonacci Retracements: Use Fibonacci retracement levels to identify potential support and resistance levels, which can help you set take-profit targets.

By combining the evening star forex pattern with other indicators, you can increase the probability of a successful trade.

Psychological Aspects of Trading the Evening Star Pattern

Trading involves not only technical analysis but also psychological factors. It’s important to be aware of your emotions and to avoid making impulsive decisions. Fear and greed can cloud your judgment and lead to costly mistakes.

When trading the evening star forex pattern, it’s crucial to remain disciplined and to stick to your trading plan. Don’t let emotions influence your decisions. Remember to manage risk carefully and to accept that losses are a part of trading. [See also: Risk Management in Forex Trading]

Common Mistakes to Avoid When Trading the Evening Star Pattern

Here are some common mistakes that traders make when trading the evening star forex pattern:

- Ignoring the Uptrend: Failing to confirm that the pattern appears at the end of a sustained uptrend.

- Ignoring the Gap: Overlooking the importance of the gap up between the first and second candles.

- Ignoring Volume: Ignoring the volume on the third candle, which can provide valuable confirmation.

- Poor Stop-Loss Placement: Placing the stop-loss order too close to the entry point, increasing the risk of being stopped out prematurely.

- Chasing Profits: Becoming greedy and failing to take profit when the market reaches your target.

By avoiding these common mistakes, you can improve your chances of success when trading the evening star forex pattern.

Conclusion: Mastering the Evening Star Forex Pattern

The evening star forex pattern is a powerful tool for identifying potential bearish reversals in the forex market. By understanding the pattern’s formation, interpretation, and application, you can enhance your trading strategies and improve your profitability. Remember to combine the pattern with other technical indicators, manage risk carefully, and remain disciplined in your trading decisions.

Mastering the evening star forex pattern takes time and practice. Continuously analyze charts, backtest your strategies, and learn from your mistakes. With dedication and perseverance, you can become a proficient trader and achieve your financial goals in the forex market. [See also: Advanced Forex Trading Strategies]