Bearer Bonds Meaning: A Comprehensive Guide

In the intricate world of finance, understanding various investment instruments is crucial for making informed decisions. One such instrument, though less common today than in the past, is the bearer bond. This article delves into the bearer bonds meaning, exploring their characteristics, historical significance, advantages, disadvantages, and current regulatory landscape. Understanding the bearer bonds meaning is essential for anyone involved in finance, investment, or even just curious about the evolution of financial instruments.

What are Bearer Bonds?

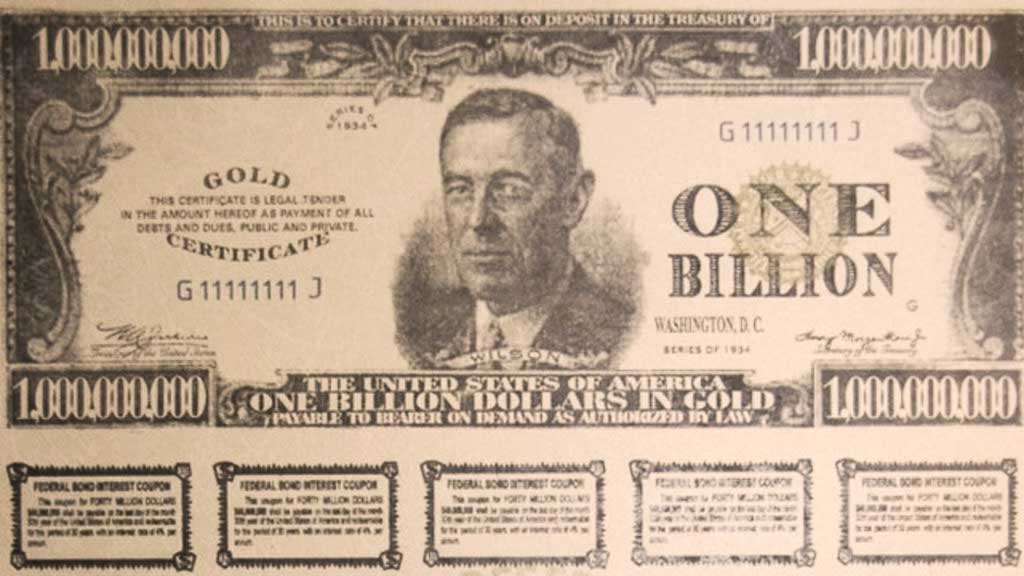

A bearer bond is a debt security that is unregistered – no record of the owner exists. Ownership is determined solely by possession of the physical bond certificate. Whoever holds the bond is presumed to be the owner and is entitled to receive interest payments and the principal upon maturity. This characteristic is what truly defines the bearer bonds meaning.

Unlike registered bonds, where the issuer keeps a record of the bondholder’s identity, bearer bonds offer anonymity. Interest payments are typically made by detaching coupons attached to the bond certificate and presenting them to the issuer or a paying agent. The principal is paid to whoever presents the bond at maturity.

The History of Bearer Bonds

Bearer bonds have a long and storied history, dating back to the 19th century. They were initially popular because they provided a convenient way to transfer ownership of debt securities, particularly in an era before sophisticated electronic record-keeping systems. The anonymity they offered also appealed to investors seeking privacy.

Throughout much of the 20th century, bearer bonds were widely used by governments and corporations to raise capital. They facilitated international investment and allowed for the efficient transfer of funds across borders. However, their anonymity also made them attractive to individuals and entities seeking to evade taxes or launder money. This is a critical aspect of understanding the full bearer bonds meaning.

Advantages of Bearer Bonds

- Anonymity: Perhaps the most significant advantage of bearer bonds is the anonymity they provide. Bondholders can maintain their privacy and avoid having their ownership of the bond recorded.

- Ease of Transfer: Bearer bonds are easily transferable. Ownership is simply transferred by physically handing over the bond certificate to another party. This makes them convenient for transactions where speed and discretion are important.

- Historical Significance: For collectors and historians, bearer bonds represent a tangible piece of financial history. Older bonds can be quite valuable as collectibles.

Disadvantages of Bearer Bonds

- Risk of Loss or Theft: Because ownership is determined by possession, bearer bonds are vulnerable to loss or theft. If a bond is lost or stolen, the owner has no recourse to recover it. There’s no record of ownership to prove their claim.

