Speculation Investment: Navigating the Murky Waters of High-Risk, High-Reward Ventures

The world of investing offers a spectrum of opportunities, ranging from conservative, low-yield options to ventures that promise substantial returns but carry significant risk. Among these, speculation investment stands out as a particularly intriguing and often misunderstood approach. This article delves into the intricacies of speculative investing, exploring its characteristics, potential benefits, inherent risks, and strategies for navigating this complex landscape.

Speculation investment, at its core, involves taking on a high degree of risk in the hope of achieving substantial gains in a short period. Unlike traditional investing, which often focuses on long-term growth and fundamental value, speculation is driven by anticipated price movements and market sentiment. This can involve investing in assets with uncertain future value, such as penny stocks, cryptocurrencies, or emerging market securities. The potential for rapid profit is what draws many investors to this type of investment.

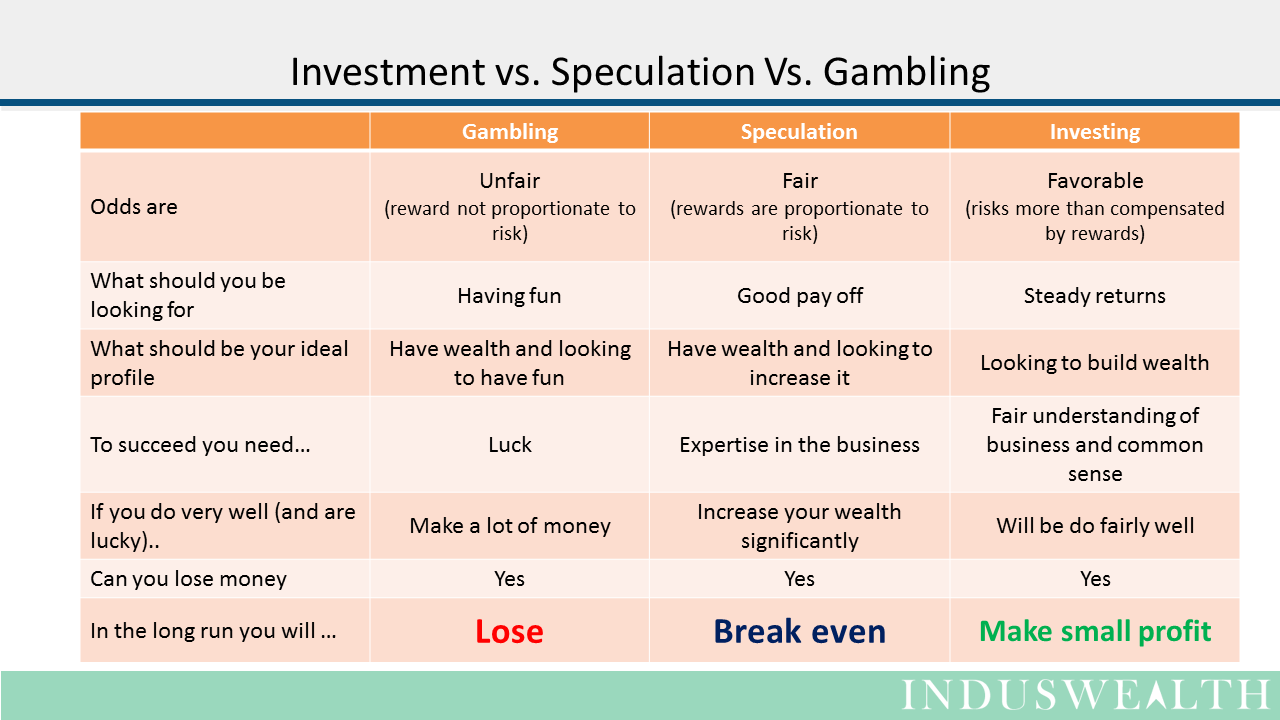

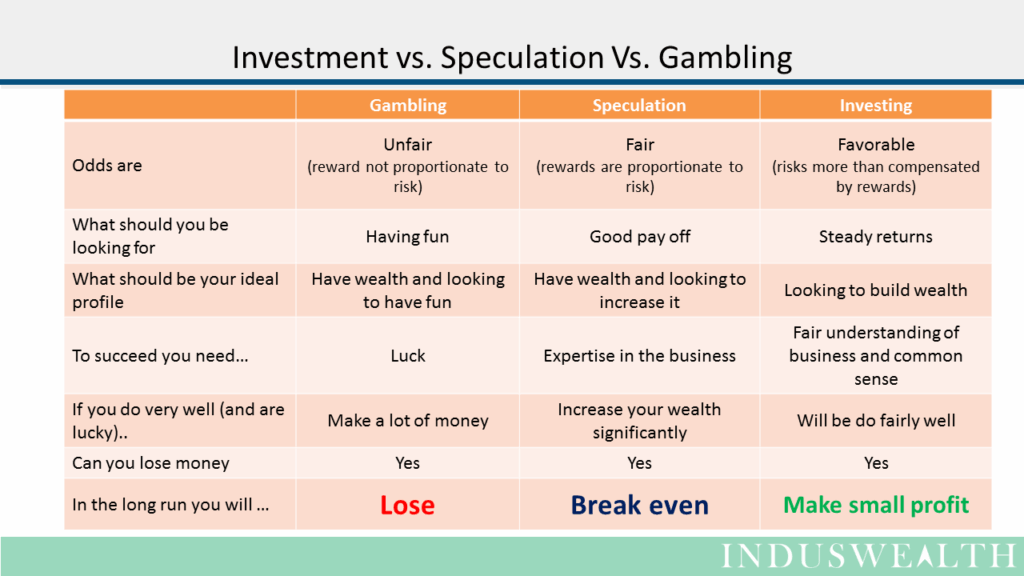

Understanding Speculation vs. Investment

It’s crucial to distinguish between speculation investment and traditional investment. A fundamental investor analyzes a company’s financial statements, management team, and competitive landscape to determine its intrinsic value. They then invest in companies trading below that value, expecting the market to eventually recognize the discrepancy. Speculators, on the other hand, are more concerned with short-term price trends and market psychology. They may invest in an asset regardless of its underlying value, believing they can profit from its price fluctuations. [See also: Value Investing vs. Growth Investing]

Consider the difference between buying shares of a well-established company like Apple based on its consistent profitability and innovation, versus buying a newly launched cryptocurrency based on hype and social media buzz. The former is an example of traditional investment, while the latter falls into the realm of speculation investment.

Characteristics of Speculative Investments

