Navigating the Turbulence: Market Outlook and Stock Predictions for the Coming Year

The financial markets are a complex and ever-shifting landscape, demanding constant vigilance and informed decision-making. Understanding the market outlook and making accurate stock predictions are crucial for investors seeking to maximize returns and mitigate risks. This article provides a comprehensive overview of the current market outlook, explores key factors influencing stock predictions, and offers insights to help investors navigate the coming year with confidence. The ability to decipher market signals and interpret their potential impact on individual stocks is paramount in today’s volatile economic environment.

Current Economic Climate: A Foundation for Predictions

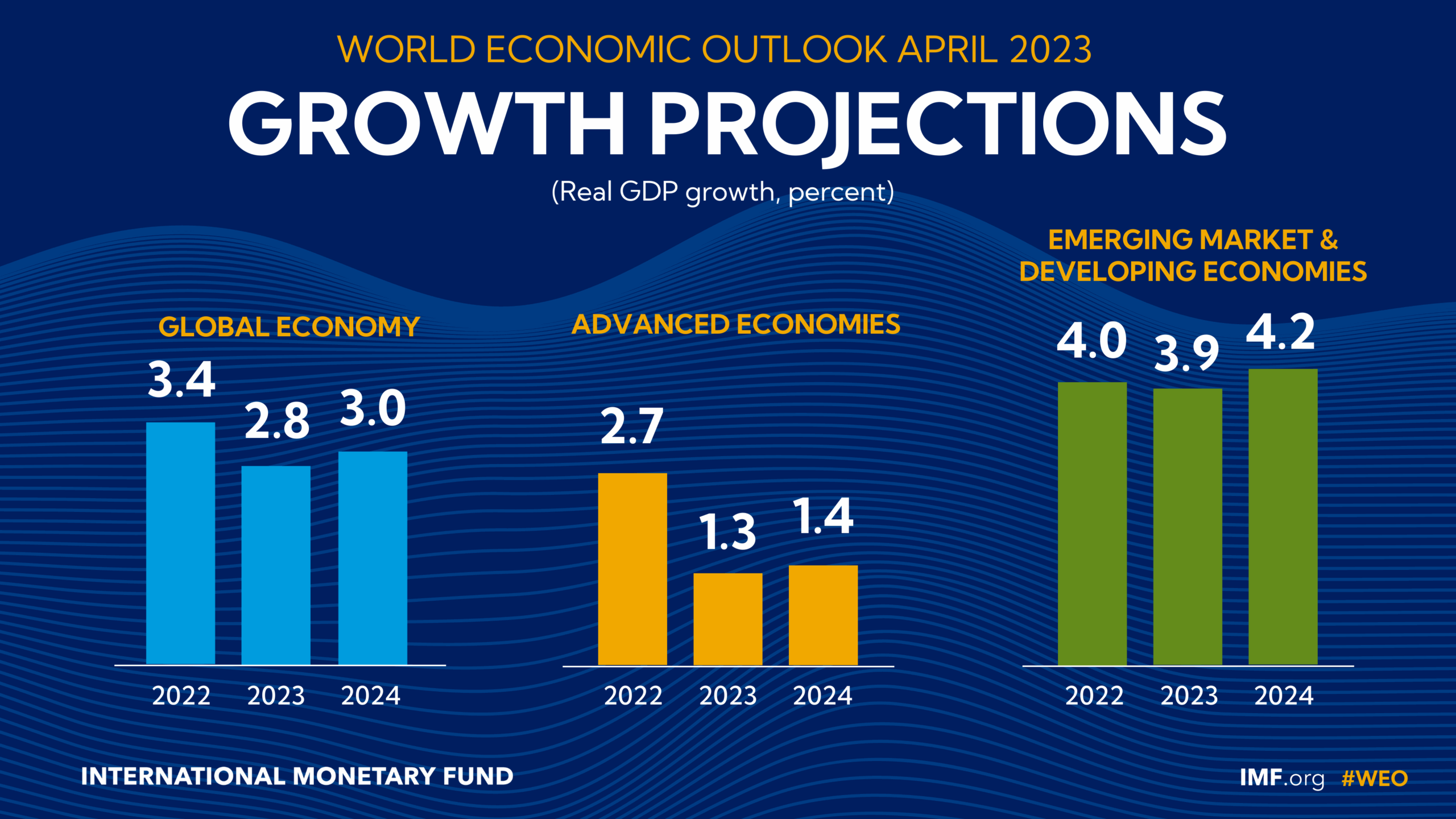

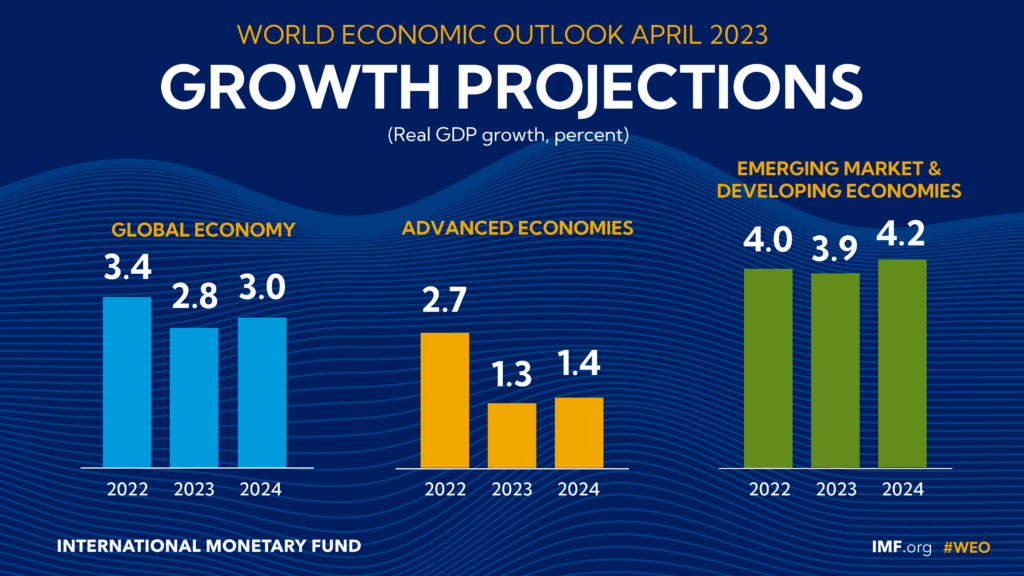

The global economy is currently facing a unique set of challenges, including persistent inflation, rising interest rates, geopolitical instability, and supply chain disruptions. These factors collectively contribute to uncertainty and volatility in the financial markets. Understanding the interplay of these forces is essential for formulating sound stock predictions and assessing the overall market outlook.

Inflation and Interest Rates

Inflation remains a primary concern for central banks worldwide. Aggressive monetary policy tightening, including raising interest rates, is being implemented to curb inflationary pressures. However, the pace and magnitude of these rate hikes can significantly impact economic growth and corporate earnings. Investors need to closely monitor inflation data and central bank announcements to gauge the potential impact on the market outlook and specific stock predictions. [See also: How Inflation Impacts Stock Prices]

Geopolitical Risks

