Stock Forecast Today: Navigating Market Volatility with Data-Driven Insights

In today’s rapidly evolving financial landscape, investors are constantly seeking reliable stock forecast today to make informed decisions. The stock market, known for its inherent volatility, demands a strategic approach grounded in data analysis and expert insights. This article delves into the methodologies used to generate stock forecast today, the factors influencing market predictions, and how investors can leverage this information to optimize their portfolios.

Understanding Stock Forecasting Methodologies

Several methodologies are employed to generate stock forecast today, each with its strengths and limitations. These can be broadly categorized into:

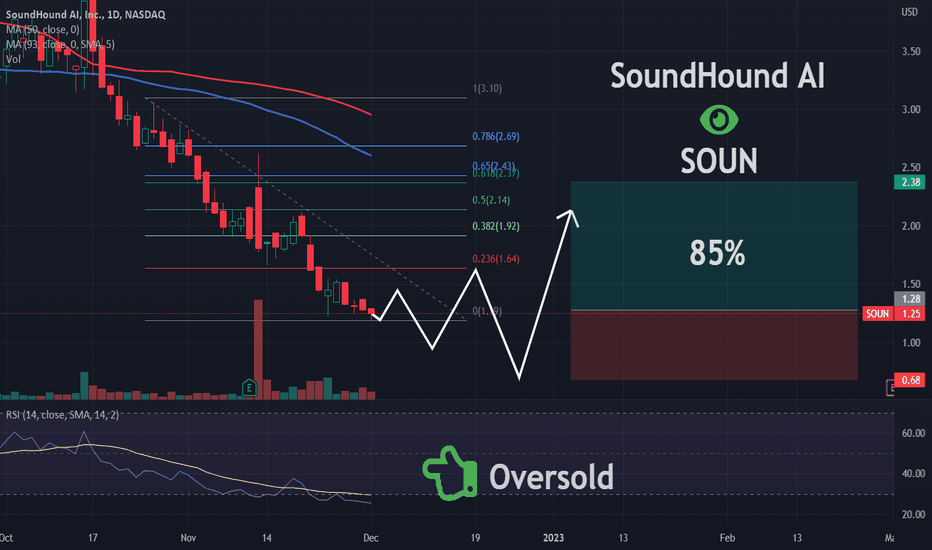

- Technical Analysis: This approach utilizes historical price and volume data to identify patterns and trends. Technical analysts use charts and indicators, such as moving averages, relative strength index (RSI), and MACD, to predict future price movements. It’s a short-term focused strategy often used for day trading and swing trading.

- Fundamental Analysis: This method involves evaluating a company’s financial health, industry position, and macroeconomic factors to determine its intrinsic value. Fundamental analysts examine financial statements (balance sheets, income statements, and cash flow statements), assess management quality, and analyze industry trends. This approach is typically used for long-term investment strategies.

- Quantitative Analysis: This advanced technique uses mathematical and statistical models to identify investment opportunities. Quantitative analysts develop algorithms that analyze vast amounts of data to predict stock prices and market movements. These models often incorporate factors such as economic indicators, market sentiment, and company-specific data.

- Sentiment Analysis: This relatively newer approach leverages natural language processing (NLP) and machine learning to gauge market sentiment from news articles, social media posts, and other sources. By analyzing the tone and content of these sources, sentiment analysis aims to predict how investors will react to certain events and, consequently, how stock prices will be affected.

Factors Influencing Stock Forecast Accuracy

The accuracy of any stock forecast today depends on a multitude of factors, including:

- Economic Indicators: Economic data, such as GDP growth, inflation rates, unemployment figures, and interest rate decisions, can significantly impact stock prices. Strong economic growth typically supports higher stock valuations, while economic downturns can lead to market declines.

- Company Performance: A company’s financial performance, including revenue growth, profitability, and debt levels, is a crucial determinant of its stock price. Positive earnings reports and strong financial metrics often lead to increased investor confidence and higher stock prices.

- Industry Trends: The overall health and outlook of the industry in which a company operates can also influence its stock price. Emerging technologies, changing consumer preferences, and regulatory changes can all impact industry performance.

- Geopolitical Events: Global events, such as political instability, trade wars, and pandemics, can create significant market volatility and impact stock prices. These events often introduce uncertainty and can lead to sudden shifts in investor sentiment.

- Market Sentiment: Investor psychology and market sentiment play a significant role in stock price movements. Periods of optimism and exuberance can drive stock prices higher, while fear and pessimism can lead to market sell-offs.

Challenges in Predicting the Stock Market

Predicting the stock market is inherently challenging due to its complex and dynamic nature. Several factors contribute to the difficulty of generating accurate stock forecast today:

- Black Swan Events: Unforeseeable events, often referred to as black swan events, can have a significant impact on the stock market. These events are difficult to predict and can disrupt even the most sophisticated forecasting models.

