Unlocking Forex Profit: Strategies and Insights for Traders

The allure of the foreign exchange (forex) market lies in its potential for significant financial gains. However, navigating the complexities of forex trading requires a strategic approach, a deep understanding of market dynamics, and a commitment to continuous learning. This article delves into the world of forex profit, exploring proven strategies, essential insights, and practical tips to help traders enhance their profitability and manage risk effectively. Whether you’re a novice trader or an experienced market participant, understanding the nuances of forex profit generation is crucial for long-term success. The potential for forex profit is substantial, but so are the risks. A solid foundation in risk management is paramount to protecting your capital while pursuing forex profit opportunities.

Understanding the Forex Market

The forex market is the world’s largest and most liquid financial market, with trillions of dollars changing hands daily. It operates 24 hours a day, five days a week, offering traders unparalleled flexibility and opportunities. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The value of one currency relative to another fluctuates based on various economic, political, and social factors. Understanding these factors is critical for identifying potential forex profit opportunities.

Key Factors Influencing Currency Values

- Economic Indicators: GDP growth, inflation rates, employment figures, and trade balances can significantly impact currency values. Strong economic data typically strengthens a currency, while weak data weakens it.

- Interest Rates: Central banks control interest rates, which influence the attractiveness of a country’s currency to foreign investors. Higher interest rates tend to attract capital inflows, boosting the currency’s value.

- Political Stability: Political instability or uncertainty can negatively affect a currency’s value. Investors prefer stable and predictable environments.

- Geopolitical Events: Major global events, such as wars, natural disasters, or trade agreements, can trigger significant currency fluctuations.

Proven Strategies for Forex Profit

Several strategies can be employed to generate forex profit. Each strategy has its own set of advantages and disadvantages, and the most suitable approach depends on the trader’s risk tolerance, trading style, and market conditions.

Trend Following

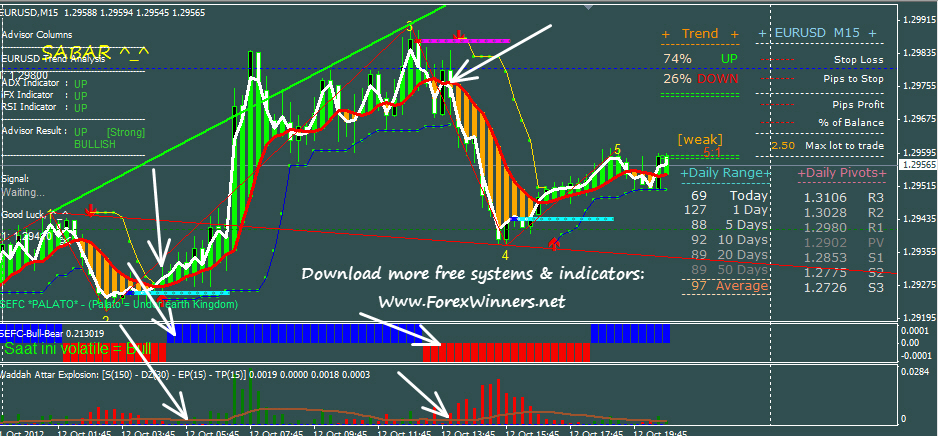

Trend following is a strategy that involves identifying and trading in the direction of the prevailing trend. This approach assumes that trends tend to persist for a certain period, allowing traders to capitalize on sustained price movements. Traders use technical indicators, such as moving averages and trendlines, to identify and confirm trends. Successfully riding a trend can yield significant forex profit.

Range Trading

Range trading is a strategy that involves identifying and trading within a specific price range. This approach assumes that prices will fluctuate between support and resistance levels. Traders buy near the support level and sell near the resistance level. Range trading is particularly effective in sideways or consolidating markets. Identifying reliable support and resistance levels is key to maximizing forex profit in range trading.

Breakout Trading

Breakout trading is a strategy that involves identifying and trading when prices break through a key support or resistance level. This approach assumes that a breakout signals the start of a new trend. Traders typically enter a long position when prices break above resistance and a short position when prices break below support. Breakout trading can be highly profitable, but it also carries a higher risk of false breakouts. [See also: Understanding Forex Breakouts]

Scalping

Scalping is a short-term trading strategy that involves making numerous small profits from minor price fluctuations. Scalpers typically hold positions for only a few seconds or minutes, aiming to accumulate small gains throughout the day. Scalping requires a high degree of discipline, quick decision-making skills, and a reliable trading platform. While individual forex profit from each trade may be small, the cumulative effect can be substantial. This strategy also requires low spreads and minimal slippage to be effective.