Geopolitical tensions, such as the ongoing conflict in Ukraine, continue to cast a shadow over the global economy. These events can disrupt supply chains, increase energy prices, and create uncertainty in financial markets. Assessing geopolitical risks and their potential impact on specific industries and companies is crucial for making informed stock predictions and evaluating the overall market outlook.

Supply Chain Disruptions

While supply chain bottlenecks have eased somewhat, they remain a concern for many industries. Disruptions can lead to higher costs, reduced production, and lower corporate earnings. Investors need to analyze supply chain vulnerabilities and their potential impact on specific companies when making stock predictions and assessing the market outlook.

Key Factors Influencing Stock Predictions

Several key factors influence stock predictions, including macroeconomic indicators, company-specific fundamentals, industry trends, and investor sentiment. A comprehensive analysis of these factors is essential for making informed investment decisions.

Macroeconomic Indicators

Macroeconomic indicators, such as GDP growth, inflation, unemployment, and consumer confidence, provide valuable insights into the overall health of the economy and its potential impact on corporate earnings. Investors should closely monitor these indicators and their potential impact on the market outlook and specific stock predictions. [See also: Understanding Key Economic Indicators]

Company-Specific Fundamentals

Company-specific fundamentals, such as revenue growth, profitability, cash flow, and debt levels, are crucial for assessing the intrinsic value of a stock. Investors should analyze these fundamentals to determine whether a stock is undervalued or overvalued relative to its peers. Thorough due diligence is essential for making accurate stock predictions.

