Mastering Forex: How to Leverage a Forex Calculator for Smarter Trading

In the fast-paced world of Forex trading, precision and informed decision-making are paramount. One of the most valuable tools in a trader’s arsenal is a forex calculator. Understanding how to effectively leverage a forex calculator can significantly impact your trading success. This article delves into the intricacies of forex calculators, exploring their functionalities, benefits, and how they can be strategically employed to enhance your trading strategies. We’ll cover everything from margin calculation to pip value assessment, ensuring you have a comprehensive understanding of how to leverage this essential tool.

Understanding the Fundamentals of Forex Calculators

A forex calculator is a versatile tool designed to assist traders in making informed decisions by providing quick and accurate calculations related to various aspects of Forex trading. These calculations are crucial for risk management, position sizing, and overall profitability. Different types of forex calculators cater to specific needs, including:

- Pip Value Calculator: Determines the monetary value of a pip (percentage in point) for a specific currency pair.

- Margin Calculator: Calculates the required margin to open and maintain a position.

- Profit/Loss Calculator: Estimates potential profits or losses based on entry and exit prices.

- Position Size Calculator: Determines the appropriate position size based on risk tolerance and account balance.

- Currency Converter: Converts currencies at real-time exchange rates.

By understanding the purpose and functionality of each type of forex calculator, traders can leverage them to make more informed and strategic decisions.

