Bearer Bonds: An In-Depth Look at Their History, Risks, and Modern Relevance

Bearer bonds, once a common instrument in the financial world, represent a type of fixed-income security where ownership is determined solely by possession of the physical bond certificate. Unlike registered bonds, where the owner’s details are recorded with the issuer, bearer bonds offer anonymity, making them attractive to some but also susceptible to misuse. This article delves into the history of bearer bonds, their inherent risks, and their diminishing role in the modern financial landscape. We will explore the reasons behind their decline, the regulatory changes that have impacted their use, and the implications for investors and governments alike.

The Historical Context of Bearer Bonds

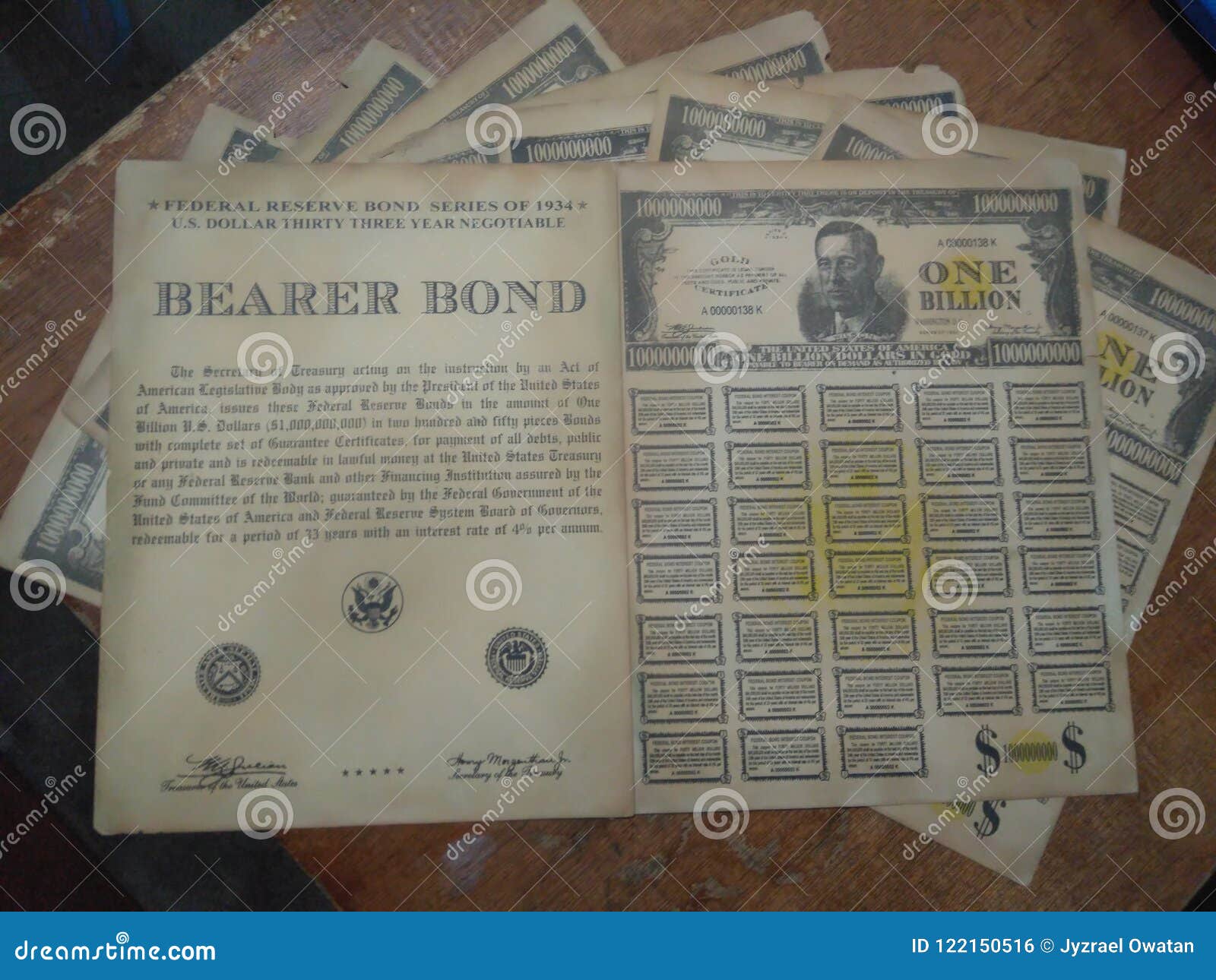

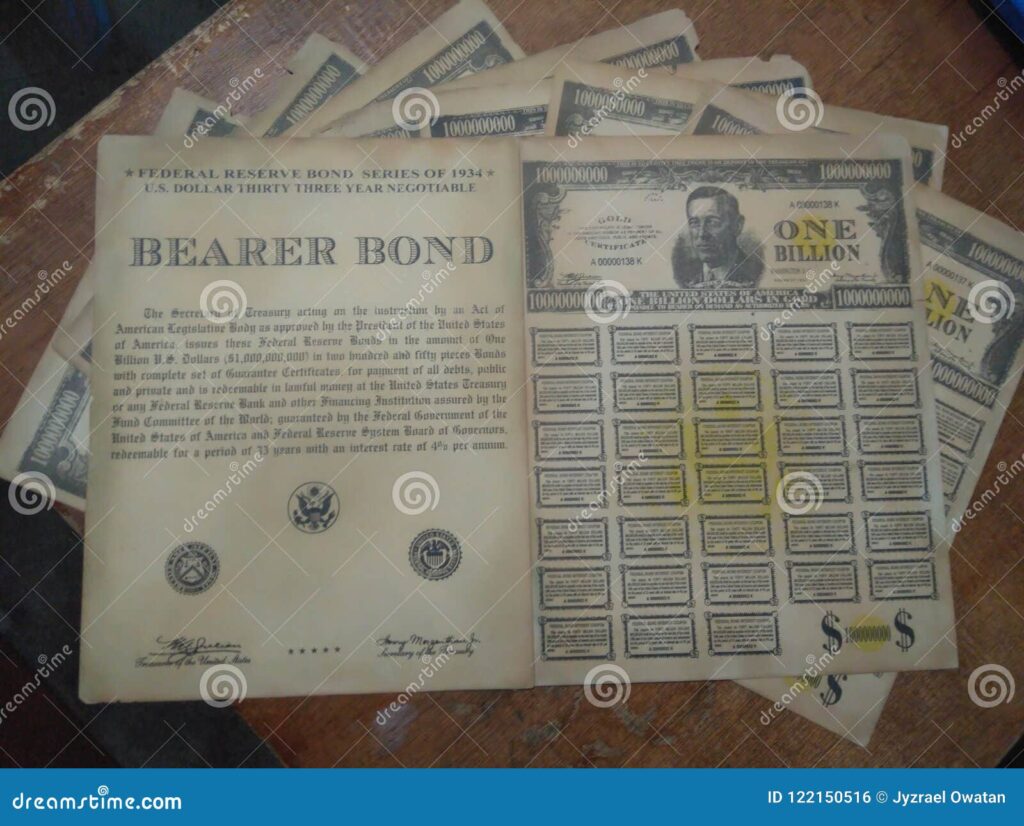

The concept of bearer bonds dates back centuries, gaining prominence in the 19th and early 20th centuries. They facilitated international capital flows, allowing investors to move funds across borders with relative ease. In an era of limited electronic tracking and less stringent financial regulations, bearer bonds offered a convenient and discreet method of investment. Governments and corporations alike issued bearer bonds to finance large-scale projects and raise capital from a diverse investor base. Their anonymity was a key selling point, appealing to individuals and entities seeking privacy in their financial dealings.

However, the very feature that made bearer bonds attractive – their anonymity – also paved the way for illicit activities. Their untraceable nature made them a favored tool for tax evasion, money laundering, and the concealment of assets. This dark side of bearer bonds eventually led to increased scrutiny and regulatory interventions aimed at curbing their use.

The Risks Associated with Bearer Bonds

Several risks are inherent in holding bearer bonds. One of the most significant is the risk of loss or theft. Since ownership is determined solely by possession, a lost or stolen bearer bond is effectively irretrievable. The holder has no recourse to recover the asset, unlike with registered bonds where ownership can be verified and the bond reissued. This lack of protection makes bearer bonds a high-risk investment, particularly for individuals who may not have secure storage facilities.

