AI Lending Companies: Revolutionizing the Financial Landscape

The financial services industry is undergoing a profound transformation, largely driven by the integration of artificial intelligence (AI). Among the most impactful applications of AI is in lending, where AI lending companies are reshaping how credit decisions are made, risks are assessed, and loans are managed. This article delves into the rise of AI lending companies, exploring their benefits, challenges, and the future of lending in an increasingly AI-driven world. The rise of AI lending companies represents a significant shift in the financial sector.

The Rise of AI in Lending

Traditional lending processes often involve lengthy applications, manual credit checks, and subjective assessments, leading to inefficiencies and potential biases. AI lending companies leverage machine learning algorithms, natural language processing (NLP), and big data analytics to automate and optimize these processes. These technologies enable lenders to make faster, more accurate, and more data-driven decisions.

The increasing availability of data and advancements in AI technologies have fueled the growth of AI lending companies. These companies can access and analyze vast amounts of data from various sources, including credit bureaus, social media, and alternative data providers, to gain a more comprehensive understanding of borrowers’ creditworthiness. This holistic approach allows them to identify creditworthy individuals who may have been overlooked by traditional lending models.

Benefits of AI Lending Companies

AI lending companies offer a range of benefits to both lenders and borrowers:

- Improved Accuracy: AI algorithms can analyze complex datasets to identify patterns and correlations that humans may miss, leading to more accurate credit risk assessments.

- Faster Loan Processing: Automation streamlines the loan application and approval process, reducing the time it takes for borrowers to receive funding.