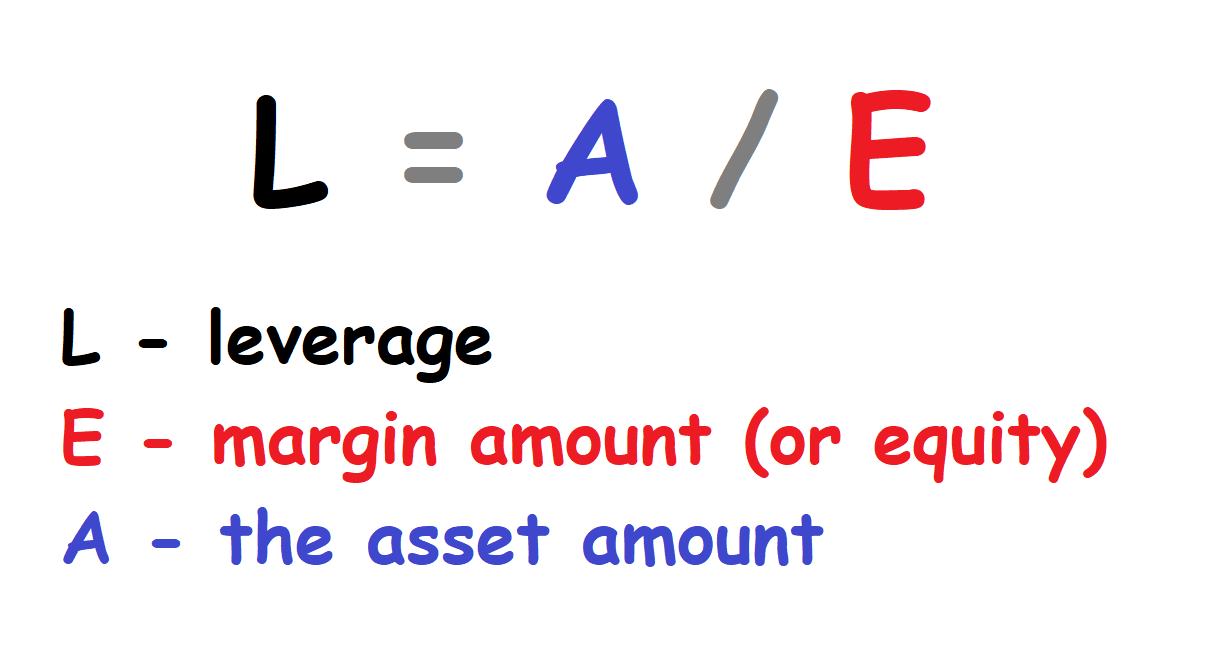

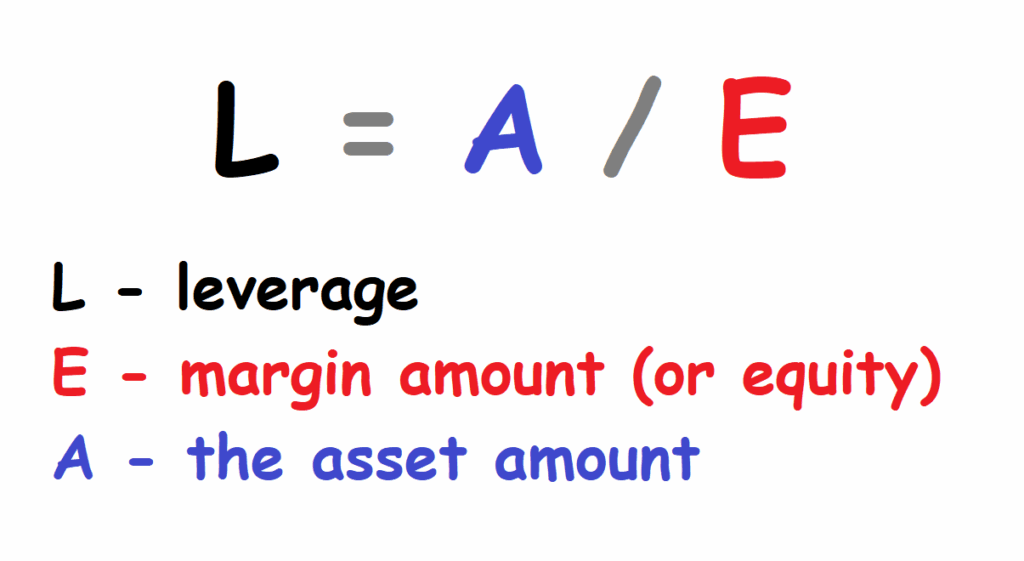

The Importance of Leverage in Forex Trading

Leverage is a double-edged sword in Forex trading. It allows traders to control larger positions with a relatively small amount of capital. While it can amplify potential profits, it also magnifies potential losses. Understanding how to manage leverage effectively is crucial for mitigating risk. A forex calculator can help traders determine the appropriate leverage ratio based on their risk tolerance and trading strategy.

For example, if a trader has a $1,000 account and uses a leverage of 1:100, they can control a position worth $100,000. While this can lead to substantial profits, it also exposes them to significant losses if the market moves against their position. Therefore, it’s critical to use a forex calculator to assess the potential risks and rewards associated with different leverage ratios.

How to Use a Forex Calculator Effectively

To effectively leverage a forex calculator, follow these steps:

- Identify Your Trading Goals: Determine your profit targets and risk tolerance.

- Select the Appropriate Calculator: Choose the calculator that aligns with your specific needs, such as a pip value calculator for assessing potential profits or a margin calculator for managing risk.

- Input Accurate Data: Enter accurate information, including account balance, currency pair, entry and exit prices, and leverage ratio.

- Analyze the Results: Carefully analyze the results provided by the calculator and adjust your trading strategy accordingly.

- Implement Risk Management Strategies: Use the information from the calculator to implement risk management strategies, such as setting stop-loss orders and managing position sizes.

By following these steps, traders can leverage a forex calculator to make more informed and strategic decisions.

Benefits of Using a Forex Calculator

Using a forex calculator offers numerous benefits, including:

- Improved Risk Management: Helps traders assess and manage risk by calculating potential losses and determining appropriate position sizes.

- Enhanced Decision-Making: Provides accurate and timely information to support informed trading decisions.

- Increased Efficiency: Automates complex calculations, saving time and reducing the risk of errors.

- Greater Profitability: Enables traders to identify profitable trading opportunities and maximize potential gains.

- Better Understanding of Leverage: Assists traders in understanding the impact of leverage on their trading positions and overall risk exposure.

By leveraging these benefits, traders can significantly improve their trading performance and increase their chances of success.

Different Types of Forex Calculators and Their Applications

Pip Value Calculator

The pip value calculator is essential for determining the monetary value of a pip for a specific currency pair. This information is crucial for assessing potential profits and losses. The formula for calculating pip value is:

Pip Value = (Pip Size / Exchange Rate) x Lot Size

For example, if the exchange rate for EUR/USD is 1.1000, the pip size is 0.0001, and the lot size is 100,000 units, the pip value would be:

Pip Value = (0.0001 / 1.1000) x 100,000 = $9.09

This means that for every pip the EUR/USD moves in your favor, you will earn $9.09. Conversely, for every pip the EUR/USD moves against you, you will lose $9.09. Understanding pip value is crucial for setting realistic profit targets and managing risk effectively. Using a forex calculator automates this process, ensuring accuracy and saving time.

Margin Calculator

The margin calculator helps traders determine the required margin to open and maintain a position. Margin is the amount of money a trader needs to have in their account to cover potential losses. The formula for calculating margin is:

Margin = (Lot Size x Current Price) / Leverage

For example, if a trader wants to open a position with a lot size of 100,000 units, the current price is 1.1000, and the leverage is 1:100, the margin required would be:

Margin = (100,000 x 1.1000) / 100 = $1,100

This means that the trader needs to have at least $1,100 in their account to open this position. The margin calculator helps traders avoid over-leveraging their accounts and ensures they have sufficient funds to cover potential losses. A forex calculator simplifies this calculation, making it easy for traders to manage their risk effectively. [See also: Forex Risk Management Strategies]