Several characteristics define speculative investments:

- High Risk: This is the defining feature. Speculative investments carry a significant risk of losing a substantial portion, or even all, of the invested capital.

- Short-Term Focus: Speculators typically aim to profit from short-term price movements rather than long-term growth.

- Leverage: Speculators often use leverage (borrowed money) to amplify their potential gains (and losses).

- Volatility: Speculative assets tend to be highly volatile, experiencing significant price swings in short periods.

- Information Asymmetry: Speculative markets are often characterized by information asymmetry, where some participants have access to more or better information than others.

- Emotional Influence: Market sentiment and emotional factors (fear and greed) play a significant role in price movements in speculative markets.

Examples of Speculative Investments

Numerous investment types can be considered speculative, depending on the context and the investor’s approach. Some common examples include:

- Penny Stocks: Stocks that trade at very low prices (typically under $5 per share) and are often associated with small, unproven companies.

- Cryptocurrencies: Digital or virtual currencies that use cryptography for security and operate independently of a central bank.

- Options and Futures: Derivatives contracts that give the holder the right (but not the obligation) to buy or sell an asset at a predetermined price on or before a specific date.

- Emerging Market Securities: Stocks and bonds issued by companies or governments in developing countries.

- Real Estate Flipping: Buying properties with the intention of quickly reselling them for a profit, often after making renovations.

- Collectibles: Investing in rare items like art, antiques, or trading cards, hoping their value will appreciate over time.

The Allure and Dangers of Speculation

The allure of speculation investment lies in the potential for rapid and substantial profits. Stories of individuals turning small investments into fortunes fuel the desire to participate in speculative markets. However, it’s crucial to recognize that these success stories are often the exception rather than the rule.

