A Comprehensive Cryptocurrency Exchanges List: Navigating the Digital Asset Landscape

The world of cryptocurrency is rapidly evolving, and at the heart of it all are cryptocurrency exchanges. These platforms serve as the gateway for buying, selling, and trading digital assets like Bitcoin, Ethereum, and countless others. With a multitude of options available, choosing the right exchange can be a daunting task. This article provides a comprehensive cryptocurrency exchanges list, offering insights into the top platforms, their features, and factors to consider when making your selection.

Understanding Cryptocurrency Exchanges

Before diving into the cryptocurrency exchanges list, it’s crucial to understand what these platforms are and how they function. A cryptocurrency exchange is a digital marketplace where users can buy, sell, or trade cryptocurrencies for other cryptocurrencies or traditional fiat currencies like USD or EUR. These exchanges act as intermediaries, connecting buyers and sellers and facilitating transactions.

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges can be broadly categorized into two main types:

- Centralized Exchanges (CEXs): These exchanges are operated by a company and act as a trusted third party. They typically offer a wider range of features, including fiat currency support, margin trading, and staking options. Examples include Binance, Coinbase, and Kraken.

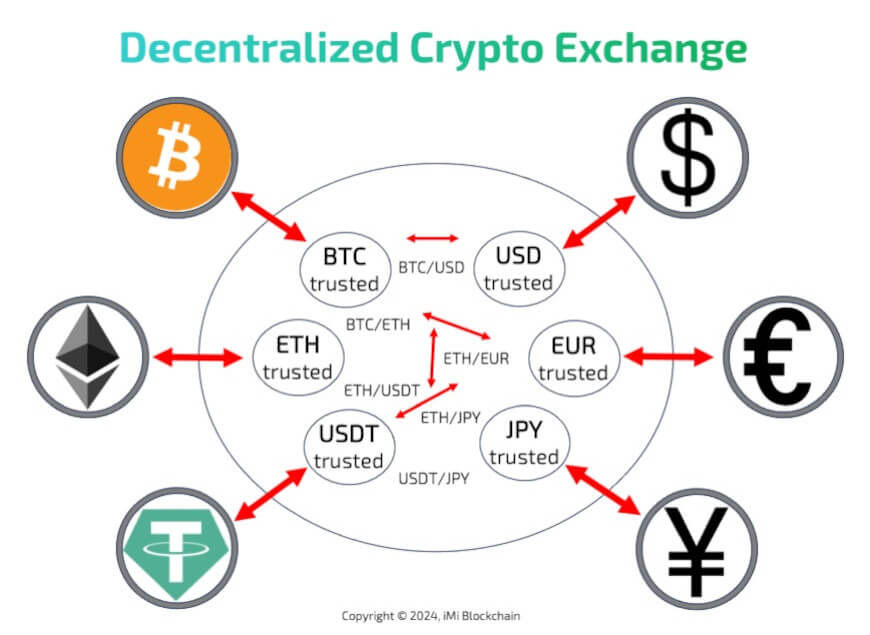

- Decentralized Exchanges (DEXs): DEXs operate on a decentralized network, eliminating the need for a central authority. They offer greater privacy and security but can be more complex to use. Examples include Uniswap, SushiSwap, and PancakeSwap.

Top Cryptocurrency Exchanges: A Detailed List

Here’s a detailed cryptocurrency exchanges list, highlighting some of the leading platforms in the industry:

Binance

Binance is one of the largest and most popular cryptocurrency exchanges globally. It offers a wide variety of cryptocurrencies, low trading fees, and a comprehensive suite of features, including spot trading, futures trading, and staking. Binance is known for its innovative approach and continuous development of new products and services.

Coinbase

Coinbase is a user-friendly cryptocurrency exchange that is particularly popular among beginners. It offers a simple and intuitive interface, making it easy to buy and sell cryptocurrencies. Coinbase also provides a secure and regulated platform, ensuring the safety of user funds. However, it generally has higher fees than Binance.

Kraken

Kraken is a well-established cryptocurrency exchange known for its security and reliability. It offers a wide range of cryptocurrencies and trading options, including margin trading and futures trading. Kraken is also a popular choice for institutional investors due to its robust security measures and compliance with regulatory requirements.