Industry Trends

Industry trends, such as technological innovation, regulatory changes, and competitive dynamics, can significantly impact the performance of companies within a specific sector. Investors should analyze these trends to identify opportunities and risks within different industries. Understanding industry-specific dynamics is critical for making informed stock predictions and evaluating the market outlook for specific sectors.

Investor Sentiment

Investor sentiment, which reflects the overall mood and expectations of investors, can significantly influence stock prices in the short term. However, sentiment can be volatile and often driven by emotions rather than fundamentals. Investors should be aware of the potential impact of sentiment on stock prices but should not rely solely on sentiment when making investment decisions. A balanced approach that considers both fundamentals and sentiment is crucial for making sound stock predictions.

Sector-Specific Market Outlook and Stock Predictions

The market outlook and stock predictions vary significantly across different sectors. Here’s a brief overview of some key sectors:

Technology

The technology sector continues to be a growth engine for the global economy, driven by innovation in areas such as artificial intelligence, cloud computing, and e-commerce. However, the sector faces challenges such as regulatory scrutiny and increased competition. Investors should focus on companies with strong competitive advantages, innovative products, and sustainable growth potential. Stock predictions for the technology sector remain largely positive, but careful stock selection is vital. [See also: Investing in Tech Stocks: A Guide]

Healthcare

The healthcare sector is generally considered to be defensive, as demand for healthcare services remains relatively stable regardless of economic conditions. However, the sector faces challenges such as regulatory pressures and rising costs. Investors should focus on companies with innovative products, strong pricing power, and a focus on cost efficiency. The market outlook for healthcare remains stable, with solid stock predictions for innovative companies.

Energy

The energy sector is highly sensitive to fluctuations in oil and gas prices. Geopolitical events, supply chain disruptions, and environmental regulations can significantly impact the sector. Investors should focus on companies with strong balance sheets, efficient operations, and a commitment to sustainable energy practices. Stock predictions in the energy sector are highly dependent on global events and energy policy.

Financials

The financials sector is influenced by interest rates, economic growth, and regulatory changes. Rising interest rates can boost profitability for banks, but also increase the risk of loan defaults. Investors should focus on companies with strong capital positions, efficient operations, and a diversified business model. The market outlook for financials is closely tied to interest rate policy and economic growth, influencing stock predictions.

Strategies for Navigating Market Volatility

Given the current economic climate and heightened market volatility, investors need to adopt prudent strategies to protect their capital and maximize returns.

Diversification

Diversification is a fundamental principle of investing. By spreading investments across different asset classes, sectors, and geographies, investors can reduce their overall risk exposure. A well-diversified portfolio can help mitigate the impact of adverse events on individual investments. Diversification is crucial for navigating market volatility and achieving long-term investment goals.

Long-Term Perspective

Adopting a long-term perspective is crucial for successful investing. Short-term market fluctuations are often driven by emotions and sentiment, while long-term returns are typically driven by fundamentals. Investors should focus on investing in companies with strong fundamentals and a sustainable competitive advantage, and avoid making impulsive decisions based on short-term market movements. A long-term view is essential for weathering market volatility and achieving financial success.

Risk Management

Effective risk management is essential for protecting capital and achieving investment goals. Investors should carefully assess their risk tolerance and adjust their portfolio accordingly. Setting stop-loss orders can help limit potential losses, while rebalancing the portfolio regularly can help maintain the desired asset allocation. Proactive risk management is crucial for navigating market turbulence and preserving wealth. Understanding your risk tolerance is key when considering stock predictions and making investment decisions based on the market outlook.

Conclusion: Informed Decisions in a Dynamic Market

The financial markets are constantly evolving, requiring investors to stay informed and adapt their strategies accordingly. By understanding the current market outlook, analyzing key factors influencing stock predictions, and adopting prudent risk management strategies, investors can navigate the challenges and opportunities of the coming year with confidence. Staying informed, conducting thorough research, and seeking professional advice are crucial for making informed investment decisions and achieving long-term financial success. Ultimately, successful investing requires a combination of knowledge, discipline, and a long-term perspective. The current market outlook necessitates careful consideration of all available data before acting on any stock predictions.