Chasing Gold: Understanding the Significance of 150 Pips in Gold Trading

Gold, often referred to as a safe-haven asset, has been a cornerstone of investment portfolios for centuries. Its volatility presents opportunities for traders seeking profit through price fluctuations. A common metric used in assessing these fluctuations is the ‘pip,’ or percentage in point. Understanding the value and implications of 150 pips in gold trading is crucial for both novice and experienced traders. This article delves into what a 150 pips in gold movement signifies, how it impacts trading strategies, and the factors influencing gold’s price.

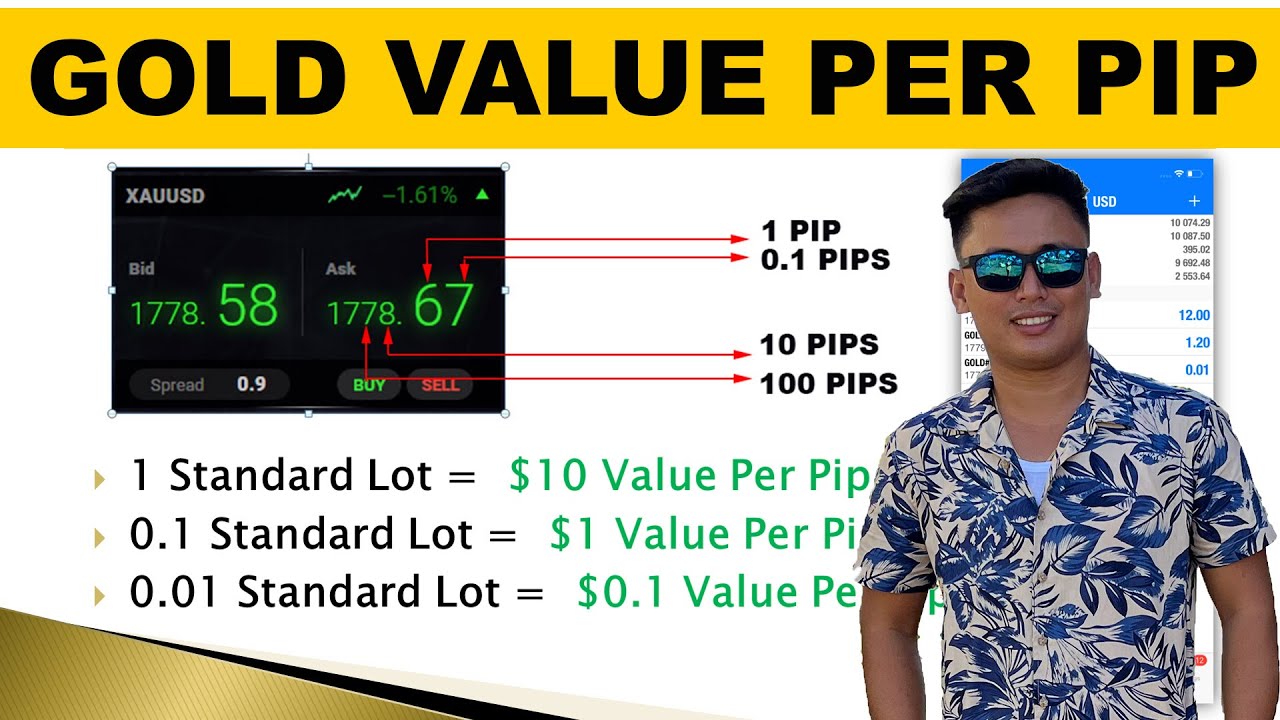

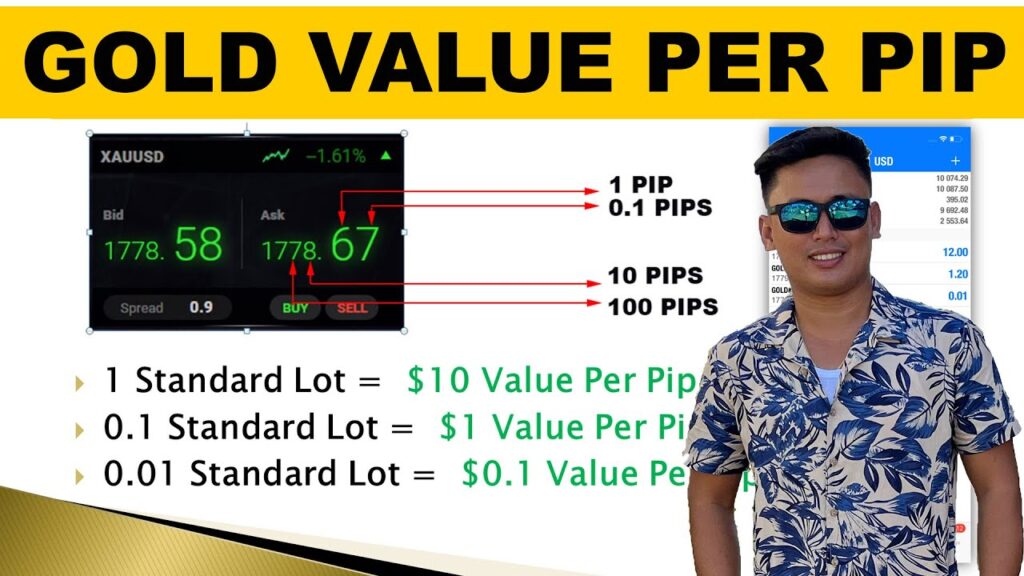

What is a Pip and How Does it Apply to Gold?

A pip represents the smallest price increment that a currency or commodity can move. For most currency pairs, a pip is equivalent to 0.0001. However, when trading gold (typically represented as XAU/USD), the pip value is often 0.01. This difference is essential to understand when calculating potential profits or losses. Therefore, a movement of 150 pips in gold equates to a $1.50 change in price per ounce.

For example, if gold is trading at $1,900 per ounce, a 150 pips in gold increase would bring the price to $1,901.50. Conversely, a decrease of 150 pips in gold would lower the price to $1,898.50. The significance of this movement depends heavily on the size of the trader’s position.

The Impact of 150 Pips in Gold on Trading Strategies

A 150 pips in gold movement can significantly impact various trading strategies, especially those involving leverage. Here’s how:

- Scalping: Scalpers aim to profit from small price changes, often holding positions for only a few minutes or seconds. A 150 pips in gold move can represent a substantial profit opportunity for scalpers, allowing them to quickly secure gains.