Profit/Loss Calculator

The profit/loss calculator estimates potential profits or losses based on entry and exit prices. This calculator helps traders assess the potential profitability of a trade before entering the market. The formula for calculating profit/loss is:

Profit/Loss = (Exit Price – Entry Price) x Lot Size x Pip Value

For example, if a trader enters a position at 1.1000 and exits at 1.1050, the lot size is 100,000 units, and the pip value is $9.09, the profit would be:

Profit = (1.1050 – 1.1000) x 100,000 x $9.09 = $454.50

This means that the trader would make a profit of $454.50 on this trade. The profit/loss calculator helps traders set realistic profit targets and assess the potential risks and rewards associated with a trade. A forex calculator provides this information quickly and accurately, enabling traders to make more informed decisions. [See also: Forex Trading Strategies for Beginners]

Position Size Calculator

The position size calculator determines the appropriate position size based on risk tolerance and account balance. This calculator helps traders avoid risking too much capital on a single trade. The formula for calculating position size is:

Position Size = (Account Balance x Risk Percentage) / (Stop Loss in Pips x Pip Value)

For example, if a trader has an account balance of $1,000, a risk percentage of 2%, a stop loss of 50 pips, and a pip value of $0.10, the position size would be:

Position Size = ($1,000 x 0.02) / (50 x $0.10) = 4 lots

This means that the trader should open a position with a size of 4 lots. The position size calculator helps traders manage their risk effectively and ensures they do not over-leverage their accounts. A forex calculator simplifies this calculation, making it easy for traders to determine the appropriate position size for each trade. [See also: Understanding Forex Lot Sizes]

Choosing the Right Forex Calculator

Selecting the right forex calculator is crucial for ensuring accurate and reliable results. Consider the following factors when choosing a forex calculator:

- Accuracy: Ensure the calculator provides accurate and up-to-date information.

- User-Friendliness: Choose a calculator that is easy to use and navigate.

- Features: Select a calculator that offers the features you need, such as pip value calculation, margin calculation, and profit/loss estimation.

- Reliability: Opt for a calculator from a reputable source.

- Accessibility: Choose a calculator that is accessible on your preferred device, whether it’s a desktop computer, laptop, or mobile device.

By considering these factors, traders can choose a forex calculator that meets their specific needs and helps them make more informed trading decisions.

Advanced Strategies for Leveraging Forex Calculators

Beyond the basic applications, forex calculators can be used in more advanced trading strategies. For example, traders can use a combination of pip value and profit/loss calculators to fine-tune their entry and exit points. By analyzing potential profits and losses, traders can identify optimal trading opportunities and adjust their strategies accordingly.

Another advanced strategy involves using the position size calculator in conjunction with risk management tools. By determining the appropriate position size based on risk tolerance, traders can implement stop-loss orders and manage their risk effectively. This helps protect their capital and minimize potential losses. Leveraging a forex calculator in these advanced strategies can significantly enhance trading performance.

Common Mistakes to Avoid When Using Forex Calculators

While forex calculators are valuable tools, it’s essential to avoid common mistakes that can lead to inaccurate results and poor trading decisions. Some common mistakes include:

- Entering Inaccurate Data: Ensure you enter accurate information, including account balance, currency pair, entry and exit prices, and leverage ratio.

- Using Outdated Information: Use up-to-date exchange rates and market data.

- Misinterpreting the Results: Carefully analyze the results provided by the calculator and understand their implications.

- Over-Reliance on Calculators: Use calculators as a tool to support your trading decisions, but don’t rely on them exclusively.

- Ignoring Risk Management: Use the information from the calculator to implement risk management strategies, such as setting stop-loss orders and managing position sizes.

By avoiding these common mistakes, traders can ensure they are leveraging forex calculators effectively and making informed trading decisions.

The Future of Forex Calculators

As technology continues to evolve, forex calculators are becoming more sophisticated and user-friendly. Future forex calculators may incorporate artificial intelligence (AI) and machine learning (ML) to provide more accurate and personalized trading recommendations. These advanced calculators could analyze market trends, identify profitable trading opportunities, and even automate trading strategies. The future of forex calculators is promising, and traders who leverage these tools effectively will have a significant advantage in the market.

Conclusion

In conclusion, leveraging a forex calculator is essential for making informed and strategic trading decisions. By understanding the functionalities, benefits, and applications of different types of forex calculators, traders can improve their risk management, enhance their decision-making, and increase their profitability. Whether you are a beginner or an experienced trader, incorporating a forex calculator into your trading strategy can significantly enhance your performance and increase your chances of success in the dynamic world of Forex trading. Remember to choose the right calculator, avoid common mistakes, and continuously refine your strategies to stay ahead in the game. By mastering the art of leveraging a forex calculator, you can unlock your full potential as a Forex trader.