CFD vs Spread Betting: Understanding the Key Differences

For individuals looking to participate in the financial markets, two popular methods are Contracts for Difference (CFDs) and spread betting. Both offer a way to speculate on the price movements of various assets without actually owning them. However, significant differences exist between CFD trading and spread betting, particularly regarding taxation, market access, and regulatory oversight. This article provides a comprehensive comparison of CFD vs spread bet, helping you make an informed decision about which approach best suits your investment goals and risk tolerance.

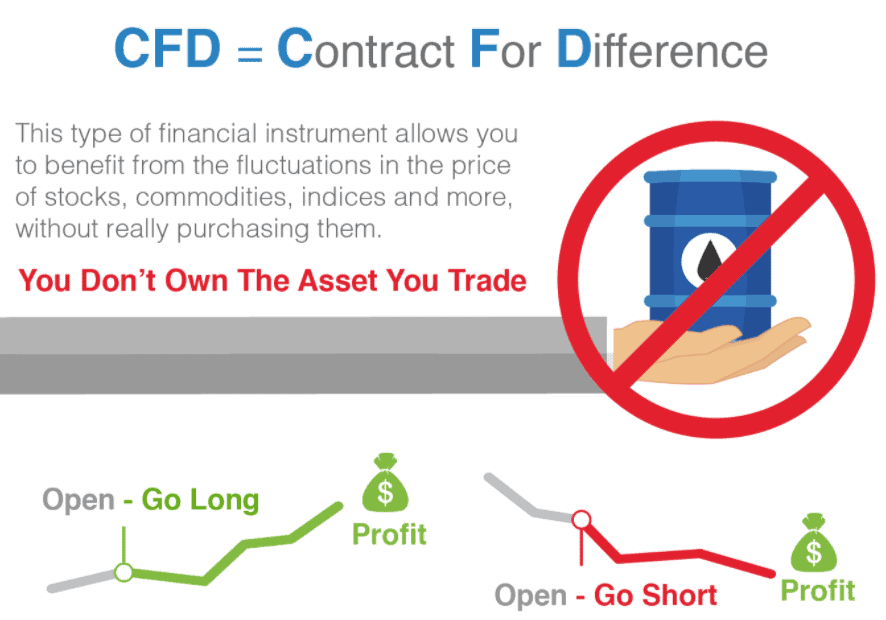

What are CFDs?

A Contract for Difference (CFD) is an agreement between two parties to exchange the difference in the value of an asset from the time the contract is opened until the time it is closed. CFDs allow traders to speculate on the price movements of a wide range of assets, including stocks, indices, commodities, and currencies. When trading CFDs, you don’t actually own the underlying asset; instead, you’re trading a contract based on its price fluctuations.

Key Features of CFDs

- Leverage: CFDs are typically traded with leverage, meaning you can control a large position with a relatively small amount of capital. This can amplify both profits and losses.

- Market Access: CFDs provide access to a global range of markets, allowing you to trade assets from different countries and sectors.

- Flexibility: CFDs allow you to go long (buy) if you believe the price will rise or go short (sell) if you believe the price will fall.

- Cost: CFD brokers typically charge a commission or spread (the difference between the buying and selling price) on CFD trades.

What is Spread Betting?

Spread betting involves speculating on the direction of price movements in various financial markets. Instead of buying or selling an asset, you’re betting on whether the price will rise or fall. The ‘spread’ is the difference between the buy and sell price quoted by the broker. Your profit or loss is determined by the accuracy of your prediction and the size of your stake per point of movement.

Key Features of Spread Betting

- Tax Advantages (UK): In the UK, profits from spread betting are generally exempt from Capital Gains Tax (CGT) and Stamp Duty. This is a significant advantage for UK-based traders.

- Leverage: Like CFDs, spread betting also utilizes leverage, allowing you to control larger positions with less capital.

- Simplicity: Spread betting can be simpler to understand than CFDs, as you’re simply betting on whether the price will go up or down.

- Cost: Spread betting brokers typically make their money through the spread, rather than charging a commission.