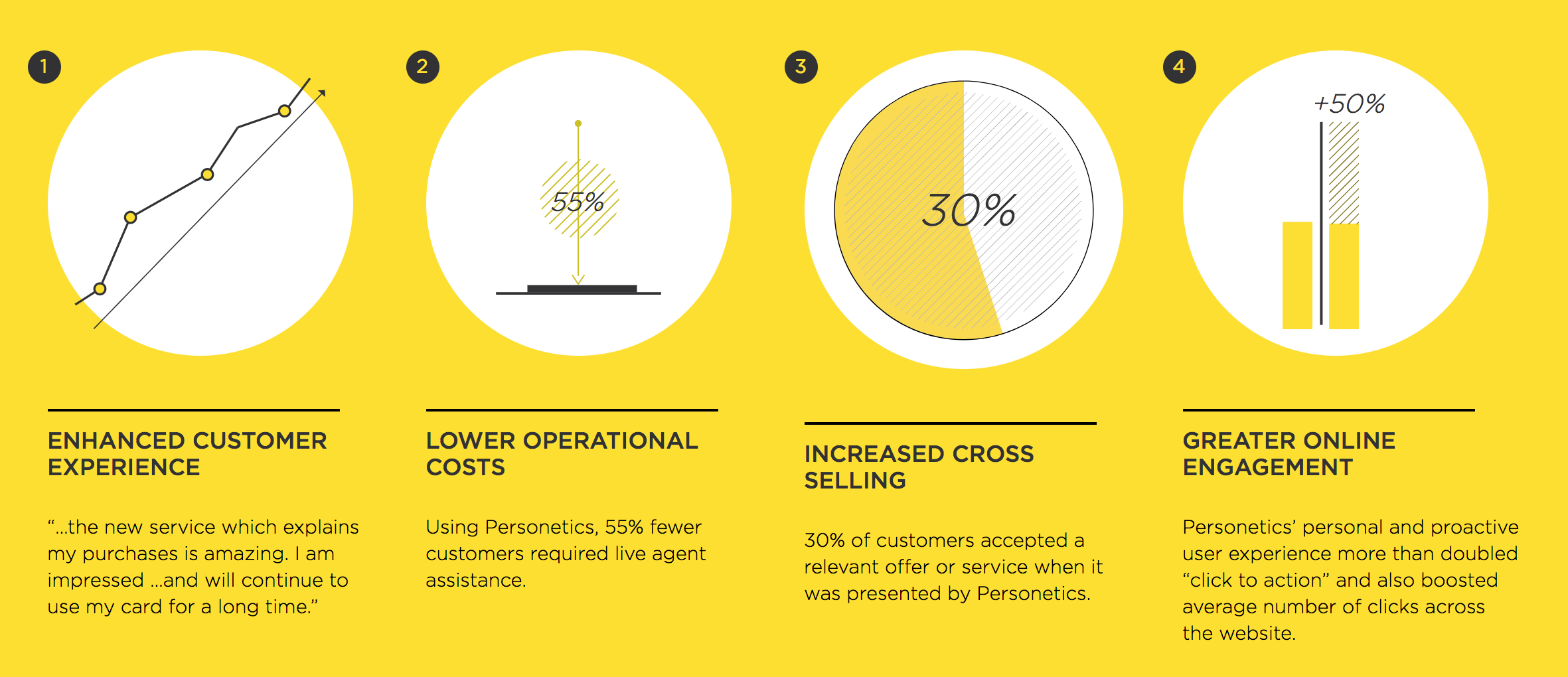

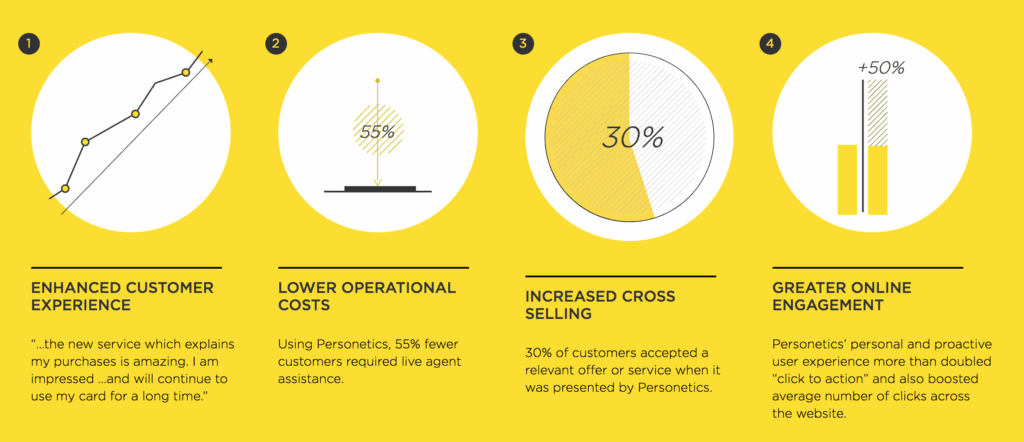

- Reduced Costs: AI-powered systems can automate many tasks previously performed by human employees, lowering operational costs for lenders.

- Enhanced Customer Experience: AI-driven chatbots and personalized recommendations can improve the borrower’s experience, making the loan process more convenient and user-friendly.

- Increased Accessibility: AI lending companies can serve underserved populations by using alternative data to assess creditworthiness, expanding access to credit for those who may not have a traditional credit history.

- Fraud Detection: AI algorithms can detect fraudulent activity by identifying suspicious patterns and anomalies in loan applications.

Key Technologies Used by AI Lending Companies

Several key technologies underpin the operations of AI lending companies:

- Machine Learning (ML): ML algorithms are used to build predictive models that assess credit risk, predict loan defaults, and personalize loan offers.

- Natural Language Processing (NLP): NLP enables lenders to analyze unstructured data, such as social media posts and customer reviews, to gain insights into borrower behavior and sentiment.

- Big Data Analytics: Big data analytics allows lenders to process and analyze vast amounts of data from various sources, providing a more comprehensive view of borrowers’ financial profiles.

- Robotic Process Automation (RPA): RPA automates repetitive tasks, such as data entry and document processing, freeing up human employees to focus on more complex tasks.

- Cloud Computing: Cloud computing provides the infrastructure and scalability needed to support AI-powered lending platforms.

Challenges and Considerations for AI Lending Companies

While AI lending companies offer numerous benefits, they also face several challenges and considerations:

- Data Bias: AI algorithms can perpetuate existing biases if they are trained on biased data. It is crucial to ensure that data used to train AI models is representative and unbiased.

- Transparency and Explainability: AI models can be complex and difficult to understand, making it challenging to explain why a particular loan decision was made. Lenders need to ensure that their AI models are transparent and explainable to comply with regulatory requirements and maintain borrower trust.

- Data Security and Privacy: AI lending companies handle sensitive financial data, making them a target for cyberattacks. It is essential to implement robust security measures to protect borrower data and comply with privacy regulations.

- Regulatory Compliance: The financial services industry is heavily regulated, and AI lending companies must comply with various regulations, such as fair lending laws and data privacy regulations.

- Model Validation and Monitoring: AI models need to be regularly validated and monitored to ensure that they are performing as expected and are not exhibiting any biases.

Examples of AI Lending Companies

Several AI lending companies are making waves in the financial services industry. Here are a few notable examples:

- Upstart: Upstart uses AI to assess credit risk and offer personal loans. They claim to approve 27% more applicants than traditional models with 16% lower average APR.

- Affirm: Affirm provides point-of-sale financing options using AI to assess creditworthiness.

- Kabbage: Kabbage offers small business loans using AI to analyze business data and assess credit risk.

- Blend: Blend provides a digital lending platform that uses AI to streamline the mortgage application process.

- Zest AI: Zest AI provides a machine learning platform for lenders to build and deploy AI-powered credit risk models.

The Future of AI Lending

The future of lending is undoubtedly intertwined with AI. As AI technologies continue to evolve, AI lending companies will become even more sophisticated and integrated into the financial ecosystem. We can expect to see the following trends:

- Increased Personalization: AI will enable lenders to offer more personalized loan products and services tailored to individual borrowers’ needs and circumstances.

- Real-Time Credit Assessment: AI will allow lenders to assess credit risk in real-time, enabling faster loan approvals and more dynamic pricing.

- Embedded Finance: AI-powered lending will be increasingly embedded into other platforms and applications, such as e-commerce sites and mobile banking apps.

- Alternative Data Integration: AI lending companies will continue to leverage alternative data sources to assess creditworthiness, expanding access to credit for underserved populations.

- Enhanced Fraud Prevention: AI will play an increasingly important role in detecting and preventing fraud in the lending process.

The use of AI lending companies is transforming the financial world. More customers are being approved for loans, and the process has become more efficient. [See also: Future of Fintech Startups]

Conclusion

AI lending companies are revolutionizing the financial landscape by leveraging artificial intelligence to improve accuracy, speed, and accessibility in lending. While challenges and considerations remain, the benefits of AI in lending are undeniable. As AI technologies continue to advance, AI lending companies will play an increasingly important role in shaping the future of finance, making credit more accessible and affordable for individuals and businesses alike. The role of AI lending companies is crucial for fair lending practices. The development of AI lending companies has been a long time coming. More AI lending companies are needed to serve the underserved. The future looks bright for AI lending companies.