Mastering Forex: How a Forex Profit Loss Calculator Can Sharpen Your Trading Edge

In the dynamic world of Forex trading, precision and informed decision-making are paramount. Navigating the complexities of currency pairs, leverage, and market volatility requires more than just intuition; it demands a strategic approach grounded in data and analysis. One indispensable tool for Forex traders, both novice and experienced, is the forex profit loss calculator. This seemingly simple instrument can significantly impact your trading outcomes by providing a clear understanding of potential profits and losses before you even execute a trade.

This article delves into the intricacies of forex profit loss calculators, exploring their functionality, benefits, and how they can be effectively integrated into your trading strategy. We’ll unpack the key components of these calculators, demonstrate their practical application, and highlight why they are essential for risk management and maximizing your returns in the Forex market.

Understanding the Forex Profit Loss Calculator

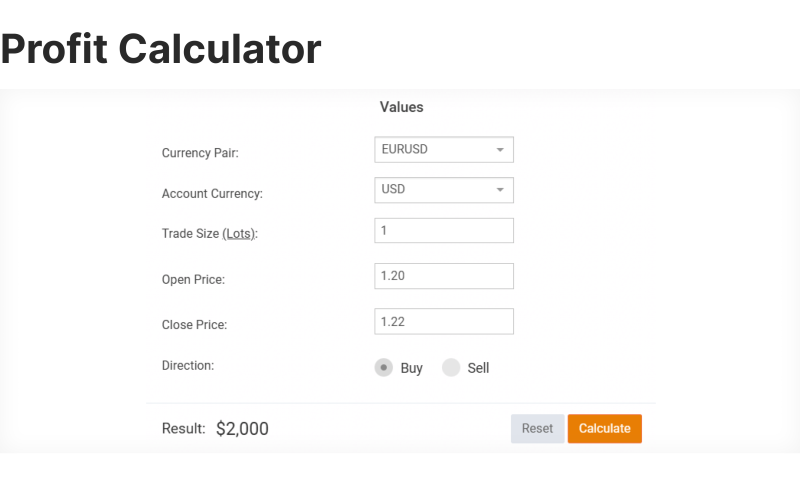

A forex profit loss calculator is a tool that allows traders to estimate the potential profit or loss of a Forex trade. It takes into account various factors, including the currency pair being traded, the trade size (lot size), the entry price, and the exit price. By inputting these variables, the calculator provides an estimate of the potential financial outcome of the trade.

Key Components of a Forex Profit Loss Calculator

- Currency Pair: The specific currencies being traded (e.g., EUR/USD, GBP/JPY).

- Trade Size (Lot Size): The quantity of the base currency being traded. Standard lots, mini lots, and micro lots are common denominations.

- Entry Price: The price at which the trade is opened.

- Exit Price: The anticipated price at which the trade will be closed. This is often based on technical analysis or a predetermined profit target.

- Account Currency: The currency in which your trading account is denominated. This is important for calculating the profit or loss in your account currency.

- Leverage (Optional): Some calculators allow you to input leverage, which can affect the margin requirements and potential profit or loss.

How a Forex Profit Loss Calculator Works

The underlying calculation is relatively straightforward. The calculator essentially determines the difference between the entry price and the exit price, multiplies it by the trade size, and converts the result to your account currency. The formula can be expressed as:

Profit/Loss = (Exit Price – Entry Price) * Trade Size * Exchange Rate (if applicable)

For example, if you buy 1 standard lot (100,000 units) of EUR/USD at 1.1000 and sell it at 1.1050, your profit would be:

(1.1050 – 1.1000) * 100,000 = $500

The forex profit loss calculator automates this process, saving you time and reducing the risk of manual calculation errors.

Benefits of Using a Forex Profit Loss Calculator

The advantages of incorporating a forex profit loss calculator into your trading routine are numerous. Here are some key benefits:

Risk Management

One of the most critical aspects of Forex trading is risk management. A forex profit loss calculator helps you assess the potential risk associated with each trade before you commit any capital. By understanding the potential loss, you can determine whether the risk-reward ratio aligns with your trading strategy and risk tolerance. This allows you to make informed decisions about position sizing, stop-loss orders, and overall capital allocation. [See also: Forex Risk Management Strategies for Beginners]

Profit Target Setting

Conversely, the calculator also helps you set realistic profit targets. By analyzing potential profits based on different exit prices, you can identify achievable targets and develop a trading plan that maximizes your potential returns. This prevents impulsive decisions based on greed or fear and promotes a disciplined approach to trading.