Carry Trade

The carry trade involves borrowing a currency with a low interest rate and investing in a currency with a high interest rate. The goal is to profit from the interest rate differential. However, carry trades are subject to currency risk, as fluctuations in exchange rates can offset the interest rate gains. Carry trades are often favored during periods of low volatility. Careful analysis of interest rate differentials and currency risk is crucial for successful carry trades. [See also: Risk Management in Forex Trading]

Essential Insights for Maximizing Forex Profit

Beyond specific trading strategies, several essential insights can help traders maximize their forex profit and minimize their losses.

Risk Management

Risk management is paramount in forex trading. It involves setting stop-loss orders to limit potential losses and using appropriate position sizes to control exposure. A general rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. Effective risk management is the cornerstone of consistent forex profit.

Trading Psychology

Trading psychology plays a crucial role in trading success. Emotions such as fear and greed can cloud judgment and lead to impulsive decisions. Developing a disciplined and rational approach to trading is essential. Maintaining a trading journal can help track your emotions and identify patterns of behavior that may be detrimental to your performance. Mastering your emotions can significantly boost your potential for forex profit.

Market Analysis

Thorough market analysis is crucial for identifying potential trading opportunities. This involves analyzing economic data, monitoring geopolitical events, and studying price charts. Traders can use fundamental analysis to assess the intrinsic value of a currency and technical analysis to identify patterns and trends. A combination of both approaches can provide a more comprehensive understanding of the market. Accurate and timely market analysis is key to unlocking forex profit opportunities.

Continuous Learning

The forex market is constantly evolving, so continuous learning is essential for staying ahead of the curve. Traders should stay updated on the latest market trends, economic developments, and trading strategies. Attending webinars, reading books, and participating in online forums can help expand your knowledge and improve your trading skills. A commitment to continuous learning is a hallmark of successful forex profit seekers.

Choosing the Right Broker

Selecting a reputable and reliable forex broker is crucial for a positive trading experience. Consider factors such as regulation, trading platform, spreads, commissions, and customer support. A well-regulated broker provides a safe and transparent trading environment. A user-friendly trading platform can enhance your trading efficiency. Competitive spreads and commissions can help maximize your forex profit. [See also: Choosing a Forex Broker]

Practical Tips for Consistent Forex Profit

Here are some practical tips to help you achieve consistent forex profit:

- Develop a Trading Plan: A well-defined trading plan outlines your trading goals, strategies, risk management rules, and entry/exit criteria.

- Stick to Your Plan: Discipline is crucial in forex trading. Avoid deviating from your trading plan based on emotions or hunches.

- Start Small: Begin with a small trading account and gradually increase your position sizes as you gain experience and confidence.

- Use Stop-Loss Orders: Always use stop-loss orders to limit potential losses.

- Take Profits: Don’t let winning trades turn into losing trades. Set profit targets and take profits when they are reached.

- Diversify Your Trades: Avoid putting all your eggs in one basket. Diversify your trades across different currency pairs.

- Stay Informed: Keep abreast of the latest market news and economic developments.

- Review Your Trades: Regularly review your past trades to identify your strengths and weaknesses.

Conclusion: The Path to Sustainable Forex Profit

Achieving consistent forex profit requires a combination of knowledge, skill, discipline, and risk management. By understanding market dynamics, employing proven strategies, and adhering to sound trading principles, traders can increase their chances of success in the forex market. Remember that forex trading involves risk, and there are no guarantees of profit. However, with a strategic approach and a commitment to continuous learning, you can unlock the potential for sustainable forex profit and achieve your financial goals. The key is to treat forex trading as a business, not a gamble, and to approach the market with a long-term perspective. By focusing on consistent risk-adjusted returns, you can build a profitable and sustainable trading career. The journey to forex profit is a marathon, not a sprint, and requires patience, perseverance, and a willingness to adapt to changing market conditions.