- Day Trading: Day traders hold positions for a single day, closing them before the market closes. A 150 pips in gold movement during the trading day can be a key target for day traders, influencing their entry and exit points.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to capture larger price swings. A 150 pips in gold move can be a confirmation signal for swing traders, indicating a potential continuation of the trend.

- Long-Term Investing: While long-term investors are less concerned with short-term fluctuations, a consistent series of 150 pips in gold movements over time can influence their overall investment strategy and portfolio adjustments.

Factors Influencing Gold Prices and Pip Movements

Several factors can influence gold prices, leading to significant pip movements, including 150 pips in gold shifts. Understanding these factors is crucial for predicting potential price changes and managing risk.

Economic Indicators

Economic indicators such as inflation rates, interest rates, and GDP growth significantly impact gold prices. High inflation often drives investors towards gold as a hedge against currency devaluation, increasing demand and pushing prices upward. Conversely, rising interest rates can make bonds and other fixed-income investments more attractive, potentially decreasing demand for gold. Monitoring these indicators is essential for anticipating potential 150 pips in gold movements.

Geopolitical Events

Geopolitical instability, such as wars, political crises, and trade disputes, often leads to increased demand for gold as a safe-haven asset. During times of uncertainty, investors seek refuge in gold, driving up its price. Significant geopolitical events can trigger rapid and substantial 150 pips in gold movements. [See also: Gold as a Safe Haven Asset]

Currency Fluctuations

Gold is typically priced in U.S. dollars, so fluctuations in the dollar’s value can significantly impact gold prices. A weaker dollar generally makes gold more attractive to investors holding other currencies, increasing demand and potentially driving up prices. Monitoring currency movements, particularly the USD, is crucial for understanding potential 150 pips in gold changes.