The dangers of speculation are equally significant. The high level of risk involved means that investors can lose a significant portion of their capital very quickly. The volatility of speculative assets can lead to emotional decision-making, further increasing the risk of losses. Furthermore, speculative markets are often susceptible to manipulation and fraud, making it even more challenging for individual investors to succeed. [See also: Understanding Market Manipulation]

Strategies for Navigating Speculative Investments

While speculation investment is inherently risky, there are strategies investors can employ to mitigate those risks and increase their chances of success:

Due Diligence and Research

Thorough research is paramount. Understand the asset you’re investing in, the market dynamics, and the factors that could influence its price. Don’t rely solely on hype or rumors. Look for credible sources of information and conduct your own independent analysis. In the case of penny stocks, scrutinize the company’s financials, business model, and management team. For cryptocurrencies, understand the underlying technology, the project’s roadmap, and the community support.

Risk Management

Implement a robust risk management strategy. This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to avoid overexposure to any single speculative asset, and allocating only a small percentage of your overall portfolio to speculative investments. Never invest more than you can afford to lose. Remember, speculation investment should be considered a small part of a broader, more diversified investment strategy.

Emotional Control

Emotional control is crucial in speculative markets. Avoid making impulsive decisions based on fear or greed. Stick to your pre-defined investment strategy and resist the temptation to chase quick profits. Be prepared to exit your position if the market moves against you. Recognize that losses are a part of the game and don’t let them cloud your judgment.

Understanding Leverage

Leverage can amplify both gains and losses. If you choose to use leverage, understand the risks involved and use it cautiously. Don’t over-leverage your position, as this can lead to significant losses if the market moves against you. Consider the potential margin calls and the impact they could have on your overall portfolio. [See also: The Dangers of Leverage]

Staying Informed

Stay informed about market trends and developments. Monitor news and announcements that could affect the price of your speculative assets. Be aware of potential scams and fraudulent schemes. Be skeptical of unrealistic promises and always verify information from multiple sources. The world of speculation investment moves quickly, and staying informed is crucial to making sound decisions.

The Psychology of Speculation

Understanding the psychology behind speculation investment is crucial for both novice and experienced investors. Fear and greed are powerful emotions that can significantly influence investment decisions. The fear of missing out (FOMO) can drive investors to jump into speculative assets without proper research, while greed can lead them to hold onto losing positions for too long, hoping for a turnaround. Recognizing these emotional biases and developing strategies to overcome them is essential for successful speculative investing. The ability to remain rational and objective, even in the face of market volatility, is a key differentiator between successful speculators and those who lose their shirts.

The Role of Regulation

Regulation plays a critical role in protecting investors in speculative markets. Regulatory bodies like the Securities and Exchange Commission (SEC) in the United States set rules and guidelines to prevent fraud and manipulation. They also require companies to disclose information to investors, helping to level the playing field. However, regulation is not always sufficient to prevent all abuses, and investors should always exercise caution and conduct their own due diligence. The complexity of modern financial markets often makes it difficult for regulators to keep pace with new and innovative speculative instruments, further emphasizing the importance of individual investor responsibility.

Is Speculation Investment Right for You?

Speculation investment is not suitable for all investors. It requires a high tolerance for risk, a strong understanding of market dynamics, and the ability to make rational decisions under pressure. If you are risk-averse or have limited investment experience, it’s best to avoid speculative investments altogether. If you are considering speculation investment, start with a small amount of capital and gradually increase your exposure as you gain experience and confidence. Always remember to prioritize risk management and never invest more than you can afford to lose. For many, a well-diversified portfolio of traditional investments is a more prudent and sustainable path to long-term financial success.

Conclusion

Speculation investment can be a potentially lucrative but also highly risky endeavor. While the allure of quick profits can be tempting, it’s crucial to approach speculative markets with caution, discipline, and a thorough understanding of the risks involved. By conducting thorough research, implementing robust risk management strategies, and controlling your emotions, you can increase your chances of success in this challenging arena. However, always remember that speculation investment should be a small part of a broader, more diversified investment portfolio, and it’s not suitable for all investors.