Navigating the Future: Stock Market Predictions and Strategies for Investors

The stock market, a dynamic and often unpredictable arena, is a subject of intense scrutiny and speculation. Investors, analysts, and economists alike constantly seek to understand and predict its future movements. This article delves into the complex world of stock market predictions, exploring the methodologies employed, the factors influencing market behavior, and the strategies investors can utilize to navigate the inherent uncertainties. Understanding predictions on the stock market is crucial for making informed investment decisions and mitigating potential risks.

Understanding Stock Market Prediction Methodologies

Several approaches are used to forecast stock market trends, each with its own strengths and limitations. These methodologies can be broadly categorized into technical analysis, fundamental analysis, and sentiment analysis.

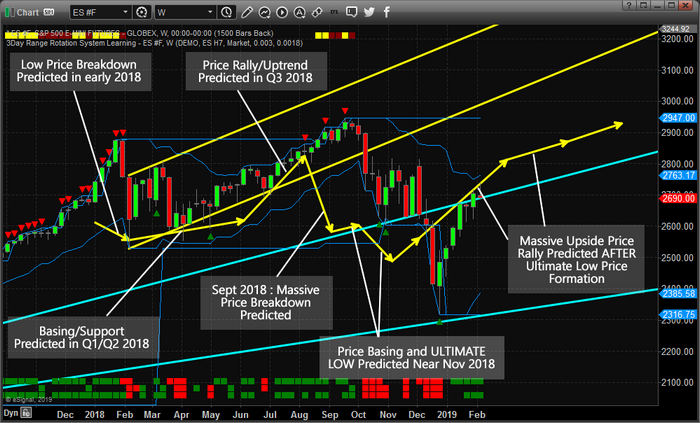

Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends. Technical analysts use charts and indicators to predict future price movements. Common technical indicators include moving averages, relative strength index (RSI), and Moving Average Convergence Divergence (MACD). The effectiveness of technical analysis is debated, with some arguing that it provides valuable insights, while others believe that the stock market is too random for such methods to be reliable. However, many investors still rely on technical analysis to inform their trading decisions related to predictions on the stock market.

Fundamental Analysis

Fundamental analysis focuses on evaluating the intrinsic value of a company by examining its financial statements, industry trends, and macroeconomic factors. Fundamental analysts assess a company’s earnings, revenue, assets, and liabilities to determine whether its stock is overvalued or undervalued. This approach often involves analyzing key financial ratios, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and debt-to-equity ratio. Fundamental analysis provides a long-term perspective on stock market predictions, helping investors identify companies with strong growth potential. [See also: Value Investing Strategies for Beginners]

Sentiment Analysis

Sentiment analysis involves gauging the overall market sentiment by monitoring news articles, social media posts, and investor surveys. The idea is that positive sentiment can drive prices higher, while negative sentiment can lead to sell-offs. Sentiment analysis tools use natural language processing (NLP) to analyze text and identify the prevailing mood. This approach is particularly useful in understanding short-term stock market fluctuations and identifying potential turning points. The rise of social media has made sentiment analysis increasingly relevant in stock market predictions.

Factors Influencing Stock Market Behavior

Numerous factors can influence the stock market, making accurate predictions challenging. These factors can be broadly categorized into economic factors, political factors, and psychological factors.

Economic Factors

Economic factors play a significant role in shaping stock market performance. Key economic indicators include GDP growth, inflation rates, interest rates, and unemployment rates. Strong economic growth typically leads to higher corporate earnings and increased investor confidence, driving stock prices higher. Conversely, economic recessions can lead to lower earnings and decreased investor confidence, resulting in stock market declines. Central bank policies, such as interest rate adjustments and quantitative easing, also have a significant impact on the stock market. Accurate predictions on the stock market require careful monitoring of these economic indicators.

Political Factors

Political events and policies can also influence the stock market. Government regulations, trade agreements, and geopolitical tensions can all impact investor sentiment and market volatility. For example, changes in tax laws can affect corporate profitability and investment decisions. Similarly, trade wars and international conflicts can create uncertainty and lead to stock market declines. Political stability and predictable policies are generally viewed favorably by investors, while political instability and policy uncertainty can create anxiety and volatility. Staying informed about political developments is crucial for understanding predictions on the stock market.

