Fake Trading Screens: Spotting Scams and Protecting Your Investments

In the fast-paced world of finance, where fortunes can be made and lost in the blink of an eye, the allure of quick profits often attracts both legitimate investors and unscrupulous scammers. One particularly insidious tactic employed by these fraudsters involves the use of fake trading screens. These deceptive displays are designed to mimic the look and feel of genuine trading platforms, creating the illusion of successful trades and substantial returns. This article aims to shed light on the dangers of fake trading screens, providing you with the knowledge and tools necessary to identify these scams and protect your hard-earned investments.

Understanding Fake Trading Screens

A fake trading screen is essentially a sophisticated piece of software or a website designed to resemble a legitimate trading platform. Scammers use these screens to manipulate victims into believing they are making real trades and generating profits when, in reality, no actual trading is taking place. The money invested is simply siphoned off by the scammers.

How Fake Trading Screens Work

The process typically unfolds as follows:

- Initial Contact: Scammers often initiate contact through social media, online advertisements, or even cold calls, promising high returns with minimal risk.

- Enticement: They lure victims in with seemingly successful trades displayed on the fake trading screen. These initial ‘profits’ are designed to build trust and encourage further investment.

- Increasing Investments: As the victim sees their ‘account’ growing, they are often pressured to invest larger sums of money to maximize their returns.

- The Trap: When the victim attempts to withdraw their funds, they are met with a series of excuses, delays, or demands for additional fees, such as ‘withdrawal fees’ or ‘taxes.’ These are all tactics to prevent the victim from accessing their money.

- Disappearance: Eventually, the scammers disappear, taking all the invested funds with them.

Red Flags: How to Identify a Fake Trading Screen

Recognizing the warning signs is crucial in avoiding fake trading screen scams. Here are some key indicators to watch out for:

- Unsolicited Offers: Be wary of unsolicited investment offers, especially those promising guaranteed high returns. Legitimate investment firms rarely make such promises.

- Pressure Tactics: Scammers often use high-pressure sales tactics, urging you to invest quickly before the ‘opportunity’ disappears.

- Unrealistic Returns: If the returns seem too good to be true, they probably are. Legitimate investments involve risk, and guaranteed high returns are a major red flag.

- Lack of Regulation: Verify that the trading platform is regulated by a reputable financial authority. Unregulated platforms are more likely to be scams.

- Complex or Opaque Operations: Be suspicious of platforms that have overly complex or opaque operational structures. Transparency is key in legitimate financial institutions.

- Withdrawal Issues: Difficulty or delays in withdrawing funds are a major warning sign. Legitimate platforms should allow you to access your money easily.

- Poor Grammar and Spelling: Look for poor grammar and spelling on the platform’s website and in communications. This is a common indicator of unprofessionalism and potential fraud.

- Fake Reviews and Testimonials: Scammers often create fake reviews and testimonials to build credibility. Be skeptical of overly positive or generic reviews.

- Demands for Upfront Fees: Be extremely cautious if you are asked to pay upfront fees, taxes, or commissions before you can withdraw your profits.

