Bearer Bonds: A Deep Dive into Anonymity, Regulation, and Modern Finance

In the intricate world of finance, few instruments evoke as much intrigue and controversy as bearer bonds. These bonds, characterized by their anonymity and ease of transfer, have a storied past, a complex present, and an uncertain future. This article delves into the history, mechanics, regulations, and modern implications of bearer bonds, providing a comprehensive overview for investors, legal professionals, and anyone interested in understanding this unique financial instrument.

What are Bearer Bonds?

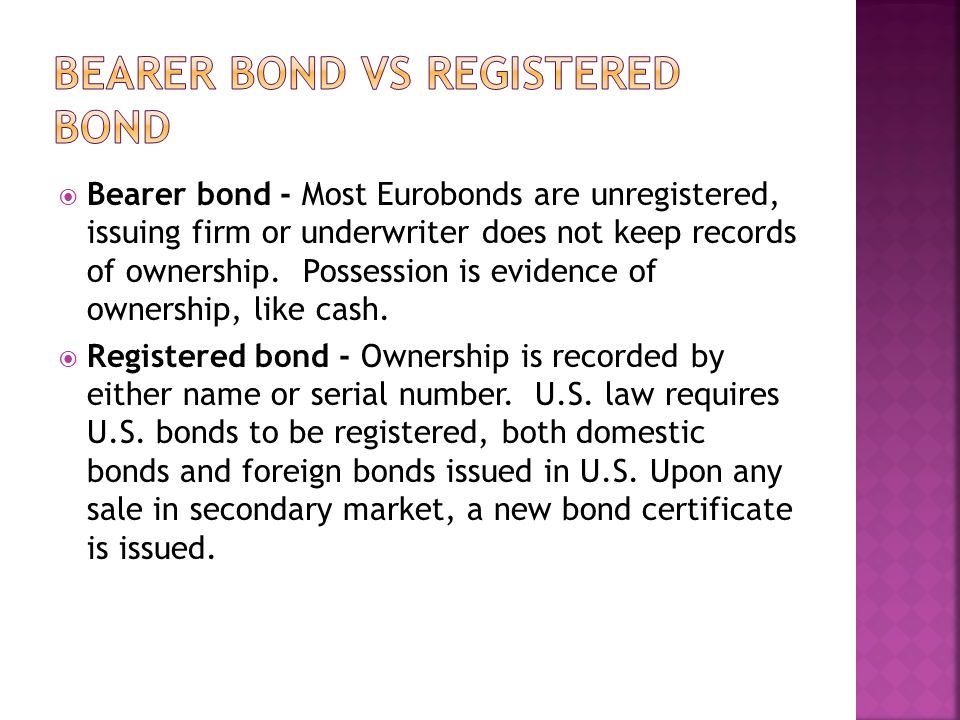

A bearer bond is a debt security that is unregistered – it is issued to the “bearer” rather than a specific individual or entity. Ownership is determined by possession of the physical bond certificate. Unlike registered bonds, where the issuer keeps records of the bondholders, bearer bonds offer anonymity; whoever physically holds the bond is presumed to be the owner. Coupon payments and principal repayments are made to the bearer upon presentation of the appropriate coupons or the bond itself.

A Brief History of Bearer Bonds

Bearer bonds have a long history, dating back to the 19th century when they were a common method for governments and corporations to raise capital. Their anonymity made them attractive to investors seeking privacy, and their ease of transfer facilitated trading in international markets. They were widely used throughout Europe and the Americas, playing a significant role in financing infrastructure projects, wars, and economic development. [See also: History of Debt Securities]

The Mechanics of Bearer Bonds

Understanding how bearer bonds function is crucial to appreciating their appeal and potential risks. Here’s a breakdown of their key characteristics:

- Anonymity: The primary feature of a bearer bond is its anonymity. The issuer does not track the identity of the bondholder, making it difficult to trace ownership.

- Ease of Transfer: Bearer bonds are easily transferable. Ownership changes simply by physically transferring the bond certificate from one party to another. No registration or endorsement is required.

- Coupon Payments: Bearer bonds typically have detachable coupons attached to the bond certificate. Bondholders redeem these coupons at specified intervals to receive interest payments.

- Redemption: At maturity, the bearer bond is presented to the issuer or a designated agent for redemption. The bearer receives the face value of the bond.

