Calculate Leverage: A Comprehensive Guide for Traders and Investors

Leverage is a powerful tool in the world of finance, allowing traders and investors to control larger positions with a relatively smaller amount of capital. Understanding how to calculate leverage and manage it effectively is crucial for both mitigating risk and maximizing potential returns. This guide provides a comprehensive overview of leverage, its implications, and the methods to calculate leverage in various financial instruments.

What is Leverage?

Leverage, at its core, is the use of borrowed capital to increase the potential return of an investment. It essentially magnifies both gains and losses. When you use leverage, you’re only putting up a fraction of the total trade value, while borrowing the rest from your broker or financial institution. This allows you to control a significantly larger position than you could with your available capital alone.

For example, if you have $1,000 and use a leverage ratio of 1:10, you can control a position worth $10,000. This means that a 1% gain in the underlying asset would result in a $100 profit (10% return on your $1,000 investment), rather than a $10 profit (1% return) without leverage. However, a 1% loss would also result in a $100 loss, wiping out 10% of your initial investment.

Why Use Leverage?

The primary reason traders and investors use leverage is to amplify potential profits. By controlling a larger position, even small price movements can translate into substantial gains. This can be particularly attractive in markets with low volatility or limited trading opportunities. Leverage allows you to participate in markets that might otherwise be inaccessible due to high capital requirements.

However, it’s crucial to remember that leverage is a double-edged sword. While it can increase your profits, it can also magnify your losses. Therefore, a thorough understanding of risk management techniques is essential when using leverage.

How to Calculate Leverage

Calculate leverage is a straightforward process. The most common ways to express leverage are as a ratio or as a margin requirement.

Leverage Ratio

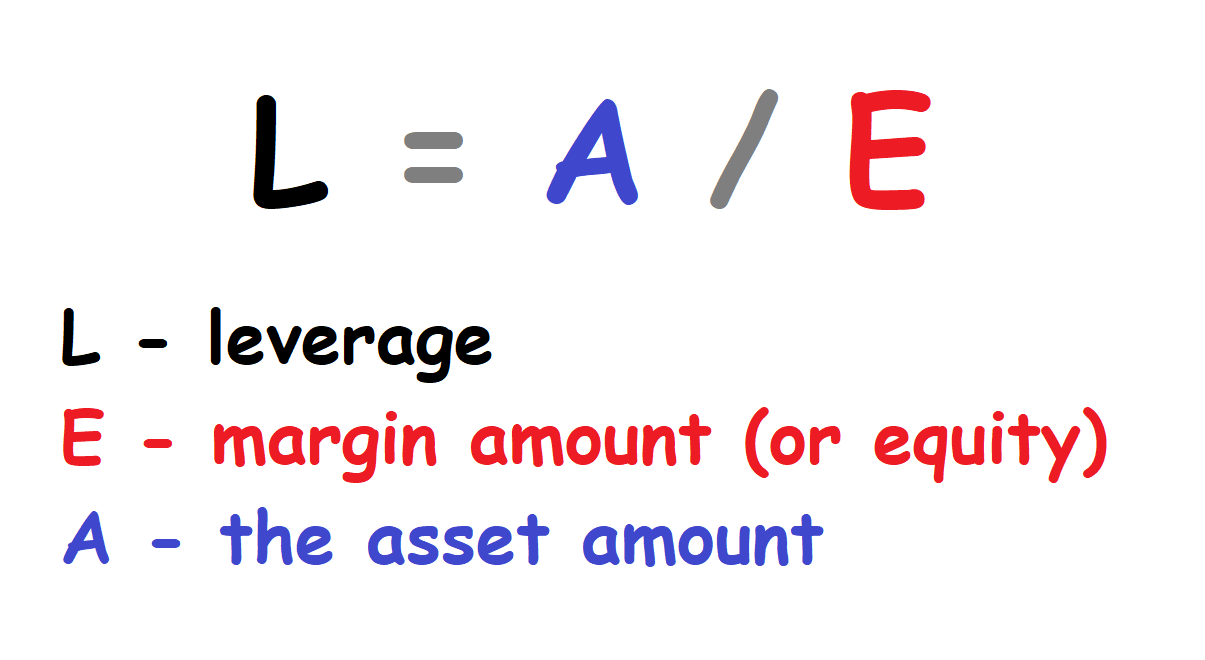

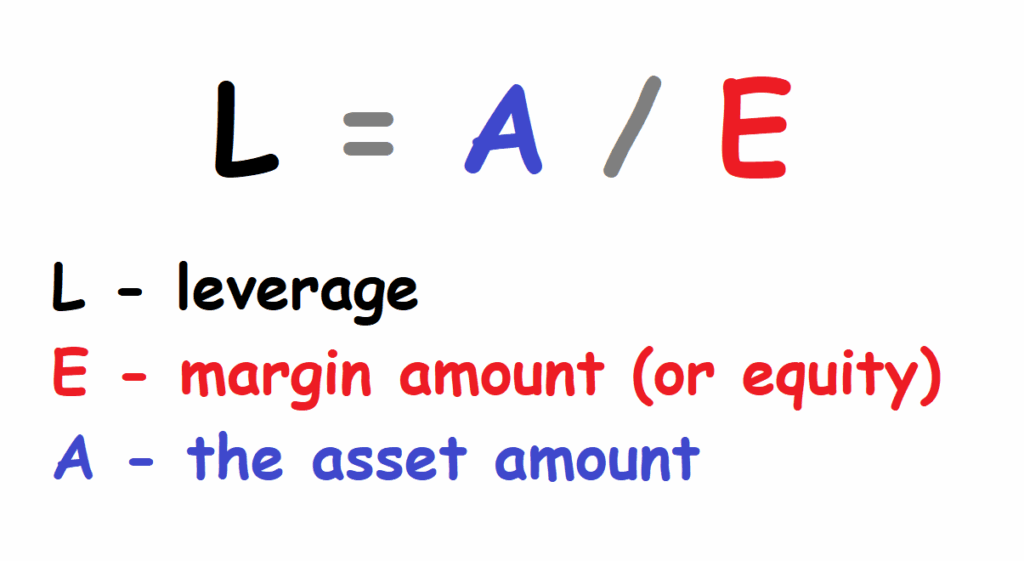

The leverage ratio represents the proportion of borrowed capital to your own capital. It is calculated as:

Leverage Ratio = Total Position Value / Capital Used

For instance, if you control a $10,000 position with $1,000 of your own capital, your leverage ratio is 10:1.

Margin Requirement

The margin requirement is the amount of capital you need to deposit with your broker to open and maintain a leveraged position. It is usually expressed as a percentage of the total position value.

To calculate leverage from the margin requirement, you can use the following formula:

Leverage Ratio = 1 / Margin Requirement

For example, if the margin requirement is 5%, then the leverage ratio is 1 / 0.05 = 20:1.

Examples of Leverage in Different Markets

Forex Trading

Forex trading is one of the most heavily leveraged markets. Brokers often offer leverage ratios of up to 50:1 or even 100:1. This allows traders to control large currency positions with a relatively small amount of capital. For example, with a 50:1 leverage, a trader with $1,000 could control a position worth $50,000 in a currency pair.

Stock Trading

Leverage in stock trading is typically lower than in forex trading. Margin accounts allow traders to borrow funds from their brokers to purchase stocks. The margin requirement for stocks is often around 50%, which translates to a leverage ratio of 2:1. This means that for every $1 of your own capital, you can borrow $1 from your broker to purchase stocks.

Futures Trading

Futures contracts also offer significant leverage. The margin requirements for futures contracts are typically lower than those for stocks, allowing traders to control large positions with a relatively small amount of capital. The exact leverage ratio depends on the specific contract and the broker’s policies.

CFD Trading

Contracts for Difference (CFDs) are derivative products that allow traders to speculate on the price movements of various assets, including stocks, indices, commodities, and currencies. CFDs often offer high leverage, similar to forex trading. Traders can control substantial positions with a small margin deposit.

Risks of Using Leverage

While leverage can amplify potential profits, it also significantly increases the risk of losses. Here are some of the key risks associated with using leverage:

- Magnified Losses: Leverage magnifies both gains and losses. If the market moves against your position, your losses can quickly exceed your initial investment.

- Margin Calls: If your losses erode your margin deposit, your broker may issue a margin call, requiring you to deposit additional funds to maintain your position. If you fail to meet the margin call, your broker may close your position, resulting in a realized loss.

- Increased Volatility: Leveraged positions are more sensitive to market volatility. Even small price fluctuations can have a significant impact on your account balance.

- Interest Charges: When you borrow capital to leverage your positions, you will typically incur interest charges on the borrowed funds. These charges can erode your profits and increase your overall costs.

Managing Leverage Effectively

To mitigate the risks associated with leverage, it’s essential to implement effective risk management strategies. Here are some key tips for managing leverage:

- Understand Your Risk Tolerance: Before using leverage, assess your risk tolerance and determine how much capital you are willing to risk on each trade.

- Use Stop-Loss Orders: Stop-loss orders automatically close your position when the price reaches a predetermined level, limiting your potential losses.

- Keep Your Leverage Ratio Low: Avoid using excessively high leverage ratios. Start with lower leverage and gradually increase it as you gain experience and confidence.

- Monitor Your Positions Regularly: Keep a close eye on your open positions and be prepared to adjust your strategy if the market moves against you.

- Diversify Your Portfolio: Diversifying your portfolio can help reduce your overall risk exposure. Avoid putting all your eggs in one basket.

- Calculate leverage before entering a trade and understand the potential impact on your capital.

Tools for Calculating Leverage

Several online tools and calculators can help you calculate leverage and margin requirements. These tools can be invaluable for planning your trades and managing your risk. Many brokers also provide built-in leverage calculators on their trading platforms.

The Psychology of Leverage

Leverage can also have a psychological impact on traders. The potential for quick profits can lead to overconfidence and impulsive decision-making. It’s crucial to maintain a disciplined and rational approach to trading, even when using leverage. Avoid chasing quick profits and stick to your trading plan.

Conclusion

Leverage is a powerful tool that can amplify both profits and losses. Understanding how to calculate leverage, manage risk, and maintain a disciplined approach is essential for successful leveraged trading. By following the guidelines outlined in this guide, you can harness the power of leverage while mitigating its risks. Remember to always calculate leverage before making any trades and understand the potential consequences. Properly calculate leverage to avoid unwanted risk. Learning to calculate leverage is a cornerstone of responsible trading. It is essential to calculate leverage for every trade you make. Never forget to calculate leverage! Always calculate leverage and manage your risk effectively. Knowing how to calculate leverage is a game changer. You must calculate leverage to be a successful trader. Remember to calculate leverage and protect your capital. Always calculate leverage before you start trading. The key to success is to calculate leverage and manage your risk. To calculate leverage is to be prepared for the market. Always calculate leverage and keep your risk in check. By following the guidelines outlined in this guide, you can harness the power of leverage while mitigating its risks.

[See also: Understanding Margin Trading] [See also: Risk Management Strategies for Traders] [See also: Forex Trading for Beginners]