Bearer Bonds: An In-Depth Look at Their History, Risks, and Modern Relevance

Bearer bonds, once a common instrument in the financial world, evoke images of international intrigue, tax evasion, and untraceable wealth. These bonds, unlike registered bonds, are not recorded in the name of the owner. Ownership is determined solely by possession, meaning whoever physically holds the bearer bond is considered the owner. This characteristic made them attractive to those seeking anonymity, but also made them susceptible to misuse and illicit activities. This article will delve into the history, risks, and modern relevance of bearer bonds, offering a comprehensive understanding of this fascinating financial instrument.

The History of Bearer Bonds

The concept of bearer bonds dates back centuries, with early forms appearing in Europe as a way for governments and corporations to raise capital. Their anonymity and ease of transfer made them popular for international transactions, especially during periods of political instability and economic uncertainty. Before the advent of sophisticated electronic tracking systems, bearer bonds were a practical solution for transferring value across borders without attracting undue attention.

In the United States, bearer bonds were widely used throughout the 19th and 20th centuries. They funded everything from railroad construction to wartime efforts. However, their inherent anonymity also made them a tool for tax evasion and money laundering, prompting increasing scrutiny from regulators.

How Bearer Bonds Work

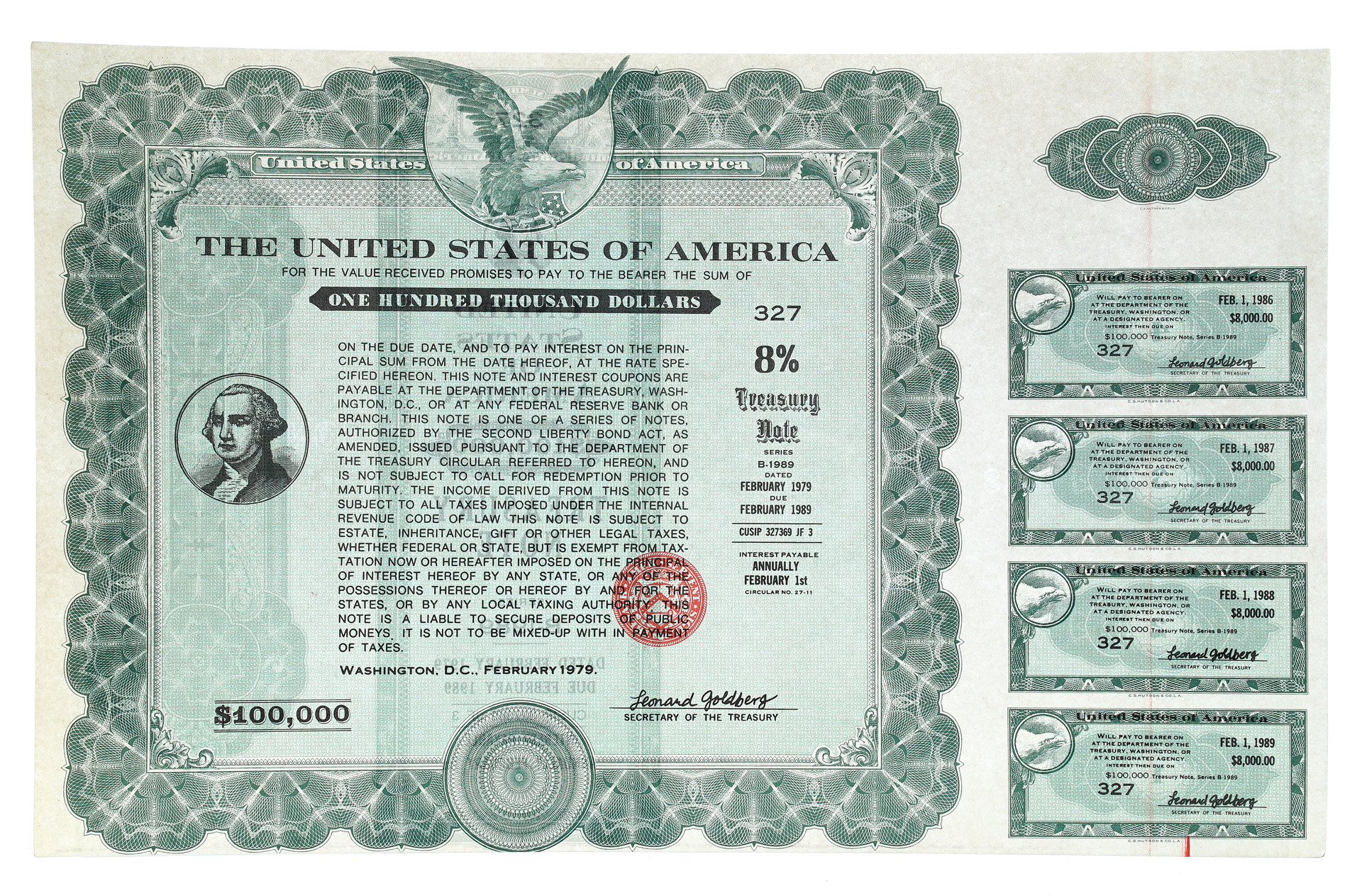

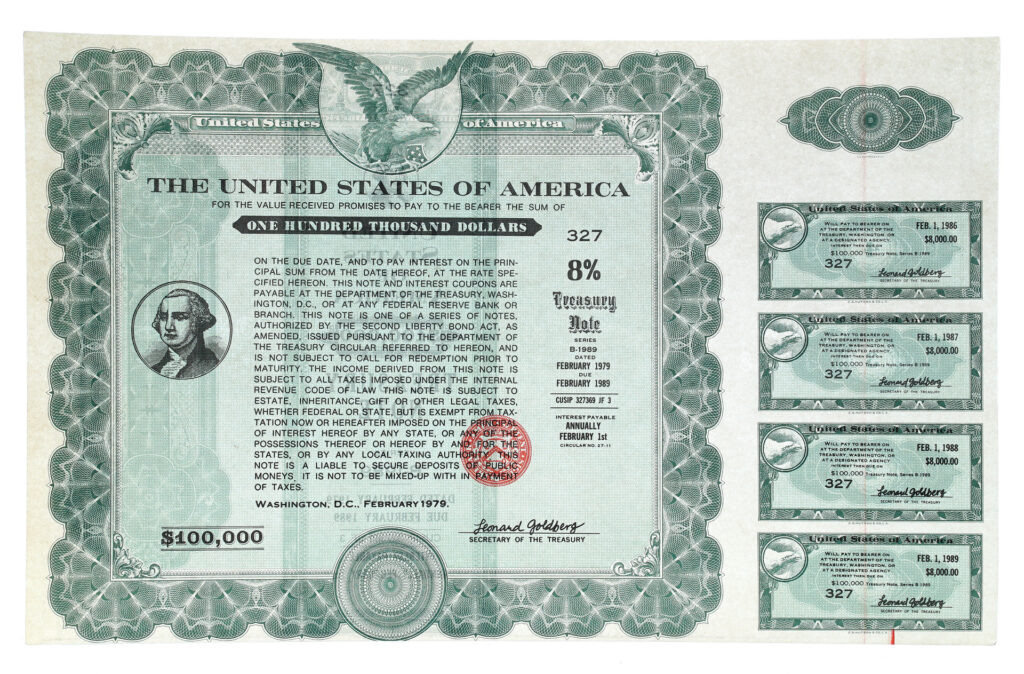

The mechanics of bearer bonds are relatively straightforward. The issuer prints a physical certificate, which includes details such as the face value, interest rate (coupon rate), and maturity date. The bondholder receives periodic interest payments, typically by clipping coupons attached to the bond and presenting them to a paying agent. At maturity, the bondholder presents the bond itself to receive the principal amount.

The key difference between a bearer bond and a registered bond lies in the ownership record. With a registered bond, the issuer keeps a record of the owner’s name and address, and interest payments are typically made electronically. With a bearer bond, there is no such record. The holder is the owner, and the issuer has no way of knowing who that is.

The Risks Associated with Bearer Bonds

The anonymity of bearer bonds, while appealing to some, presents significant risks:

- Tax Evasion: The lack of ownership records makes it easier to conceal income and assets from tax authorities.