Another risk is the potential for forgery. Counterfeit bearer bonds can be difficult to detect, and investors may unknowingly purchase fraudulent securities, resulting in significant financial losses. The lack of a central registry makes it challenging to verify the authenticity of a bearer bond, increasing the risk of falling victim to fraud. Due diligence is crucial, but even experienced investors can be deceived by sophisticated forgeries. [See also: Due Diligence in Fixed Income Investments]

Furthermore, bearer bonds are often associated with tax evasion and money laundering, which can lead to legal repercussions for holders. Even if an investor is unaware of the illicit origins of a bearer bond, possessing such a security can raise red flags with regulatory authorities and trigger investigations. The stigma associated with bearer bonds can also make it difficult to sell them on the secondary market, further diminishing their value.

The Decline of Bearer Bonds

Over the past few decades, bearer bonds have experienced a significant decline in popularity and usage. This decline is largely due to increased regulatory scrutiny and international efforts to combat tax evasion and money laundering. Governments around the world have implemented measures to restrict the issuance and trading of bearer bonds, making them less attractive to both issuers and investors.

The United States, for example, effectively eliminated the issuance of bearer bonds in the 1980s through tax law changes. These changes imposed significant penalties on issuers of bearer bonds, making it economically unviable to continue issuing them. Other countries have followed suit, implementing similar restrictions to comply with international standards and combat financial crime. [See also: Global Financial Regulations]

The rise of electronic payment systems and the increasing transparency of financial transactions have also contributed to the decline of bearer bonds. With electronic transfers, it is easier to track the flow of funds and identify suspicious activities. This increased transparency makes bearer bonds less appealing to those seeking to conceal their assets or evade taxes.

Regulatory Changes and Their Impact

Several key regulatory changes have significantly impacted the use of bearer bonds. The Foreign Account Tax Compliance Act (FATCA) in the United States and the Common Reporting Standard (CRS) developed by the Organisation for Economic Co-operation and Development (OECD) have increased international cooperation in tax matters. These agreements require financial institutions to report information about foreign accounts held by their citizens, making it more difficult to hide assets using bearer bonds.

Anti-money laundering (AML) regulations have also played a crucial role in curbing the use of bearer bonds. Financial institutions are required to conduct enhanced due diligence on customers and transactions involving bearer bonds, and to report any suspicious activity to the authorities. These measures make it more difficult to use bearer bonds for illicit purposes and have significantly reduced their appeal to criminals and tax evaders.

The increased scrutiny and regulatory burden associated with bearer bonds have made them less attractive to legitimate investors and issuers. The costs of compliance and the risk of legal repercussions outweigh the benefits of anonymity, leading to a shift towards more transparent and regulated financial instruments.

The Modern Relevance of Bearer Bonds

While bearer bonds are no longer as prevalent as they once were, they still exist in some jurisdictions and may be encountered in certain situations. Some older bearer bonds may still be outstanding, and investors may unknowingly inherit or acquire them. It is important to understand the risks and legal implications associated with holding bearer bonds, and to seek professional advice if necessary.

In some countries, bearer bonds may still be used for specific purposes, such as facilitating cross-border transactions or providing anonymity to investors in certain sectors. However, their use is generally limited and subject to strict regulatory controls. The anonymity offered by bearer bonds continues to be a draw for some, despite the associated risks and potential legal issues.

The legacy of bearer bonds serves as a reminder of the importance of transparency and regulation in the financial system. The challenges posed by bearer bonds in terms of tax evasion and money laundering have shaped the development of modern financial regulations and international cooperation in combating financial crime. [See also: The Future of Financial Regulation]

Conclusion

Bearer bonds, with their historical allure of anonymity, have faced a significant decline due to inherent risks and increasing regulatory scrutiny. While they once played a vital role in international finance, their susceptibility to misuse has led to stricter regulations and a shift towards more transparent financial instruments. Understanding the history, risks, and regulatory landscape surrounding bearer bonds is crucial for investors and policymakers alike. As the financial world continues to evolve, the lessons learned from the era of bearer bonds will continue to shape the development of a more secure and transparent global financial system. The future likely holds even less room for these instruments as the push for transparency continues.