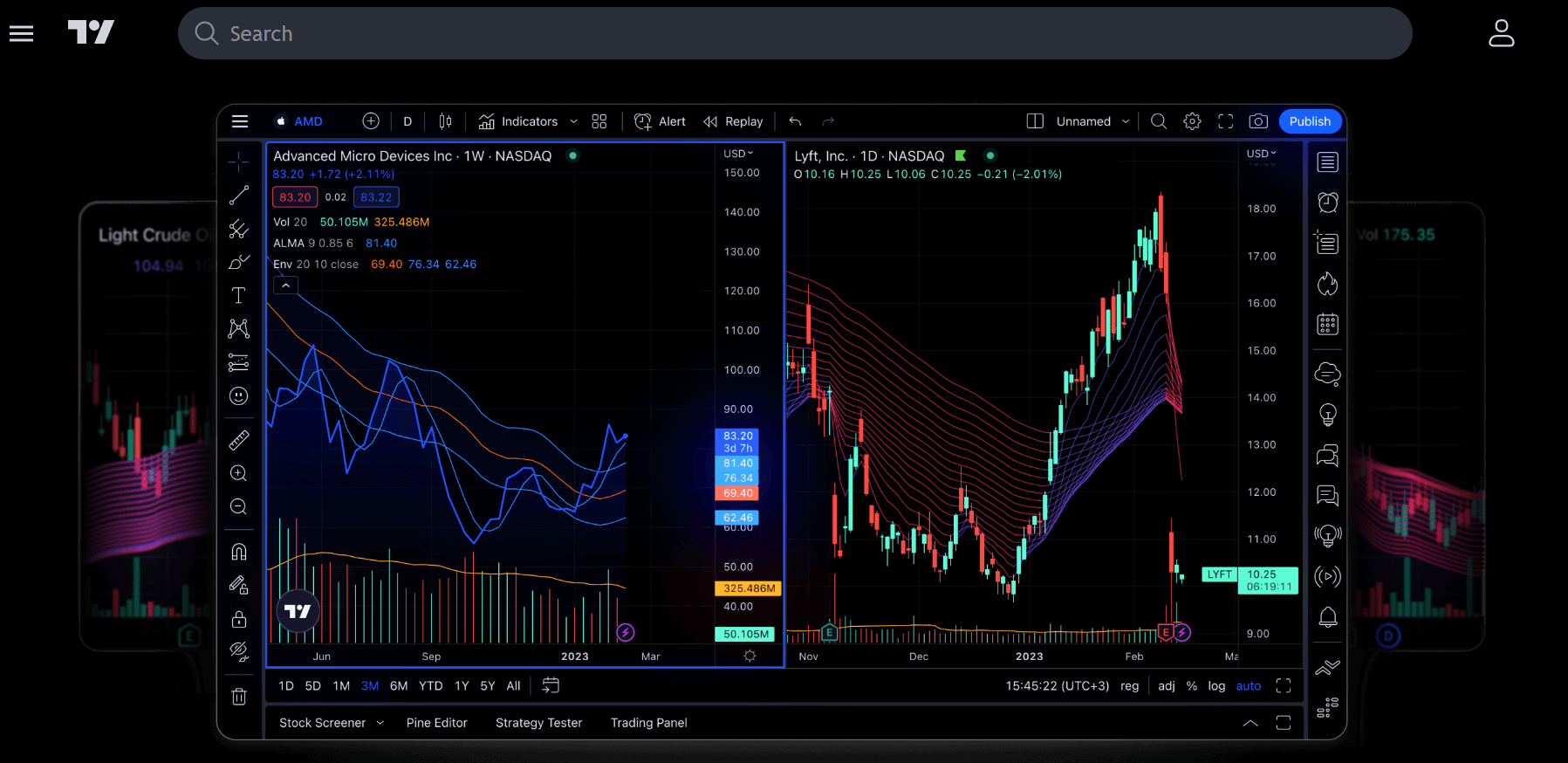

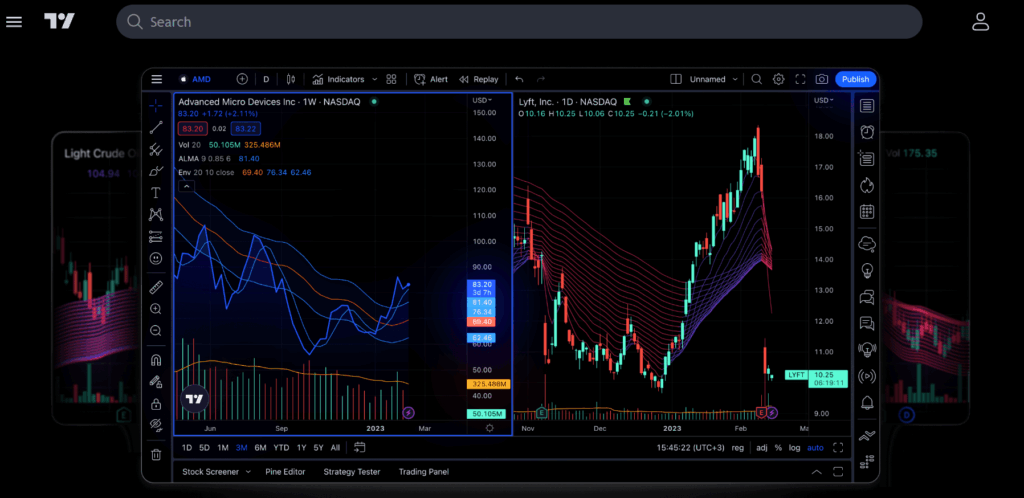

Examples of Fake Trading Screen Scams

Several high-profile cases have highlighted the devastating impact of fake trading screen scams. While specific details may vary, the underlying principles remain the same: deception, manipulation, and financial loss. One common scenario involves cryptocurrency trading, where scammers create fake trading screens that mimic popular cryptocurrency exchanges. Victims are lured in with the promise of high returns on Bitcoin or other cryptocurrencies, only to find that their investments vanish without a trace. Another example involves forex trading, where scammers create fake trading screens that simulate currency trading. These platforms often use manipulated data to show fictitious profits, enticing victims to invest larger sums of money.

Protecting Yourself from Fake Trading Screen Scams

Protecting yourself from fake trading screen scams requires vigilance, skepticism, and a healthy dose of common sense. Here are some practical steps you can take to safeguard your investments:

- Do Your Research: Before investing in any trading platform, thoroughly research the company and its background. Check for regulatory licenses, customer reviews, and any history of complaints or legal issues.

- Verify Regulation: Ensure that the trading platform is regulated by a reputable financial authority, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

- Use Reputable Platforms: Stick to well-known and established trading platforms with a proven track record. These platforms are more likely to have robust security measures and regulatory oversight.

- Be Skeptical of Unsolicited Offers: Be extremely cautious of unsolicited investment offers, especially those promising guaranteed high returns.

- Never Invest Under Pressure: Avoid investing under pressure or feeling rushed to make a decision. Take your time to carefully consider the risks and benefits.

- Start Small: If you decide to invest in a new platform, start with a small amount of money to test the waters.

- Monitor Your Account Regularly: Keep a close eye on your account activity and report any suspicious transactions immediately.

- Be Wary of Complex Schemes: Avoid platforms that have overly complex or opaque operational structures.

- Report Suspicious Activity: If you suspect that you have been targeted by a fake trading screen scam, report it to the relevant authorities, such as the SEC or the Federal Trade Commission (FTC).

- Seek Professional Advice: Consult with a qualified financial advisor before making any investment decisions.