Psychological Factors

Psychological factors, such as investor sentiment and herd behavior, can also play a significant role in stock market movements. Investor sentiment refers to the overall mood or attitude of investors towards the market. Optimism and confidence can drive prices higher, while pessimism and fear can lead to sell-offs. Herd behavior refers to the tendency of investors to follow the crowd, often leading to irrational exuberance or panic selling. These psychological factors can amplify market trends and create short-term volatility. Understanding these psychological biases is essential for making rational investment decisions despite predictions on the stock market.

Strategies for Navigating Stock Market Uncertainties

Given the inherent uncertainties of the stock market, investors need to adopt strategies to mitigate risk and enhance returns. These strategies include diversification, long-term investing, and risk management.

Diversification

Diversification involves spreading investments across different asset classes, sectors, and geographic regions. By diversifying their portfolios, investors can reduce the impact of any single investment on their overall returns. Diversification can help mitigate risk and improve long-term performance. A well-diversified portfolio may include stocks, bonds, real estate, and commodities. Diversification is a key strategy for navigating stock market uncertainties and improving the reliability of investment predictions.

Long-Term Investing

Long-term investing involves holding investments for an extended period, typically several years or even decades. Long-term investors are less concerned with short-term market fluctuations and focus on the long-term growth potential of their investments. This approach allows investors to ride out market downturns and benefit from the power of compounding. Long-term investing requires patience and discipline, but it can be a highly effective strategy for building wealth over time. It’s also a great way to avoid being overly influenced by short-term stock market predictions. [See also: The Power of Compound Interest]

Risk Management

Risk management involves identifying and assessing potential risks and taking steps to mitigate those risks. This may include setting stop-loss orders, hedging positions, and maintaining a cash reserve. Risk management is essential for protecting capital and minimizing losses during market downturns. Investors should carefully assess their risk tolerance and adjust their investment strategies accordingly. Understanding risk management principles is crucial for navigating the stock market successfully despite uncertain predictions.

The Role of Technology in Stock Market Predictions

Technology is playing an increasingly important role in stock market predictions. Advanced algorithms, machine learning, and artificial intelligence (AI) are being used to analyze vast amounts of data and identify patterns that humans may miss. These technologies can improve the accuracy of stock market predictions and help investors make more informed decisions. However, it is important to recognize that even the most sophisticated algorithms are not foolproof, and human judgment remains essential.

Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades based on pre-defined rules and parameters. These algorithms can analyze market data, identify trading opportunities, and execute trades much faster than humans. Algorithmic trading is becoming increasingly prevalent in the stock market, accounting for a significant portion of trading volume. While algorithmic trading can improve efficiency and reduce transaction costs, it can also contribute to market volatility. These algorithms are often based on predictions on the stock market but can also exacerbate unexpected movements.

Machine Learning and AI

Machine learning and AI are being used to develop more sophisticated stock market predictions models. These models can analyze vast amounts of data, including financial statements, news articles, and social media posts, to identify patterns and predict future price movements. Machine learning algorithms can also adapt and improve over time as they are exposed to more data. While these technologies hold great promise, it is important to recognize that they are not perfect and can be subject to biases and errors. Therefore, it is crucial to use them in conjunction with human judgment and critical thinking. The future of predictions on the stock market is inextricably linked to the advancement of AI and machine learning.

Conclusion

Stock market predictions are a complex and challenging endeavor. While various methodologies and technologies can provide valuable insights, the stock market remains inherently unpredictable. Investors should focus on understanding the factors influencing market behavior, adopting sound investment strategies, and managing risk effectively. Diversification, long-term investing, and risk management are essential for navigating stock market uncertainties and achieving long-term financial goals. While predictions on the stock market can be helpful, they should not be the sole basis for investment decisions. A well-informed and disciplined approach is the key to success in the stock market. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions. The journey to financial success requires a blend of knowledge, strategy, and a healthy dose of caution, especially when navigating the often-turbulent waters of the stock market. [See also: How to Choose a Financial Advisor]