- Money Laundering: Bearer bonds can be used to disguise the proceeds of illegal activities, making it difficult to trace the flow of funds.

- Theft and Loss: Because ownership is based on possession, a lost or stolen bearer bond is essentially as good as cash to the finder or thief. There is no way to prove ownership or prevent the bond from being redeemed.

- Terrorist Financing: The anonymity provided by bearer bonds makes them a potential tool for financing terrorist activities.

The Decline of Bearer Bonds

Due to the risks associated with bearer bonds, governments around the world have taken steps to restrict their use. The United States effectively eliminated the issuance of bearer bonds in 1982 with the Tax Equity and Fiscal Responsibility Act (TEFRA). This legislation required bonds to be registered in order to be tax-exempt. Other countries followed suit, implementing regulations to curb the use of bearer bonds and increase transparency in financial transactions.

The rise of electronic payment systems and the increasing emphasis on anti-money laundering (AML) and counter-terrorism financing (CTF) measures have further contributed to the decline of bearer bonds. These developments have made it easier to track financial transactions and identify suspicious activity.

Bearer Bonds in the Modern Era

While the issuance of new bearer bonds is largely prohibited in many jurisdictions, existing bearer bonds may still be circulating. These bonds, often issued decades ago, can still be redeemed at maturity. However, financial institutions are required to conduct due diligence to ensure that the bondholder is not involved in illegal activities.

Furthermore, some jurisdictions may still allow the issuance of bearer bonds under specific circumstances, such as for certain types of international transactions or for investors who can demonstrate a legitimate need for anonymity. However, these exceptions are becoming increasingly rare as governments continue to tighten regulations.

The Financial Action Task Force (FATF), an intergovernmental organization that sets standards for combating money laundering and terrorist financing, has been a key driver in the global effort to restrict the use of bearer bonds. FATF recommendations call for countries to implement measures to identify and mitigate the risks associated with bearer bonds, including prohibiting their issuance and requiring financial institutions to report suspicious transactions involving them.

The Allure of Anonymity: Why Bearer Bonds Persist

Despite the risks and regulatory restrictions, bearer bonds retain a certain allure for individuals and entities seeking anonymity. This allure stems from a variety of factors:

- Privacy Concerns: Some individuals may legitimately want to keep their financial affairs private, particularly in countries with unstable political or economic conditions.

- Tax Avoidance: While illegal, the temptation to evade taxes remains a strong motivator for some. Bearer bonds offer a way to conceal income and assets from tax authorities.

- Capital Flight: In countries with capital controls, bearer bonds can be used to move money out of the country without attracting the attention of regulators.

- Criminal Activities: As previously mentioned, bearer bonds can be used to launder money and finance illegal activities.

Alternatives to Bearer Bonds

For individuals and entities seeking privacy and security in their financial transactions, there are legitimate alternatives to bearer bonds. These alternatives include:

- Offshore Trusts and Companies: These structures can provide a degree of anonymity while complying with legal and regulatory requirements.

- Numbered Bank Accounts: These accounts do not bear the name of the account holder, but the bank still knows the identity of the owner.

- Registered Bonds Held in Nominee Accounts: These accounts allow investors to hold bonds in the name of a nominee, providing a layer of privacy.

The Future of Bearer Bonds

The future of bearer bonds appears bleak. The global trend is towards greater transparency and regulation in financial markets, making it increasingly difficult to use bearer bonds for legitimate purposes. As technology continues to evolve and regulators become more sophisticated, the anonymity offered by bearer bonds will likely diminish further.

The remaining bearer bonds in circulation will likely be redeemed over time, and the issuance of new bearer bonds will remain tightly controlled. While the allure of anonymity may persist, the risks and regulatory hurdles associated with bearer bonds make them an increasingly unattractive option for most investors.

In conclusion, bearer bonds represent a fascinating chapter in the history of finance. Their anonymity made them attractive to some, but also made them vulnerable to misuse. As governments and regulators continue to crack down on tax evasion, money laundering, and terrorist financing, the future of bearer bonds looks increasingly limited. [See also: Anti-Money Laundering Regulations] [See also: The History of Financial Instruments]