How to Cash In Bearer Bonds: A Comprehensive Guide

Bearer bonds, once a popular investment vehicle, represent a fascinating piece of financial history. Unlike registered bonds, bearer bonds are not recorded in the owner’s name. Instead, the holder of the physical certificate is presumed to be the owner. This anonymity made them attractive but also contributed to their decline due to concerns about money laundering and tax evasion. If you’ve stumbled upon a bearer bond, understanding how to cash in bearer bonds is crucial. This guide will walk you through the process, potential challenges, and important considerations.

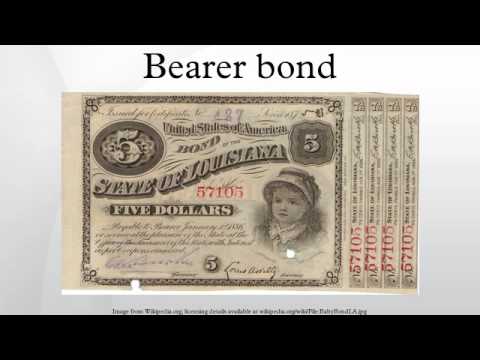

Understanding Bearer Bonds

Before diving into the process of cashing in a bearer bond, it’s important to understand what they are and why they’re relatively rare today. Bearer bonds were essentially IOUs issued by corporations or governments. The bond itself was the proof of ownership, and whoever physically possessed the bond was entitled to the interest payments and the principal upon maturity. Because ownership wasn’t registered, tracking and taxation became problematic, leading to their disuse in many countries.

Key Characteristics of Bearer Bonds

- Anonymity: The primary feature. No record of ownership existed beyond physical possession.

- Physical Certificate: Ownership is represented by the physical bond certificate.

- Interest Coupons: Bearer bonds typically had detachable coupons that the holder would redeem for interest payments.

- Maturity Date: A date when the principal amount becomes payable to the bearer.

Steps to Cash In a Bearer Bond

Cashing in a bearer bond can be a complex process, especially if the bond is old or the issuer is no longer in existence. Here’s a step-by-step guide:

Step 1: Identification and Authentication

The first step is to carefully examine the bond. Note the following:

- Issuer: Who issued the bond (e.g., a corporation, a government entity)?

- Face Value: The principal amount of the bond.

- Interest Rate: The stated interest rate, if any.

- Maturity Date: The date when the principal is due.

- CUSIP or ISIN Number: If present, this number will help identify the bond.

- Physical Condition: Assess the condition of the bond. Is it damaged or deteriorated?

Authentication is crucial. Counterfeit bearer bonds exist, so verifying the bond’s authenticity is paramount. Consult with a financial expert or a bond specialist who can examine the bond and provide an opinion on its validity.

Step 2: Research the Issuer

Once you have the bond’s details, research the issuer. Is the issuing company still in business? Has it been acquired by another entity? If the issuer is a government entity, has that entity undergone significant changes (e.g., a country splitting into multiple nations)?

If the issuer still exists, contact their investor relations department or bondholder services. They can provide information on the bond’s current status and the process for redemption. If the original issuer no longer exists, you may need to trace the bond through mergers, acquisitions, or government reorganizations. This can be a time-consuming process.

Step 3: Locate the Paying Agent

Bearer bonds typically have a paying agent, which is a financial institution responsible for distributing interest and principal payments. This information may be printed on the bond certificate. Contact the paying agent to inquire about the redemption process. If the original paying agent is no longer in business, the issuer or its successor may have designated a new agent.

Step 4: Prepare Documentation

When you contact the issuer or paying agent, they will likely require documentation to process the redemption. This may include:

- The Original Bond Certificate: This is the primary proof of ownership.

- Proof of Identity: Government-issued ID, such as a passport or driver’s license.

- Proof of Address: Utility bill or bank statement.

- Tax Identification Number: Your Social Security Number (SSN) or Employer Identification Number (EIN).

- Affidavit of Ownership: A sworn statement attesting to your ownership of the bond.

- Legal Opinion: In some cases, a legal opinion may be required to verify the bond’s authenticity and your right to redeem it.

