A Comprehensive Cryptocurrency Exchanges List: Navigating the Digital Asset Landscape

The world of cryptocurrency is rapidly evolving, with new digital assets and platforms emerging constantly. A crucial gateway to this dynamic market is through cryptocurrency exchanges. These platforms facilitate the buying, selling, and trading of various cryptocurrencies. Choosing the right exchange is paramount for both novice and experienced traders. This article provides a comprehensive cryptocurrency exchanges list, offering insights into key features, security measures, and user experience to help you make informed decisions in the digital asset space.

Understanding Cryptocurrency Exchanges

Before diving into a cryptocurrency exchanges list, it’s essential to understand what these platforms are and how they operate. Cryptocurrency exchanges are online marketplaces where users can buy, sell, or exchange cryptocurrencies for other digital currencies or traditional fiat currencies like USD or EUR. They act as intermediaries, connecting buyers and sellers and providing the necessary infrastructure for trading.

Types of Cryptocurrency Exchanges

Centralized Exchanges (CEX): These are the most common type of exchange, operated by a company that oversees the platform and its operations. CEXs typically offer a user-friendly interface, high liquidity, and a wide range of trading pairs. However, they often require users to undergo KYC (Know Your Customer) verification and are susceptible to hacking and regulatory scrutiny.

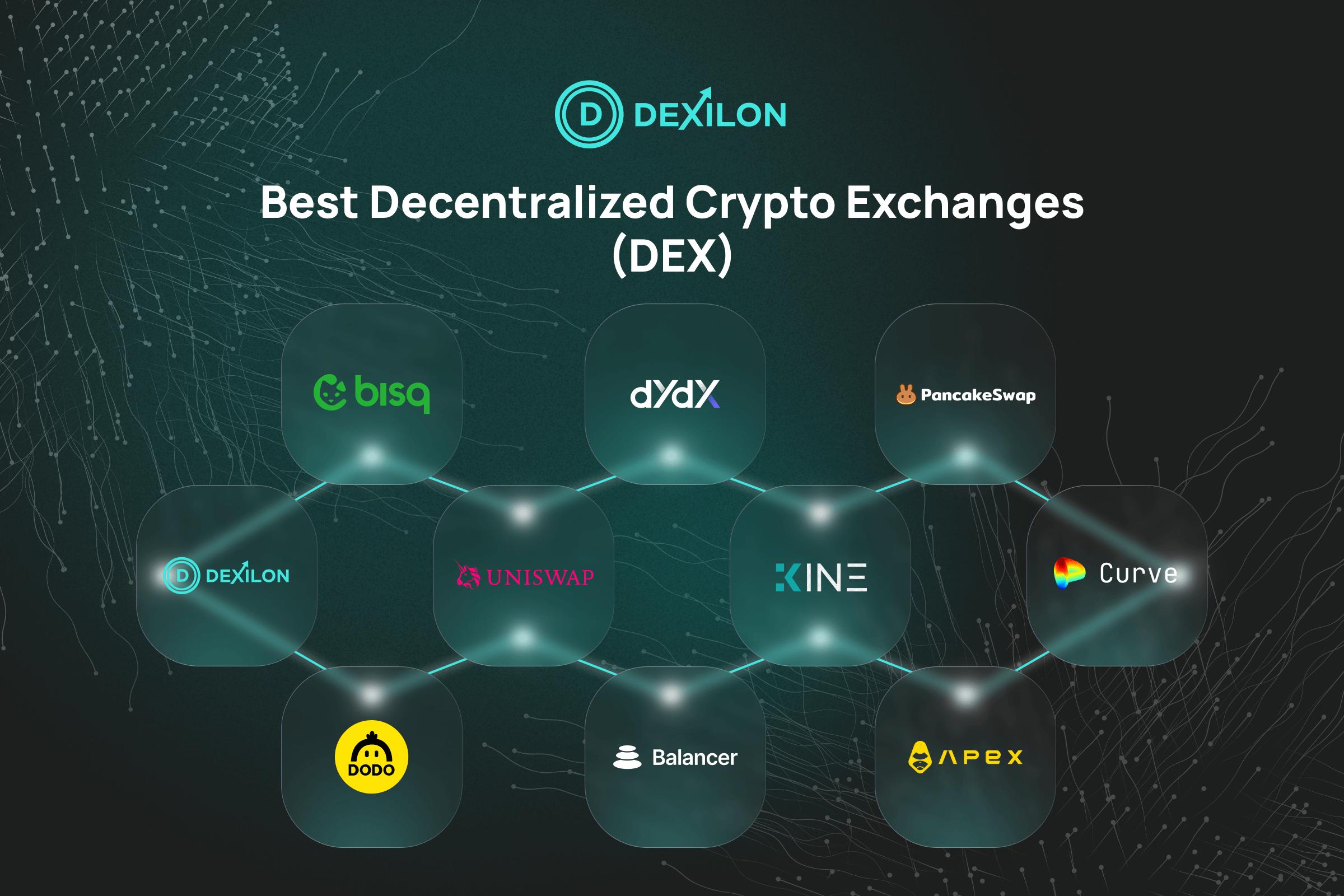

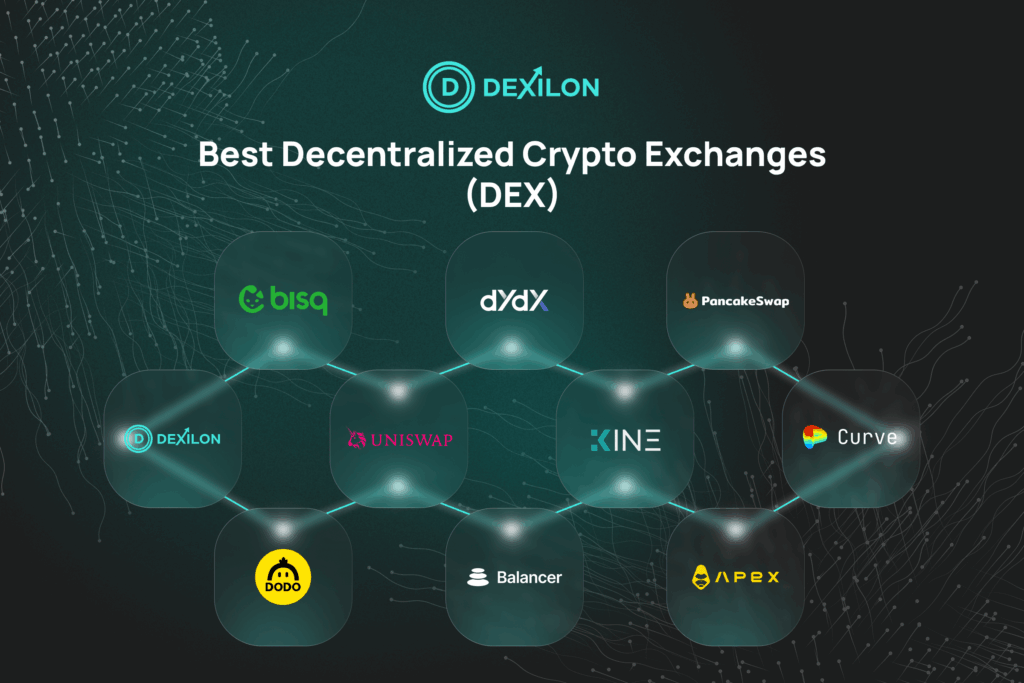

Decentralized Exchanges (DEX): DEXs operate on a decentralized network, allowing users to trade directly with each other without the need for an intermediary. They offer greater privacy and security but may have lower liquidity and a more complex user interface. Examples include Uniswap and Sushiswap.

Hybrid Exchanges: These exchanges attempt to combine the benefits of both CEXs and DEXs, offering a balance between user-friendliness, security, and decentralization.

Key Factors to Consider When Choosing a Cryptocurrency Exchange

Selecting the right cryptocurrency exchange depends on individual needs and preferences. Here are some key factors to consider:

- Security: Security is paramount. Look for exchanges with robust security measures, such as two-factor authentication (2FA), cold storage of funds, and regular security audits.

- Liquidity: High liquidity ensures that you can easily buy or sell cryptocurrencies without significant price slippage.

- Fees: Different exchanges charge different fees for trading, withdrawals, and other services. Compare fees across platforms to find the most cost-effective option.

- Supported Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you are interested in trading.

