Understanding the Liquidity Preference Framework: A Comprehensive Guide

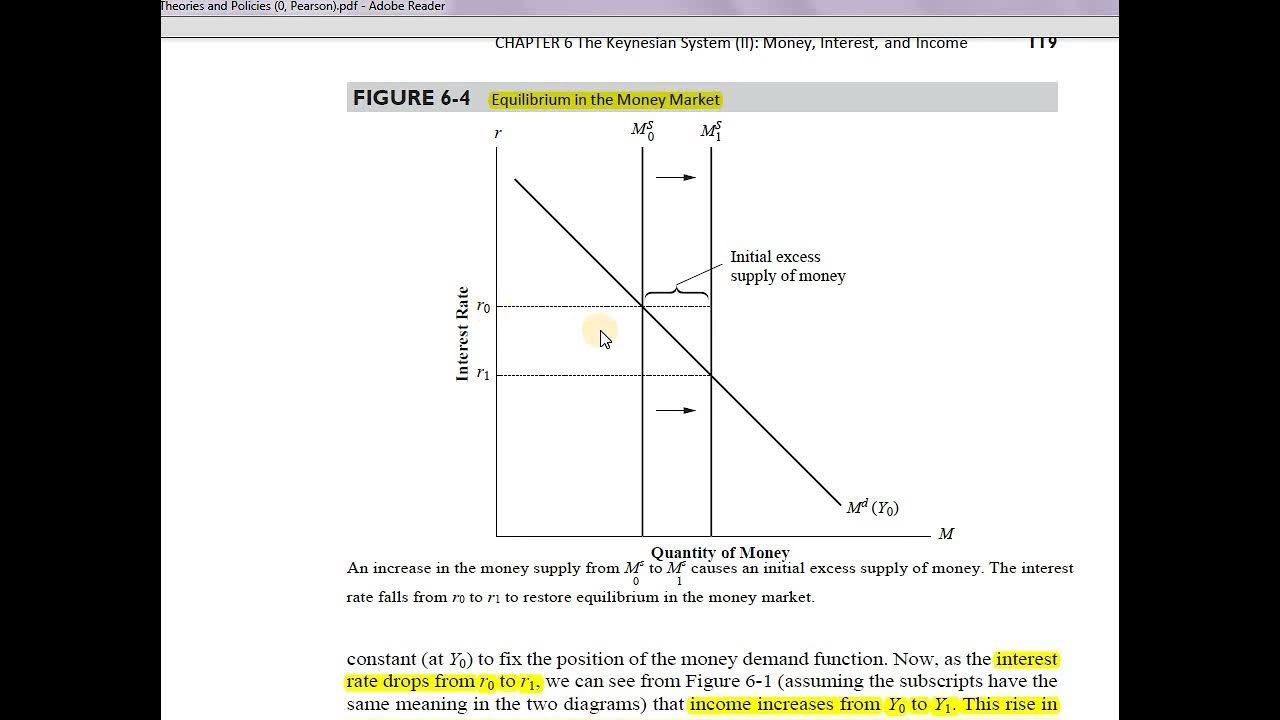

Understanding the Liquidity Preference Framework: A Comprehensive Guide The liquidity preference framework, a cornerstone of Keynesian economics, offers a detailed explanation of how interest rates are determined in an economy. It posits that interest rates are not simply a function of the supply and demand for loanable funds, as classical economists believed, but are instead … Read more