The Psychological Impact of Fake Trading Screen Scams

The financial losses associated with fake trading screen scams can be devastating, but the psychological impact can be equally profound. Victims often experience feelings of shame, guilt, anger, and betrayal. The emotional toll can lead to depression, anxiety, and even suicidal thoughts. It is important for victims to seek support from friends, family, or mental health professionals. [See also: Coping with Investment Loss]

The Role of Regulation and Enforcement

Combating fake trading screen scams requires a multi-faceted approach involving regulation, enforcement, and education. Regulatory agencies play a crucial role in overseeing trading platforms and ensuring compliance with financial laws. Law enforcement agencies are responsible for investigating and prosecuting scammers. Education is key to raising awareness and empowering individuals to protect themselves from fraud. [See also: Financial Regulatory Bodies]

The Future of Fake Trading Screen Detection

As technology evolves, so too do the tactics used by scammers. Advanced artificial intelligence (AI) and machine learning (ML) techniques are being developed to detect and prevent fake trading screen scams. These technologies can analyze trading patterns, identify suspicious activity, and flag potential fraud. However, it is important to remember that technology is only one piece of the puzzle. Human vigilance and critical thinking remain essential in the fight against financial fraud.

Conclusion

Fake trading screens pose a significant threat to investors of all levels of experience. By understanding how these scams work, recognizing the red flags, and taking proactive steps to protect yourself, you can significantly reduce your risk of becoming a victim. Remember to always do your research, verify regulation, and be skeptical of unsolicited offers. Vigilance and a healthy dose of skepticism are your best defenses against these insidious scams. The presence of a fake trading screen is a serious indicator of fraud, and should be reported immediately. Protecting your investments from fake trading screens is paramount in today’s complex financial landscape. Always be aware of the potential for a fake trading screen when engaging with new or unfamiliar platforms. Don’t let the allure of quick profits cloud your judgment; a fake trading screen is designed to do just that. Remember, if something seems too good to be true, it probably is. Stay informed, stay vigilant, and protect your financial future.