- User Interface: A user-friendly interface is crucial, especially for beginners. Look for exchanges with intuitive navigation and clear trading tools.

- Customer Support: Reliable customer support is essential in case you encounter any issues or have questions.

- Regulation: Consider the regulatory compliance of the exchange. Exchanges that adhere to regulatory standards offer greater protection for users.

Cryptocurrency Exchanges List: Top Platforms in the Market

Here’s a cryptocurrency exchanges list featuring some of the leading platforms in the market. This is not an exhaustive list, and it’s important to conduct your own research before choosing an exchange.

- Binance: One of the largest and most popular cryptocurrency exchanges globally, Binance offers a wide range of cryptocurrencies, trading pairs, and features. It has a user-friendly interface and robust security measures. However, it has faced regulatory challenges in some jurisdictions.

- Coinbase: A leading US-based exchange, Coinbase is known for its user-friendly interface and strong security. It offers a limited selection of cryptocurrencies but is a good option for beginners. Coinbase Pro offers more advanced trading features.

- Kraken: Another reputable US-based exchange, Kraken offers a wide range of cryptocurrencies and trading options, including margin trading and futures. It is known for its strong security and regulatory compliance.

- KuCoin: KuCoin offers a wide variety of cryptocurrencies, including many smaller altcoins. It also features a unique “KuCoin Shares” (KCS) token that provides users with trading fee discounts and other benefits.

- Huobi Global: A global cryptocurrency exchange with a strong presence in Asia, Huobi Global offers a wide range of cryptocurrencies and trading features.

- Gemini: A US-based exchange founded by the Winklevoss twins, Gemini is known for its security and regulatory compliance. It offers a limited selection of cryptocurrencies but is a good option for institutional investors.

- Bitstamp: One of the oldest cryptocurrency exchanges, Bitstamp is known for its reliability and security. It offers a limited selection of cryptocurrencies but is a good option for long-term investors.

- Crypto.com: Crypto.com offers a wide range of cryptocurrency-related services, including an exchange, a wallet, and a crypto debit card. It is known for its aggressive marketing and partnerships.

- Binance US: A separate entity from Binance, Binance US is designed to comply with US regulations. It offers a limited selection of cryptocurrencies compared to Binance but is a good option for US residents.

- OKEx: OKEx is a cryptocurrency exchange that provides a platform for trading various digital assets. It offers spot trading, derivatives trading, and margin trading options.

Security Best Practices for Cryptocurrency Exchange Users

Even when using a reputable cryptocurrency exchange, it’s essential to follow security best practices to protect your funds:

- Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a second verification code in addition to your password.

- Use a Strong Password: Create a strong, unique password for your exchange account.

- Enable Whitelisting: Whitelisting allows you to restrict withdrawals to specific addresses, preventing unauthorized withdrawals.

- Be Wary of Phishing: Be cautious of phishing emails or websites that attempt to steal your login credentials. Always verify the URL of the exchange before logging in.

- Store Funds in a Hardware Wallet: For long-term storage, consider storing your cryptocurrencies in a hardware wallet, which is a physical device that stores your private keys offline.

- Regularly Monitor Your Account: Regularly monitor your account activity for any suspicious transactions.

The Future of Cryptocurrency Exchanges

The cryptocurrency exchange landscape is constantly evolving, with new technologies and regulations shaping the future of the industry. Decentralized exchanges (DEXs) are gaining popularity as users seek greater privacy and control over their funds. Regulatory clarity is also crucial for the long-term growth of the industry.

As the cryptocurrency market matures, we can expect to see more sophisticated trading tools, improved security measures, and greater regulatory oversight. The cryptocurrency exchanges that adapt to these changes and prioritize user security and experience will be best positioned for success.

Conclusion

Choosing the right cryptocurrency exchange is a critical decision for anyone involved in the digital asset market. By considering the factors outlined in this article and conducting thorough research, you can find an exchange that meets your specific needs and provides a safe and reliable platform for trading cryptocurrencies. Remember to prioritize security and always follow best practices to protect your funds. Explore the options in the cryptocurrency exchanges list provided, but always do your own due diligence before entrusting any platform with your assets. The world of digital assets offers great opportunities, but it also requires informed decision-making. [See also: Cryptocurrency Security Best Practices] [See also: Understanding Decentralized Exchanges]