Step 5: Redemption Process

Follow the instructions provided by the issuer or paying agent. This may involve submitting the bond certificate and required documentation in person or by mail. Be sure to follow their instructions carefully to avoid delays or complications.

Step 6: Tax Implications

Redeeming a bearer bond can have tax implications. Interest income and capital gains from the bond are generally taxable. Consult with a tax advisor to understand your tax obligations and ensure you comply with all applicable tax laws. Keep detailed records of the redemption, including the amount received and any expenses incurred.

Challenges and Considerations

Cashing in bearer bonds isn’t always straightforward. Several challenges and considerations can arise:

Lost or Damaged Bonds

If the bond certificate is lost or damaged, it may be difficult or impossible to redeem it. Bearer bonds are like cash; if you lose them, they’re gone. Some issuers may have procedures for replacing lost or damaged bonds, but these procedures can be complex and time-consuming.

Issuer Insolvency

If the issuer has gone bankrupt or is otherwise insolvent, you may not be able to redeem the bond for its full face value. In some cases, you may receive only a fraction of the principal, or nothing at all. Research the issuer’s financial condition before attempting to redeem the bond.

Statute of Limitations

Some bearer bonds may be subject to a statute of limitations, which sets a time limit on your ability to claim the principal or interest. If the statute of limitations has expired, you may lose your right to redeem the bond. Check the bond’s terms and conditions and consult with a legal expert to determine if a statute of limitations applies.

Escheatment

Unclaimed property, including unredeemed bearer bonds, may be subject to escheatment laws. Escheatment is the process by which unclaimed property reverts to the state or government. If you wait too long to redeem the bond, it may be turned over to the state as unclaimed property. You may still be able to claim the property from the state, but the process can be cumbersome.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations

Financial institutions are subject to strict KYC and AML regulations. When you attempt to redeem a bearer bond, the issuer or paying agent will likely require you to provide detailed information about yourself and the source of the bond. This is to prevent money laundering and other illicit activities. Be prepared to provide documentation to support your claim.

Alternatives to Cashing In

In some cases, cashing in a bearer bond may not be the best option. Here are some alternatives:

Selling the Bond

You may be able to sell the bearer bond to a private buyer or a bond dealer. However, the market for bearer bonds is limited, and you may not be able to get the full face value of the bond. Be sure to do your research and work with a reputable buyer.

Donating the Bond

You may be able to donate the bearer bond to a charitable organization. This can provide a tax deduction and support a worthy cause. However, the charity may need to be able to redeem the bond themselves, which can present challenges.

Collecting the Bond

Some bearer bonds have historical or collectible value. If the bond is particularly old or rare, it may be worth more to a collector than its face value. Consult with a bond collector or appraiser to determine the bond’s potential value.

Seeking Professional Advice

Cashing in bearer bonds can be a complex and challenging process. It is often advisable to seek professional advice from a financial advisor, attorney, or bond specialist. These professionals can help you navigate the process, understand your rights and obligations, and avoid potential pitfalls.

A financial advisor can help you assess the bond’s value, understand the tax implications of redemption, and develop a financial plan. An attorney can help you navigate legal issues, such as statute of limitations or escheatment. A bond specialist can help you authenticate the bond and locate the issuer or paying agent. [See also: Understanding Bond Yields] [See also: Investing in Corporate Bonds]

The Future of Bearer Bonds

Bearer bonds are largely a relic of the past. Due to concerns about money laundering and tax evasion, they have been phased out in many countries. However, some bearer bonds are still outstanding, and it is important to understand how to cash them in if you happen to come across one.

While bearer bonds may not be a viable investment option today, they represent a fascinating piece of financial history. Understanding their characteristics and the process for redeeming them is essential for anyone who owns or may inherit one. Navigating how to cash in bearer bonds requires patience, diligence, and often, professional guidance.

The key takeaway is that while how to cash in bearer bonds can be complicated, it’s a process that, with the right information and professional assistance, can be successfully navigated. Understanding the steps involved, potential challenges, and available alternatives is crucial to maximizing the value of these historical financial instruments. Remember to prioritize authentication, thorough research, and compliance with all applicable regulations when dealing with bearer bonds.