KuCoin

KuCoin is a global cryptocurrency exchange that offers a wide range of cryptocurrencies and features, including spot trading, futures trading, and lending. KuCoin is known for its innovative token listing process and its focus on emerging cryptocurrencies. It also offers a unique referral program that allows users to earn rewards by inviting new users to the platform.

Gemini

Gemini is a regulated cryptocurrency exchange that prioritizes security and compliance. It offers a limited but carefully selected range of cryptocurrencies and is known for its high level of transparency and security. Gemini is a popular choice for users who are concerned about the safety of their funds.

Huobi Global

Huobi Global is a large cryptocurrency exchange that offers a wide range of cryptocurrencies and features, including spot trading, futures trading, and staking. Huobi Global is known for its strong presence in the Asian market and its focus on innovation.

OKX (formerly OKEx)

OKX is a global cryptocurrency exchange that offers a wide range of cryptocurrencies and trading options, including spot trading, margin trading, and futures trading. OKX is known for its advanced trading features and its focus on institutional investors.

Factors to Consider When Choosing a Cryptocurrency Exchange

When selecting a cryptocurrency exchange from the cryptocurrency exchanges list, consider the following factors:

- Security: Choose an exchange with robust security measures to protect your funds. Look for features like two-factor authentication (2FA), cold storage, and insurance coverage.

- Fees: Compare the trading fees of different exchanges. Fees can vary significantly, so it’s important to find an exchange that offers competitive rates.

- Supported Cryptocurrencies: Ensure that the exchange supports the cryptocurrencies you want to trade.

- User Interface: Choose an exchange with a user-friendly interface that is easy to navigate.

- Payment Methods: Check if the exchange supports your preferred payment methods, such as credit cards, bank transfers, or PayPal.

- Customer Support: Look for an exchange with responsive and helpful customer support.

- Regulation: Consider whether the exchange is regulated by a reputable authority. Regulation can provide greater protection for your funds.

Security Best Practices for Cryptocurrency Exchanges

Regardless of which cryptocurrency exchange you choose from the cryptocurrency exchanges list, it’s crucial to follow security best practices to protect your funds:

- Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of security to your account, requiring a second verification code in addition to your password.

- Use a Strong Password: Create a strong and unique password for your exchange account.

- Store Cryptocurrencies in a Cold Wallet: For long-term storage, consider transferring your cryptocurrencies to a cold wallet, which is a hardware wallet that is not connected to the internet.

- Be Wary of Phishing Scams: Be cautious of phishing emails or websites that attempt to steal your login credentials. Always verify the legitimacy of any website before entering your information.

- Keep Your Software Up to Date: Keep your operating system and antivirus software up to date to protect against malware.

The Future of Cryptocurrency Exchanges

The cryptocurrency exchanges landscape is constantly evolving. We can expect to see continued innovation and development in the coming years, including:

- Increased Regulation: Governments around the world are increasingly focusing on regulating the cryptocurrency industry.

- Growth of Decentralized Exchanges (DEXs): DEXs are gaining popularity as users seek greater privacy and security.

- Integration with Traditional Finance: We may see greater integration between cryptocurrency exchanges and traditional financial institutions.

- Development of New Trading Products: Exchanges are likely to continue developing new trading products and services, such as derivatives and lending platforms.

Conclusion

Choosing the right cryptocurrency exchange from the cryptocurrency exchanges list is a critical decision for anyone looking to participate in the digital asset market. By considering the factors outlined in this article and following security best practices, you can find a platform that meets your needs and provides a safe and secure trading environment. Remember to always do your own research and consult with a financial advisor before making any investment decisions. The world of cryptocurrency exchanges is vast and complex, so staying informed is key to navigating it successfully. The best cryptocurrency exchange for you depends on your individual needs and risk tolerance. Thorough research and due diligence are essential before entrusting your funds to any platform. This cryptocurrency exchanges list is just a starting point – delve deeper into each platform to make an informed decision.

[See also: Understanding Cryptocurrency Wallets]

[See also: The Future of Decentralized Finance (DeFi)]