Improved Trading Decisions

By providing a clear picture of potential outcomes, a forex profit loss calculator empowers you to make more informed trading decisions. You can quickly compare different trading scenarios and assess the impact of various factors on your profitability. This allows you to refine your strategy, optimize your entry and exit points, and ultimately improve your trading performance.

Time Efficiency

Manually calculating potential profits and losses can be time-consuming, especially when analyzing multiple currency pairs or trading strategies. A forex profit loss calculator automates this process, saving you valuable time that can be better spent on market analysis, research, and strategy development. This efficiency allows you to react quickly to market opportunities and make timely trading decisions.

Understanding Margin Requirements

While not all calculators explicitly display margin requirements, the potential loss calculation helps you understand the capital at risk. This indirectly helps you assess the impact on your margin and avoid over-leveraging your account. Prudent use of leverage is crucial for sustainable Forex trading, and a forex profit loss calculator contributes to this by highlighting the potential downside of each trade.

How to Use a Forex Profit Loss Calculator Effectively

To maximize the benefits of a forex profit loss calculator, it’s essential to use it strategically and integrate it into your overall trading process. Here are some tips for effective utilization:

Integrate with Your Trading Plan

Don’t use the calculator in isolation. Integrate it with your overall trading plan, which should include your risk tolerance, profit targets, and trading strategy. Use the calculator to validate your trading ideas and ensure that they align with your predetermined goals. [See also: Developing a Comprehensive Forex Trading Plan]

Use Realistic Entry and Exit Prices

The accuracy of the calculator’s output depends on the accuracy of your input. Use realistic entry and exit prices based on your technical analysis, fundamental analysis, or trading signals. Avoid using arbitrary prices, as this will lead to inaccurate estimates and potentially flawed trading decisions.

Consider Transaction Costs

Remember that the forex profit loss calculator typically does not account for transaction costs, such as spreads and commissions. These costs can significantly impact your profitability, especially for high-frequency traders. Factor in these costs when assessing the overall profitability of a trade. Some advanced calculators may allow you to input these costs directly.

Regularly Review and Adjust Your Strategy

The Forex market is constantly evolving, and your trading strategy should adapt accordingly. Regularly review your past trades and analyze the accuracy of your forex profit loss calculator estimates. Identify any discrepancies and adjust your strategy to improve your accuracy and profitability.

Use Multiple Calculators for Validation

Different forex profit loss calculators may use slightly different formulas or assumptions. To ensure accuracy, consider using multiple calculators and comparing the results. This will help you identify any potential errors and validate your calculations.

Choosing the Right Forex Profit Loss Calculator

Numerous forex profit loss calculators are available online, ranging from simple to sophisticated. When choosing a calculator, consider the following factors:

Accuracy

The calculator should provide accurate and reliable results. Test the calculator with known values to ensure that it produces correct outputs.

Ease of Use

The calculator should be user-friendly and easy to navigate. The input fields should be clearly labeled, and the results should be displayed in a clear and concise manner.

Features

Consider the features offered by the calculator. Some calculators may include advanced features such as leverage calculation, margin requirement estimation, and support for multiple currency pairs.

Accessibility

Choose a calculator that is accessible on your preferred devices, whether it’s a desktop computer, a mobile phone, or a tablet. Many online calculators are web-based, while others are available as mobile apps.

Conclusion

A forex profit loss calculator is an indispensable tool for any Forex trader seeking to improve their risk management, set realistic profit targets, and make more informed trading decisions. By understanding the functionality of these calculators and integrating them effectively into your trading strategy, you can significantly enhance your trading performance and increase your chances of success in the dynamic world of Forex trading. Remember to always validate your calculations, consider transaction costs, and regularly review your strategy to adapt to the ever-changing market conditions. The diligent use of a forex profit loss calculator, combined with sound trading principles, can empower you to navigate the Forex market with confidence and precision.