The Appeal of Anonymity

The anonymity offered by bearer bonds has been a double-edged sword. While it appeals to legitimate investors seeking privacy, it has also made them attractive to individuals and organizations involved in illicit activities. The ability to move funds anonymously has facilitated tax evasion, money laundering, and terrorist financing. [See also: Anti-Money Laundering Regulations]

The Regulatory Crackdown

Recognizing the potential for abuse, governments around the world began to crack down on bearer bonds in the late 20th and early 21st centuries. The United States, for example, largely eliminated bearer bonds through the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA). Many other countries followed suit, imposing strict regulations and reporting requirements on the issuance and holding of bearer bonds.

These regulatory efforts were driven by a desire to increase transparency in financial markets and combat financial crime. By requiring registration of bondholders, governments could better track the flow of funds and identify potential illicit activities. The push for greater transparency was further intensified by international initiatives such as the Financial Action Task Force (FATF), which has promoted global standards for combating money laundering and terrorist financing.

Modern Regulations and Restrictions

Today, bearer bonds are heavily regulated in most developed countries. In many jurisdictions, they are either prohibited outright or subject to stringent reporting requirements. Issuance is often restricted to government entities or international organizations, and even then, strict controls are in place to prevent abuse. [See also: International Financial Regulations]

The regulations surrounding bearer bonds typically include:

- Prohibition of Issuance: Many countries prohibit the issuance of new bearer bonds by private entities.

- Mandatory Registration: Existing bearer bonds may be subject to mandatory registration requirements, forcing bondholders to disclose their identities.

- Reporting Requirements: Financial institutions are required to report transactions involving bearer bonds to regulatory authorities.

- Tax Compliance: Interest payments on bearer bonds may be subject to withholding taxes, and bondholders are required to report their income to tax authorities.

The Use of Bearer Bonds in Illicit Activities

Despite increased regulation, bearer bonds continue to be used in illicit activities, albeit on a smaller scale than in the past. Their anonymity still makes them attractive to criminals seeking to hide assets and evade detection. Cases of bearer bonds being used in money laundering schemes, tax evasion, and other financial crimes continue to surface, highlighting the ongoing challenges in regulating these instruments. [See also: Financial Crime Investigation]

Are Bearer Bonds Still Legal?

The legality of bearer bonds varies by jurisdiction. While they are largely prohibited or heavily regulated in developed countries, they may still be permitted in some offshore financial centers or jurisdictions with less stringent regulations. However, even in these jurisdictions, the use of bearer bonds is often subject to scrutiny, and financial institutions may be reluctant to handle them due to the associated risks.

It is crucial for investors and financial professionals to understand the legal and regulatory landscape surrounding bearer bonds in any jurisdiction where they are considering using or handling them. Failure to comply with applicable laws and regulations can result in severe penalties, including fines, imprisonment, and reputational damage.

Alternatives to Bearer Bonds

For investors seeking privacy and flexibility, there are alternative financial instruments that offer similar benefits without the same risks and regulatory scrutiny as bearer bonds. These alternatives include:

- Nominee Accounts: Nominee accounts allow investors to hold assets through a third-party nominee, providing a degree of privacy without violating regulations.

- Offshore Trusts and Foundations: Offshore trusts and foundations can be used to hold assets in a confidential manner, subject to compliance with applicable laws and regulations.

- Cryptocurrencies: While cryptocurrencies are not entirely anonymous, they offer a higher degree of privacy than traditional financial instruments. However, they are also subject to increasing regulatory scrutiny.

The Future of Bearer Bonds

The future of bearer bonds is uncertain. As governments continue to prioritize transparency and combat financial crime, it is likely that regulations surrounding these instruments will become even more stringent. While they may continue to exist in some niche markets or offshore jurisdictions, their role in the global financial system is likely to diminish over time. The era of widespread use of bearer bonds for legitimate investment purposes is likely over, replaced by more transparent and regulated alternatives.

Conclusion

Bearer bonds represent a fascinating chapter in the history of finance. Their anonymity and ease of transfer made them popular in the past, but their potential for abuse has led to increased regulation and restrictions. Today, bearer bonds are a shadow of their former selves, largely replaced by more transparent and regulated financial instruments. While they may continue to exist in some corners of the world, their future is uncertain, and their role in the global financial system is likely to continue to decline.