CFD vs Spread Betting: A Detailed Comparison

Now, let’s delve into a more detailed comparison of CFD vs spread bet, highlighting the key differences across various aspects:

Taxation

This is arguably the most significant difference, particularly for UK residents. In the UK, profits from spread betting are generally tax-free under current legislation, as they are classified as gambling. However, profits from CFD trading are subject to Capital Gains Tax (CGT). Outside the UK, the tax implications vary depending on the jurisdiction. Always consult a tax professional for advice specific to your situation. The tax advantage makes spread betting a compelling option for many UK traders.

Regulatory Oversight

Both CFDs and spread betting are regulated in many jurisdictions, but the specific regulatory bodies and rules can differ. In the UK, both are regulated by the Financial Conduct Authority (FCA). Regulation aims to protect investors by ensuring that brokers adhere to certain standards of conduct and financial stability. It’s crucial to choose a broker that is regulated by a reputable authority. [See also: Choosing a Regulated Broker]

Market Access

Both CFDs and spread betting offer access to a wide range of markets, including stocks, indices, commodities, and currencies. The specific markets available may vary depending on the broker. However, both generally provide similar opportunities to trade on global markets. Diversification is key, and both CFD trading and spread betting facilitate this.

Cost Structure

The cost structure can vary between CFDs and spread betting. CFD brokers may charge a commission on each trade, as well as a spread. Spread betting brokers typically only charge a spread. It’s important to compare the overall cost of trading, taking into account both the spread and any commissions. Consider the frequency of your trades when evaluating cost structures; frequent traders might prefer a lower commission, while infrequent traders might prioritize a tighter spread.

Leverage and Margin Requirements

Both CFDs and spread betting utilize leverage, which can magnify both profits and losses. The margin requirements (the amount of capital you need to deposit to open a position) can vary depending on the asset and the broker. High leverage can be risky, so it’s crucial to manage your risk carefully. [See also: Risk Management Strategies for Leveraged Trading]

Understanding the Mechanics

The underlying mechanics of CFD trading and spread betting are slightly different. With CFDs, you’re essentially trading a contract based on the price difference of an asset. With spread betting, you’re betting on the direction of the price movement and profiting or losing based on the accuracy of your prediction and your stake per point. While both involve speculating on price movements, the way profits and losses are calculated differs.

Advantages and Disadvantages

CFD Advantages

- Access to a wide range of markets.

- Flexibility to go long or short.

- Leverage can amplify profits.

CFD Disadvantages

- Profits are subject to Capital Gains Tax (CGT) in many jurisdictions.

- Leverage can amplify losses.

- Can be complex for beginners.

Spread Betting Advantages

- Tax-free profits (in the UK).

- Simpler to understand than CFDs.

- Leverage can amplify profits.

Spread Betting Disadvantages

- Leverage can amplify losses.

- Can be addictive due to its gambling nature.

- Availability may be limited in some jurisdictions.

Who Should Choose CFDs?

CFDs might be a better option for traders who:

- Are comfortable with a more complex trading instrument.

- Trade frequently and prefer lower commissions.

- Reside in a jurisdiction where the tax implications are favorable or neutral.

Who Should Choose Spread Betting?

Spread betting might be a better option for traders who:

- Are based in the UK and want to take advantage of the tax-free profits.

- Prefer a simpler trading instrument.

- Are comfortable with the inherent risks of leveraged trading.

Risk Management

Regardless of whether you choose CFDs or spread betting, risk management is crucial. Both involve leverage, which can magnify both profits and losses. Implement strategies such as setting stop-loss orders, limiting your leverage, and diversifying your portfolio to mitigate risk. Never trade with money you can’t afford to lose. [See also: Advanced Risk Management Techniques]

Conclusion

The choice between CFD trading and spread betting depends on your individual circumstances, investment goals, and risk tolerance. Consider factors such as taxation, regulatory oversight, cost structure, and your understanding of the underlying mechanics. While spread betting offers a tax advantage in the UK, CFDs might be more suitable for traders in other jurisdictions or those who prefer a different trading structure. Thoroughly research both options and choose the one that best aligns with your needs. Understanding the nuances of CFD vs spread bet is essential for making informed trading decisions.