- Data Limitations: The availability and quality of data can also pose challenges. Forecasting models rely on historical data, but past performance is not always indicative of future results. Furthermore, some data may be incomplete or inaccurate, which can affect the accuracy of the forecast.

- Model Complexity: Developing accurate forecasting models requires a deep understanding of statistical and mathematical techniques. However, overly complex models can be prone to overfitting, which means they perform well on historical data but fail to generalize to new data.

- Human Behavior: The stock market is driven by human behavior, which is often irrational and unpredictable. Emotional factors, such as fear and greed, can influence investor decisions and lead to unexpected market movements.

Leveraging Stock Forecasts for Investment Decisions

While stock forecast today should not be the sole basis for investment decisions, they can be a valuable tool for investors when used in conjunction with other research and analysis. Here’s how investors can leverage stock forecasts:

- Generate Investment Ideas: Stock forecasts can help investors identify potential investment opportunities that they may not have otherwise considered.

- Assess Risk: By understanding the potential risks and rewards associated with a particular stock, investors can make more informed decisions about whether to invest.

- Time Market Entries and Exits: Stock forecasts can help investors time their market entries and exits, potentially maximizing their returns and minimizing their losses. However, it’s crucial to remember that market timing is notoriously difficult, and no forecasting model is perfect.

- Diversify Portfolios: By diversifying their portfolios across different asset classes and sectors, investors can reduce their overall risk exposure. Stock forecasts can help investors identify sectors and companies that are likely to perform well in the future.

Where to Find Reliable Stock Forecasts

Numerous sources offer stock forecast today, but it’s essential to choose reputable and reliable providers. Some common sources include:

- Financial News Websites: Major financial news websites, such as Bloomberg, Reuters, and The Wall Street Journal, often provide stock forecasts and analysis from various experts.

- Brokerage Firms: Many brokerage firms offer stock research and forecasts to their clients. These reports are typically prepared by in-house analysts and can provide valuable insights.

- Independent Research Firms: Several independent research firms specialize in providing stock forecasts and analysis. These firms often have a more objective perspective than brokerage firms, as they are not directly involved in trading stocks.

- AI-Powered Platforms: Emerging AI-powered platforms are gaining traction in providing data-driven stock forecast today. These platforms use machine learning algorithms to analyze vast amounts of data and generate forecasts.

The Future of Stock Forecasting

The field of stock forecasting is constantly evolving, driven by advancements in technology and data analytics. The future of stock forecast today is likely to be characterized by:

- Increased Use of Artificial Intelligence: AI and machine learning will play an increasingly important role in stock forecasting, as these technologies can analyze vast amounts of data and identify patterns that humans may miss.

- Greater Emphasis on Alternative Data: Alternative data sources, such as social media sentiment, satellite imagery, and credit card transaction data, will become more widely used in stock forecasting models.

- More Personalized Forecasts: Stock forecasts will become more personalized, taking into account individual investors’ risk tolerance, investment goals, and time horizons.

- Real-Time Analysis: Stock forecasts will be updated in real-time, reflecting the latest market data and news events.

Conclusion

Stock forecast today can be a valuable tool for investors seeking to navigate the complexities of the stock market. By understanding the methodologies used to generate forecasts, the factors influencing their accuracy, and the challenges involved in predicting the market, investors can make more informed decisions. While stock forecasts should not be the sole basis for investment decisions, they can provide valuable insights and help investors optimize their portfolios. Remember to consider various factors, including economic indicators, company performance, and geopolitical events, when interpreting stock forecast today. Always conduct thorough research and consult with a financial advisor before making any investment decisions. Analyzing a stock forecast today requires a comprehensive understanding of financial markets and investment strategies. Staying informed about current events and market trends is crucial for making sound investment choices based on any stock forecast today. The accuracy of any stock forecast today can be affected by unforeseen circumstances, highlighting the importance of diversification and risk management. Utilizing a stock forecast today as part of a broader investment strategy can enhance decision-making. Monitoring the performance of a stock forecast today over time can help refine investment approaches. Many investors rely on a stock forecast today to guide their trading activity and portfolio adjustments. A stock forecast today is just one piece of the puzzle when it comes to making smart financial decisions. For those looking to enhance their financial literacy, understanding a stock forecast today is a great starting point. The usefulness of a stock forecast today depends on the methodology used and the accuracy of the data analyzed. Keep in mind that a stock forecast today is not a guarantee of future performance, but a prediction based on current information.

[See also: Understanding Market Volatility] [See also: Investing for Beginners] [See also: Building a Diversified Portfolio]