- Lack of Security: Unlike registered bonds, bearer bonds offer no security against unauthorized transfer. Anyone in possession of the bond can claim ownership, making them risky for investors.

- Regulatory Scrutiny: Due to their potential for tax evasion and money laundering, bearer bonds have come under increasing regulatory scrutiny in recent years. Many countries have either banned or severely restricted their use.

The Decline of Bearer Bonds

In recent decades, the use of bearer bonds has declined sharply due to increased regulatory scrutiny and the rise of electronic record-keeping systems. Governments and international organizations have cracked down on bearer bonds in an effort to combat tax evasion, money laundering, and terrorist financing. The bearer bonds meaning has therefore shifted from a convenient financial tool to a symbol of potential illicit activity.

Many countries have either banned the issuance of new bearer bonds or have imposed strict regulations on their use. For example, the United States effectively banned the issuance of bearer bonds in 1982, with limited exceptions. Other countries have followed suit, leading to a significant reduction in the global supply of bearer bonds. [See also: Tax Havens and Financial Secrecy]

The shift towards electronic record-keeping has also contributed to the decline of bearer bonds. With the advent of computerized systems, it has become much easier and more efficient to track ownership of securities electronically. This has reduced the need for physical bond certificates and has made registered bonds a more attractive option for investors.

Bearer Bonds and Tax Evasion

One of the main reasons why bearer bonds have fallen out of favor is their association with tax evasion. The anonymity they provide makes it difficult for tax authorities to track ownership and collect taxes on interest income. Individuals and entities seeking to hide assets from tax authorities have historically used bearer bonds to avoid paying taxes.

The use of bearer bonds for tax evasion has been a major concern for governments around the world. International organizations such as the Financial Action Task Force (FATF) have called for greater transparency in the financial system and have urged countries to crack down on the use of bearer bonds and other anonymous financial instruments. This focus on transparency has significantly redefined the bearer bonds meaning in the modern financial landscape.

Bearer Bonds and Money Laundering

In addition to tax evasion, bearer bonds have also been used for money laundering. The anonymity they offer makes it difficult to trace the origin of funds used to purchase the bonds. Criminal organizations have used bearer bonds to conceal the proceeds of illegal activities and to move money across borders without detection.

The use of bearer bonds for money laundering has been a major concern for law enforcement agencies around the world. Efforts to combat money laundering have led to increased scrutiny of bearer bonds and other anonymous financial instruments. [See also: Anti-Money Laundering Regulations]

The Future of Bearer Bonds

Given the increased regulatory scrutiny and the rise of electronic record-keeping, the future of bearer bonds looks bleak. It is unlikely that they will ever regain their former popularity. Most countries have either banned or severely restricted their use, and the trend is likely to continue.

While some bearer bonds may still exist in circulation, they are becoming increasingly rare. Investors should be aware of the risks associated with bearer bonds and should exercise caution before investing in them. The bearer bonds meaning is now more about historical context than current investment strategy.

Are Bearer Bonds Still Legal?

The legality of bearer bonds varies from country to country. In some countries, they are completely banned. In others, they may be legal but subject to strict regulations. It is important to check the laws of the relevant jurisdiction before buying or selling bearer bonds.

In the United States, the issuance of new bearer bonds is generally prohibited, but some older bearer bonds may still be outstanding. These bonds are subject to reporting requirements and other regulations. [See also: US Treasury Regulations]

Investing in Remaining Bearer Bonds: A Risky Proposition

While some older bearer bonds might still exist, investing in them is generally considered a risky proposition. The lack of security, the potential for loss or theft, and the regulatory scrutiny make them unattractive to most investors.

Investors should carefully consider the risks and rewards before investing in bearer bonds. It is important to consult with a financial advisor and to conduct thorough due diligence before making any investment decisions. Understanding the bearer bonds meaning in the context of current regulations is paramount.

Conclusion

Bearer bonds represent a fascinating chapter in the history of finance. While they once played a significant role in international investment, their anonymity has made them vulnerable to abuse. Increased regulatory scrutiny and the rise of electronic record-keeping have led to a sharp decline in their use. While the bearer bonds meaning was once tied to convenience and privacy, it is now largely associated with tax evasion and money laundering. As such, investors should exercise caution when dealing with bearer bonds and should be aware of the risks involved. The story of bearer bonds serves as a reminder of the importance of transparency and accountability in the financial system. Understanding the bearer bonds meaning today requires acknowledging its complex and often controversial past.