AI Lending Companies: Revolutionizing Finance with Artificial Intelligence

The financial landscape is undergoing a seismic shift, driven by the relentless march of artificial intelligence (AI). Among the most transformative applications of AI is in lending, where AI lending companies are reshaping traditional processes, enhancing efficiency, and improving accessibility to credit. This article delves into the world of AI lending companies, exploring their impact, benefits, challenges, and future trajectory.

The Rise of AI in Lending

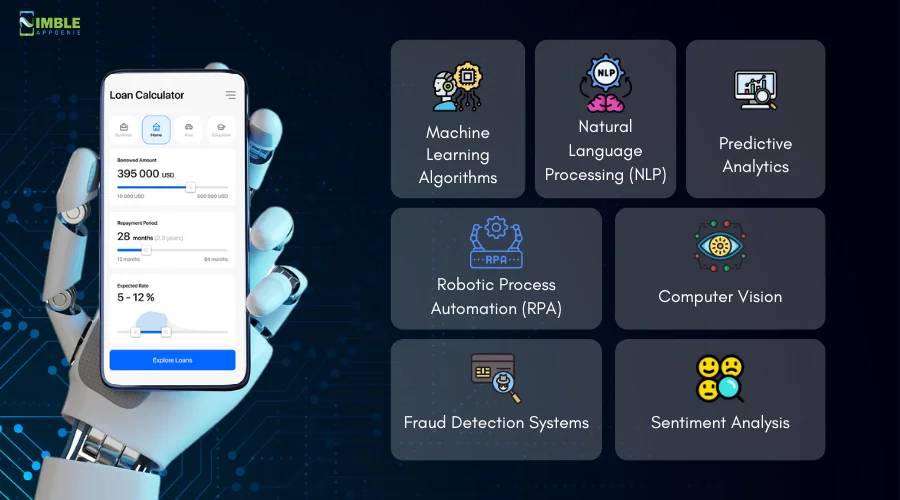

Traditional lending practices often involve cumbersome paperwork, lengthy approval processes, and reliance on credit scores that may not accurately reflect an individual’s financial situation. AI lending companies are disrupting this status quo by leveraging sophisticated algorithms and machine learning models to automate and optimize various aspects of the lending lifecycle. These include credit scoring, risk assessment, loan origination, and fraud detection.

The adoption of AI in lending has been fueled by several factors, including the increasing availability of data, advancements in AI technology, and the growing demand for faster and more convenient financial services. AI lending companies are capitalizing on these trends to offer innovative solutions that cater to the evolving needs of borrowers and lenders alike. [See also: The Future of Fintech and AI]

Key Benefits of AI Lending Companies

Enhanced Credit Scoring

Traditional credit scoring models often rely on limited data points, such as credit history and payment behavior. AI lending companies, on the other hand, can analyze a much wider range of data, including social media activity, online behavior, and alternative financial data, to create more comprehensive and accurate credit profiles. This allows them to assess risk more effectively and extend credit to individuals who may have been previously underserved by traditional lenders.

Faster Loan Approval Processes

One of the most significant advantages of AI lending companies is their ability to automate and streamline the loan approval process. AI-powered systems can quickly analyze loan applications, verify information, and make lending decisions in a fraction of the time it takes for traditional lenders. This can be particularly beneficial for borrowers who need access to funds quickly.

Improved Risk Management

AI lending companies utilize advanced algorithms to identify and mitigate potential risks associated with lending. By analyzing vast amounts of data, these systems can detect patterns and anomalies that may indicate fraudulent activity or potential loan defaults. This enables lenders to make more informed decisions and reduce their exposure to risk.

Personalized Lending Solutions

AI lending companies can tailor lending products and services to meet the specific needs of individual borrowers. By analyzing data on borrower preferences, financial goals, and risk tolerance, these companies can offer personalized loan terms, interest rates, and repayment schedules. This can lead to greater customer satisfaction and improved loan performance.

Increased Accessibility to Credit

AI lending companies are expanding access to credit for individuals who may have been excluded from traditional lending markets. By leveraging alternative data sources and advanced credit scoring models, these companies can assess the creditworthiness of borrowers who may have limited credit history or non-traditional employment arrangements. This can help to promote financial inclusion and empower underserved communities.

Challenges and Considerations for AI Lending Companies

Data Privacy and Security

AI lending companies rely on vast amounts of data to power their algorithms and make lending decisions. This raises concerns about data privacy and security, as sensitive financial information could be vulnerable to breaches or misuse. It is crucial for these companies to implement robust data security measures and comply with relevant data privacy regulations.

Bias and Fairness

AI algorithms are only as good as the data they are trained on. If the data used to train these algorithms contains biases, the resulting lending decisions may also be biased. This could lead to discriminatory lending practices that disproportionately affect certain groups of individuals. AI lending companies must take steps to identify and mitigate potential biases in their algorithms to ensure fairness and equity.

Transparency and Explainability

The decision-making processes of AI algorithms can be opaque and difficult to understand. This lack of transparency can make it challenging for borrowers to understand why they were denied a loan or offered a particular interest rate. AI lending companies should strive to make their algorithms more transparent and explainable to build trust and accountability.

Regulatory Uncertainty

The regulatory landscape for AI lending companies is still evolving. Regulators are grappling with how to oversee these innovative technologies and ensure that they are used responsibly and ethically. This regulatory uncertainty can create challenges for AI lending companies as they navigate the legal and compliance requirements in different jurisdictions.

Examples of Leading AI Lending Companies

Several AI lending companies are making significant strides in the financial industry. Here are a few notable examples:

- Upstart: Upstart is an AI lending company that uses machine learning to assess credit risk and provide personal loans.

- Affirm: Affirm partners with retailers to offer point-of-sale financing options powered by AI.

- Kabbage: Kabbage provides small business loans using automated underwriting and risk assessment.

- Zest AI: Zest AI develops AI-powered credit scoring models for lenders.

- Blend: Blend provides a digital lending platform that streamlines the loan origination process for banks and credit unions.

The Future of AI Lending

The future of AI lending companies looks promising. As AI technology continues to evolve and data availability increases, these companies are poised to play an even greater role in the financial industry. We can expect to see further advancements in credit scoring, risk management, and personalized lending solutions. AI lending companies will likely continue to expand access to credit for underserved populations and drive greater efficiency and transparency in the lending process. [See also: The Ethical Implications of AI in Finance]

However, it is important to address the challenges and considerations associated with AI lending, such as data privacy, bias, and regulatory uncertainty. By proactively addressing these issues, AI lending companies can ensure that their technologies are used responsibly and ethically, benefiting both borrowers and lenders alike. The key is to focus on creating fair, transparent, and secure lending practices that empower individuals and promote financial well-being.

In conclusion, AI lending companies are revolutionizing the financial industry by leveraging the power of artificial intelligence to transform traditional lending processes. While challenges remain, the potential benefits of AI lending are undeniable. As these companies continue to innovate and address the ethical considerations, they are poised to shape the future of finance for years to come. The integration of AI into lending represents a significant step forward in creating a more accessible, efficient, and personalized financial ecosystem.