Supply and Demand Dynamics

The supply and demand for gold play a fundamental role in determining its price. Factors such as gold mine production, central bank purchases, and jewelry demand can influence the overall supply and demand balance. Increased demand with limited supply can lead to price increases, potentially resulting in 150 pips in gold gains. [See also: Gold Mining and Market Supply]

Market Sentiment

Market sentiment, driven by news, rumors, and investor psychology, can also influence gold prices. Positive news or bullish sentiment can drive prices upward, while negative news or bearish sentiment can push prices downward. Monitoring market sentiment through news analysis and social media can provide insights into potential 150 pips in gold movements.

Risk Management When Trading Gold

Trading gold, like any other financial market, involves risk. Effective risk management is crucial for protecting capital and maximizing potential profits. Here are some key risk management strategies:

Setting Stop-Loss Orders

A stop-loss order is an instruction to automatically close a trade when the price reaches a specified level. This helps limit potential losses if the market moves against the trader’s position. Setting appropriate stop-loss levels based on market volatility and risk tolerance is essential. For example, a trader might set a stop-loss order 50 pips below their entry point to protect against a sudden downward movement. While targeting a 150 pips in gold profit, protecting your initial investment is paramount.

Using Leverage Wisely

Leverage allows traders to control a larger position with a smaller amount of capital. While leverage can amplify potential profits, it can also magnify losses. Using leverage wisely and understanding its implications is crucial for managing risk. Traders should avoid excessive leverage, as it can quickly erode their capital if the market moves against them. Even aiming for a modest 150 pips in gold gain can be risky with high leverage.

Diversifying Investments

Diversifying investments across different asset classes can help reduce overall portfolio risk. By allocating capital to various assets, traders can mitigate the impact of losses in any single asset. Diversification can help protect against unexpected market movements and ensure a more stable investment portfolio. While gold can be a valuable addition to a portfolio, it should not be the sole investment. [See also: Diversification Strategies for Gold Investors]

Staying Informed

Staying informed about market news, economic indicators, and geopolitical events is crucial for making informed trading decisions. Traders should regularly monitor news sources, analyze market trends, and understand the factors influencing gold prices. Informed traders are better equipped to anticipate potential price movements and manage risk effectively. Keeping an eye on factors that could trigger a 150 pips in gold move is essential for successful trading.

Tools and Resources for Gold Traders

Numerous tools and resources are available to help gold traders make informed decisions and manage risk effectively.

- Technical Analysis Tools: These tools include charting software, technical indicators, and pattern recognition algorithms. They help traders analyze historical price data and identify potential trading opportunities.

- Fundamental Analysis Resources: These resources include economic calendars, news sources, and financial reports. They help traders stay informed about economic indicators, geopolitical events, and other factors influencing gold prices.

- Trading Platforms: These platforms provide access to the gold market and offer various tools for trading and analysis. They often include features such as real-time price quotes, charting tools, and order management systems.

- Educational Resources: These resources include online courses, webinars, and articles. They help traders learn about gold trading strategies, risk management techniques, and market analysis.

Conclusion: Is Chasing 150 Pips in Gold Worth It?

A 150 pips in gold movement can represent a significant profit opportunity for traders, but it also involves risk. Understanding the factors influencing gold prices, employing effective risk management strategies, and utilizing available tools and resources are crucial for successful gold trading. Whether chasing a 150 pips in gold profit is worth it depends on individual risk tolerance, trading strategy, and market conditions. Traders should carefully assess their goals and risk appetite before entering the gold market. Analyzing the potential for a 150 pips in gold profit against the associated risks is the cornerstone of sound trading. With careful planning and diligent execution, capturing 150 pips in gold can be a rewarding endeavor.